Bonds rates around the world moved higher, sharply so, overnight on the back of the better than expected data in the US and in Europe. Retail sales in the US looked disappointing on the face of it printing just 0.2% against 0.3% expected but this was largely because auto sales were lower with the core number which strips them out printing a robust 0.5% which was on the upper side of expectation. As a result US 10 year yields rose 11 basis points to 2.72% which poses a big problem to the Fed’s exit strategy given the taper hasn’t even begun yet.

Across the Atlantic rates were higher as well with 10 year Bunds up 10 points to 1.81% and 10 year Gilts rose 13 basis points to 2.60% after the ZEW economic confidence survey for both Germany and the EU as a whole printed on the stronger side of the ledger and the UK inflation data showed CPI was stuck fast at 2.8% over the past year.

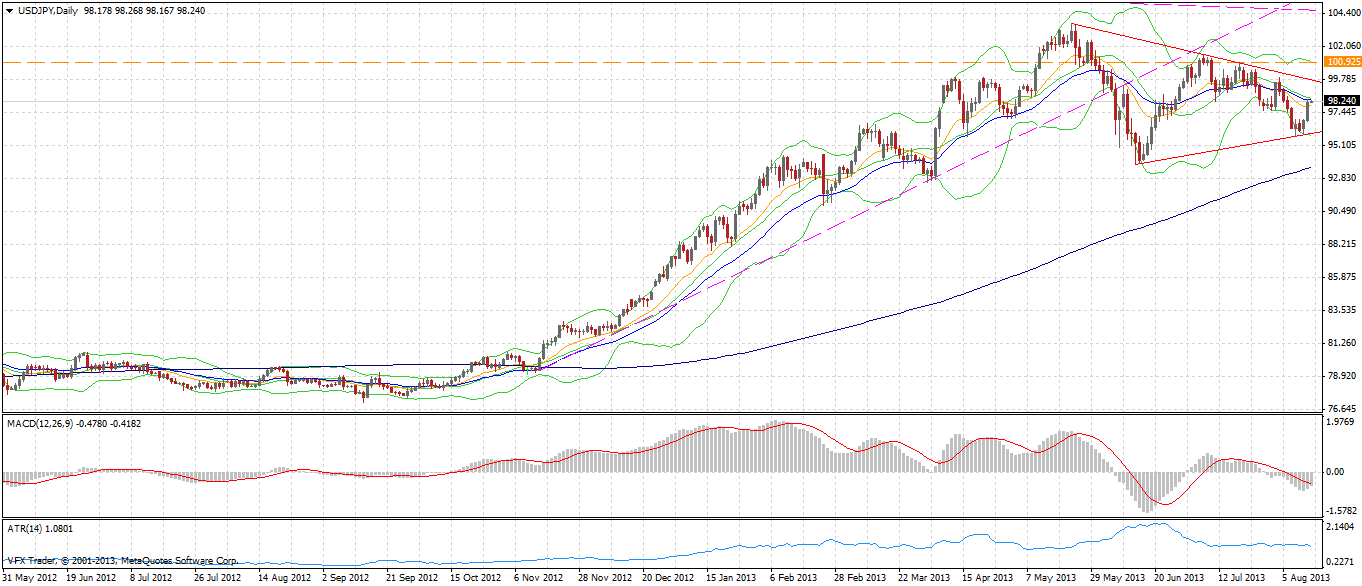

The impact was a short euro rally initially before the US data gave the US dollar a big kick in the tail and it rallied across the board. The yen was the biggest loser and it sits at 98.21 this morning with USDJPY up more than 1.3%. 98.60/70 will be strong resistance or a signal for a big break higher as you can see in the chart below.

On other FX markets the euro, sterling, Swissie, Loonie and Aussie are all lower to varying degrees against the US dollar and the Aussie in particular is at an interesting juncture in its rally from the lows of last week.

Yesterday the Aussie held the support we articulated at 0.9100/05 but overnight it slipped to a low around 0.9070 which is the 50% retracement level of the second leg of run higher we saw last week and the 38.2% of the entire run higher to Monday’s peak. Siting at 0.9103 this morning the Aussie looks a little vulnerable to a further push lower to find real solid support.

