Cross-Posted from Bullion Baron

A question posed by email to the RBA earlier in the year suggested that RBA officials had performed the audit themselves.

I decided to lodge another FOI request.

“I request that a copy of the following documents be provided to me: All documents pertaining to the audit of the RBA’s gold holdings performed during the 2013/14 financial year, as was specified in the ‘Operations in Financial Markets’ section of the Reserve Bank of Australia Annual Report 2014 (“During the year in review, the Bank audited its gold holdings”).”

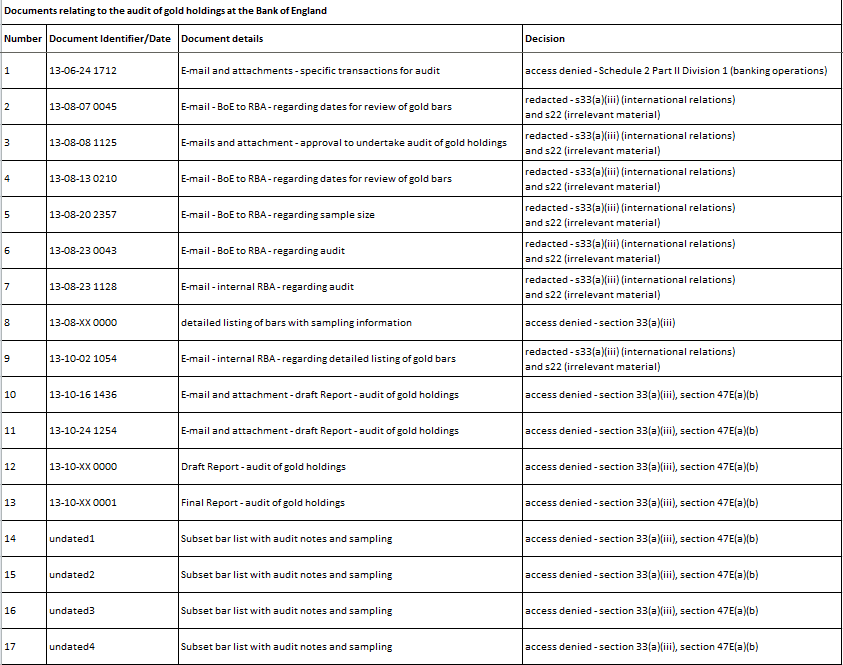

Two months later (decision on the documents was delayed due to consultation with the Bank of England) I received the following list of documents that would be provided (on payment of fees, which were reduced from an original quote due to the small number of documents that could be released):

And today the documents arrived. Here’s what we know…

In February 2013, the Assistant Governor (Financial Markets) requested Audit Department include in its audit program a review of the Bank’s gold holdings at the Bank of England (BoE). The Chief Representative in EU approached the BoE to facilitate this review and in late May 2013 initial planning discussions were held with BoE staff with tentative agreement that the review would take place in September 2013.

The audit included:

- An on-site physical verification commencing 23 September 2013, which will take 4-5 days to complete, assuming two RBA auditors are involved given the proposed scope.

- Inspecting a sample of RBA Gold bars (list to be provided in advance), including checking the details of these bars against the Bank’s inventory list and weighing of the bars by BoE staff using their equipment.

- Randomly selecting additional Gold bars from the inventory list and observing these bars being located and retrieved from their vault (plus verifying the details and weighing them).

- Obtain a high level understanding of the BoE gold safe custody service.

- Continuing discussions for a comprehensive safe custody agreement between the RBA and BoE.

As the above document list shows, those relating to final audit results were not provided. I would assume the audit was successful, but no doubt that would be a highly contested opinion in the Gold blogosphere. The following reason was provided for denying access to the report:

Documents 10, 11 and 12 are drafts of the report prepared by the RBA’s Audit Department detailing the findings of the audit and document 13 is the final of that report.

Denial of access to these four documents in terms of s33(a)(iii) is appropriate because release of the information (which relates to procedures for the conduct of the audit with the BoE and the subsequent results) ‘would, or could reasonably be expected to, cause damage to’ the relationship between the RBA and the BoE. This belief is soundly held by us on the basis that we are aware that the BoE provides safe custody services not only to the RBA, but also to other central banks around the world. Disclosure of the information in these documents could damage the relationship between the BoE and its other central bank clients, and by extension (as the source of the information), the relationship between the BoE and RBA. As foreshadowed to you in earlier correspondence, we consulted with the BoE in relation to these documents and they affirmed the views we held regarding the damage that would be done to the relationship between the BoE and RBA if the redacted information were disclosed.

Denial of access to these four documents is also appropriate in terms of s47E(a) (‘disclosure would, or could be reasonably expected to, prejudice the effectiveness of procedures or methods for the conduct of tests, examinations or audits’ by the Bank) and (b) (‘disclosure would, or could be reasonably expected to, prejudice the attainment of the objects of particular tests, examinations or audits conducted, or to be conducted’, by the Bank). The documents in question concern the ‘procedures and methods’ within both the RBA and the BoE regarding the conduct of the physical check of a sample of gold bars (for the purpose of conducting the audit). Disclosure of this information would, of course, reveal those procedures and methods, and by logical extension render them less effective. Also, the ability of the Bank to attain the objects of the audit (which is to reveal whether the Bank’s arrangements are robust and secure) would be prejudiced. These considerations apply to both the audit currently the subject of your FOI request and also any other audits undertaken by the RBA. A key requirement for undertaking a successful audit (of any aspect of the RBA’s work) is that there is as little opportunity as possible for individuals to take steps to predict what an auditor may choose to focus on, and/or how they will conduct the audit. It is self-evident that if such procedures and methods are revealed, then the opportunity to circumvent them is greatly increased. As s47E is a public interest conditional exemption, I must take into account whether the giving of access is in the general public interest (in terms of s11A(5)). When deciding whether access is in the public interest, I must take into account the following from s11B(3) and have noted my views in each case:

Section 11B(3) factors favouring access to the document in the public interest include whether access to the document would do any of the following:

(a) promote the objects of this Act (including all the matters set out in sections 3 and 3A); release would be contrary to some sections, particularly sections 2(a) and 3(3)

(b) inform debate on a matter of public importance; the Bank’s gold holdings, while important and of interest to some, are not a matter of public importance generating any level of debate

(c) promote effective oversight of public expenditure; release of the information would not do this

(d) allow a person to access his or her own personal information; the request is not seeking personal information.

Taking into account these factors, and the implications release of the information would have on the Bank’s audit processes, I have decided that it is clearly not in the public interest to disclose the information in these four documents (10, 11, 12 and 13). Disclosure of these documents would manifestly harm the public interest by way of reducing the ability of the RBA to successfully conduct audits and tests of its operations going forward.

The released documents (mostly a chain of various emails) also suggested the RBA have been invited back for another review in 12 months.

One interesting point from the documents, the Bank of England was emailing clients in June 2013 (those for whom they’re providing custodial services) inviting them to audit samples of their Gold:

|

| Click Above Text To Enlarge |

However discussions on the RBA audit were already well advanced at that time.

Given that the RBA has followed the lead of other countries to release reserve location details, perform audits and release (some) bar list details, it will be interesting to see whether they go further and follow the lead of the many countries now deciding to repatriate some or all of their Gold reserves…