If you want a prime example of why the mainstream media is rotten to the core, look no further than the below editorial published by The Australian late last week [my emphasis]:

A broader GST base also would preclude the need to scrap negative gearing on investment property. Tax deductions for interest and other business costs encourage investment. Real estate investment should not be treated any differently. In 1985, Labor abolished negative gearing for future rental property investors but restored it just two years later after investment fell and rents soared.

Seriously, how many more times must the myths surrounding negative gearing be busted before commentators take note?

The Australian’s claim that housing investment fell following negative gearing’s quarantining between 1985 and 1987 is plain wrong.

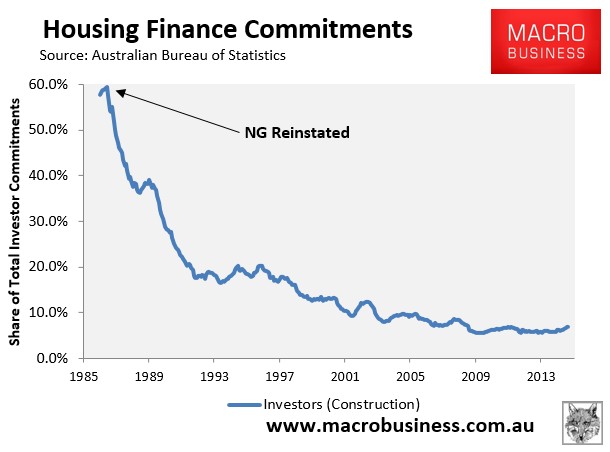

The below chart illustrates clearly that genuine investment – i.e. investment in new dwelling construction rather than the transfer of ownership of established dwellings – fell sharply after negative gearing was reinstated in 1987:

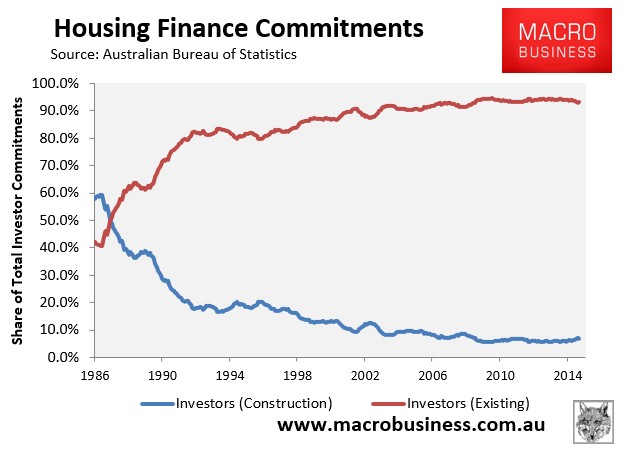

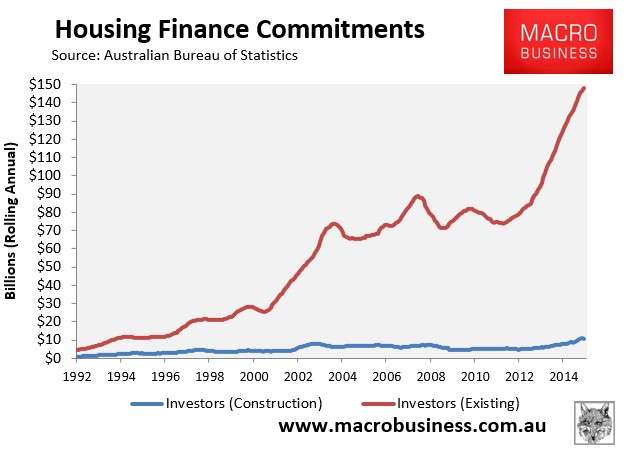

Such that over 90% of property investors now purchase established homes, rather than adding to housing supply:

