by Chris Becker

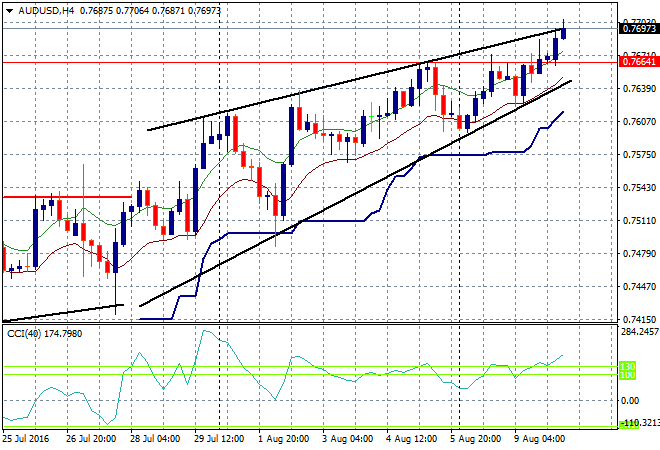

No, not the Olympics, but another tally that doesn’t matter – or make sense – the Australian dollar is now above 77 cents against the USD, not far off its high for the year at just over 78 cents:

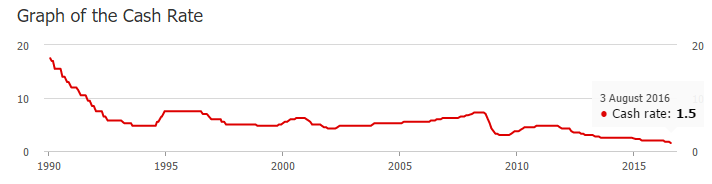

Even as the RBA cuts to record lows (in another weird graph from the RBA nerds):

Its still better than elsewhere, with only NZ pipping Australia for gold:

And as 10 year government bond yields crater:

There’s still a minor gap or differential between the Aussie and US Treasuries – a gap that may never close if the Fed keeps holding off on raising rates:

With interest rate futures indicating that the RBA will likely finish at around 1% by the third quarter of 2017, and the Federal Reserve to maybe possibly, I don’t know, kind of ratcheting up to – wait for it – 0.5% by the end of this year, the attraction by foreign money to bid the Aussie is plain to see.

There is of course, the blatant correlation between commodity prices and the Aussie, with iron ore the big ‘un, as Annette Beacher, chief Asia Pacific macro strategist at TD Securities, explains in her chart below:

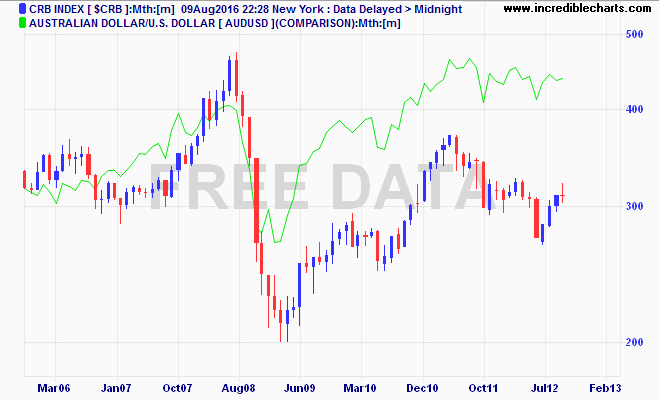

Although the broader CRB Index is a little less ebullient on the correlation, it is there as a proxy:

So as long as commodities sing their bear market song, the fat lady that is the Australian dollar will keep wurbling that dog-awful tune and advance, but not fairly…