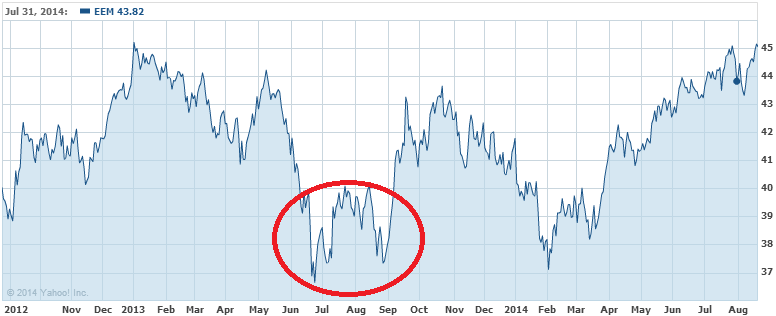

Last year’s spectacular “taper tantrum” in markets is something of a misnomer. It was an episode of “risk off” behavior driven in part by the Federal Reserve move to begin tapering quantitative easing (QE). US bond yields suddenly soared as higher interest rates became an expectation. That saw capital repatriated from emerging markets economies to the US and, as the MSCI emerging markets (EM) index shows, equity was hit hard (so was debt and forex):

But there was another very important factor in the tantrum that is usually forgotten. The timing coincided with a sharp slowing in the Chinese economy after its 2012 round of stimulus (which wasn’t that “mini”) and that set up a feedback loop for markets to rush out of EMs because they are very China export dependent. Couple that with the withdrawal of capital chasing higher interest rates in developed economies and you had a near perfect storm in EM external balances.

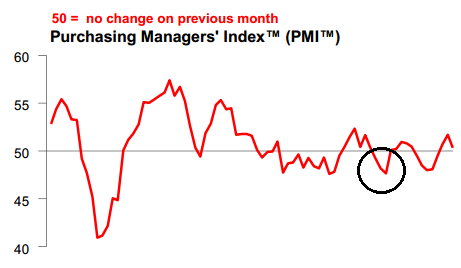

Markets have since recovered handsomely owing to two changes. The Fed managed to convince markets that tapering was not tightening and the backup in bond yields stopped (and has been reversing ever since). Secondly, China launched another mini-stimulus and turned its economy back to growth quick smart. You can see this in the PMI chart: