A senior tax adviser to the Abbott Government, EY tax partner Glenn Williams, has called on the Abbott government to scrap tax breaks that benefit the wealthy before it seeks to hike the GST and reduce other taxes. From The AFR:

While people earning over $180,000 already face a marginal tax rate close to 50 per cent, he said popular tax breaks that provide most benefits to the wealthy – such as dividend imputation, negative gearing and capital gains tax breaks – could be curbed.

“You can’t go above 50 per cent (income tax for people on the top marginal tax rate) because then there’s a disincentive to work,” he said. “But there’s a general consensus that the tax burden has to fall on those who are more well off”…

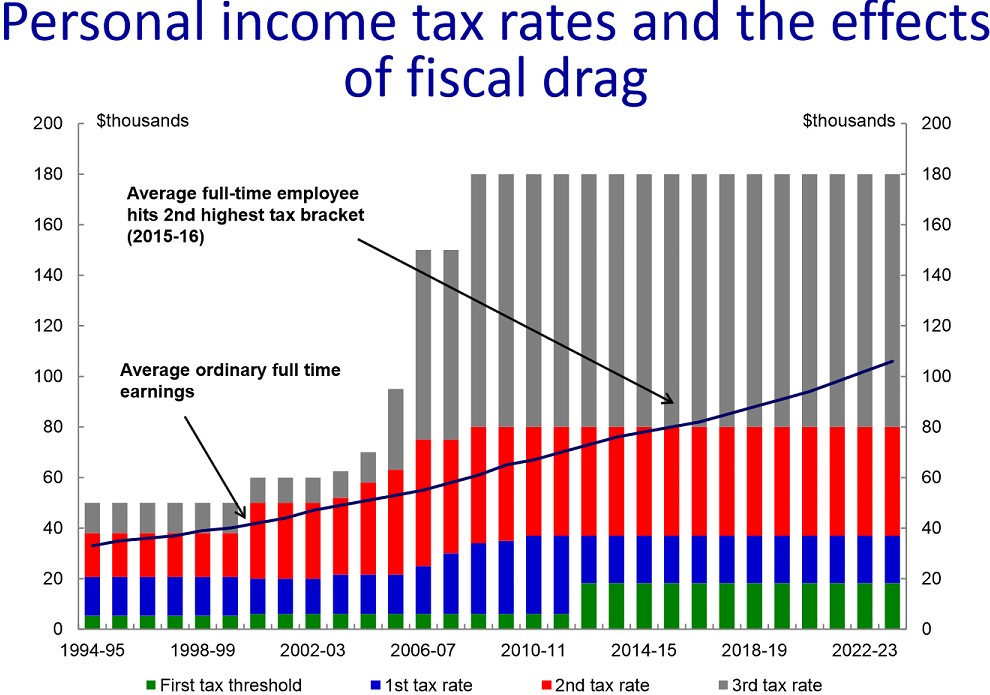

“For example, the burden of personal income tax is increasingly falling on people on average income levels, and the superannuation tax settings do not incentivise lower income earners to contribute their own money to their superannuation savings.”

Without reform, the tax system will become increasingly regressive as bracket creep (aka “fiscal drag”) pushes lower and middle income earners into higher tax brackets, significantly increasing their tax burden. The dilemma was spelled-out in yesterday’s Budget report by Deloitte Access Economics:

…there are 1.3 million taxpayers with incomes in the $30,000 to $37,000 range (and whose marginal tax rate may therefore soon jump 14 percentage points), and a further 0.8 million taxpayers with incomes in the $70,000 to $80,000 range (and whose marginal tax rate may therefore soon jump 4 percentage points).

Outgoing Treasury Secretary, Martin Parkinson, has drawn similar conclusions:

…over the decade ahead, the average tax rate paid by that individual is expected to rise from 23 per cent to 28 per cent, an increase of over 20 per cent. Moreover, the increase in the average tax rate for lower income earners is generally greater than for higher income earners. One consequence of this is to make the personal income tax system less progressive…

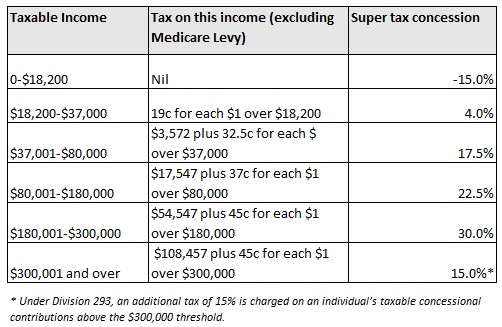

Williams’ recommendation that the Abbott Government clamp down on superannuation concessions is sound. While the exact budgetary cost of these concessions is difficult to ascertain – since it is difficult to determine behavioural changes as some people move their funds elsewhere – super concessions likely cost the Budget many billions in foregone revenue and are skewed toward high earners.

