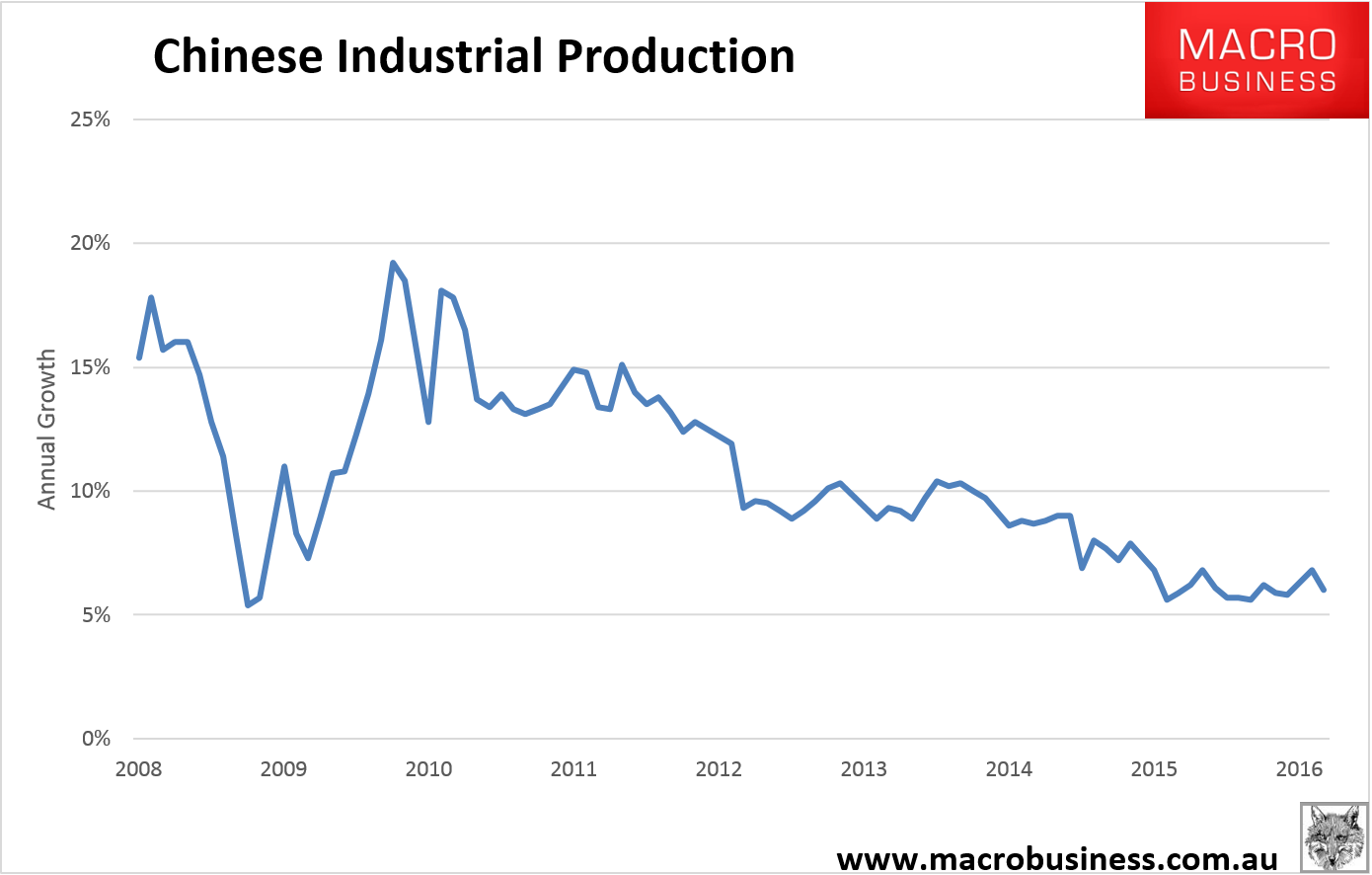

China unleashed its April data avalanche over the weekend and it missed big across the board as expected. Industrial production fell back to 6% from 6.8% and 6.5% expected:

