The Sydney-Melbourne rivalry has been a century in the making.

In the 26 years after Australia’s Federation in 1901, the Commonwealth Government was temporarily housed in Melbourne. But after intense competition between the two cities for national-capital status, Canberra had to be built as a compromise to quell both cities.

Since then, snide barbs have been traded between both cities’ residents. Sydneysiders often decry Melbourne’s cold and grey weather and hail its spectacular harbour, bridge and Opera House, whereas Melbournians cling to the fact that their city is often adjudged “world’s most livable city”, despite it being a rather meaningless award, as well as its much-hyped “culture” and being the “sporting capital”.

In this half-year member’s special report, I want to add to the rivalry and determine which capital wins the award of Australia’s biggest housing bubble? It’s a close race that will be judged on various metrics, including:

- House price growth;

- Values relative to incomes;

- Values relative to rents;

- Values relative to the other Australian markets;

- Dwelling construction relative to fundamental demand;

- Rental vacancy rates; and

- Economic strength.

Let’s dig in.

Why Sydney and Melbourne?

The answer is in the below charts.

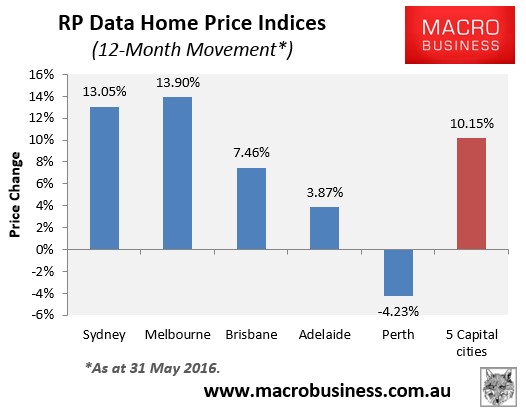

Both markets experienced by far the strongest value growth in the year to May 2016:

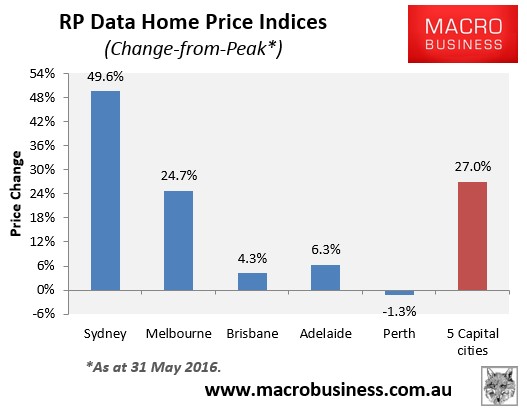

They have also experienced by far the strongest growth since their previous respective peaks:

Indeed, while all housing markets in Australia are expensive, Australia’s housing bubble is now concentrated in Sydney and Melbourne.

Judging from the second chart above, it would be easy to conclude that Sydney wins the award of having the biggest housing bubble. But what does the long-term data say about which market has experienced the strongest house price growth?

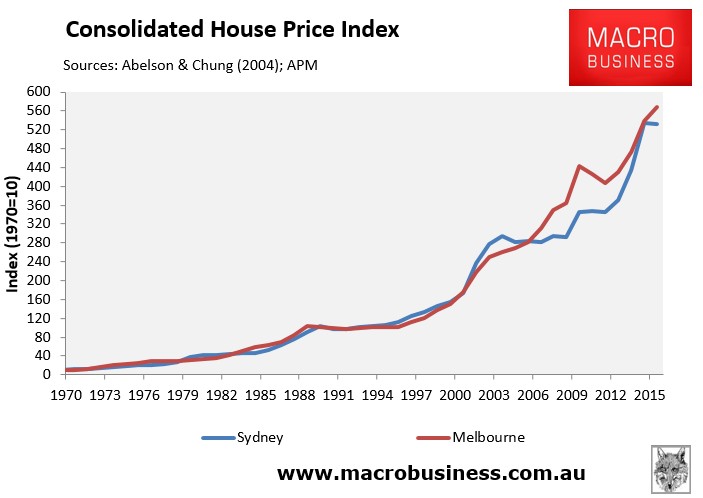

To answer this question, I have plotted Sydney and Melbourne house prices from 1970 to March 2016 – the longest time series that I could make. The data consists of median house prices from Abelson & Chung (1970 to 2003) and APM (2004 to 2016):

As you can see, according to long-term house price growth alone, Melbourne has just pipped Sydney as the bigger bubble, and only in the last year.

