The US dollar was firm overnight:

Yen and euro fell, yuan finally bounced:

Commodity currencies fell:

Gold too:

Brent was pole-axed as expected:

Base metals fell sharply:

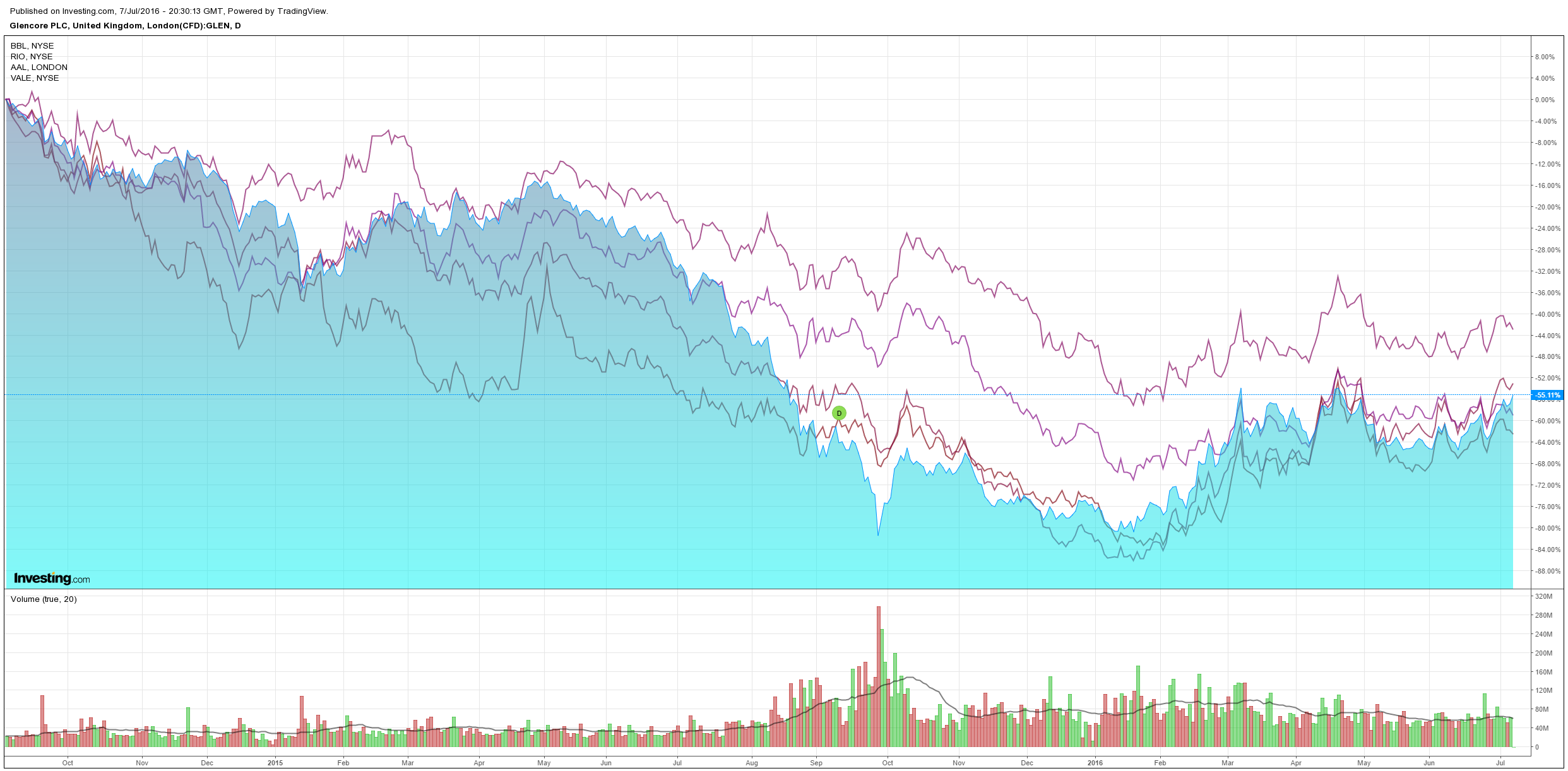

Most miners too:

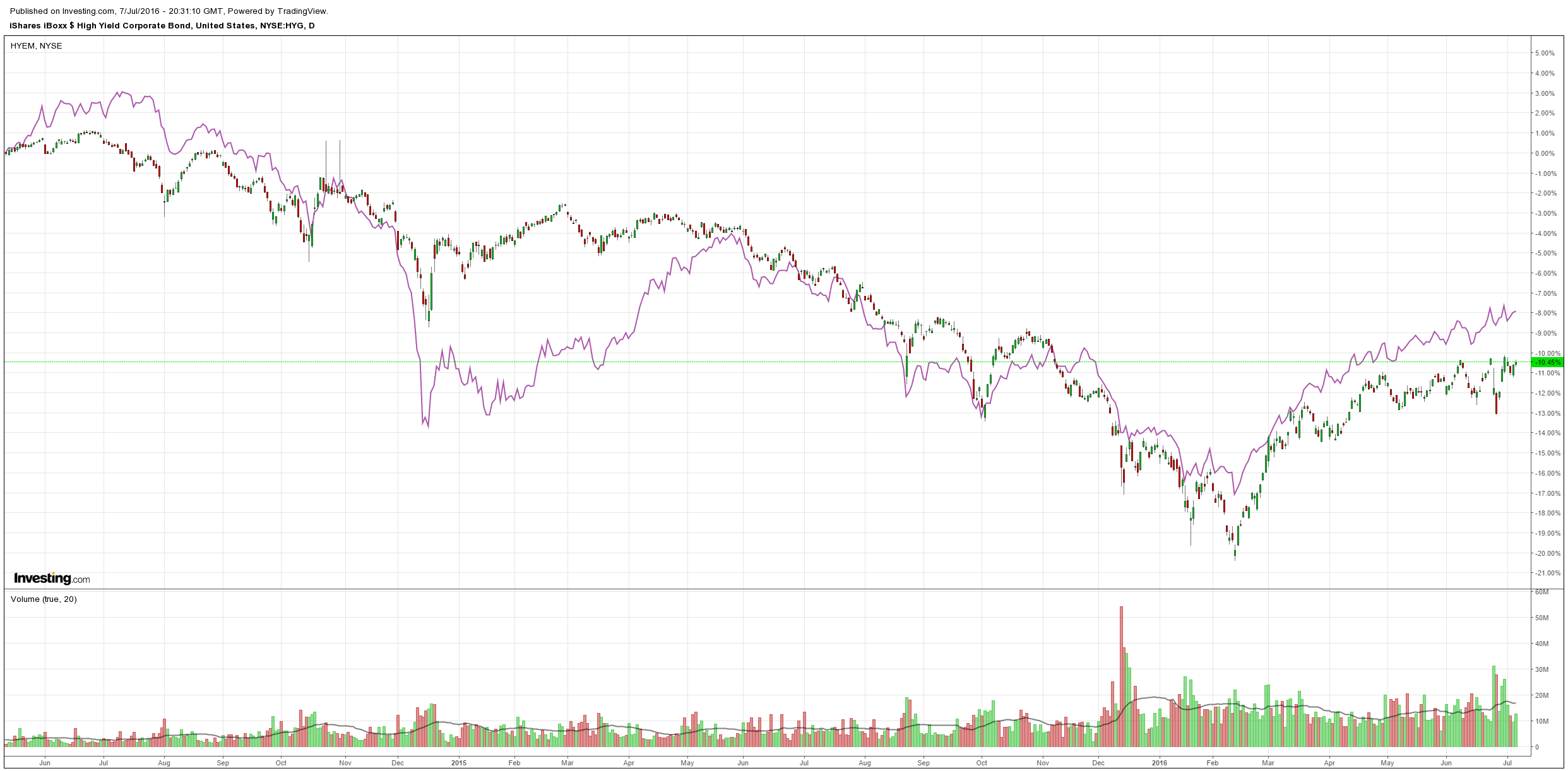

US and EM high yield debt still did not get the oil memo:

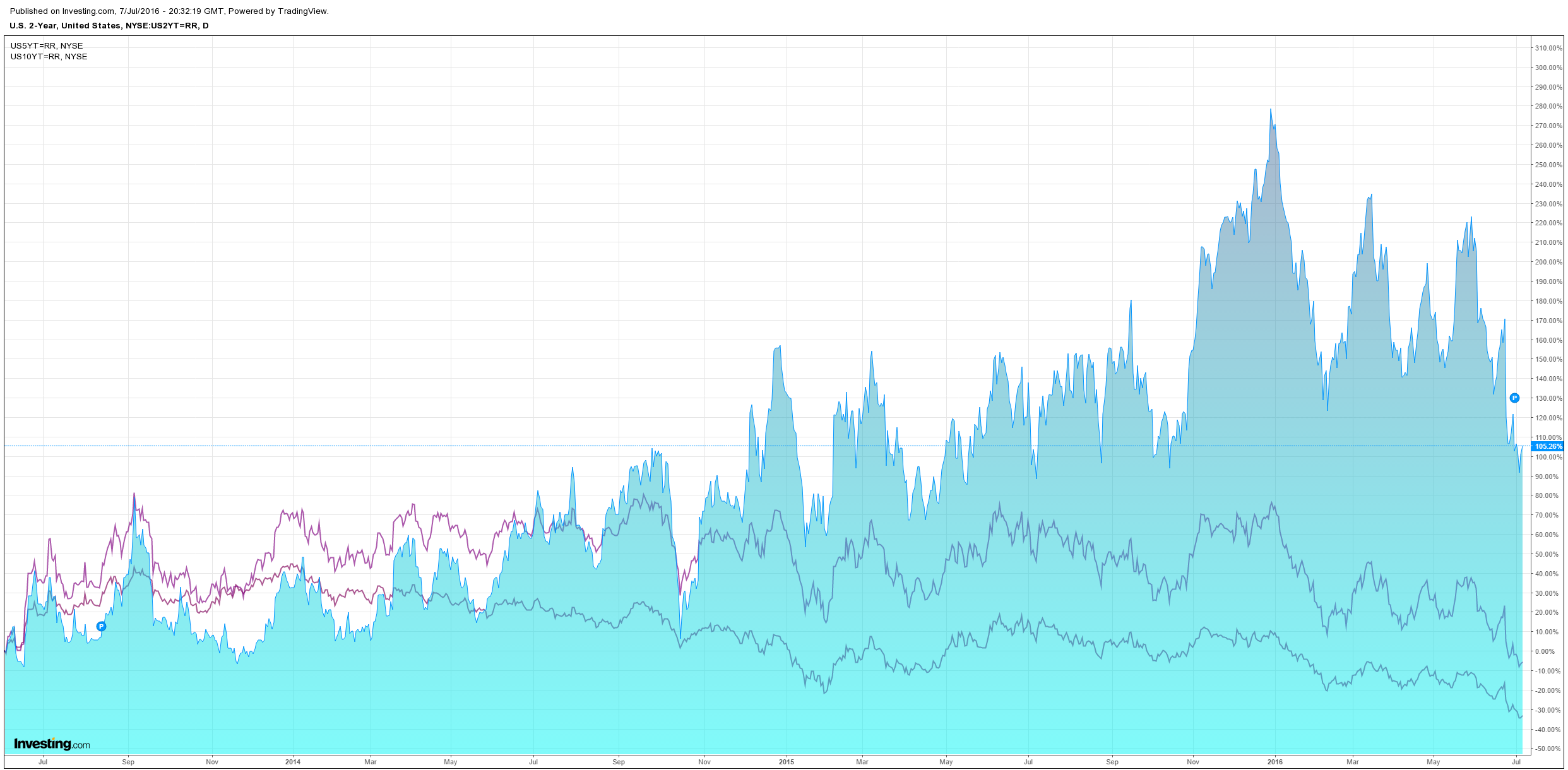

US bonds sold:

Shares fell marginally:

A cautious evening of mostly technical action (except oil) as we head into the US jobs report tomorrow. Markets appear positioned for a weak report and are holding up on bad news being good news I hazard.

Meanwhile, the twin peaks of market terror – the Mining GFC and Brexit – are worsening. On the former, oil broke and is shaping for a tough second half with good news from Nigeria and Libya, US consumption weaker than thought, China’s strategic reserve build over. We’re headed for $40 at least to kick US rigs back into hibernation. I don’t know why high yield debt is not onto it yet but it will be. Perhaps it needs China to slow first.