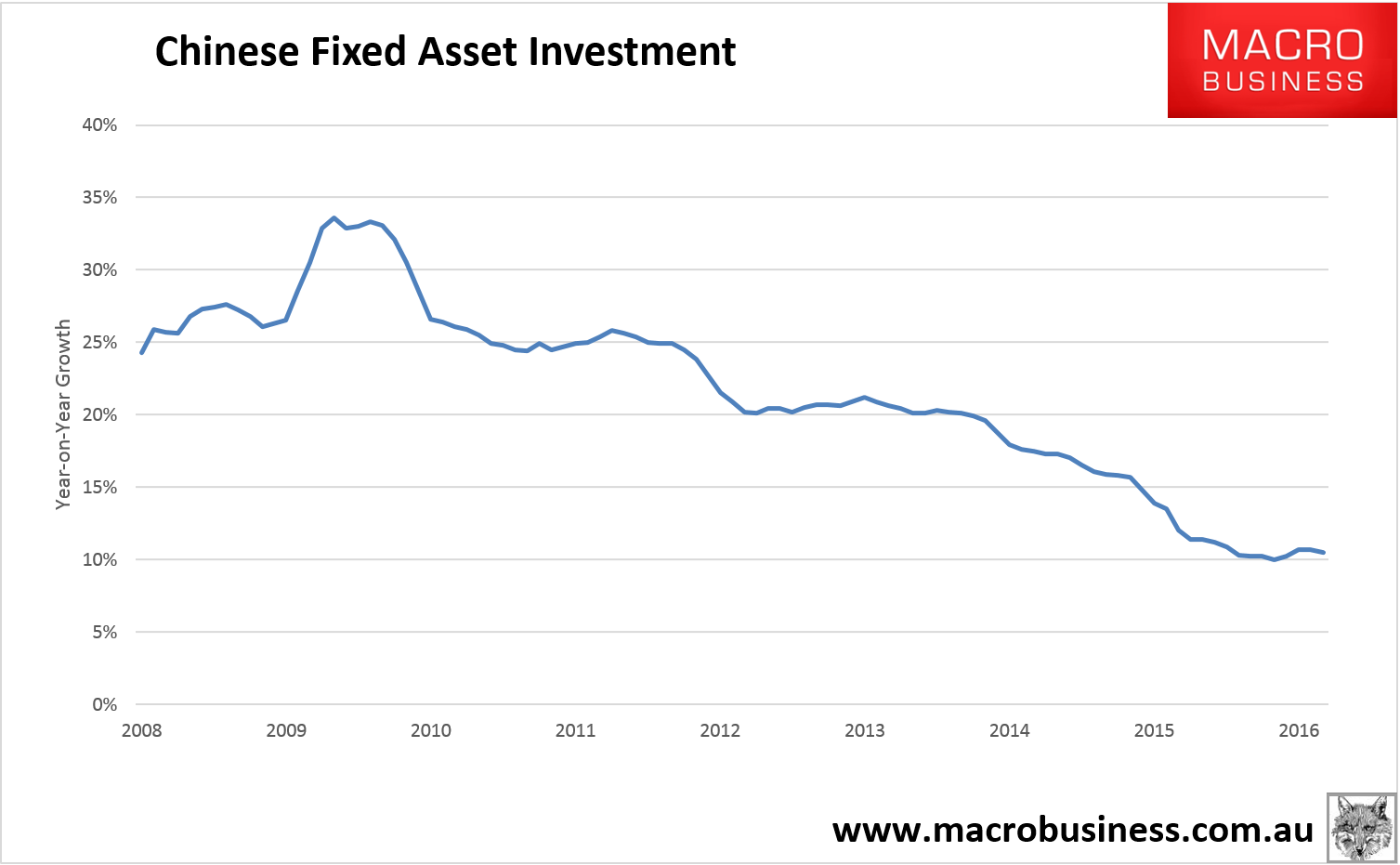

Fixed asset investment eased to 10.5% from 10.7% versus 10.9% expected:

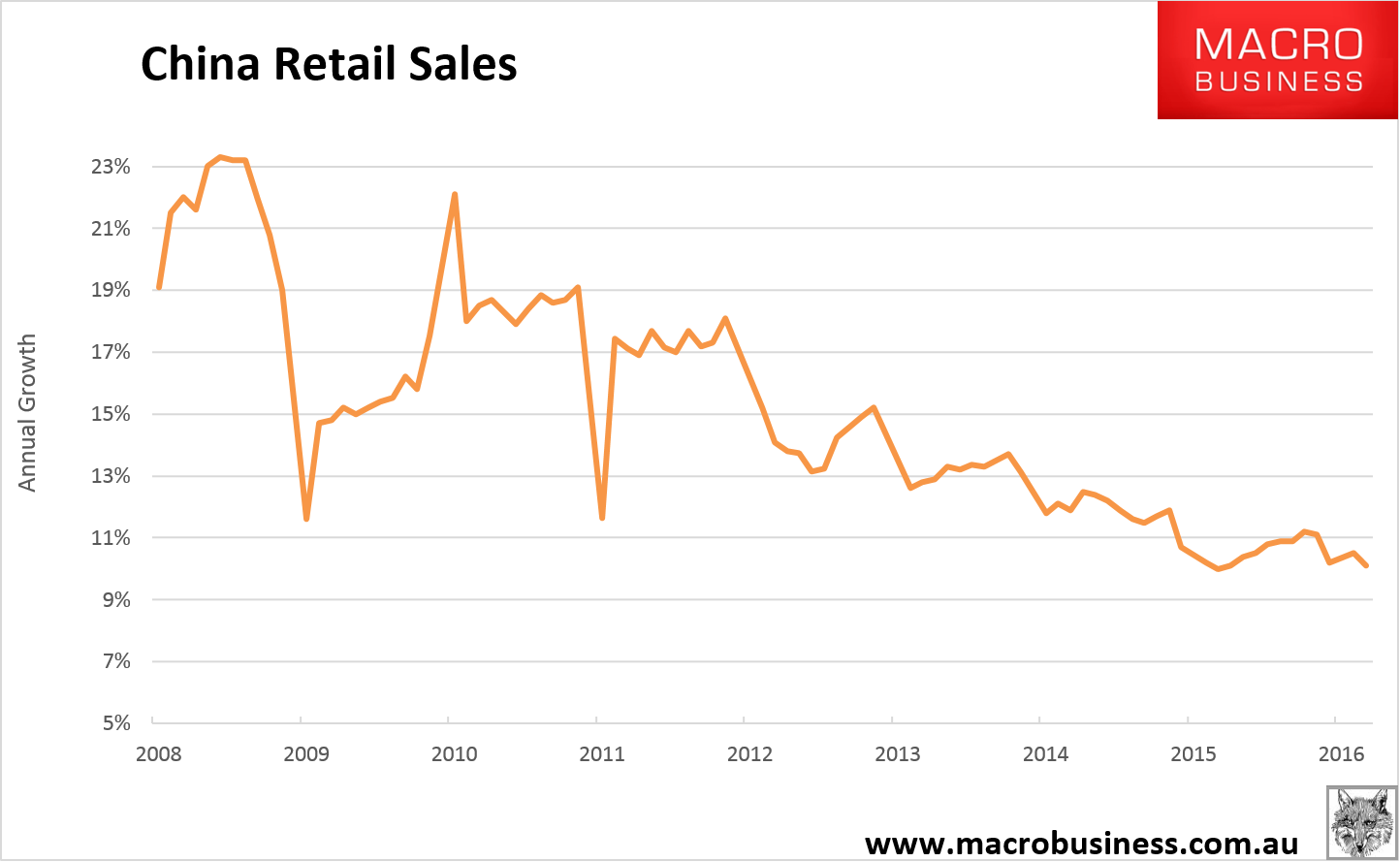

Retail sales growth fell to 10.1% from 10.5% versus 10.5% expected:

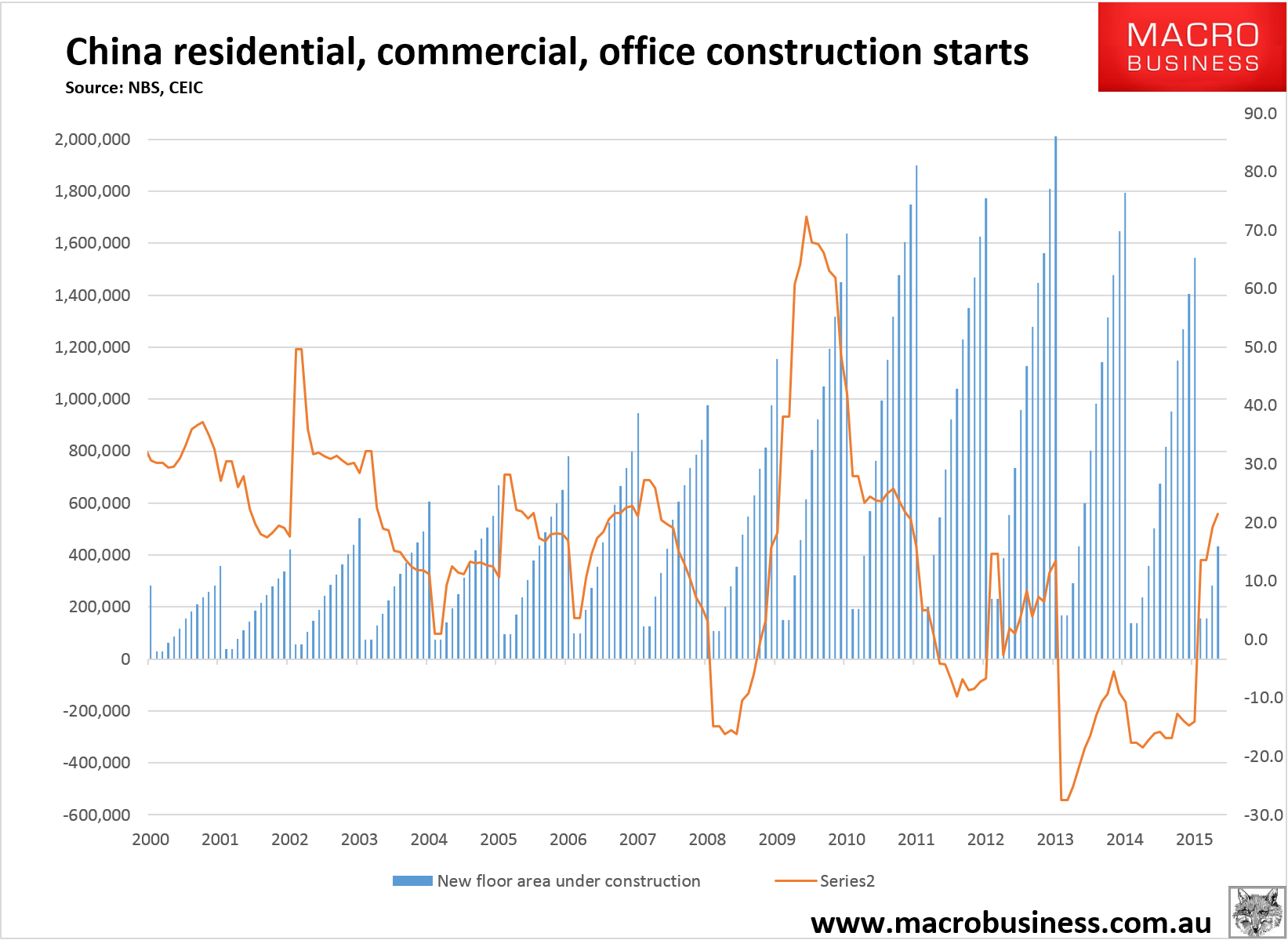

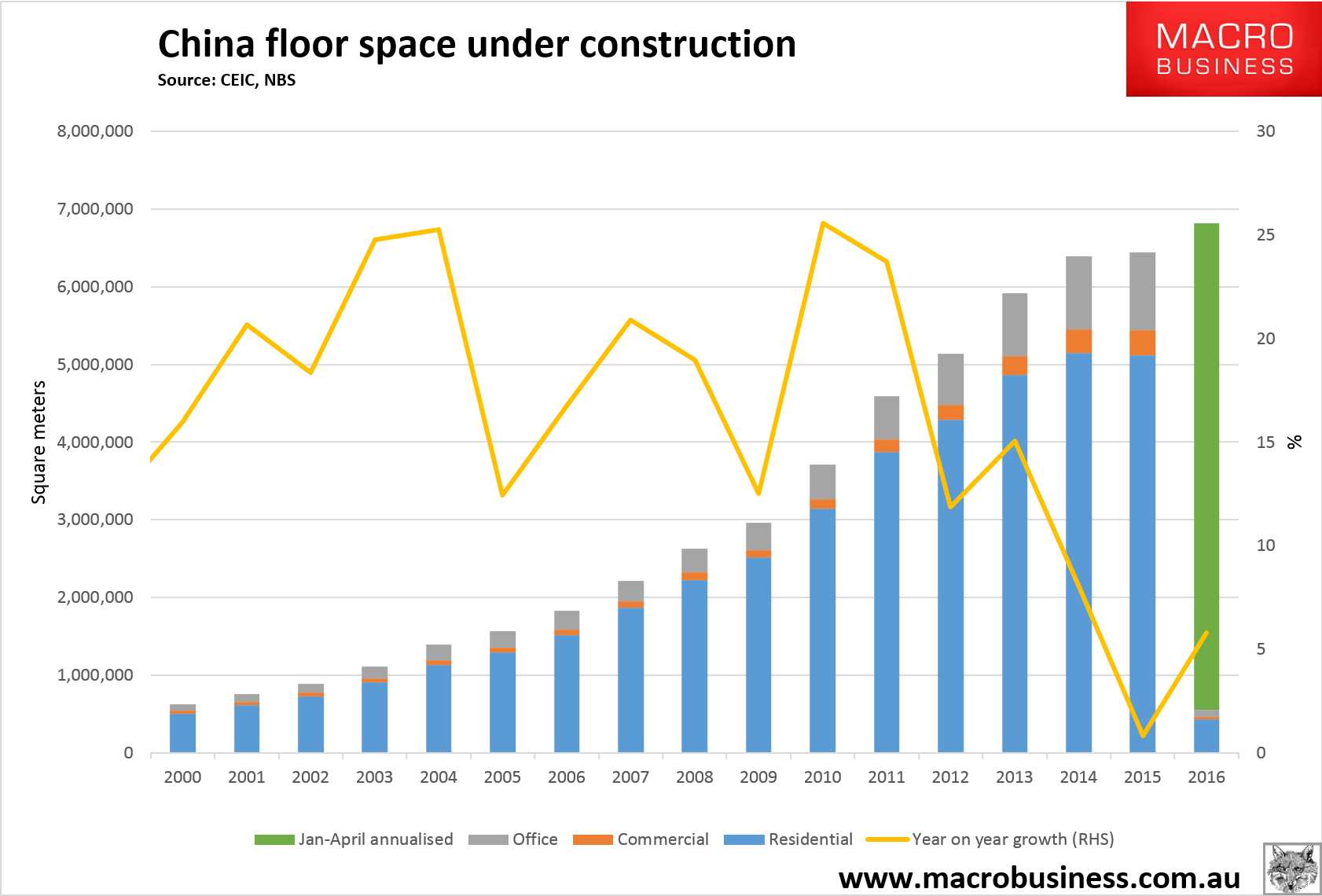

However, there were some better numbers in the mix for bulk commodities and Australia. The property recovery continued with floor space new starts accelerating from 19.2% year on year to 21.4% and roughly tracking 2014:

The stock of floor space under construction is now up 5.8% year on year and if sustained will post a new record in 2016:

