Labor versus the giant Australian Vampire Squid

Anybody that has read Matt Taibbi’s legendary take on Goldman Sachs will remember this:

The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.

Over the years I’ve offered my own version of this colourful metaphor in my descriptions of Australia’s “politico-housing complex”:

Australian housing and finance doesn’t have anything to do with economics. It long since ceased being a “market” at all.

Rather, it is a political complex – a quango – that represents the single largest page in the socio-economic contract between the government, the banks and an ageing baby-boomer population.

When the baby-boomer generation first took power and reshaped Australia in the 1980s, the promise was for a new kind of meritocracy.

The old “Australian Settlement” described brilliantly by Paul Kelly in The End of Certainty – a protectionist social contract between unions, industry, government and the people – was swept aside in favour of a neoliberal vision.

The new world demanded an open, more dynamic Australia. An Australia that rewarded entrepreneurial effort and flexibility. A productive Australia.

For a while it worked. Australia dropped its tariffs, deregulated government enterprise, most especially the banks, and after a false start at the end of the eighties, embarked on an historic productivity boom.

But at some point a distortion began to grow at the heart of the new vision. Its dark seed was sown by the original architects of the new world when they back-tracked on the removal of negative-gearing tax policy for housing in the ’80s.

By the late 1990s it had become a cancer eating away at the achievements of the baby-boomer generation and a second wave of bipartisan supporters of the new vision took power only to further deregulate finance and install fabulous capital gains tax privileges on property investment.

As we entered the 2000s, the new vision threatened to dim and the same baby boomers that had convinced us all to embark on their neoliberal journey deployed new, more direct subsidies for houses, in the form of first-home buyer grants that sought to co-opt the baby boomers’ children in the same now rapidly distorting vision.

Through the 2000s, the neoliberal vision became virtually unrecognisable. The dynamic and open Australia mutated into a speculative abomination based almost entirely on houses.

Our precious capital, freed in the ’80s to find the most productive outlets possible became instead the keystone in a system of offshore borrowing and asset inflation.

The final death knell of the new vision surely came in 2003 when the old national good luck arrived in the nick of time.

As the housing quango lay dying in 2003, along came a commodities boom the likes of which nobody had seen in century. The transformation was complete.

The entrepreneurial vision of those pioneering ’80s baby-boomers replaced with happy-jack dirt salesmen and a bloated entitlement state that now had the money to keep its most hideous progeny alive, the great, quivering housing sack hung from its belly.

That’s the history. You will note that it is more clearly defined by a generational and sectoral conflict than it is any traditional political division. One can’t point to either capital or labour, or their notional political representatives, as more responsible for the complex. It was Labor that restored negative gearing, Labor state governments that restricted land supply and introduced state level demand stimulus, it was a Labor government that bailed housing out in 2008. It was the Liberals that cut capital gains tax, introduced demand stimulus measures at the Federal level and gutted prudential regulation such that banks could lend on far higher leverage than was historically the case. Both parties have pursued rabid population growth.

But, that’s no longer the case. As we push towards the Federal election, suddenly we do have a real choice. Driven by solid economics in addressing the post-mining boom adjustment and by concerns for equity in the tax system, the Australian Labor Party has a platform that will deliver a heavy blow to the politico-housing complex by cutting negative gearing, rebalancing housing favourable capital gains taxes and delivering a royal commission into the malfeasance that has permeated the entire value chain of banking services, from interest rate manipulation, to financial planning and insurance scandals, not to mention regulatory observations of lending recklessness.

Yet it won’t come easy. Labor’s policies poke a sharp stick into the fleshy abdomen of the complex and from its compressed meat suddenly has sprung a frenzy of thrashing tentacles in response. Australia’s own vampire squid is loose, seeking purchase on our faces, blood funnel jamming at the collective mouth. At its bulbous head is Prime Minister Malcolm Turnbull, Goldman Sachs alumnus, outrageous liar, and the new champion of Australia’s version of what is good for “Wall St is good for Main St”, from his Facebook page yesterday”:

Kim and Julian Mignacca have used negative gearing to buy property and invest in their family’s future.

Kim is a social worker and Julian is a plumber. They are a young couple with a baby girl and they have invested in real estate in order to get ahead.

They are like thousands of other Australians who negative gear – two thirds of whom have a taxable income of less than $80,000 a year.

Labor wants to eliminate negative gearing on existing residential property, commercial property, shares- in fact on every type of asset except a new dwelling.

This will reduce property values, it will increase rents and it will make it harder for people to get ahead.

