by Cameron Murray and Philip Soos

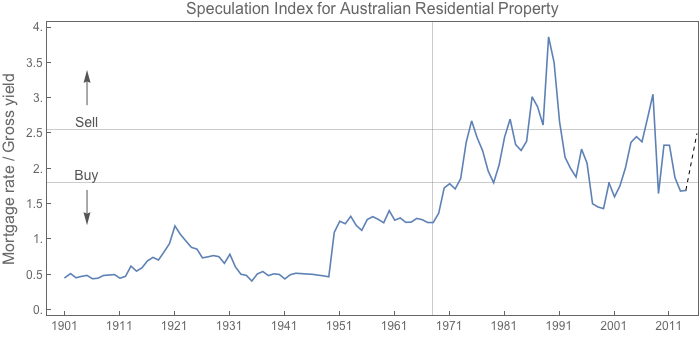

The last two years have been somewhat of a testing ground for making property price forecasts informed by my indicator, which has a new name – the Speculation Index. It is the ratio of housing gross yields to mortgage interest rates, and captures the degree of price growth speculation embedded in current prices.

Above is a new long term series of this Index using data compiled by Philip Soos. It offers a number of insights into the history of housing credit, the durability of cycles in periods of apparent macroeconomic stability, and offers a warning about the future of residential property markets to those who hold out hope that maybe now is the beginning of that elusive era of stability.

Above is a new long term series of this Index using data compiled by Philip Soos. It offers a number of insights into the history of housing credit, the durability of cycles in periods of apparent macroeconomic stability, and offers a warning about the future of residential property markets to those who hold out hope that maybe now is the beginning of that elusive era of stability.

The primary lesson from the long term Speculative Index is that the easy money era since the late 1960s has been qualitatively similar to the pre-WWII period in terms of cyclical patterns, but far different in terms of scale. Whether this has to do with the openness of credit markets, dual incomes, or the development of private investor markets in Australian housing, it is best to consider this period a unique conflation of institutions that cannot be compared to prior periods.

Or it could just be terrible data. Take your pick.

We can gaze back at the early part of the 20th century, which followed a massive housing boom and slump, particularly in Melbourne, during the 1890s. The first decade, by this measure, was a period of relative stability for property prices in Australia.

After WWI a property boom took hold, peaking around 1921 as yields fell and interest rates crept upwards, and followed by a long slump that continued through the Great Depression. During WWII the market was completely unmoved as resources were sucked out of domestic private markets into the war effort and various administrative controls kept prices and rents steady.

The renowned stability of the 1950s and 1960s is on display in this metric as well, with housing capitalisation rates very stable compared to yields, with almost no price speculation built into prices. Perhaps this was primarily a product of tight credit to households, coordinated construction efforts, and relatively high levels of non-housing investment.

Post 1970 the modern finance era kicked off with a Sydney boom, which rippled across States and was over by about 1974. Then the 1980s saw another round of smaller surges of speculation, ultimately collapsing in 1989 and leading to a recession a few years later. The end of the 1990s recession ended appeared to be the best time to buy property in the past two decades, as this index and a whole host of property-related metrics indicate.

The massive 2000s boom then rippled across the nation, and as interest rates where ratcheted up on falling property yields we see another index peak in 2008, which plunged back in response to substantial stimulatory interest rates cuts.

In essence, housing prices were rescued by the RBA during this period. Historically low mortgage interest rates, the influx of foreign investment into the housing market (and mining) and the Rudd government’s bailout of the banking and financial system saved the day.

As I wrote early last year, my Speculative Index again showed it was an opportune time to buy Australia housing. Prices are up over 10% nationally since, and around 17% in Sydney. Currently this Index suggests there is more to run in the national price cycle. Prices being more likely to rise than fall in the near future.

I add a dashed prediction line to show what might be the next moves in this Index, jointly arising from a number of evolving trends including

- Rising mortgage interest rates

- Flat or falling rents

- Rising prices

For example, if prices rise by 10%, mortgage rates rise by 0.75%, while rents are flat, the Index will shift up to 2.1. That’s still a long way off the type of irrational exuberance we normally see, taking us only halfway from the buy line to the sell line.

Unless we see significant credit controls in the housing market, it is likely we will continue the property price cycle we have just started. This cycle itself will compress yields while rents are stable and result in a surge of the index, providing the boom for necessary for the next bust. The RBA, as usual, will be too late to increase interest rates. Governments at all levels will be too uncoordinated to increase public investment to smooth the transition to a higher rates or tighter credit environment.

If the Georgist 18 year average period of asset cycles has merit, then we are now likely living in a period much like mid 1990s – still cautious from recent experience and ignorant of the property cycle about to get under way. Remember though that this Index does not represent prices, but reflects the degree of speculative fervour in the market. The Index can rise without price price increases if rents are flat and mortgage interest rates are rising. Which of these factors we see play out will determine the scale of the price gains likely to be experienced.

Looking at the history of this index, coupled with the recent success of using its cyclical pattern to predict property market movements, suggests it is unlikely that ‘this time is different’.