One only needs to look at the below table, which shows the amount of concession provided at each income tax threshold, to realise that the lion’s share of benefits flow to higher income earners, whilst penalising lower income earners:

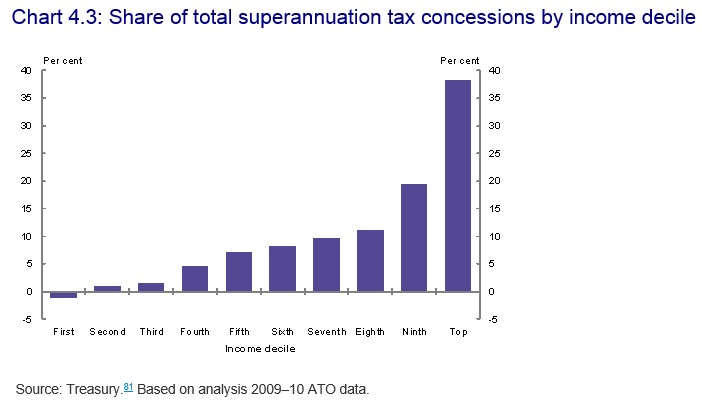

The draft report of the Murray Inquiry into Australia’s financial system agreed, noting that “the majority of superannuation tax concessions accrue to the top 20 per cent of income earners (Chart 4.3). These individuals are likely to have saved sufficiently for their retirement, even in the absence of compulsory superannuation or tax concessions”.

Winding back superannuation concessions, therefore, could potentially save the Budget billions whilst also improving the progressiveness of the tax system. It’s a no-brainer.

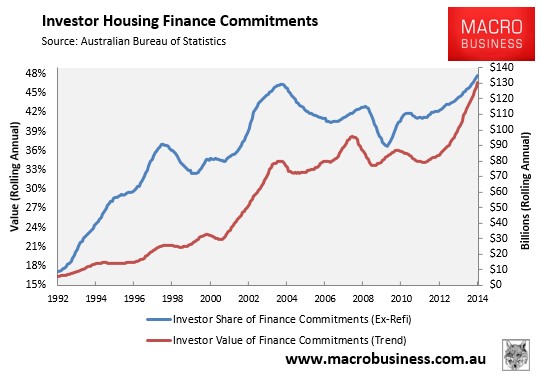

Unwinding capital gains and negative gearing concessions makes equally good sense.

For example, the Grattan Institute has estimated that quarantining negative gearing losses, so that they can only be claimed against the same asset’s future earnings (rather than unrelated wage/salary income), would save the Budget around $2 billion a year in revenue foregone once lower capital gains tax receipts are taken into account.

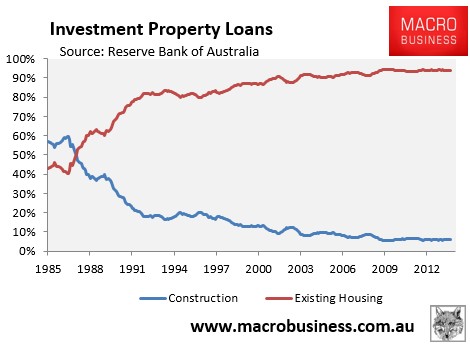

These concessions also juice housing demand:

Without expanding supply:

Therefore, they should be ‘abolished’ on equity and efficiency grounds, let alone for the sake of Budget sustainability.

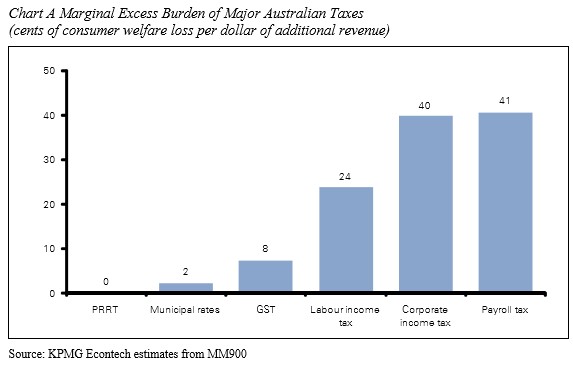

Of course, in addition to closing Australia’s world-beating tax concessions, there is also good sense in broadening the tax base to ensure that it is built around more efficient and equitable sources, such as land, resources and consumption, whose efficiency are far higher than personal and company taxes (see next chart from the Henry Tax Review).

The bottom line is that it is highly inequitable to expect workers – whose share of the population will fall as the population ages and the proportion of retirees rises – to keep shouldering more and more of the tax burden. Nor is it sustainable in the longer-term. This is why root-and-branch reform of the tax system is required, encompassing the elimination of highly distorting and inequitable tax concessions, along with broadening the tax base in favour of more efficient sources.