Former federal Liberal Party Leader, John Hewson, has written a well-argued piece in The AFR today, joining the chorus to wind-back superannuation concessions granted to high income earners:

It’s worth reconsidering concessions granted for super: they’re as costly as the age pension ($44.8 billion compared to $44.9 billion in age pension), but are growing more rapidly…

Treasury estimates that from the combined support of superannuation tax concessions and the age pension, most people (about 80 per cent) receive around $270,000 support over their lifetime. In contrast, the top 1 per cent of male income earners receives about $520,000 support over their lifetime, because of significant tax concessions to high-income earners.

Surely, we don’t believe that the top 1 per cent require that much incentive to adequately save for their retirement.

These tax concessions not only skew heavily towards high-income earners: low-income earners are actually penalised for saving (you read that right: penalised)…

As a result of this poorly targeted tax concession, 36.1 per cent of the benefits go to the top 10 per cent of income earners, whereas the bottom 10 per cent don’t receive any assistance at all, but are instead penalised.

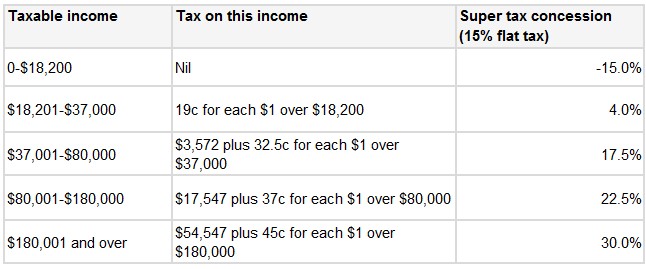

The egregious nature of Australia’s superannuation concessions are highlighted by the below table, which shows how under the current 15% flat-tax system, low income earners are effective penalised for placing money into super, whereas high income earners receive the largest concessions:

For example, someone that earns in excess of $180,000 per year receives a 30% tax concession for each dollar that they contribute into super (i.e. 45% marginal tax rate less the 15% flat tax). At the other end of the scale, someone that earns less than $18,200 per year in effect gets penalised 15% for each dollar that they contribute into super.

By providing massive taxation concessions to those on the highest incomes, the Budget loses billions of dollars of forgone revenue. At the same time, the super system is unlikely to relieve pressure on the aged pension, since those that are most likely to need it – lower and middle income earners – receive minimal (if any) concessions, which both hinders their ability to build-up a retirement nest egg and discourages them from making additional contributions.

The exclusion of the family home from the assets test for the aged pension and the ability to withdraw one’s super as a lump-sum (instead of an annuity) also creates an incentive for households to borrow to purchase an expensive home in the lead-up to retirement, retire at 60, withdraw their super tax-free as a lump sum, use the money to pay-off their mortgage or to fund consumption, and then go on the aged pension from 65 years of age. In such instances, the taxpayer is left wearing the cost of superannuation concessions throughout the individual’s working life, and then again once that same individual goes on the aged pension.

In fact, the latest Retirement and Retirement Intentions survey by the Australian Bureau of Statistics found that “of those who had made contributions, 55% had received all or part of their superannuation funds as a lump sum payment”. It also found that “many of those who received a lump sum payment used it to pay off or improve their existing home or purchase a new home… or to buy or pay off a motor vehicle”.

This is why I keep arguing for holistic reforms to Australia’s retirement system – both superannuation and the Aged Pension – to improve its integrity, fairness and sustainability, including:

- Increasing the eligibility age for the Aged Pension to 70 years (from 65 currently and 67 from 2023);

- Increasing the access age to superannuation (from 60 years currently) so that it more closely matches the pension access age;

- Reducing the ability to draw superannuation as a lump-sum;

- Providing everyone with the same superannuation concession (e.g. 15%); and

- Including one’s owner-occupied home (or some part thereof) in the assets test for the Aged Pension and related benefits, and/or reducing the eligibility thresholds for income and financial assets, so that welfare flows only to those in genuine need, rather than those well capable of taking care of themselves.

Irrespective, Australia’s ineffective and poorly targeted superannuation system is a major and growing problem, and desperately needs to be reformed.

unconventionaleconomist@hotmail.com