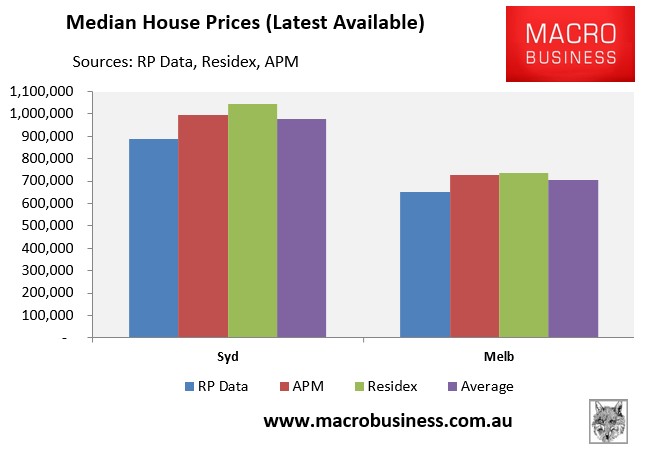

In actual dollar value terms, however, Sydney house prices easily eclipse Melbourne’s, clocking in at just under $980,000 versus just under $705,000 for Melbourne, when averaged across the three major private housing data providers (i.e. Core Logic-RP Data, APM (Domain), and Residex):

However, house price growth and levels does not a bubble make, since we also need to take into account fundamentals, such as incomes and rents, to determine the degree of over-valuation.

House Prices relative to incomes:

One useful metric commonly used to gauge whether a housing market is over-valued is the “median multiple”, which measures the median house price as a multiple of median household disposable income.

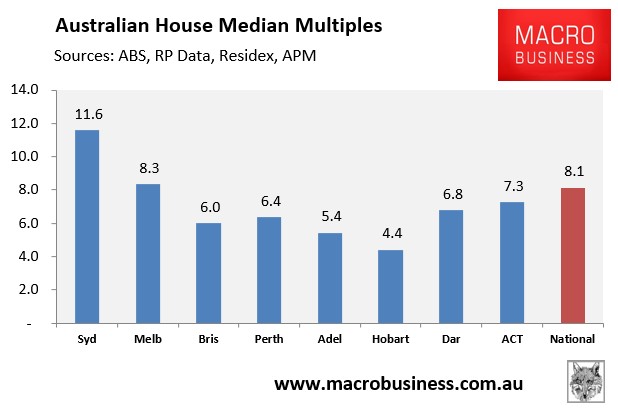

The below chart plots the situation across Australia, with house prices derived by averaging the latest available results from the three major private housing data providers against the Australian Bureau of Statistics’ (ABS) median household disposable income data for 2013-14, scaled-up by wages growth since then:

Clearly, Sydney housing is most over-valued by this measure, followed by Melbourne.

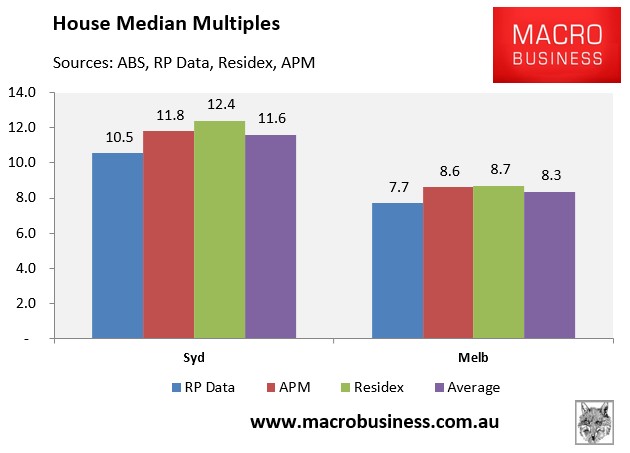

The next chart zooms in on just Sydney and Melbourne and shows the median multiples under each of the three major private housing data providers. Again, Sydney wins hands-down:

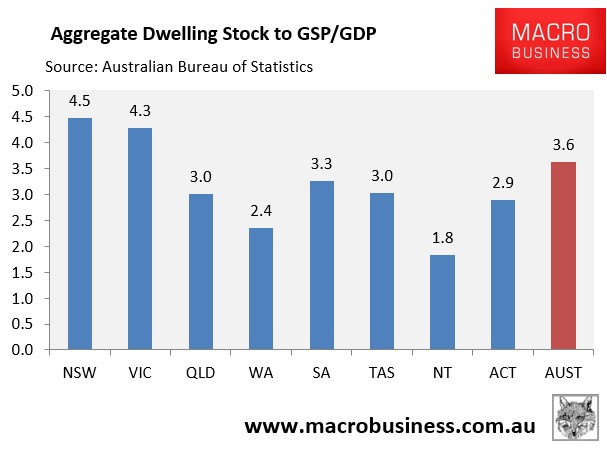

Another proxy measure of prices versus income is to compare the total value of the dwelling stock against the size of the economy, as measured by GSP/GDP:

As shown above, Sydney is again the clear leader nationally, with Melbourne running a close second.

So Sydney without doubt wins in the housing over-valuation stakes when measured against incomes.

Running tally: Sydney 1; Melbourne 0.

