One of the most satisfying aspects of being a commentator is exerting a great deal of time and effort pushing a reform idea, and then finding that idea taking a life of its own, even if by coincidence.

Over recent months, I have argued repeatedly that Australia’s retirement system is both inequitable and unsustainable, and desperately in need of fundamental reform (see posts under here and here). The core of the problem lies in:

- Australia’s superannuation system, which provides too many tax advantages to those whom need it least – i.e. higher income earners – whilst providing minimal tax concessions to lower income earners. The end result is a system that costs the Budget a fortune in lost revenue, but does very little to relieve the pressure on the Budget from the aged pension.

- Exception of the family home from the assets test for the aged pension, which results in many wealthy retirees receiving the aged pension despite being more than capable of taking care of themselves.

As a solution to these problems, I proposed the following reforms:

- Axing the flat 15% tax on superannuation contributions in favour of a flat 15% concession. This would: 1) provide all taxpayers with the same taxation concession, thereby improving equity; 2) boost lower income earners’ super savings, thereby reducing reliance on the aged pension; and 3) reduce overall costs to the Federal Budget.

- Means testing all of one’s assets (including the family home) when working out who receives the pension.

On Friday, Business Spectator’s new economics writer, Callum Pickering, echoed my reform proposals and also included the Productivity Commission’s sensible suggestion to raise the retirement age to 70.

And over the weekend, the Grattan Institute released a new report that as its centrepiece argues to raise the pension age to 70, limit superannuation tax benefits for higher income earners, and include the family home in the pension assets test, which it claims would save the budget around $27 billion a year.

The Grattan Institute forecasts that the Federal Budget deficit could hit $60 billion per year by 2023, or up to 4% of GDP, due mostly to rising health and welfare costs. It argues that the only part of the tax and welfare system that is not well targeted is for old people. As such, subsidies for older people need to be far better targeted.

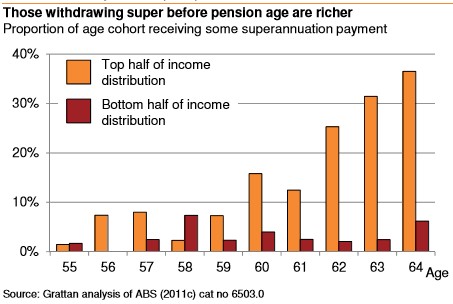

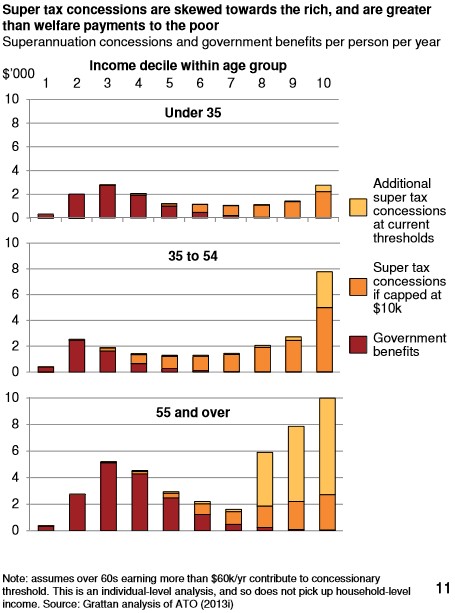

Superannuation is a particularly large problem. While the system was originally designed so that a younger generation could pay for its own retirement, it has instead become a mechanism whereby older people pay less tax given their income than everybody else, with the lion’s share of benefits also overwhelmingly going to richer people (see below charts).

The Grattan Institute proposes capping concessional superannuation contributions to $10,000 a year, instead of $35,000 currently. This would raise around $6 billion a year and have almost no impact on the bottom 20% of the population.

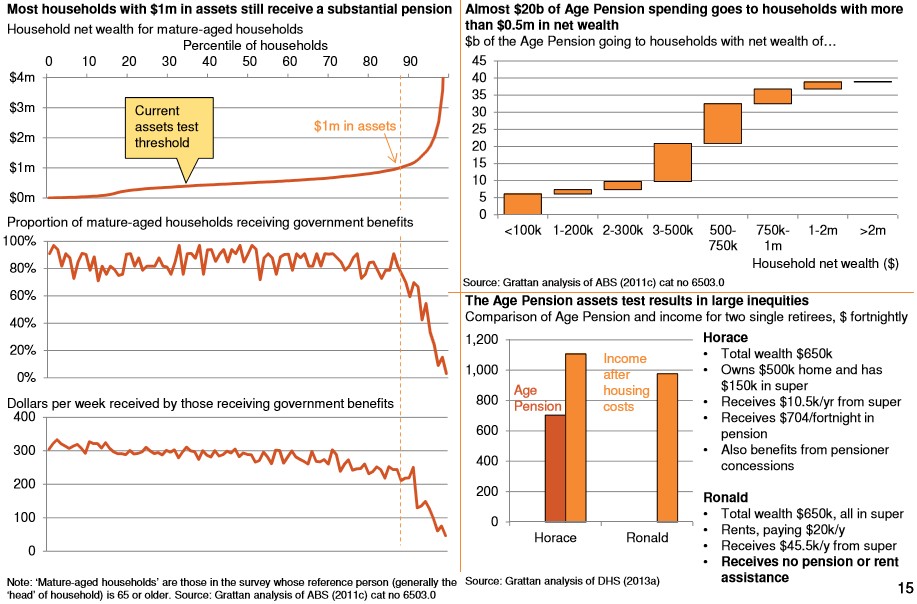

The report also notes how aged care expenditure is around $38 billion a year, with half of that going to people who have more than half a million dollars in assets (see below charts).

The core of the problem is the exemption of the family home from the pension assets test. In addition to being inequitable and unsustainable, the system also encourages an inefficient use of the housing stock by encouraging retirees to stay in their large family homes because the minute they sell it they will fail the assets test for the pension.

The obvious solution, therefore, is to include the family home in the means test for the pension, which would save the Budget around $7 billion per year, according to Grattan.

The Grattan Institute notes that none of these reforms will be easy, but they are vital to Australia’s long-term prosperity and to ensure the integrity of the Budget. I will add that with Australia’s population ageing, and the vested interest pool of older retirees continuing to grow, it would also be wiser to act now rather than delaying reform.

unconventionaleconomist@hotmail.com