by Chris Becker

A fairly dour note on corporate earnings has been released by Deutsche Bank today, which flies in the face of the headline GDP result for the March quarter. Deutsche points to three factors, apart from the usual seasonal ones, that they think will weigh on market sentiment:

- high Australian dollar (although they forecast a drop to 85 cents by the end of 2015)

- falling commodity prices (but higher volumes?)

- “hard-hitting” (sic) Federal Budget (when will it hit?)

Not much escapes the pessimism: banks, retailers, telcos and miners – although favour is found in healthcare and REITs.

Deutsche point to worsening business conditions from March going into the June quarter, which is probably on the back of the recently released survey from NAB:

Business conditions dipped slightly again in the month, revealing an emerging trend lower since the start of the year. Together with the poor conditions reported by wholesale – a bellwether industry – it suggests little scope for improvement in domestic demand

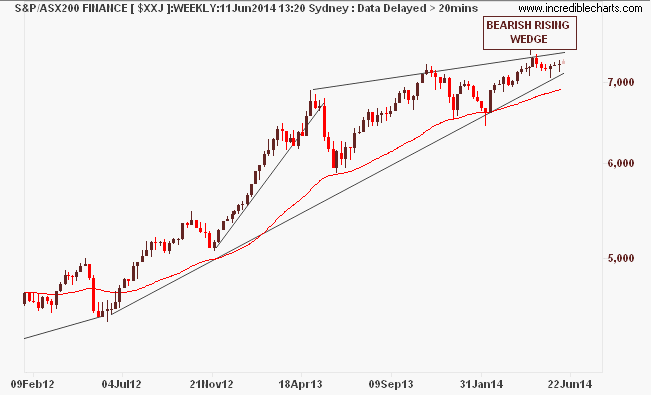

The note on banks is very interesting given the extremely overbought situation – the financial sector (ex property) is up over 55% in the last 12 months:

From the SMH:

Despite a ”reasonable earnings outlook”, Mr Baker said the banks were fully priced and had a relative high price to earnings ratio compared to both their own history and the rest of the market. ”

Banks comprise 31 per cent of the Australian market cap, a record high. Credit growth should remain reasonable (mid-single digit), but not strong as in the past.

”While housing is picking up, we expect a construction cycle without a leverage cycle, and the latter matters more for credit. Bad debts are already fairly low, and seem unlikely to fall much further.”

He goes on to suggest that the Federal Budget will begin to weigh on market sentiment coming into the June/Sept quarters – for mind, I think this is currently a little overblown.

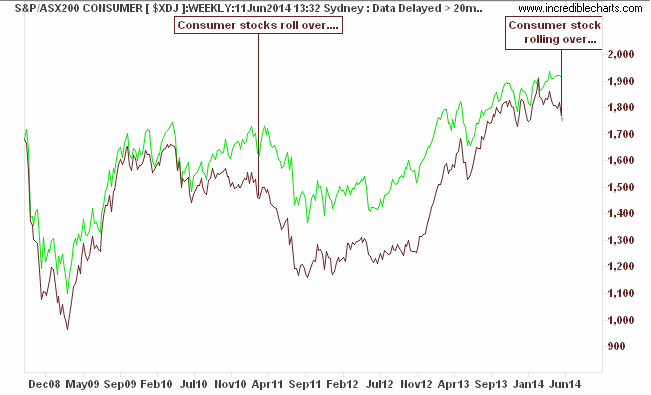

The sector that looks most likely to roll over in the coming months are consumer discretionary, as noted earlier this morning, and it could indeed be the bellwether as other downturns in the broader market were prefaced by a slump in consumer spending. Macro 101…