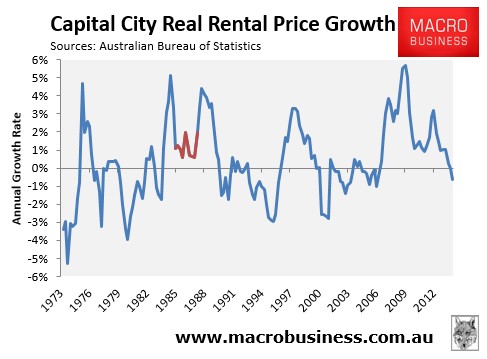

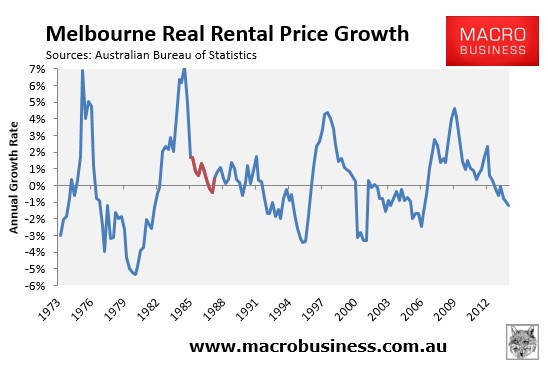

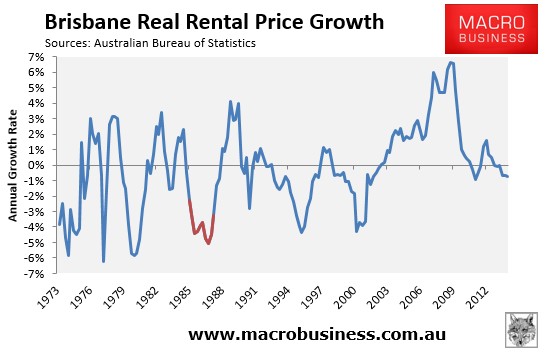

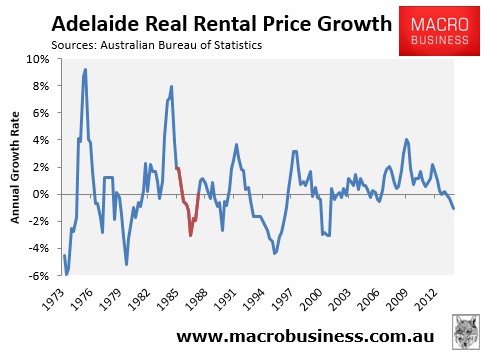

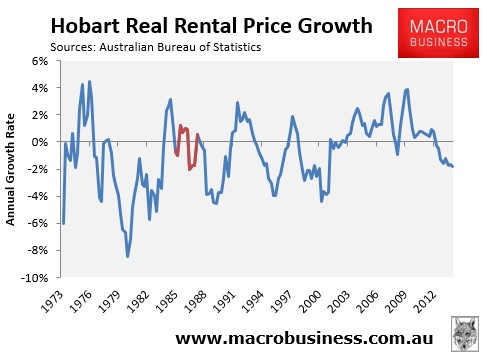

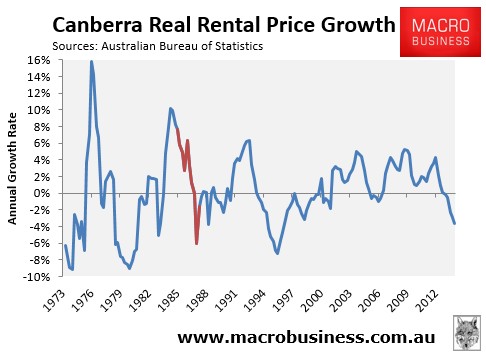

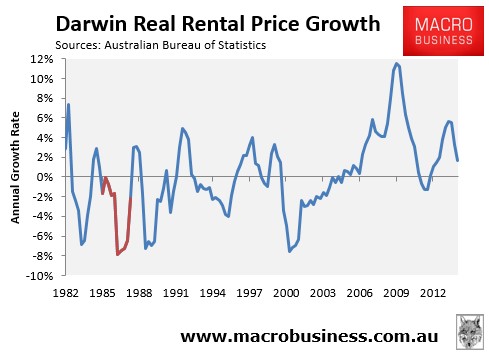

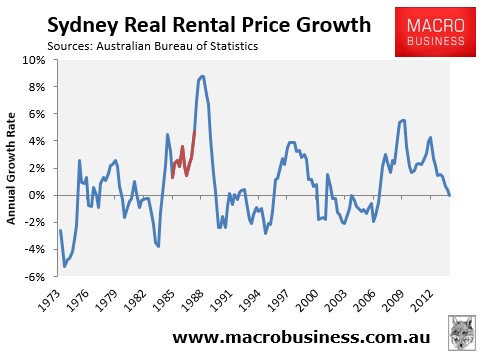

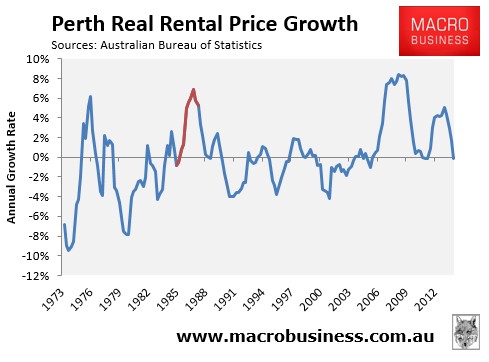

The Australian’s claim that “rents soared” when negative gearing was quarantined between 1985 and 1987 also does not pass scrutiny. The below charts track the change in real (inflation-adjusted) rents across all major markets, with the period where negative gearing was “abolished” shown in red.

Rental growth remained either flat or fell nationally:

In Melbourne:

In Brisbane:

In Adelaide:

In Hobart:

In Canberra:

And in Darwin:

With only Sydney and Perth registering increases, due to very low vacancy rates at the time:

Surely, if negative gearing had any impact on the cost of renting, its abolition in 1985 would have caused rents nationally to explode? Yet, the evidence shows absolutely no impact.

The Australian clearly favours ideology over evidenced-based policy debate.

unconventionaleconomist@hotmail.com