And if that’s not bad enough, Labor wants to increase capital gains tax by 50 per cent which will mean less investment right across the board.

Consider for a moment how formidable this many-tentacled complex now is. The Prime Minister is a former banker, Treasurer Scott Morison is former head of research at the Property Council of Australia. We know that the clenching limbs of RBA and Treasury both seek to protect the housing bubble that they blew as an offset to the mining bust they never saw coming. Treasury is headed by another former banker in UBS wealth doyen, John Fraser. Landed and negatively geared back-benchers dominate both parties though especially that of the Government.

Mirroring this in the private sector is the Property Council of Australia as it devises election advertising that will school every property parasite in the country. The big bank unguis has a thickened hide and musculature so broad that it chokes the national narrative, as a corrupt media – dependent upon its own real estate businesses and bank advertising for survival – flagellates between moments of clarity and vomiting great clouds of obfuscating ink in support of its own profits.

Even the law appears to have been vacuumed up the politico-housing complex funnel, as what were sensible new foreign buyer property laws governed by the ATO have suddenly been muffled by the Turnbull Government sucker fastened to its face.

Labor, and the reform needed in the national interest, is wrestling a giant rent-seeking kraken that has rooted proboscises in every crevice of our social democracy.

But all is not lost. As the Labor platform emboldens resistance, the screeching Australian Vampire Squid is drawing the attention of a shocked political centre and polls for the unctuous suckhole are falling fast. Several titans of mainstream media commentary have already condemned it. And over the weekend several more ripped to shreds Prime Minister Turnbull’s latest banking policy constrictor, the fix he’s put in at ASIC. First, Adele Ferguson:

The IOOF whistleblower who was sacked after using the company’s internal whistleblower policy to reveal serious misconduct, is adamant the latest reforms to ASIC and suite of bank promises is no substitute for a royal commission.

The whistleblower, whose identity is well known to IOOF but who requested anonymity for privacy reasons, is “frustrated with ASIC’s obvious lack of motivation”.

He gave the regulator 59,000 documents almost a year ago, after alleging front running by a senior executive, cheating on exams and misrepresentation of outperformance numbers.

He says he has had little contact except for a few emails and a 35-minute meeting, which was organised after he wrote a complaining email to ASIC chairman Greg Medcraft that he had heard nothing from the regulator since reporting the matter.

This is what happens when there’s no transparency with the public, especially for whistleblowers,” he says. “They just get shafted because it’s easier to shaft one person than a billion dollar-plus institution,” he said.

It is why a royal commission is important, “to investigate the problems in an open arena”, the IOOF whistleblower said.

Absolutely right. These whistleblowers have the moral grit that our prime minister lacks. Put them in charge! Second, Alan Kohler tore into ASIC’s Greg Medcraft at The Australian:

The government should have sacked ASIC chairman Greg Medcraft, not extended his term to implement the changes recommended by the “Capability Review”.

That’s not because he has done a bad job, but because he’s not going to reform the organisation. Medcraft and ASIC have rejected the panel’s key recommendations on governance and culture. The government has therefore kept him on in order not toimplement them.

Not only will ASIC’s governance and culture not change — as urgently recommended by the review led by Karen Chester — its budget will be barely increased: it’s $121 million over four years, half of which is to go on capital equipment, which means about $15m extra per year, or less than a 5 per cent increase (plus $6m to Treasury for its trouble).

And that money doesn’t even come from the government. It’s to be funded by the banks — all of them. No wonder the banks are happy and have promised not to pass the cost on to customers: they won’t even notice it.

But you wouldn’t know any of that from Scott Morrison’s media release and press conference on the subject.

The Treasurer’s and Greg Medcraft’s performances this week have been among the most mealy-mouthed, weaselly pieces of spin ever seen in public policy, which is saying something.

It sure is and well said. There is one other that should be sacked: the person responsible for hiring Medcraft in the first instance. Prior to his appointment, the ASIC chief was a founder and CEO of the American Securitisation Forum, the industry peak body and chief lobby for the subprime succubus that leeched the US economy. Medcraft’s former organisation, of which he is an honorary lifetime member, was so central it had a starring role in the movie The Big Short. ASIC under Mr Medcraft, and the Government’s support for him, is only further evidence that the giant Australian Vampire Squid is tightening its grip.

Matt Taibbi’s metaphor was pointed. He used it to define a parasitic bank that represented an over-weened financial sector in the United States, a bank that no longer allocated capital most efficiently in the economy, instead allocating it most aggressively to itself. Taibbi’s vampire squid fed on the economy rather than boosting it, and prevented the host from fighting back by occupying the positions of power that might inhibit its gorging.

