Bob Birrell and David McCloskey from the Australian Population Research Institute have released an explosive new report examining new household and dwelling projections for Sydney and Melbourne for the period 2012 to 2022.

The report finds that there will be a continuing scarcity of family-friendly housing in both cities, especially of detached housing, but an epic oversupply of shoe box apartments, particularly in Melbourne, if current construction trends persist.

The report estimates that if net overseas migration continues at 240,000 a year, and Sydney and Melbourne continue to receive almost half of these migrants, then Sydney will have to add a total of some 308,000 dwellings and Melbourne some 355,000 over the decade 2012 to 2022, with around half of this increase in demand coming from net migration (i.e. 199,000 dwellings in Sydney and 193,000 dwellings in Melbourne).

At the same time, there will be huge growth in the number of older households living in both cities. In the inner and middle suburbs of Sydney and Melbourne, 50% to 60% of the detached housing stock was occupied by older households in 2011, and the report projects that their numbers will rise rapidly. Moreover, as of 2011, the share of older households living in detached dwellings does not start to decline significantly until people reach 75 years of age.

The net result is that younger households wishing to start a family will find it increasingly difficult to secure a detached home with a backyard, since the stock that is available will be taken-up mostly by older empty-nesters at the same time as the number of younger households is increasing via rapid immigration.

Given the explosion of apartment construction in both Sydney and Melbourne, the report projects that there would be a shortfall of approximately 28,500 detached houses and a surplus of around 59,000 apartments by 2022 in Sydney, if dwelling approvals do not adjust. Similarly, in Melbourne, there would be a shortfall of around 19,000 detached houses and ginormous surplus of around 123,000 apartments by 2022.

And since these new apartments are predominantly tiny (60 square metres or smaller), with no access to protected outdoor space, they are totally unsuitable for raising a family.

The report concludes that households of 2022 are highly unlikely to achieve the standard of dwellings afforded to their counterparts in 2012, given the increased competition for detached housing and the hording of such stock by the older generations. And while the impact will be bad in both cities, it will be worst in Sydney, given the city’s greater natural geographical boundaries, along with its stricter urban planning policies.

For mine, the report highlights four important issues.

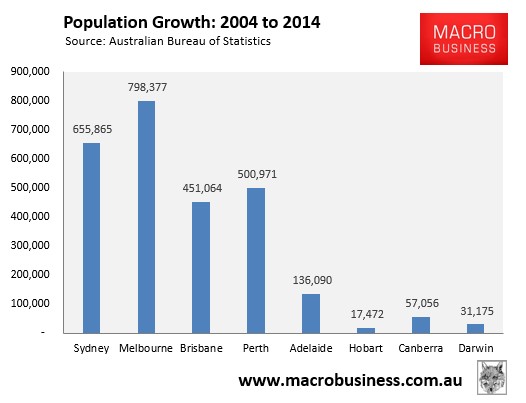

First, the immigration intake needs to be tightened significantly. Much of the added demand for housing is coming from new migrants (see next chart), which are causing severe housing indigestion and congestion, particularly in Melbourne and Sydney, thereby lowering the living standards of pre-existing residents (especially the younger generations).

Second, one’s owner-occupied residence needs to be brought into the assets test for the Aged Pension.

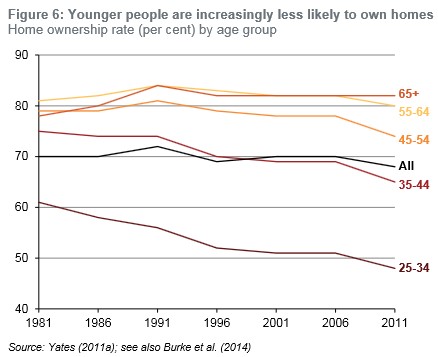

It is the height of unfairness that the biggest asset most households retiree with is essentially excluded from their capacity to fund their own retirement. And it is especially unfair to expect younger generations – who are either struggling under the weight of the high mortgage debt legacy they inherited or unable to afford a home altogether (see below chart) – to bare the full cost of their parents’ and grandparents’ retirement while they live in homes they themselves cannot afford.

Including the family home in the pension assets test would also encourage empty nesters to downsize to smaller accommodation, thus freeing-up larger family-friendly homes for young families.

Third, stamp duties must be replaced by a broad-based land tax. In addition to vastly improving tax efficiency, such a tax shift would encourage households to move to homes that best suit their needs by removing the punitive tax on moving (stamp duty), encouraging the highest value use of land, and penalising land banking and vagrancy.

Finally, artificial constraints on fringe land supply must be abolished, along with better provision and funding of housing-related infrastructure, and replacing the “first-user-pays-all” tax on new housing with long-term bond financing recovered through rate payers over time.

If the Government is going to persist with a high immigration intake, the least it can do is facilitate this growth via an adequate release of new land and the provision of housing-related infrastructure.

Without policy change, Australia’s young families are facing lower living standards than their forbears, and the unenviable reality of raising their kids in dog box apartments and townhouses while they support their parents as they live in homes that they will never afford.

unconventionaleconomist@hotmail.com