House Prices relative to rents:

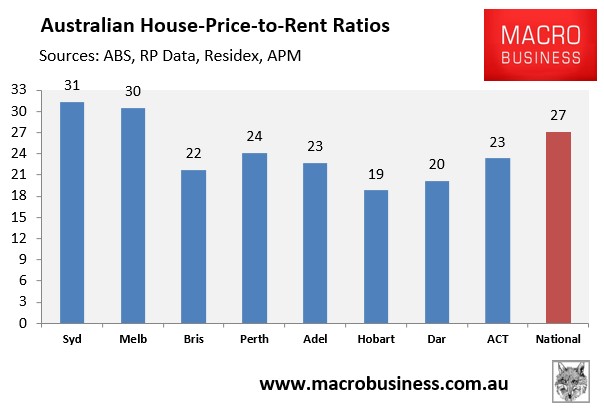

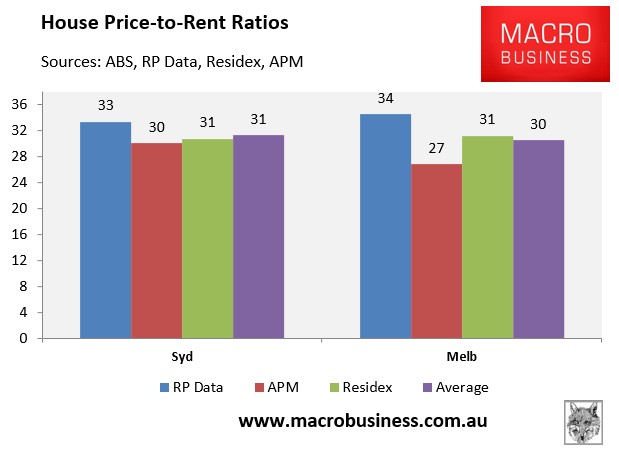

Another way of measuring potential over-valuation is to compare house prices against their earning capacity, as measured by gross rents, to determine the price-to-rent ratio. This is much like the price-to-earnings ratio applied to shares.

The below chart plots the situation across Australia’s major housing markets, calculated as the inverse of the rental yields averaged-out across Australia’s three major data providers:

As shown above, Sydney once again is the leader followed very closely by Melbourne.

When the ratio is charted across each individual private data provider, Sydney wins easily under APM’s measure, is even under Residex’s, but loses narrowly under RP Data’s:

It’s a close race, but Sydney is again the winner in the bubble stakes under the price-to-rents measure.

Running tally: Sydney 2; Melbourne 0.

Relative values (deviation from historical average):

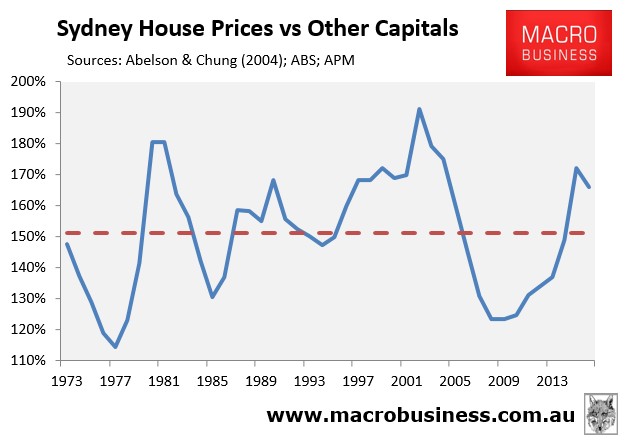

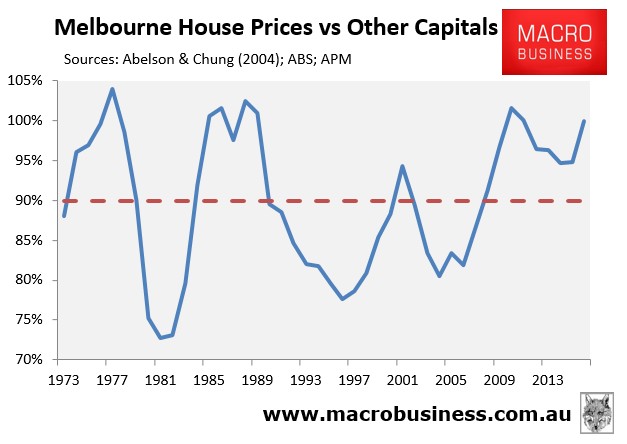

The below charts measure the relative values of Sydney and Melbourne houses against the weighted average of the other capital cities. The data, which dates back to 1973, comes from Abelson & Chung (1973 to 2003) and APM (2004 to 2016).

First, here’s the chart for Sydney, which shows that the median Sydney house is 166% times the value of the other capitals, which is above the 151% average but well below the 191% recorded in 2002 and the 181% in 1981:

Next, Melbourne’s median house is valued at 100% of the other capitals (which are inflated because of Sydney), which is not far below the peaks reached in 1977 (104%), 1986 and 1988 (102%), and 2010 (102%):

While it is a subjective judgement, I give this round to Melbourne, given its relative valuation is so much closer to earlier peaks.

Running tally: Sydney 2; Melbourne 1.

