Apparently the only true economic danger in Japan, as elsewhere, is not the actual economy (which is always terrific or just about to be) but the evil, dreaded “deflationary mindsight.” So the BoJ upped its ante in case Japanese people start thinking unhappily about what QQE might not be able to do with, apparently, no real basis for them to actually think that way. .

by Chris Becker

The Japanese economy has now had two decades of near zero growth, a hangover from the ebullient 1990s, where a massive housing and stock market bubble imploded, leaving a huge mountain of private debt that has been transformed into a huge mountain of public debt.

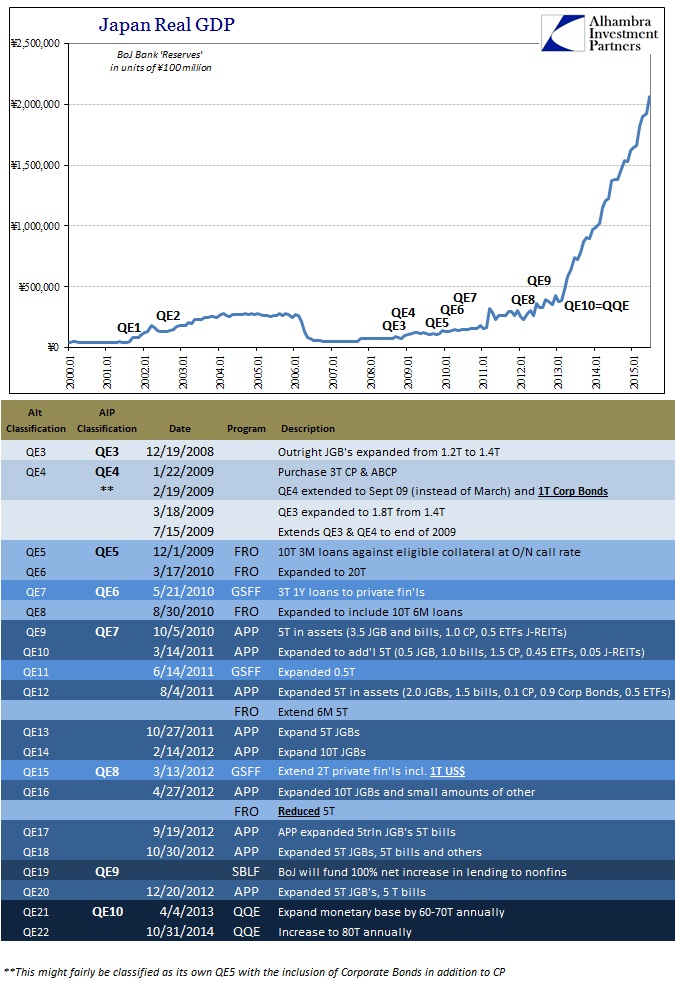

Whereas the US Federal Reserve has enacted 3 quantitative easing programs since the GFC, the Bank of Japan has done 19 and recently announced an effective endless line of them, with ¥80 trillion annually, in what almost everyone can see is a failed attempt at creating inflation.

Prime Minister Shinzo Abe was recently re-elected as the country’s prime minister and is facing pressure as his version of economics – Abenomics – is not succeeding as expected. Interestingly the only options, is more monetary easing, as fiscal stimulus and structural reforms (The other two “arrows” of Abenomics) have no political momentum.

More from Jeffrey Snider on why the cult of endless monetarism has to end:

But Japanese observers, if not the Japanese themselves, have already noticed the broken record. It even goes back to the original QE in March 2001 when the BoJ explicitly gave much the same goals for that world’s first monetary outbreak. Reaching for something they termed the “time-axis” effect, the BoJ fully expected that reducing the rates on longer-term instruments would have a direct and opposite effect on inflationary expectations; so long as that action would continue until rates, of their own, began to rise and signal an end to the “deflationary mindset”.

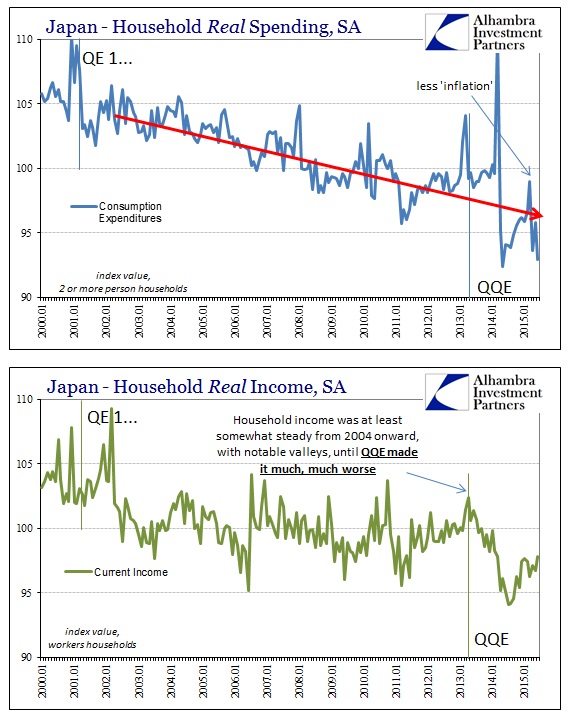

What none of those have amounted to is an actual and sustainable economic advance; NONE, no matter how you count them. In very simple fact, the idea that central banks “need” to keep doing them in continuous fashion is quite convincing that at the very least they don’t mean what central bankers think they mean, and perhaps worse that the more they are done and to greater extents the more harm that eventually befalls.

It isn’t difficult to suggest and even directly observe that Japan’s economy has shrunk during the QE age, but that fact isn’t applicable to Japan alone (there are sure too many non-adjusted data points that uncomfortably assert the same for even the US). That would seem to at least offer a basis for a “deflationary mindset” no matter the actual economic effects.

This is not so much investing or even finance as it is a cult (calling it a religion or even ideology is unjustifiably too charitable). That is the usefulness of “deflationary mindset” not so much as a matter of actual economic pathology but as a built-in, squishy appeal to “we’ll get it right next time.” And there is always, always a next time which doesn’t seem to count for much inside the cult when, in fact, it is everything.

Much like our own government wants to keep talking up the economy, Japans approach and indeed that of other economists who consider confidence more important than household finance reality will never work unless the core problem is addressed.

Even 20 years later, there is too much private debt and even at zero interest rate, deflationary forces will continue until its cleared or the public debt mountain shadows it so much, the entire mountain range collapses.