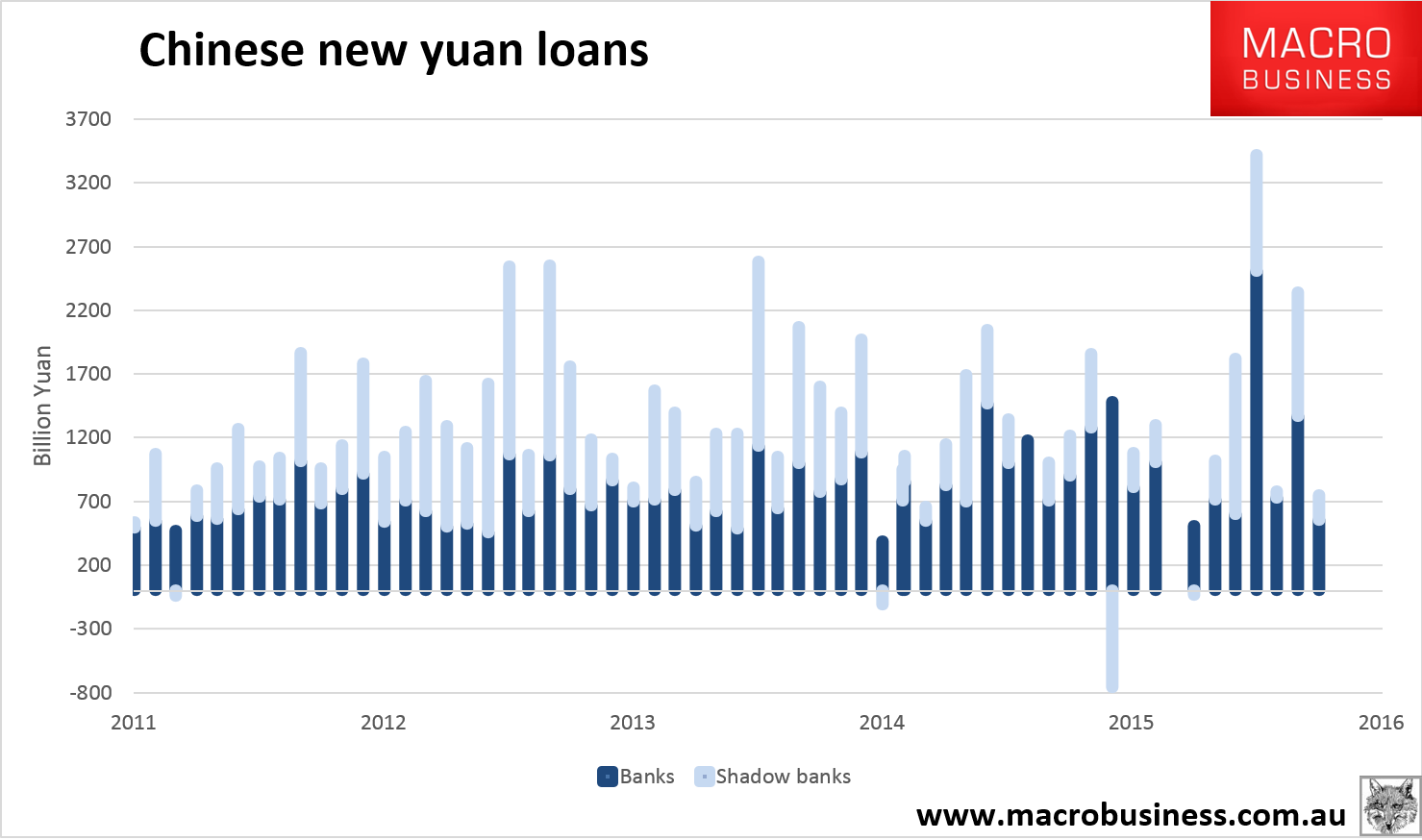

However, I do not expect it to be sustained. Also released were credit numbers and they were the most weak of all, indicating that the second derivative acceleration in property will likely soon reverse. New yuan loans missed big at 751bn yuan versus 1300bn expected:

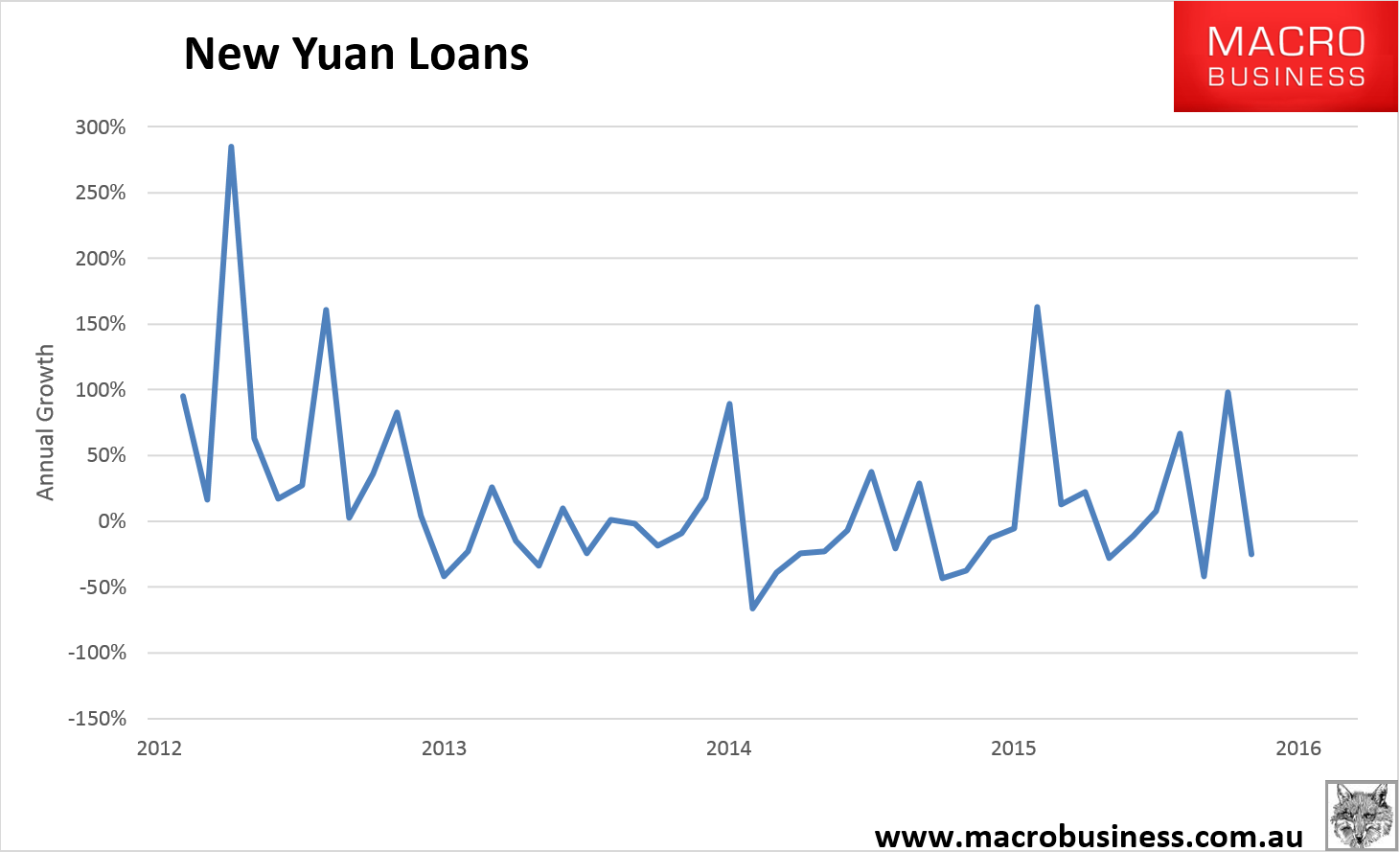

Year on year growth tumbled to -25%:

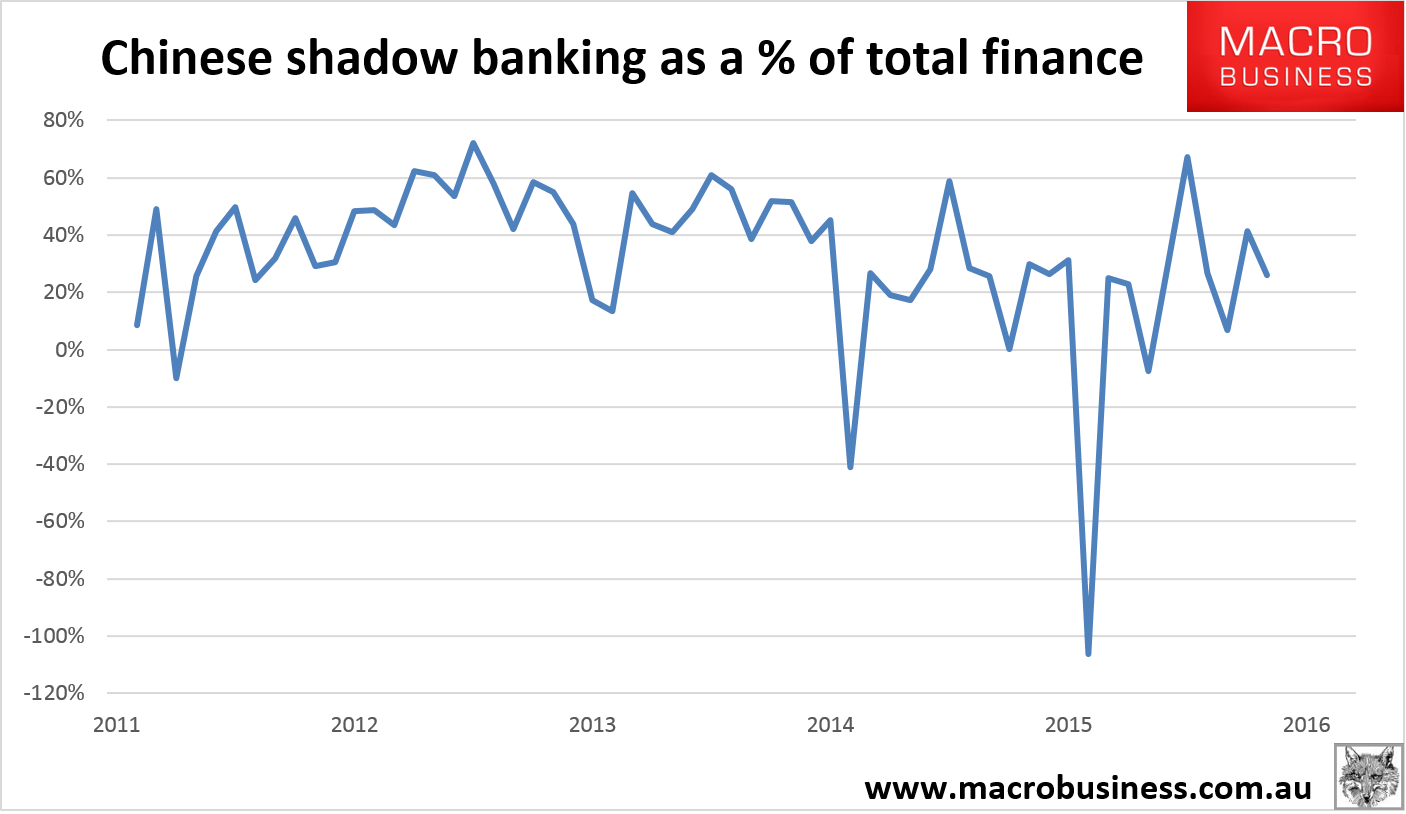

The shadow banking share was hit hard as macroprudential measures bite:

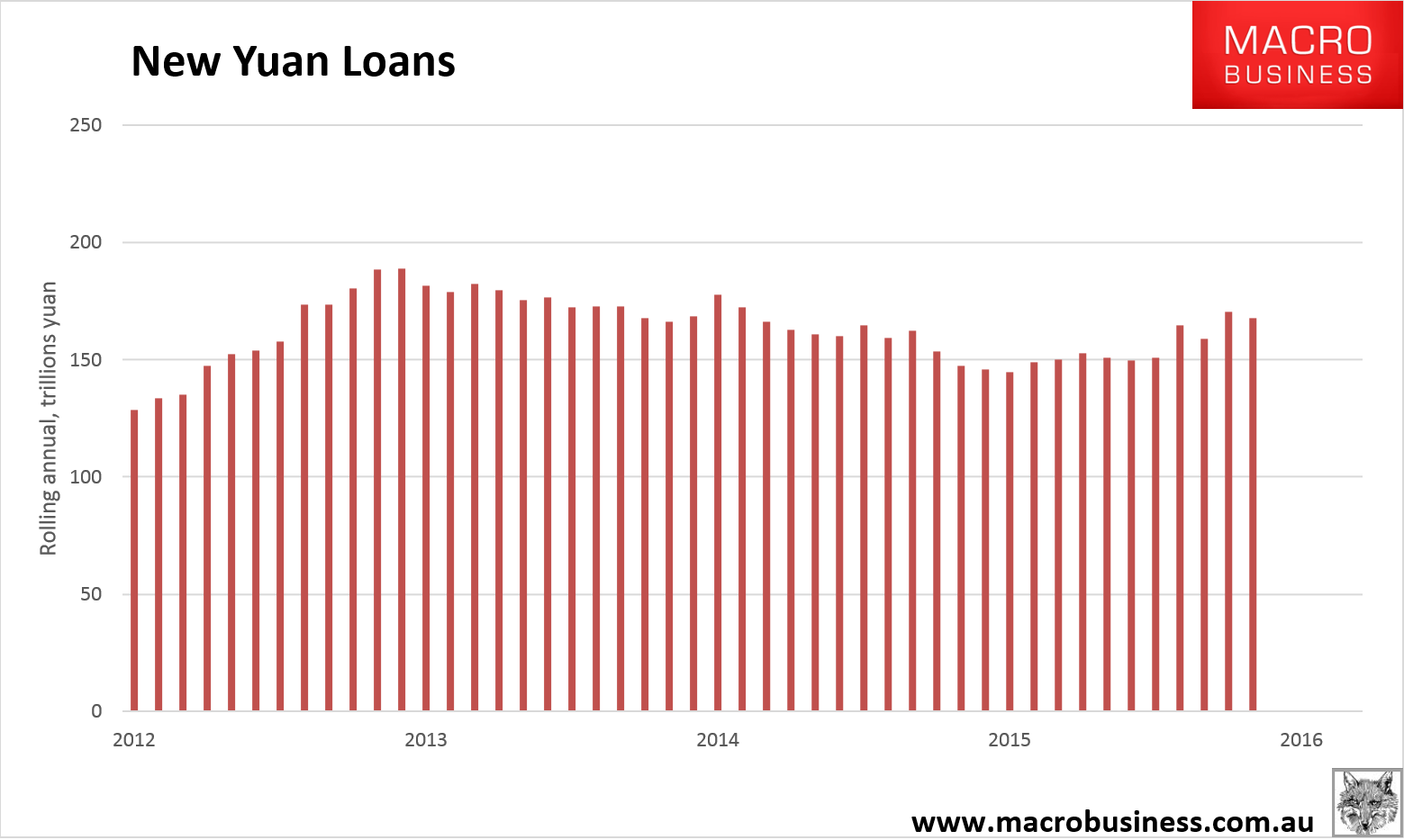

The rolling annual tipped over before if it’s even really gotten started:

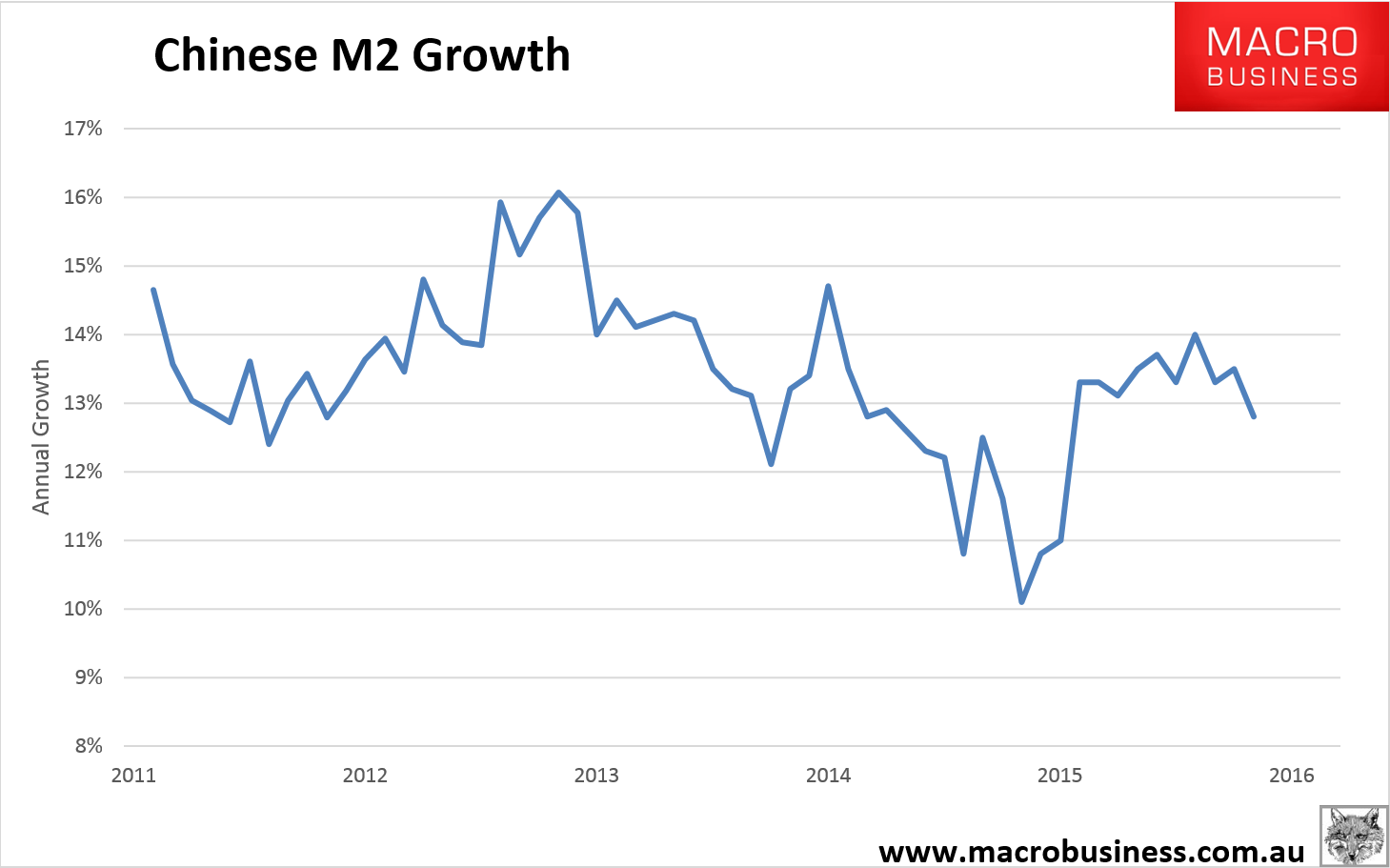

And M2 growth fell sharply to 12.8% versus 13.5% expected:

In short, it looks like property curbs in tier one cities are already blowing the froth off so I’d expect new starts to reflect this in H2 and for total floor space under construction to pull back to near zero by year end.

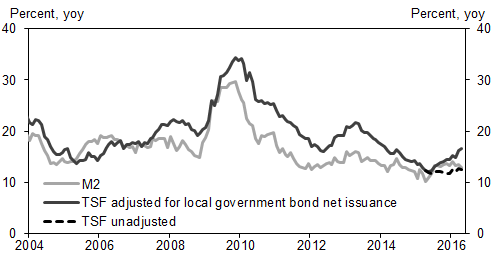

But! Yes, there is another one, there was one more positive, as this chart from Goldman shows:

Local government borrowing was shifted out of the new yuan loans index a while ago but it is still going strong indicating good infrastructure spending ahead. Although this is materially less commodity-intensive than property it will help.

In conclusion, we appear to be reliving 2012/13 here not 2009, another kick of the can in the glide slope that will have less duration owing to China’s plummeting growth return from issued credit. The MB outlook for the year is thus unchanged with China expected to stabilise for a few quarters then resume sinking.