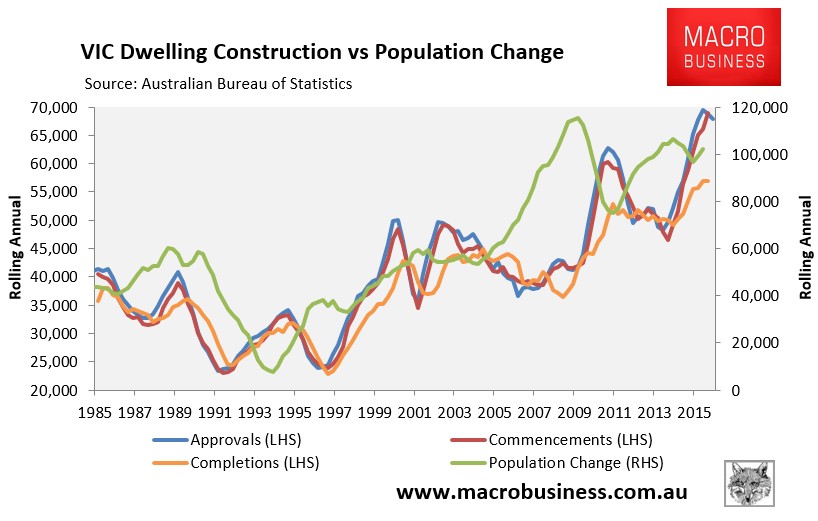

Dwelling construction vs fundamental demand:

While Sydney wins in the over-valuation stakes, what about the level of construction (dwelling supply) relative to fundamental demand (population growth)?

Certainly, an examination of the state-wide data shows that Victoria is running well ahead on dwelling supply relative to New South Wales.

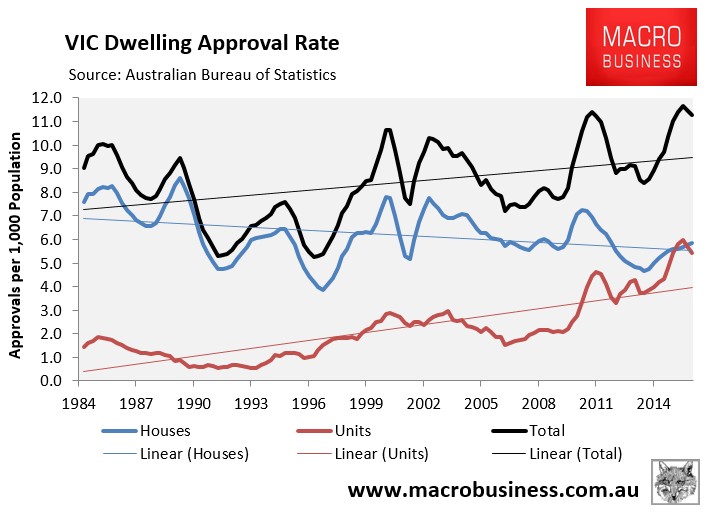

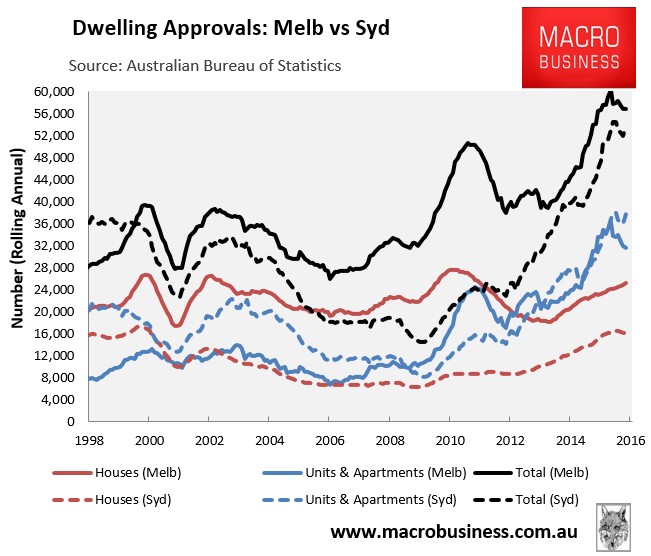

As shown in the next chart, Victoria has experienced a near six-year dwelling construction boom; albeit amid strong population growth:

This has seen Victoria’s dwelling approvals per 1,000 residents rise to 11.3 as at March 2016, which is close to the highest level in at least 30-years:

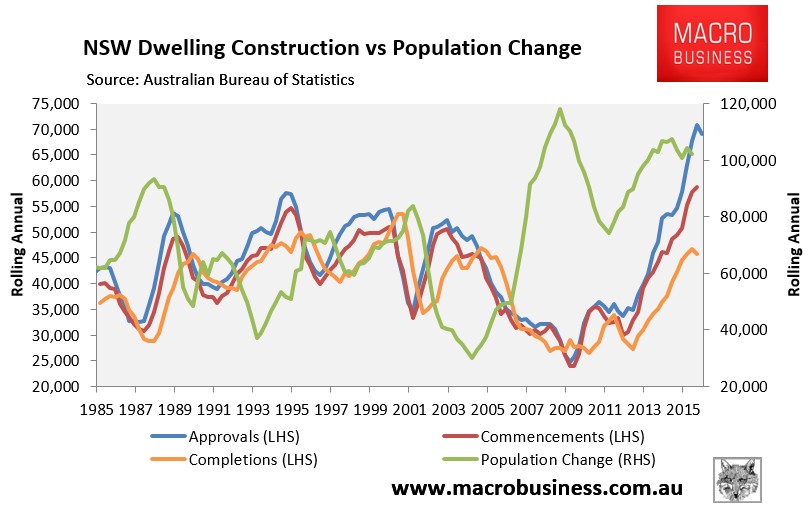

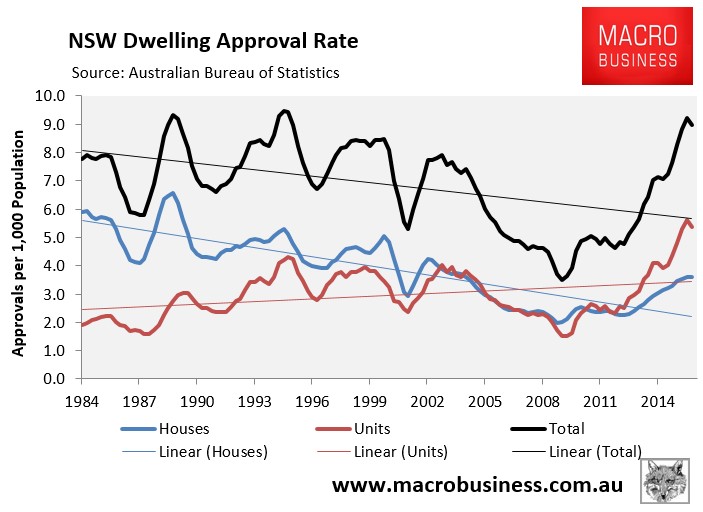

The dwelling construction boom in New South Wales, by comparison, has arrived much later and follows a prolonged period of under-building:

New South Wales’ dwelling approvals per 1,000 residents was also just 9.0 as at March 2016, well below Victoria’s:

While there is less data available at the capital city level, what does exist paints a similar picture.

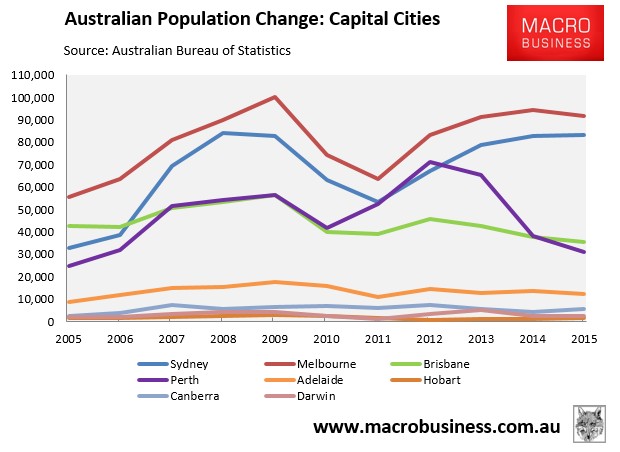

While Melbourne has experienced the stronger population growth over the past 11 years:

Melbourne’s rate of dwelling construction has also been far stronger than Sydney’s:

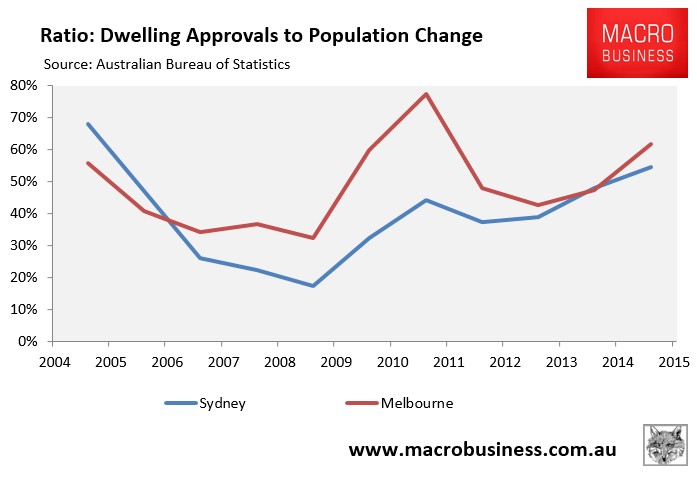

Accordingly, the ratio of dwelling approvals versus population change has easily exceeded Sydney’s over the past decade:

Sydney’s dwelling supply is also far more concentrated in apartments, which tend to be capable of housing fewer occupants than detached houses, thus leaving Sydney with even less latent housing capacity than Melbourne.