Aussie looks biased lower on the hourlies while below 0.9120 today.

On stocks, the early weakness in the US dissipated around lunchtime as markets climbed back into the black and stayed there to close with the Dow (+0.2% @15,451), Nasdaq (+0.38% @3,684) and the S&P 500 (+0.27% @1694) all higher. In stock specific news Carl Icahn was on Twitter saying that he has a position in Apple and had talked to CEO Tim Cook about stock buybacks. While I am a macro guy I’d posit Apple is finished if that is the best thing it can do with its cash.

European stocks were a sea of green with the FTSE (+0.57%), DAX (0.68%), CAC (0.52%), Milan (0.68%) and Madrid (0.47%) all higher.

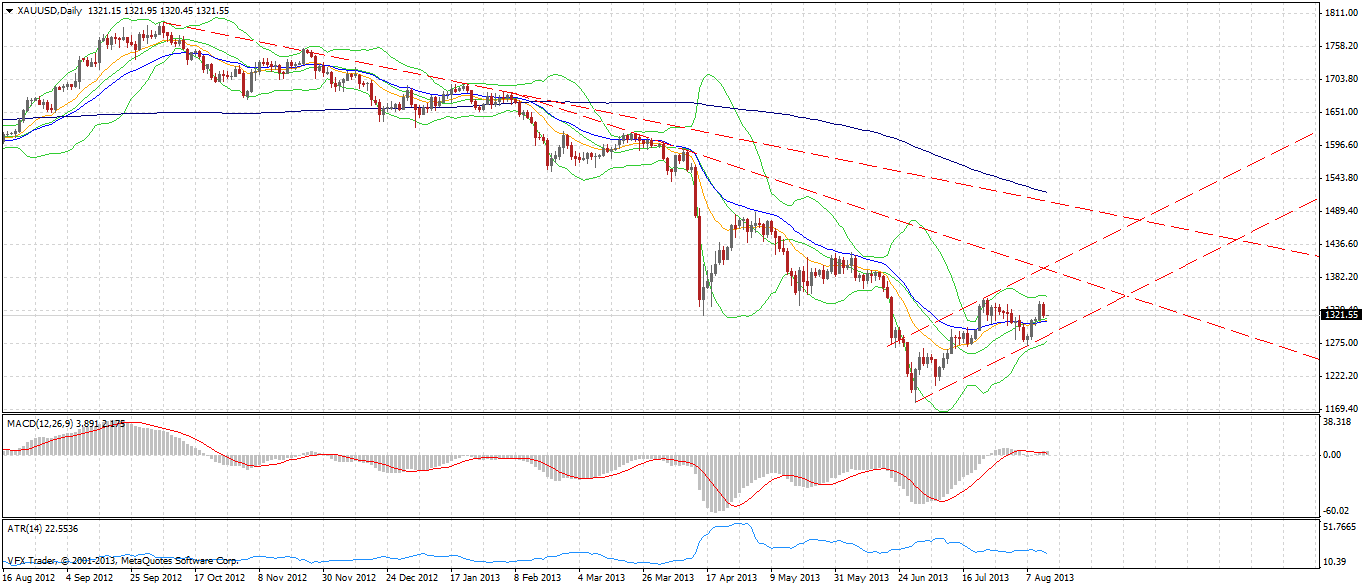

On commodity market, gold was a little lower down 1% at $1321 oz, silver was unmoved after its big push the day before, copper was unchanged at $3.31 lb while Nymex crude was up 0.43%. On the Ags markets it was more volatility with corn down 3.39% I imagine margin amounts must be rising in the Ag pits after all this volatility.

Gold is really interesting at the moment – in a nice little uptrend and I think going to do well if stocks go off as they might in the week or weeks ahead. The trade and the levels are clear as you can see in the chart below.

Data

On the data front Retails sales in New Zealand then the Westpac-MI consumer confidence index and the Wage Price Index in Australia before we head to Europe for French, German, Portuguese and EU wide GDP data and UK unemployment. PPI in the US and EIA Crude stockpiles are also out.

This GDP data in Europe tonight is going to be a huge lead for FX markets – is the recovery real or is it ephemeral? We’ll get a better feel tonight.