The Fourth Intergenerational Report (IGR), released yesterday, contained some interesting tid-bits which help to illustrate why Australia’s retirement system is failing, despite its massive (and growing) cost to taxpayers.

First, superannuation (my emphasis):

In 2013-14, around 70 per cent of people of Age Pension age were receiving the Age Pension. Of these, 60 per cent were in receipt of the full-rate pension. As Australia’s superannuation system matures, and compulsory contributions increase, many Australian workers will retire with much larger superannuation balances. The proportion of part-rate pensioners relative to full-rate pensioners is expected to increase. The proportion of retirees receiving any pension is not projected to decline.

Anyone undertaking an objective analysis of the above statement would conclude that Australia’s superannuation system is seriously awry.

By the end of the IGR forecast period (2055), the compulsory superannuation system will be 62 years old, meaning workers entering retirement will have made a lifetime of contributions.

And yet despite the tens-of-billions of dollars worth of budgetary concessions provided to super each year, and their growing financial burden (concessions are forecast to grow 10.8% per annum between 2014-15 and 2017-18 alone), the proportion of Australians relying an the Aged Pension – either full or in part – is not projected to decline!

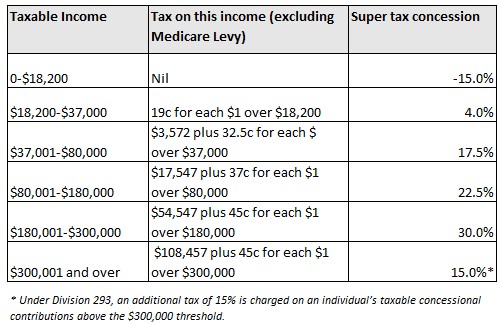

Central to the problem is that concessions are very poorly targeted, with higher income earners receiving the lion’s share of concessions when they contribute to super, whereas lower income earners actually incur a tax penalty (see below table).

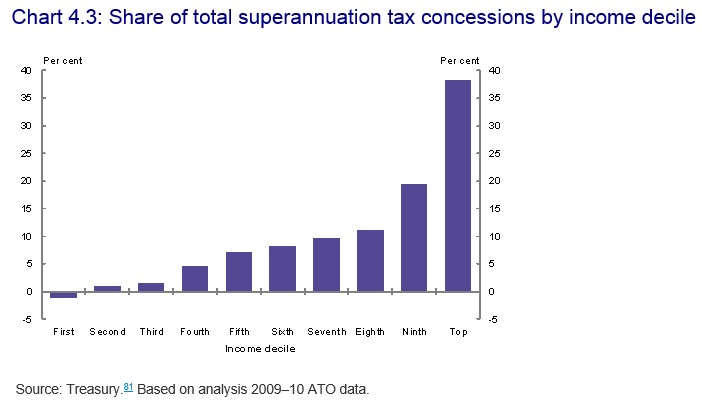

As such, the lion’s share of concessions have gone to those on the highest incomes (see next chart).

Obviously, by providing massive taxation concessions to those on the highest incomes, the Budget is losing many billions of dollars of forgone revenue each and every year. Meanwhile, super is failing to relieve pressure on the Aged Pension, since those that are most likely to need it – lower and middle income earners – receive minimal concessions (or get penalised), which both hinders their ability to build-up a retirement nest egg and discourages them from making additional contributions.

Then there is the problem is that superannuation can be accessed well before the Aged Pension (i.e. tax free at 60) – a problem that will be exacerbated if the Pension access age is pushed-out to 70, but the superannuation access age remains the same.

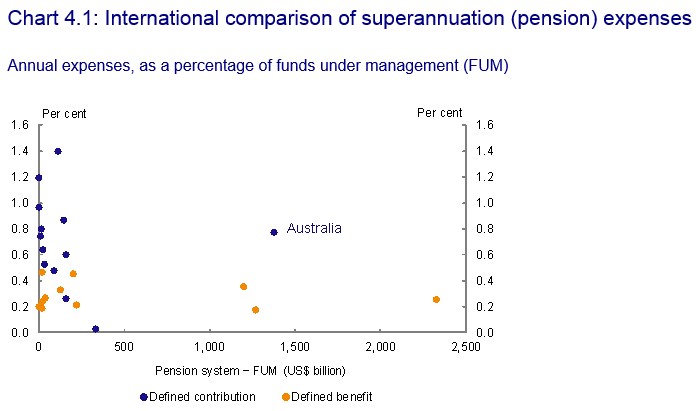

Adding insult to injury is that Australians are being gouged by excessive superannuation fees, which further hinders their ability to build up a retirement nest egg (see next chart).

One obvious solution is to provide everyone with the same superannuation concession (e.g. 15%), rather than skewing concessions towards the wealthy. This way, contributions would be lifted where it is most needed – for those at the lower end of the income scale – reducing pressures on the Aged Pension and reducing overall costs to the Budget.

The IGR also noted the following about the Aged Pension:

A pensioner can continue to receive some payment and the Pensioner Concession Card with assets (excluding their primary residence) up to $771,750 for single homeowners and $1,145,500 combined for couple homeowners. A single person who does not own a home can have assets up to $918,250 and a couple up to $1,292,000 combined and still receive a part pension. A single pensioner can also earn up to $1,868.60 per fortnight (approximately $48,580 per annum) in income and continue to receive a part pension, while a couple can earn up to $2,860 per fortnight combined (approximately $74,360 per annum).

For example:

• Kathleen and Steve are 68, own their home and have $1.1 million in superannuation, shares and bank accounts. They have no other income. They will receive a part-rate pension.

• Liam is 75 is single and has superannuation, an investment property and shares valued at $910,000. He does not own a home and has no other income. He also receives a part-rate pension.

• Lillian is 85, single and lives in her own home worth $1.5 million. She has bank accounts valued at $50,000 but has no other income. Lillian receives a full-rate pension.

Again, it is hard to deny that the Aged Pension is very poorly targeted, providing far too much assistance to those with significant assets – both financial and non-financial (e.g. owner-occupied housing).

Given the Aged Pension is the fastest growing area of welfare expenditure, and the proportion of workers supporting retirees is projected to shrink, it makes good budgetary sense to tighten the means test on the Aged Pension to ensure that only those in genuine need receive it.

Otherwise, richer older Australians will continue to receive a free taxpayer ride, while poorer segments of society (and the young, in particular) are required to shoulder the burden of Budget cuts.