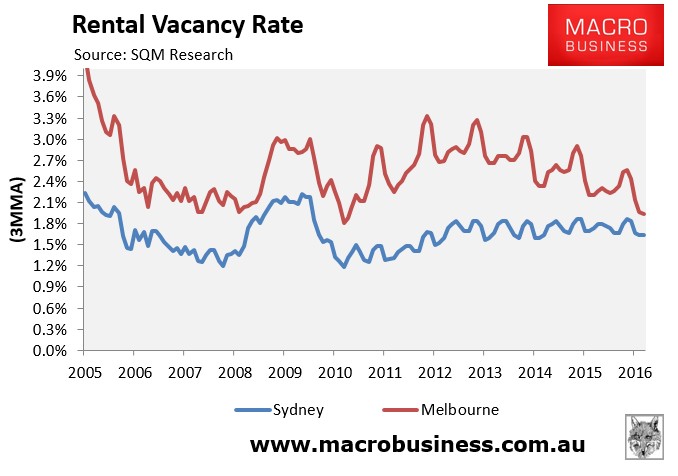

Rental vacancy data from SQM Research also shows that Melbourne’s rental vacancy rate has consistently tracked above Sydney’s for more than a decade, suggesting relatively tighter supply in Sydney:

It should be noted, however, that the true vacancy rate in Melbourne is likely much higher.

SQM Research’s calculations of vacancies are based on online rental listings that have been advertised for three weeks or more compared to the total number of established rental properties. Therefore, SQM does not count the potentially very large number of homes withheld from the rental market.

We know from the Prosper Australia Speculative Vacancies Survey that almost 20% of Melbourne’s investor homes were being kept vacant. Four Corner’s recent Home Truth’s special report also covered the phenomenon of Melbourne’s ‘ghost’ apartment towers (watch video here).

Thus, while advertised vacancies might still be fairly tight in Melbourne, actual vacant properties are likely not.

Regardless, when it comes to dwelling construction vs fundamental demand, all of the data is pointing to Melbourne’s housing market being far more “bubbly” than Sydney’s. Melbourne, therefore, easily wins on this measure.

Running tally: Sydney 2; Melbourne 2.

Economic strength:

This brings us to the final round in our bubble battle: the relative strength of each economy.

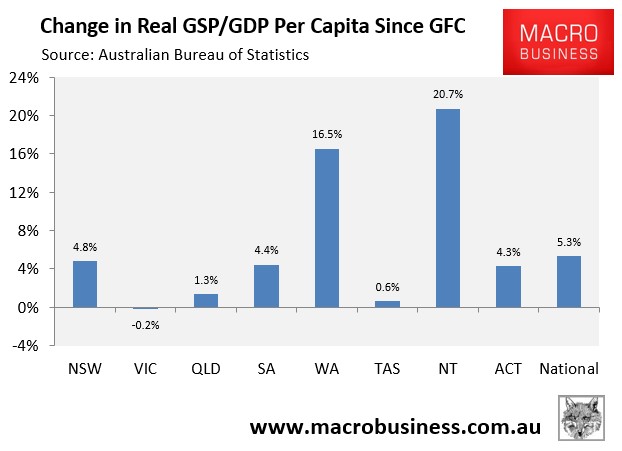

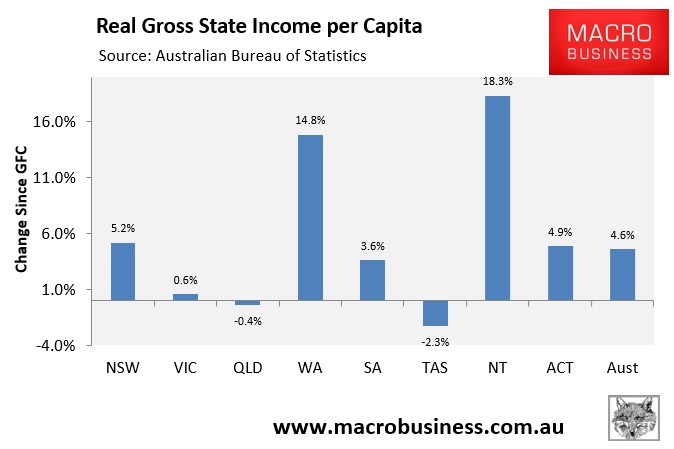

The annual state accounts provide the most detailed perspective; although they are only current to June 2015. Still, by these measures, New South Wales has exhibited the stronger economic performance, with gross state product (GSP) per capita growing by 4.8% since the Global Financial Crisis (GFC), versus a fall in GSP per capita of 0.2% in Victoria:

New South Wales has also easily out performed Victoria on income growth, with per capita gross state income (GSI) growing by 5.2% since the GFC, versus just 0.6% growth in Victoria:

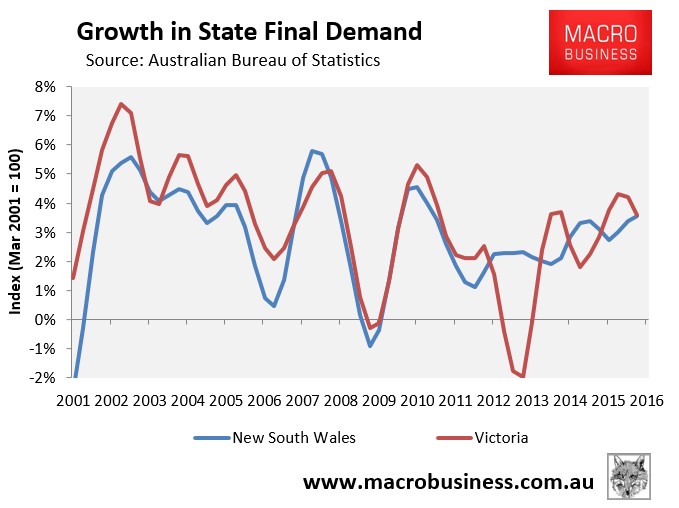

The most recent measure of economic momentum was similar between the two jurisdictions, albeit with diverging trends.

