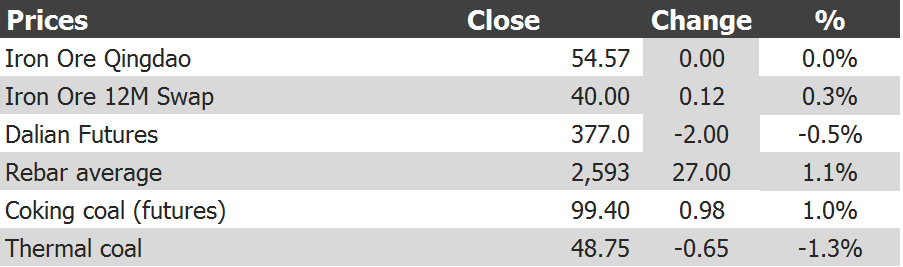

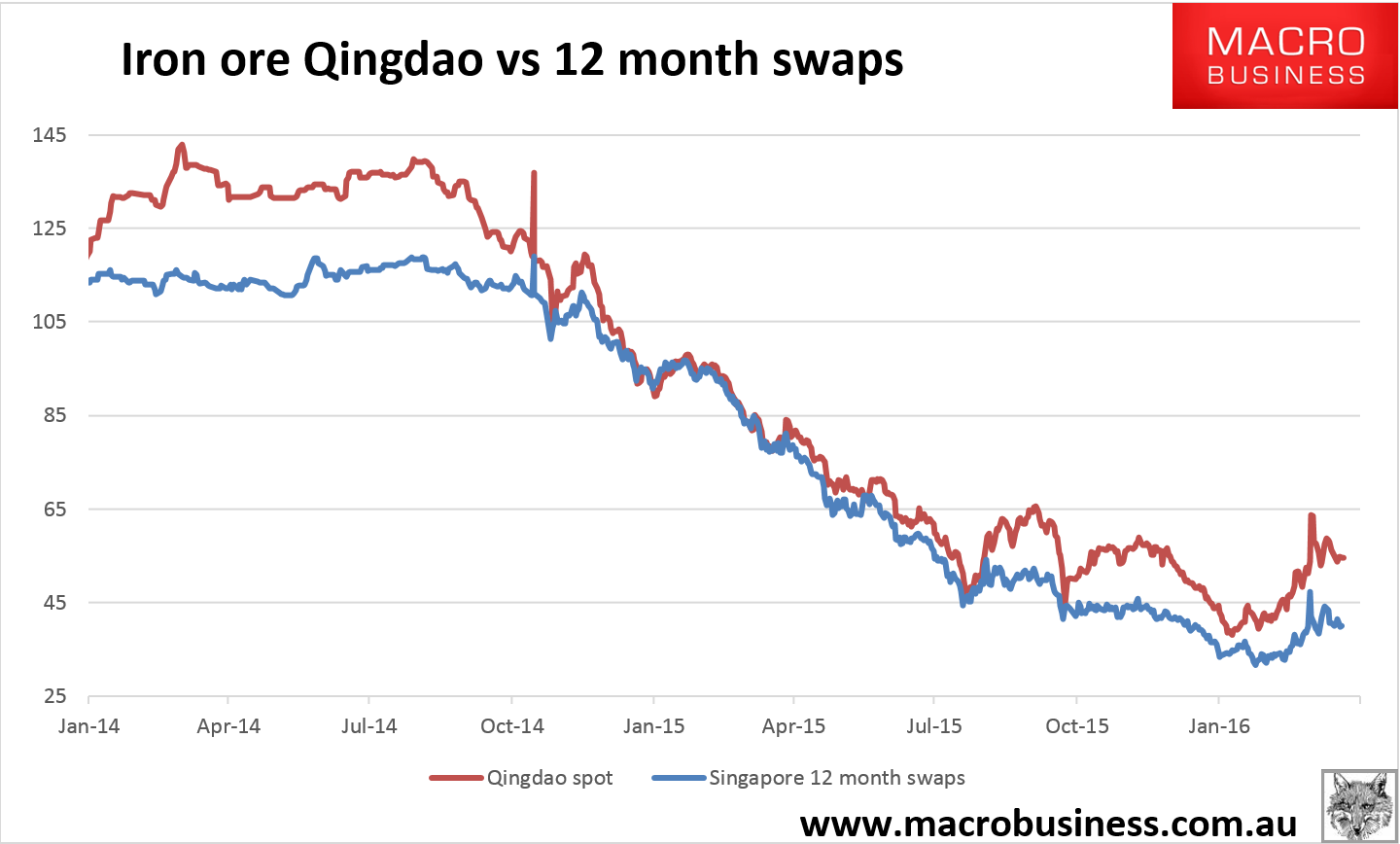

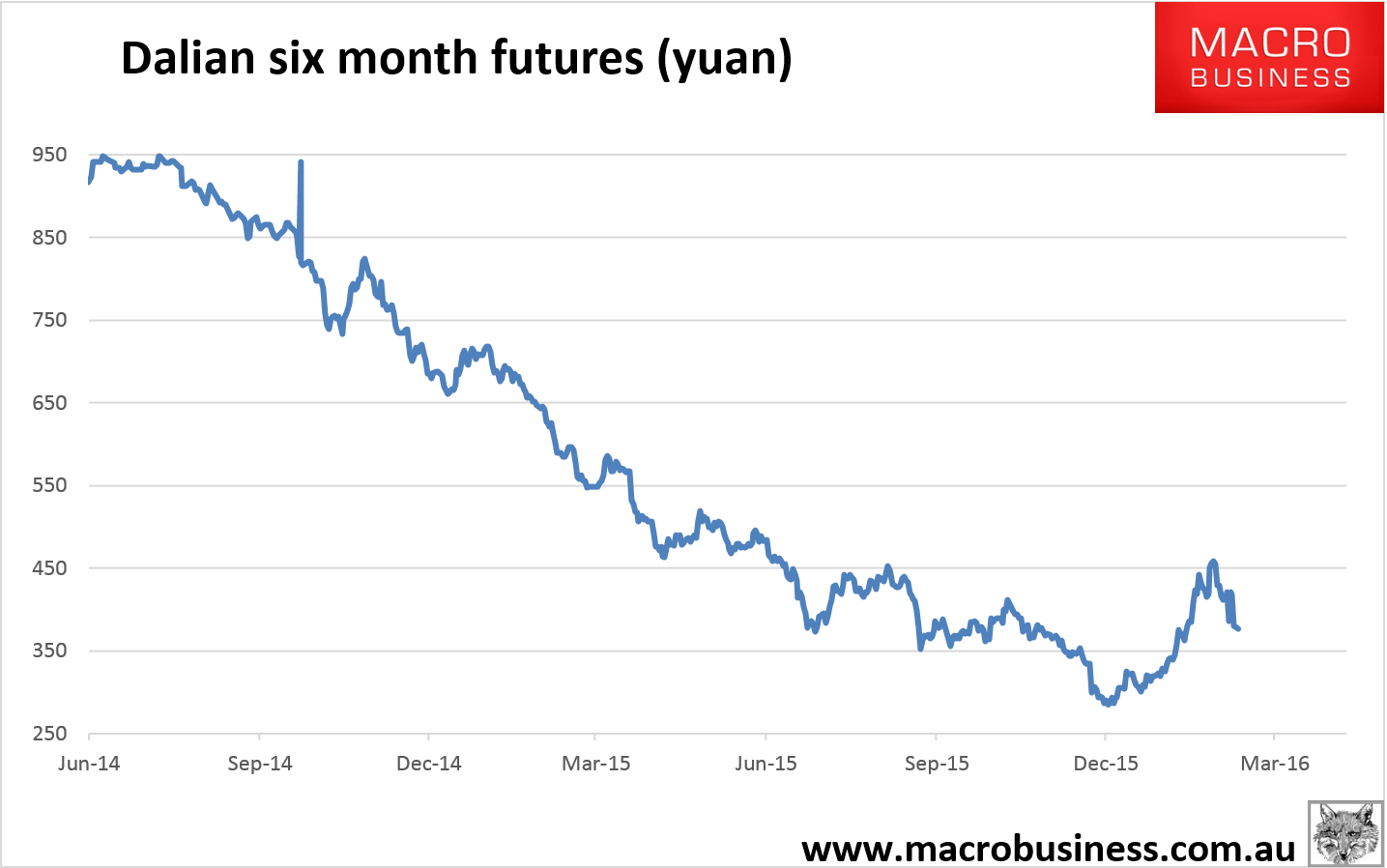

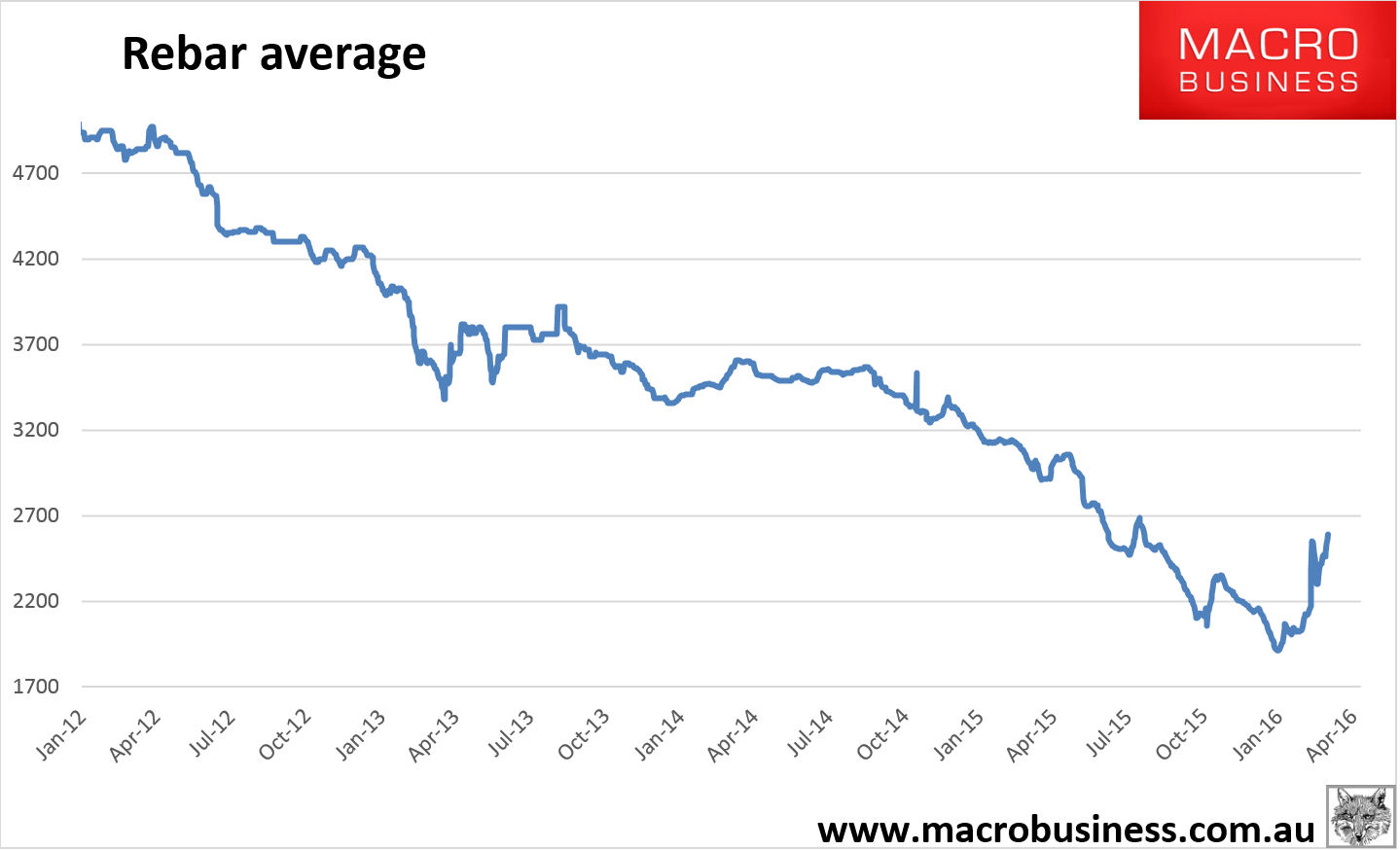

The iron ore charts for April 7, 2016:

Tianjin spot unchanged. Paper firm. Rebar following through on its breakout. We are beginning to see the decoupling I’ve recently discussed as steel prices rise and iron ore does not. After April I still expect both to fall once more.

Which is going to come as a shock to Nev Power, from The Australian:

Mr Power said the iron ore price, which has rebounded about 40 per cent off December lows to around $US54 a tonne, was being heavily influenced by hedge funds “shorting” the commodity in an attempt to profit from slowing growth in China, the world’s biggest consumer of the mineral.

But he said “we’re passed the worst” of the volatility and China’s demand would ultimately drive the iron ore price.

“There’s a cautious confidence starting to come back about China,” he said.

“I think Premier Li really put a stake around saying that they wouldn’t let economic growth drop below 6.5 per cent (and) the Chinese government have got a lot of horsepower to make sure that happens.”

The bottom, Nev, will be some time in the 2020s.