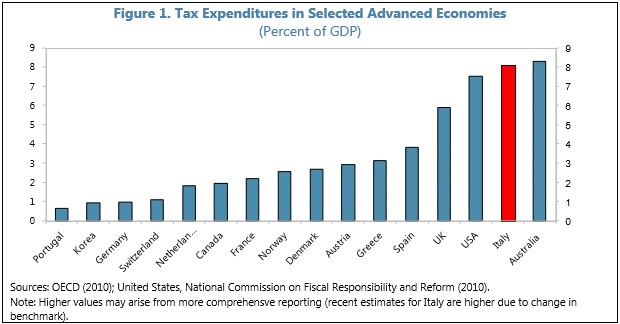

IMF: Australia world number one in tax rent-seeking

A new report from the International Monetary Fund (IMF) suggests that Australia has the highest tax expenditures in the OECD when measured against GDP (see next chart).

According to the report, tax expenditures are:

…government revenues foregone as a result of differential, or preferential, treatment of specific sectors, activities, regions, or agents. They can take many forms, including allowances (deductions from the base), exemptions (exclusions from the base), rate relief (lower rates), credits (reductions in liability) and tax deferrals (postponing payments).

The IMF believes that tax expenditures should be reformed since they:

…can have major consequences for the fairness, complexity, efficiency, and effectiveness of not only the tax system itself but, since they often serve purposes that might be (or are also) pursued through public spending, of the wider fiscal system.

It also argues that now is the time to roll back tax expenditures to help cut budget deficits. Regular reviews would increase scrutiny of outdated perks, and many could be replaced with more targeted measures, since most of the benefits are currently enjoyed by the wealthy rather than those needing help.

In Australia’s case, obvious tax expenditures that should be wound-back include negative gearing and superannuation concessions, whose benefits overwhelmingly flow to higher income earners and undermines the progressiveness of the tax system.

That said, reform is obviously easier said than done, as evident by the ruckus created when the former Labor Government last year attempted to reform fringe benefits on company vehicles.