As shown in the next chart, New South Wales’ state final demand (SFD) grew at 3.5% in the year to March 2016, marginally below Victoria’s 3.6%. However, New South Wales growth is trending upwards, whereas Victoria’s is trending down:

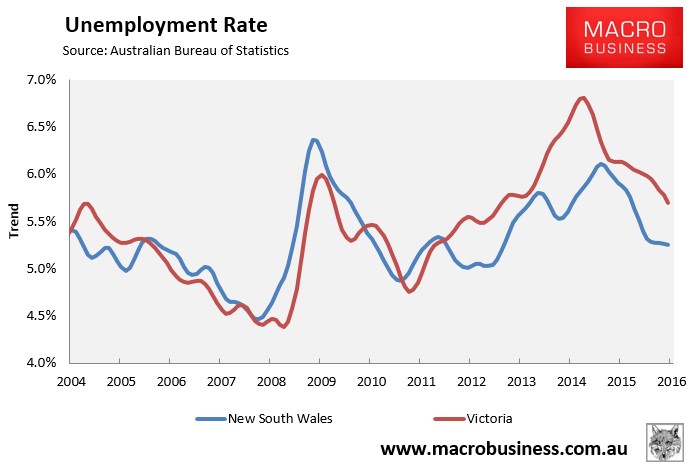

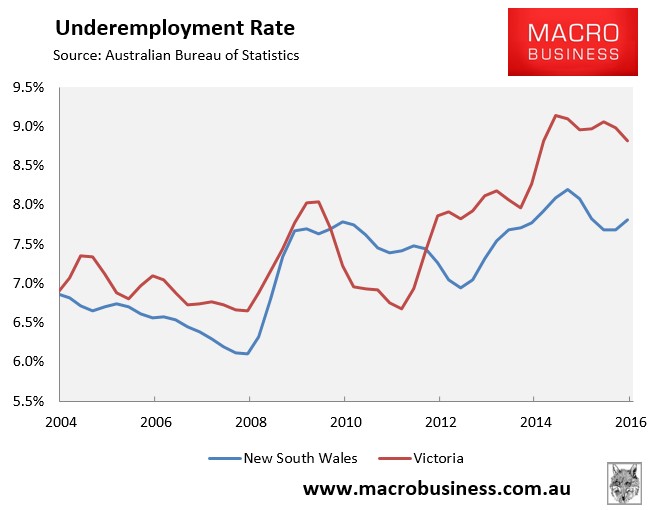

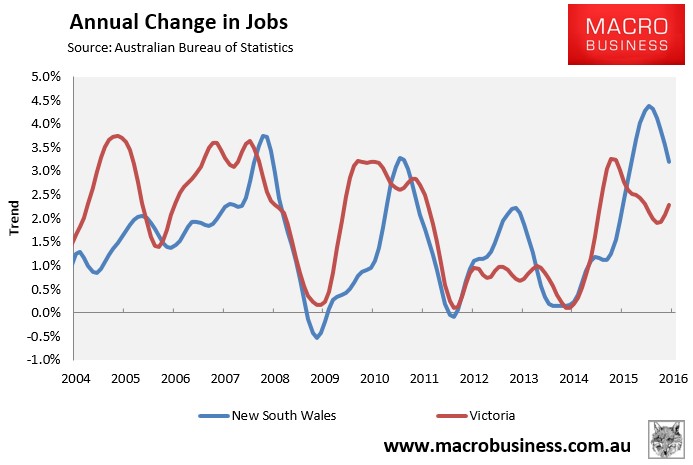

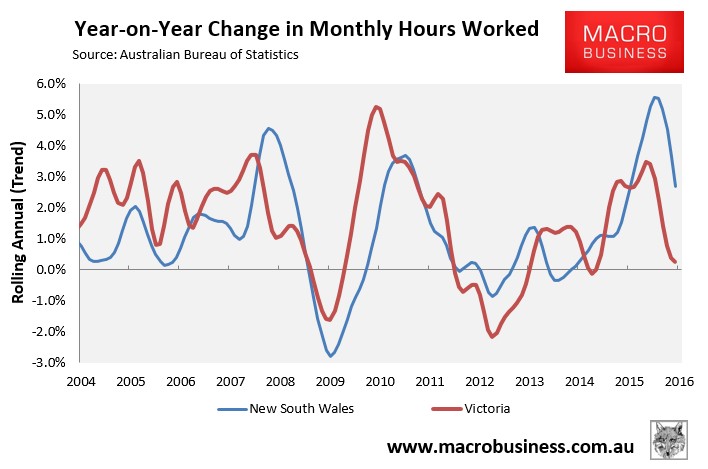

Labour market indicators point further in New South Wales’ favour.

