by Chris Becker

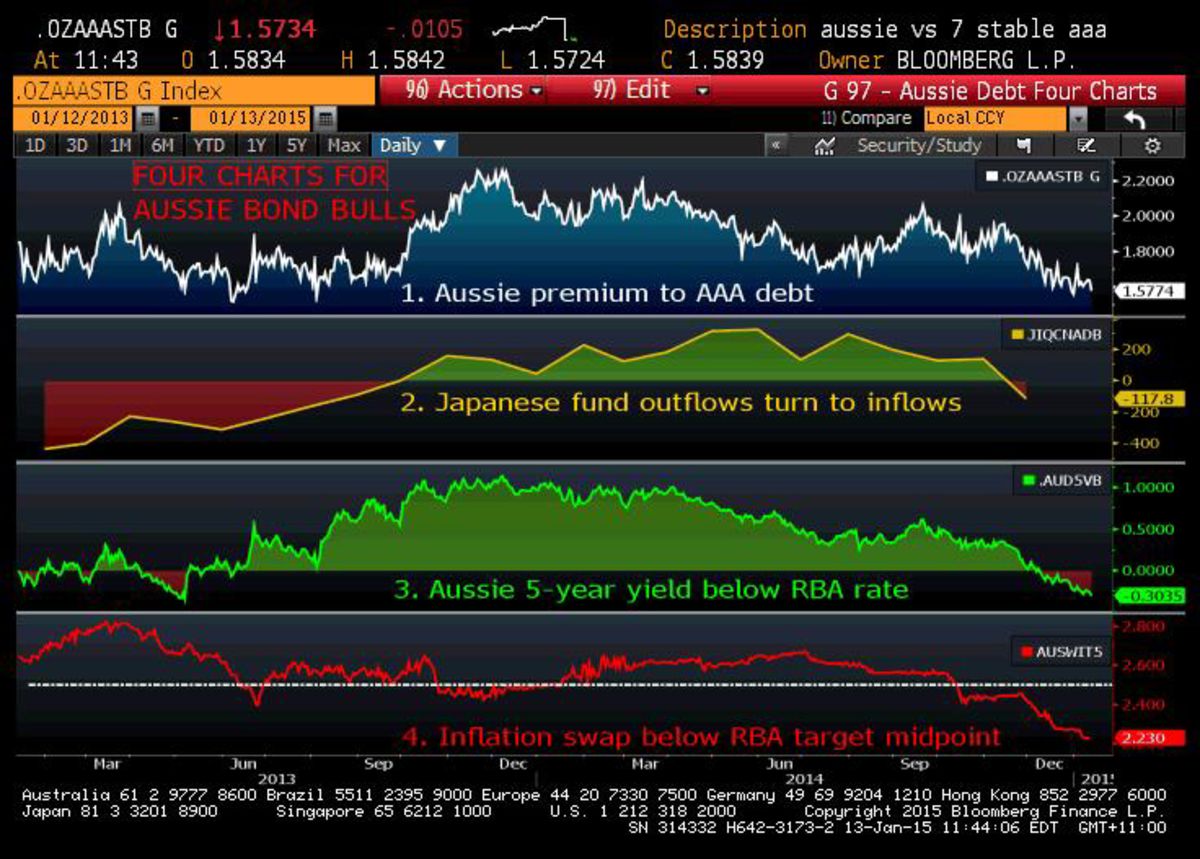

Today’s chart is actually a 4 in 1 and carries on from last week’s expose on Australia’s sovereign bond yield lows.

From Bloomberg:

Here are the cliff (or is that Michael) notes from Bloomie and my take thereafter:

Chart 1: Australian 10-year yield premium to AAA peers. Ten-year bonds offer 1.6 percentage points of extra yield over comparable securities.

This is still a considerable yield and the carry trade still explains why a country with higher unemployment than the US, low GDP growth while facing a massive headwind as the mining boom unwinds should have a currency at least 20-25% lower, but doesn’t. Rates differentials matter

Chart 2: Inflows from Japanese investors. Japanese money managers have purchased Australian bonds for 13 straight months. It’s the longest run since 2010, based on Japan’s Ministry of Finance data that go back to 2005.

Japanese purchasing comprises about 6-7% of all foreign buying, which by the way comprises over 70% of destination of Aussie bonds. The locals aren’t interested, preferring to take literal punts on local stocks.

Chart 3: Yields signal expectation for rate cut. Five-year notes yielded 2.24, or 26 basis points less than the central bank’s target for overnight lending, or the cash rate. The inversion signals investors are buying debt to lock in yields now in case they fall later.

This is the first clue to an outlook that screams lower rates and lower growth.

Chart 4: Inflation outlook falls. Five-year inflation swaps, which allow investors to exchange fixed interest rates for returns equivalent to the consumer price index, dropped to 2.23 percent this month. It was the lowest level since the global financial crisis triggered a contraction in the world economy in 2009.

The clincher. Contrary to mad economist opinion, the RBA is not raising rates anytime soon as inflation, both tradeable and non-tradeable, is not a concern. There are no wage breakouts to speak of as the income recession rolls on and households continue to disleverage with debt servicing ratios falling as house prices rise.

Is this a beautiful deleveraging as Ray Dalio calls the US post-GFC economic restructure or are there a few air pockets to come? Buckle up.