Dad’s Army’s Robert Gottliebsen (“Gotti”) has produced a tortured defence of Australia’s superannuation system today, claiming that the costs of the scheme are a “small fraction” of the “hoax” figures estimated by the Australian Treasury:

As we start the next round of superannuation debate, we are still hindered by the elaborate hoax Treasury played on Australian politicians and the public by giving out false costs on superannuation…

The real cost of superannuation is a small fraction of $32bn…

…The $32bn “cost” figure was reached by adding two theoretical calculations that Treasury researchers in 2013 said must never be added…

Not only was Treasury mathematically wrong in adding the 2013 sums but they used a highly optimistic earning rate of 7 per cent over 35 years to artificially boost the income lost in the concession and “forgot” to deduct the reduction in the pension bill that superannuation delivers.

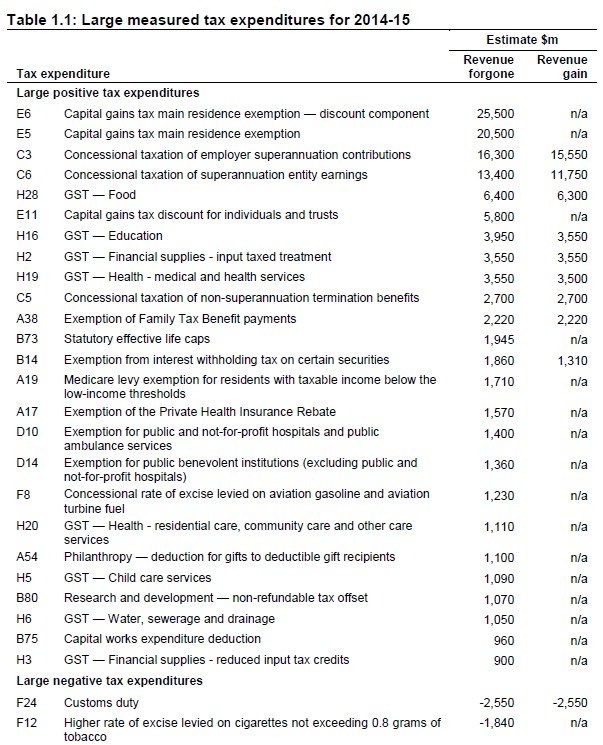

The “hoax” figures Gotti refers to are shown in the table below:

As you can see, the concessional taxation of employer superannuation contributions, whereby super contributions are taxed at 15% rather than at the employees marginal tax rate, is forecast to cost the Budget a whopping $16,300 in 2014-15.

Similarly, the concessional taxation of superannuation entity earnings – whereby earnings within super funds are taxed at just 15% before the age of 60 and 0% afterwards – are forecast by the Treasury to cost the Budget $13,400 million in 2014-15.

To add insult to injury, superannuation concessions were also forecast in the December Mid-Year Economic and Fiscal Outlook to grow by a whopping 10.8% per annum between 2014-15 and 2017-18 – well in excess of the growth in the economy.

Gotti argues that Treasury’s tax expenditures measurement is wrong, and that it is incorrect to simply add the costs of the two types of super tax concessions together (i.e. C3 and C6 above).

He has a point: if employer contributions were taxed more heavily then there would be less in the super funds to create earnings that would be taxed.

However, these complexities of measurement are besides the point. The fact is superannuation concessions are costing the Budget many billions of dollars of revenue foregone. They are also growing rapidly. Even if their true cost was half the amount estimated by Treasury above (an impossibly low figure), their cost to the Budget would still be a ginormous $15 billion this year, rising to some $20 billion in 2017-18!

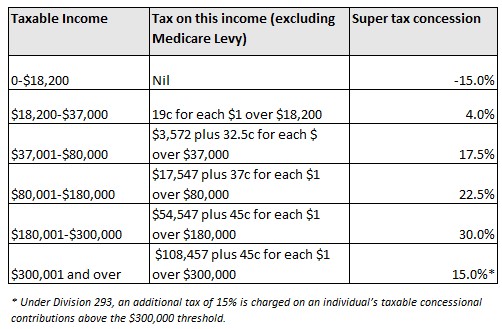

Gotti also needs to explain why it is efficient and fair that the amount of superannuation tax concession received grows as one moves up the income tax scale. For example, a very low income earner earning up to $18,200 effectively pays 15% for their superannuation concession, whereas a high income earner earning $300,000 enjoys a 30% tax benefit (see below table).

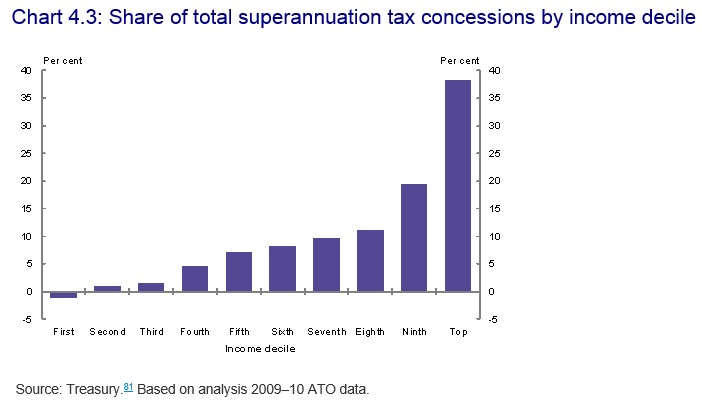

The draft report of the Murray Inquiry into Australia’s financial system agreed that the system makes little sense, noting that “the majority of superannuation tax concessions accrue to the top 20 per cent of income earners (Chart 4.3). These individuals are likely to have saved sufficiently for their retirement, even in the absence of compulsory superannuation or tax concessions”.

The bottom line is that superannuation concessions in their current form are both highly inequitable and inefficient, costing the Federal Budget many billions in foregone revenue whilst reducing the progressiveness of the tax system. They have increasingly become a mechanism for richer older people to avoid paying tax, rather than a genuine means for Australians to pay for their own retirement and avoid drawing on the Aged Pension.

Moreover, as noted in last week’s inter-generational report, despite its massive and growing cost to the Budget, superannuation will do little to relieve pressures on the Aged Pension, with the proportion of Australians relying on the Aged Pension – either full or in part – not projected to decline by 2055 (my emphasis):

In 2013-14, around 70 per cent of people of Age Pension age were receiving the Age Pension. Of these, 60 per cent were in receipt of the full-rate pension. As Australia’s superannuation system matures, and compulsory contributions increase, many Australian workers will retire with much larger superannuation balances. The proportion of part-rate pensioners relative to full-rate pensioners is expected to increase. The proportion of retirees receiving any pension is not projected to decline.

If Gotti had any morals, he would be pushing for superannuation reform, in the interests of inter-generational equity and Budget sustainability, rather than muddying the waters with arguments about “hoax” figures from Treasury.

unconventionaleconomist@hotmail.com