As shown in the below charts, New South Wales has lower unemployment and underemployment, as well as higher jobs growth and growth in aggregate hours worked:

Thus, across almost all broad economic measures, New South Wales is ahead of Victoria, thus arguably making it a less “bubbly” market, other things equal.

That said, both Sydney and Melbourne are highly exposed to any housing correction. Both are “parasite” economies that are the epicentres of big finance, most notably the big four banks that manage the nation’s mortgage debt as well as the funds management industries that manages the nation’s superannuation.

Any housing correction would, therefore, adversely impact the banks’ mortgage books, thereby impacting Sydney and Melbourne the most via their deep ties to the financial sector.

A housing correction would also lead to a decline in dwelling construction, which has underpinned both markets, as well as lead to a negative “wealth effect”, which would damage consumer-facing sectors like retail.

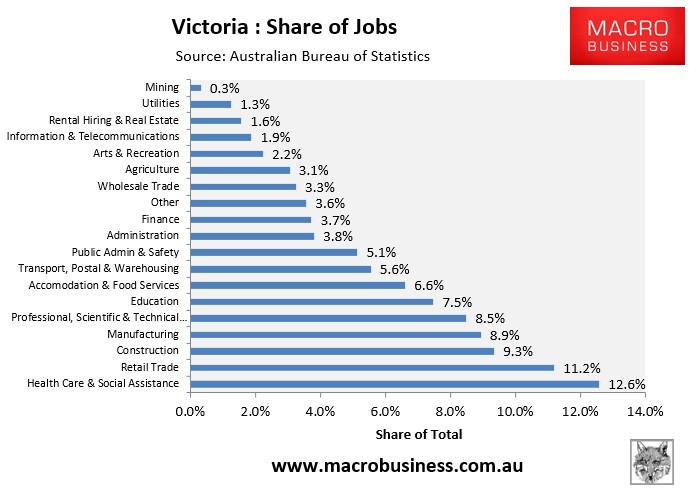

In my view, Melbourne’s economy is more exposed than Sydney to a downturn. The below chart shows the composition of employment across Victoria (read Melbourne) based on the latest ABS quarterly data:

As you can see, Victoria’s second, third and fourth biggest employers are retail trade (11.2%), construction (9.3%), and manufacturing (8.9%) respectively.

Retail trade and construction are directly tied to the housing market – the former via the ‘wealth effect’ and the latter via dwelling construction – whereas the manufacturing sector is facing retrenchment from late this year as the local car assembly industry closes (i.e. Ford and Toyota).

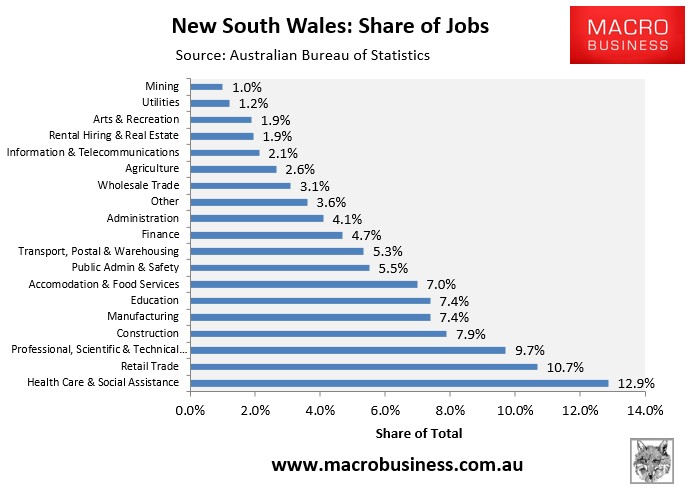

New South Wales’ (read Sydney’s) employment composition is arguably less troublesome:

The retail sector employs relatively less people (10.7%), as does the construction sector (7.9%), making it less directly exposed to housing weakness. The manufacturing sector also employs relatively less people (7.4%) and is less exposed to the closure of the car industry.

Finance and rental hiring & real estate services employ relatively more people in New South Wales, but these are small employers overall, mitigating any employment shock in the event of a significant housing correction.

Hence, overall, New South Wales’ economy is less precariously placed than Victoria’s, thus making its housing market a relatively safer bet, other things equal.

Final tally: Sydney 2; Melbourne 3.

Melbourne wins the bubble battle, but only just:

So based on the measures outlined above, Melbourne narrowly wins the crown of Australia’s biggest housing bubble in a close fought race.

While Melbourne’s home values are less exorbitant than Sydney’s, they face far more competition from new dwelling supply. Melbourne’s economy is also more precariously placed, with around 35% of employment in industries directly exposed to either a housing downturn or the closure of the local car assembly industry.