The AFR has today called on the Government to introduce greater means testing of the Aged Pension, whose benefits are increasingly flowing to retirees that “live in big houses, drive new cars, and holiday in Europe”:

…even though many public policy experts and even some pensioners say the rules for the age pension are loose and the scheme too expensive, both main political parties are enthusiastic supporters.

Former treasurer Wayne Swan boasted on Twitter last week that “Labor delivered the biggest age pension increase in history”. When a lobbyist representing pensioner groups complained to Social Services Minister Kevin Andrews recently that the government had raised the huge cost of paying for retirees, he said Andrews assured him the age pension wasn’t up for review…

Eighty per cent of Australian families over the age 65 with about $1 million in assets get it or another welfare benefit, according to the Grattan Institute, a Melbourne-based think tank pushing to make the pension less expensive.

“People are deliberately structuring their affairs to qualify for the pension and that’s relatively easy to do,” says Grattan Institute chief executive John Daley. “Unless you are really very, very well off, you can qualify”…

It’s great to see more and more articles questioning the efficacy and sustainability of the Aged Pension. Any discussions around ending the “Age of Entitlement” and returning the Budget to surplus simply cannot ignore one of the the biggest and fastest growing drains on the Budget, whose $36 billion of outlays last year has ballooned by $13 billion over the past decade and now makes-up around 10% of the Budget.

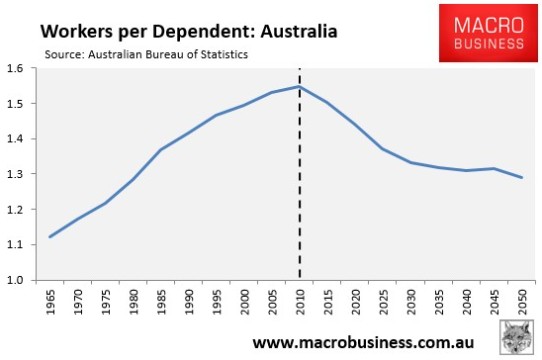

Moreover, without reform, the growing burden from the Aged Pension is likely to worsen significantly as the large scale retirement of the baby boomer generation pushes the ratio of working-aged Australians supporting dependents (mostly the aged) lower, slashing the tax base at the same time as age-related outlays expands.

According to the Grattan Institute, without corrective action, the Federal Budget deficit could hit $60 billion per year by 2023, or up to 4% of GDP, due mostly to rising health and welfare costs. Grattan also argues that the only part of the tax and welfare system that is not well targeted is for old people – a view supported by researchers from Curtin University, who recently found that welfare policies across the period 1984 to 2010 overwhelmingly favoured the elderly at the expense of the young.

While there are no doubt many genuine pensioners scraping by on $20,000 a year, the loose eligibility requirements for the Aged Pension also means that there are many well-off “BMW pensioners” unnecessarily receiving assistance. For the sake of equity and Budget sustainability, assistance to these types of people must be cut-off, so that benefits only flow to those genuinely in need.

That said, it is simply not enough to only focus on the overly generous nature of the Aged Pension. Just as bigger lurks lie with superannuation, although politicians and the media are largely quiet on this issue.

While the superannuation system was originally designed so that a younger generation could pay for its own retirement, it has instead become a mechanism whereby older people pay less tax given their income than everybody else, with the lion’s share of benefits also overwhelmingly going to richer people.

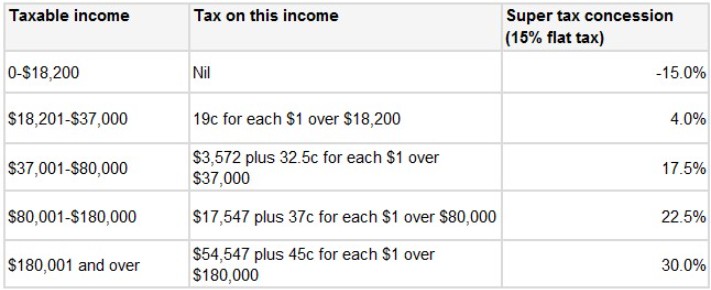

Under the current system, all employees that contribute compulsorily into super pay a flat 15% contributions tax, which effectively means that the amount of concessions received increases as one moves up the income scale (See below table).

For example, someone that earns in excess of $180,000 per year receives a 30% tax concession for each dollar that they contribute into super (i.e. 45% marginal tax rate less the 15% flat tax). At the other end of the scale, someone that earns less than $18,200 per year in effect gets penalised 15% for each dollar that they contribute into super.

According to the Australian Treasury, concessions on superannuation contributions were estimated at $16.5 billion in 2012-13, with concessions on superannuation earnings valued at $15.5 billion. Moreover, the Treasury estimated that the top 5% of contributors would receive 20.3% of contribution concessions, with higher income earners also receiving the lion’s share of the earnings tax concessions.

Given that the main rationale behind superannuation is to both adequately provide for retirement and take pressure off the Aged Pension, the 15% flat tax system is inherently flawed and designed to fail. By providing massive taxation concessions to those on the highest incomes, the Budget loses billions of dollars of forgone revenue. At the same time, the super system is unlikely to relieve pressure on the aged pension, since those that are most likely to need it – lower and middle income earners – receive minimal (if any) concessions, which both hinders their ability to build-up a retirement nest egg and discourages them from making additional contributions.

A simple reform that would greatly improve the equity and sustainability of the retirement system would be to abolish the flat 15% tax on superannuation contributions and replace it with a flat concession (e.g. 15%) that is the same for all income earners. A reform of this nature would not only improve equity, since all taxpayers would receive the same taxation concession, but also boost lower income earners’ super savings, thereby reducing reliance on the Aged Pension and relieving pressures on the Budget.

The exclusion of the family home from the assets test for the aged pension and the ability to withdraw one’s super as a lump-sum (instead of an annuity) also creates an incentive for households to borrow to purchase an expensive home in the lead-up to retirement, retire at 60, withdraw their super tax-free as a lump sum, use the money to pay-off their mortgage or to fund consumption, and then go on the aged pension from 65 years of age. In such instances, the taxpayer is left wearing the cost of superannuation concessions throughout the individual’s working life, and then again once that same individual goes on the aged pension.

In fact, the latest Retirement and Retirement Intentions survey by the Australian Bureau of Statistics found that “of those who had made contributions, 55% had received all or part of their superannuation funds as a lump sum payment”. It also found that “many of those who received a lump sum payment used it to pay off or improve their existing home or purchase a new home… or to buy or pay off a motor vehicle”.

Given the above issues, obvious reforms that would improve the integrity, fairness and sustainability of the retirement system include:

- Increasing the eligibility age for the Aged Pension to 70 years (from 65 currently and 67 from 2023);

- Increasing the access age to superannuation (from 60 years currently) so that it more closely matches the pension access age;

- Reducing the ability to draw superannuation as a lump-sum;

- Providing everyone with the same superannuation concession (e.g. 15%); and

- Including one’s owner-occupied home (or part thereof) in the assets test for the Aged Pension and/or reducing the eligibility thresholds for income and financial assets, so that welfare flows only to those in genuine need.

If the Government’s “ending the age of entitlement” is to be equitable and consistent, it will need to place the retirement system front-and-centre, incorporating the growing army of wealthier older Australians drawing unreasonable tax concessions and benefits.