Geoff Carmody – director, Geoff Carmody & Associates, co-founder of Access Economics, and formerly a senior officer in the Commonwealth Treasury – has written a though provoking piece in The AFR challenging the common view that Australia is a low taxing nation.

According to Carmody, the common metric used to measure Australia’s tax burden – the simple tax-to-GDP ratio – is flawed, since it excludes compulsory levies on Australian workers, such as compulsory superannuation (9%) and workers compensation insurance premiums (averaging 1.5%), but includes compulsory social security levies for European member countries, which makes for an “apple-and-pears” comparison.

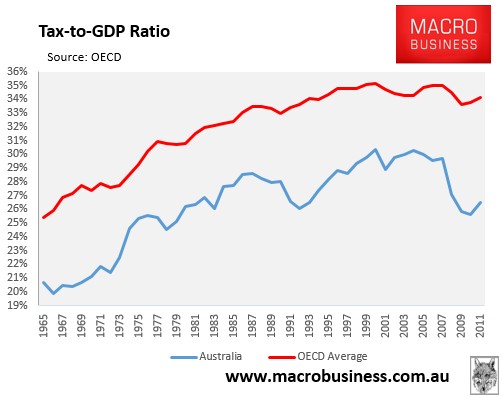

As a consequence, Australia’s tax-to-GDP ratio of 26.5% in 2011 was the fifth lowest in the OECD, and well below the 34.1% OECD average (see next chart).

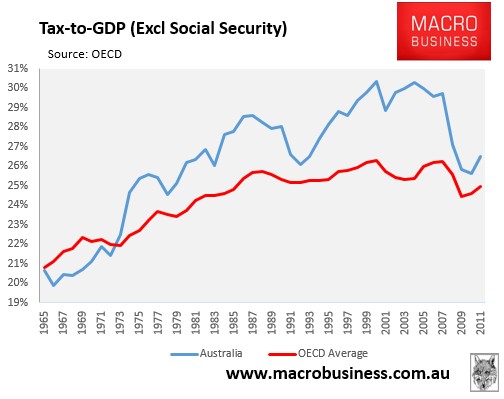

However, if social security is excluded from the tax-to-GDP measure, as Carmody thinks it should be, then Australia’s tax-to-GDP ratio of 26.5% in 2011 is actually above the OECD average of 25.0%, and “has been above the OECD average for the entire period since the election of the Whitlam government” (see next chart).

Carmody believes that Australia’s ‘high tax burden’ is undesirable:

We should not be happy with this. The OECD average includes sclerotic, stagnating European members with average tax/GDP burdens ranging up to 48 per cent. In this ‘Asian Century’, aren’t we benchmarking ourselves against our more dynamic neighbours and trade competitors? Our non-European competitors generally have tax/GDP burdens much lower than the OECD average. Marginal tax rates, rather than average tax rates, are generally regarded as most important for assessing tax effects on incentives to employ labour, to work, to save, etc…

The high marginal tax rates shown in the table suggest strong and growing incentives legally to minimise tax burdens, especially for higher-income earners. Opportunities afforded by, for example, capital gains tax discounts and superannuation concessions concentrated at the higher end of the income scale, facilitate this. Increasing on-costs faced by employers probably don’t help the labour market either.

Australia’s revenue problem is the structure of our tax “system”, not the myth we are a low-tax country.

For the record, I agree with Carmody’s preferred measurement of Australia’s tax burden. Given that Europe’s compulsory social security levies work in a similar manner to Australia’s superannuation system, then they should be excluded from any tax-to-GDP measurement for comparison purposes.

That said, I don’t necessarily agree that Australia’s tax take is too high. Tax revenue is required to fund the public services that the community both expects and needs. And I personally wouldn’t care if taxes were increased a little if it meant important social programs remained (or were expanded), along with the provision of well-targeted infrastructure.

Of primary importance is ensuring that the tax base is broadened and based on more efficient and equitable sources. This requires a shift in sources from productive effort (e.g labour) towards taxes on land, resources, and consumption, along with adequate compensation for the poor (in the case of raising/broadening the GST). It also requires the closure of egregious tax lurks that distort the economy and/or overly benefit the wealthy, such as negative gearing, capital gains tax discounts, superannuation concessions, and tax breaks on company cars.

An adequate tax take is a vital element for a civilised society. And a high tax take is not an issue provided it is raised in and equitable and efficient way, along with well-targeted expenditure.

unconventionaleconomist@hotmail.com