The Australian Treasury has released a new paper, which examines historical trends in capital gains taxes (CGT), as well as forecasting issues.

While the paper is rather wonkish, and not particularly interesting, it does point-out that the decision by the Howard Government in 1999 to halve the rate of capital gains tax for investments held for more than year has fueled negatively geared property investment:

…the total effective concessions on capital gains income are significant. Both the indexation and discount methods have provided a strong incentive towards financial investment in products which provide significant capital growth, such as shares or property, rather than in products which primarily provide income streams, such as bonds. The concessionary treatment of capital gains income is arguably the primary motivation for financial investment in negatively geared real estate, which aims to shift all of the investment return into the capital gain on the eventual sale of the asset…

Assuming historical trends in key variables such as house prices, interest rates and rental income and depreciation, the largest tax benefit from investment in negatively geared property is the CGT discount, which is around twice as large as either the CGT tax deferral advantage or the ability to offsetting operating losses against other forms of income.

The Treasury paper also notes that high income earners have been the main beneficiary of the CGT concession, with around half of all net capital gains income reported by those earning above $180,000:

Taxable net capital gains income tends to be received by individuals at the higher end of the income distribution. Around half of total taxable net capital gains income reported for 2011-12 was received by taxpayers whose other taxable income was above $180,000 (the top tax rate threshold). For the 2011-12 year the average statutory rate of tax on taxable net capital gains income was 30.9 per cent, compared to the overall average rate of around 22.2 per cent.

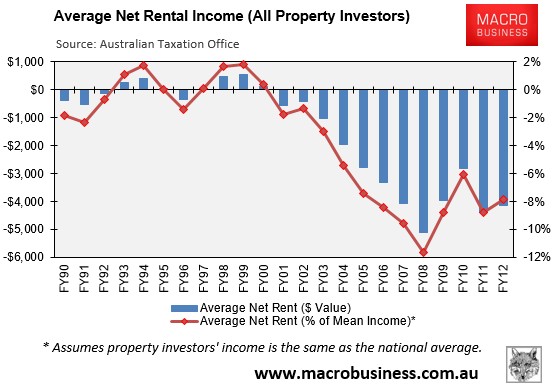

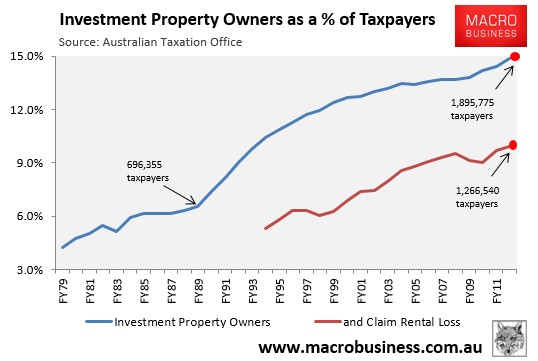

It’s worth pointing-out that up until 2000, property investment was more or less neutral from an income perspective, with aggregate rental receipts broadly covering costs. From 2000 onwards, however, net rents deteriorated sharply, with aggregate losses totaling $7.9 billion in 2011-12, or $4,146 per investor (see next chart).

Clearly, the Howard Government’s decision in 1999 to halve the rate of CGT encouraged investors to speculate on rising housing values in full knowledge that any losses would reduce their overall tax liability, and any capital gains would be taxed at only half the rate of labour income. Hence, the explosion of negatively geared investment over that time period (see next chart).

Congratulations Howard and Costello for your short-sighted decision to lower CGT, which has encouraged greater speculation in housing, increased Australia’s mortgage debt, and helped to push-up the cost of housing for younger Australians.