In Europe, the banking system is throwing up daily problems as UK property trusts shutter, German banks see equity evaporate and Italian banks flirt with outright crisis, from Citi:

Italian Banks: Are We Nearing a Decisive Solution? We Doubt It

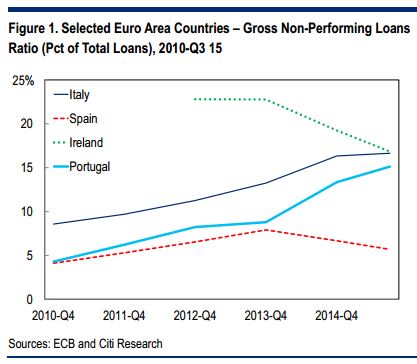

Italian banks’ woes are once again roiling markets, in the aftermath of Brexit and ahead of EU-wide stress test results on 29 July. Italian banks suffer from among the highest non-performing loan ratios in the EU – €198.3bn, or 10.4% of total loans in April-16 (16.6% on the ECB definition) – as well as relatively poor profitability amid falling margins, muted credit growth and the low-yield/flat-yield-curve environment.

Direct public support difficult under EU rules … Several policy actions in the past few months – improved credit recovery procedures, state guarantees on senior NPL tranches, a public-private fund (Atlante) to recapitalise small lenders – have had only very limited effects on the banking system. Direct state intervention has so far been held back mainly because it would trigger EU state-aid and bail-in rules, which require burden-sharing of junior debt and at least 8% of liabilities bailed in in the event of public support to banks. Because of the significant share of retail bondholders among banks’ creditors (1/3 of bank bonds, around €200bn, but only 5% of total liabilities), the application of bail-in rules is particularly difficult in Italy. There are political hurdles too, as the backlash from the resolution of four small lenders in late-2015 showed and given heightened sensitivity at present ahead of a crucial autumn referendum on which the survival of the government rests.

… but state intervention seems now on the table. A €150bn government-guarantee liquidity scheme was authorized by the EC on 26 June, although we think this is unlikely to have any meaningful impact, as liquidity is probably not a major issue now for most banks, given ample ECB provision on this front. The government is also reportedly asking to apply the “exceptional circumstances” clause in Art 108 of the EU Treaty to temporarily suspend state-aid rules and proceed with direct capital support for banks – as much as €40bn, according to some press reports (e.g. Bloomberg) – without triggering creditors’ losses. The EC seems willing to allow some protection for retail bondholders, but not for institutional investors. We doubt Italy would take any unilateral actions without Brussels’ consent, as the FT has suggested, due to the likely negative political and market repercussions.

Is this the once-and-for-all fixing of Italian banks’ woes? While some form of public support seems forthcoming, an outright suspension of bail-in rules remains unlikely, in our view. The latter would represent a major blow to the new bail-in rules and it is strongly opposed by Germany. Any state intervention will likely be small, in our view, confined to a very small number of lenders and broadly within EU rules.

As such, it is unlikely to represent a decisive fix of Italy’s banking problems. Retail investors will probably be protected (perhaps via ex-post reimbursement) as fears of a severe market backlash and subsequent deposit outflows may prevail. Such a compromise may limit the negative political fallout for PM Renzi, but increased concerns among households about their savings are likely to hit the already dwindling popularity of the government in any case.

And behind that looms Itexit, from Vimal Gor:

One important event to watch for is a referendum scheduled for October in Italy. This referendum is not about membership to the EU but about a more boring topic of streamlining how government works (removing the power of the senate) to stop gridlocked bills that stand in the way of reform. Matteo Renzi, the Italian Prime Minister, has staked his career on this vote and if it is lost then it is likely that his government will fall and Beppe Grillo and the Five Star Movement (the populist party) will take over, which would obviously lead to a European membership referendum. The UK leaving the EU is one thing, but Italy wanting to leave the EU and ditch the Euro is a move that could bring down the whole of Europe. If the establishment wants to keep Europe together realistically there will have to be some pandering towards these populist parties that are clearly getting stronger and stronger. The arrogance of the establishment, as evidenced by how the ‘remain’ campaign was run in the UK, will likely mean that this pandering won’t happen, and we have a real risk of populist parties running populist policies being in power. This could be the trigger to break up Europe.

No change to the outlook today (except its worse).