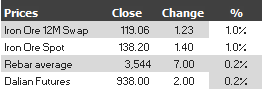

Find below the iron ore price table for December 12, 2013:

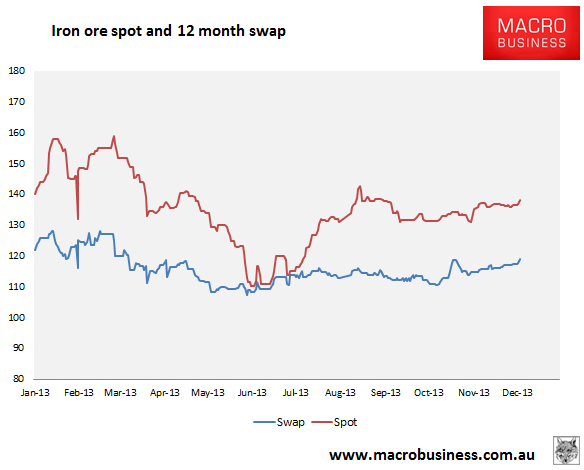

All green and the charts have broken out with 12 month the highest since March:

If spot can get through $142.80 we’re off to the races on the restock for the first quarter of next year. Good odds.

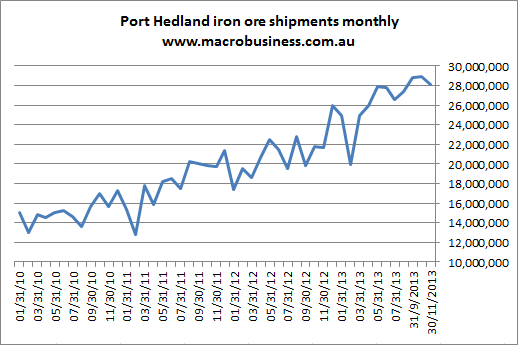

In news today we have November Port Hedland shipment results which eased bu remained above 28 million tonnes:

More evidence here for why iron ore has remained unseasonably strong. Shipment to China fell sharply from 25 to 22 million tonnes but Korea and Japan both stepped up, buying 5 milion tonnes between them in the month, double the previous. But China will come back in for it’s Q1 restock.

Also, the majors are all singing bullish song. From The Australian:

THE world’s two biggest iron ore producers, Rio Tinto and Vale, have issued a strong outlook for Australia’s biggest export, saying China’s demand continues to beat expectations at the same time the Asian powerhouse’s domestic mines are struggling.

Both miners yesterday said Chinese iron ore demand continued to exceed expectations and would remain strong.

They also said the cost of mining the steelmaking ingredient, whose price has remained strong at between $US130 and $US140 per tonne in recent months, was rising substantially in China.

Vale said it did not see long-term iron ore prices falling below $US100 per tonne.

Rio, which last week flagged an extra $US2 billion ($2.2bn) of iron ore mine spending to boost production to more than 350 million tonnes per year, made bullish comments on iron ore at an investor briefing in Sydney.

While Chinese growth and urbanisation would continue, supply constraints were likely to be worse than many predicted as miners reined in growth, Rio chief Sam Walsh said.

…Vale’s head of iron ore strategy, Jose Carlos Martins, told investors in New York that China’s iron ore production cost was increasing much faster than in the rest of the world.

“We know that some mines are producing at $US170 per tonne,” Mr Martins said, adding that a lot of other global supply would replace declines elsewhere.

“We don’t see any big issue of oversupply in the market.”

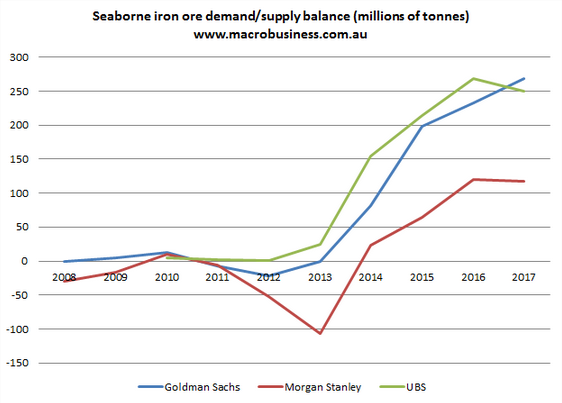

You’re not looking then. Here it is:

The cartel will hold it together so long as the supply isn’t overwhelming but any hiccup in China and down we go. That’s the risk for Q1/2 next year. But for now it’s all good.