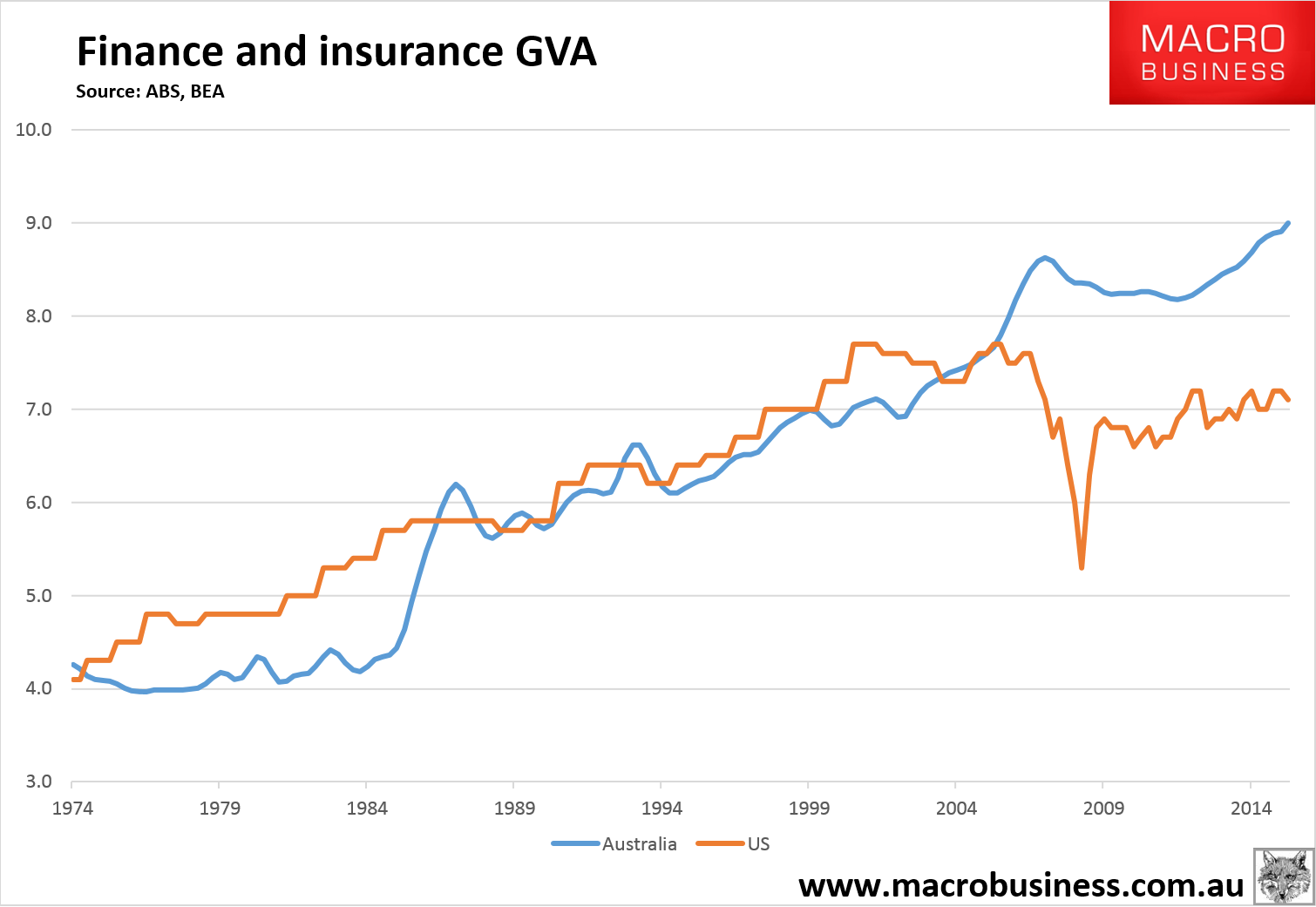

The Australian Vampire Squid is much the same if more diffuse. It’s not one bank or institution, it’s congealed support by regulators, bankers and politicians for a financial system that long since stopped functioning as it should. Some time around the turn of the millennium it’s core function morphed from discerning distributor of capital for entrepreneurs and business into a caustic mortgage gusher that consumes commerce. These days it is so bloated from feasting on economic tissue that Wall St looks positively slim by comparison:

The forthcoming election is our last chance to voluntarily prise the Australian Vampire Squid from our vital organs before it sucks them dry. After that, as we know, parasites die with the host.