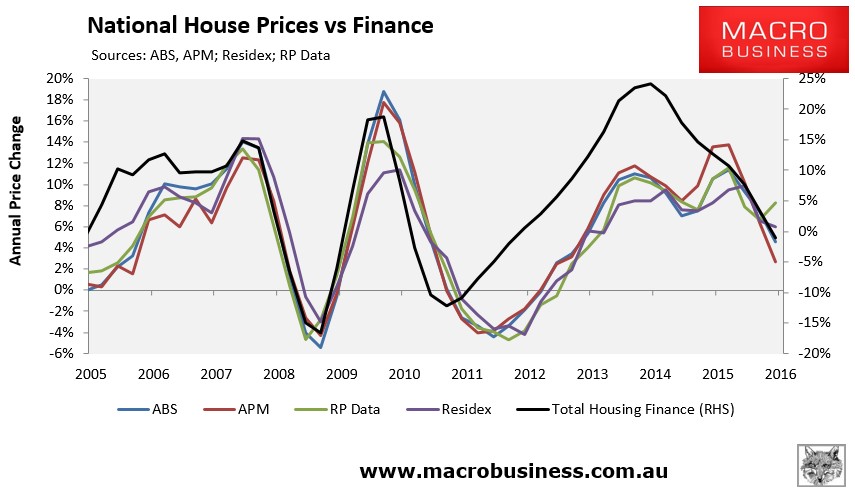

With the release yesterday of the ABS residential property price data for June, it is an opportune time to once again plot house prices against total finance commitments (excluding refinancings) as measured by the ABS.

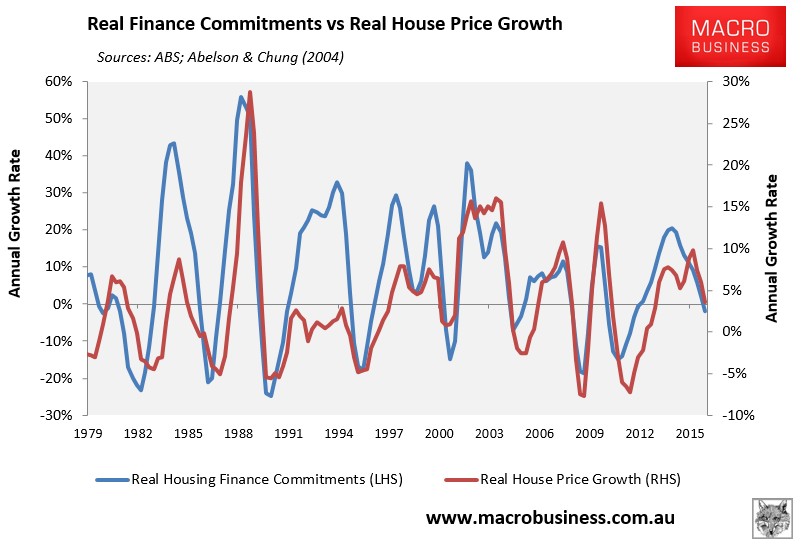

First, below is the national picture, which shows finance approvals typically leading price growth:

As shown above, the ABS house price series seemed to break away from finance commitments between December 2014 and September 2015, but have since fallen back into line.

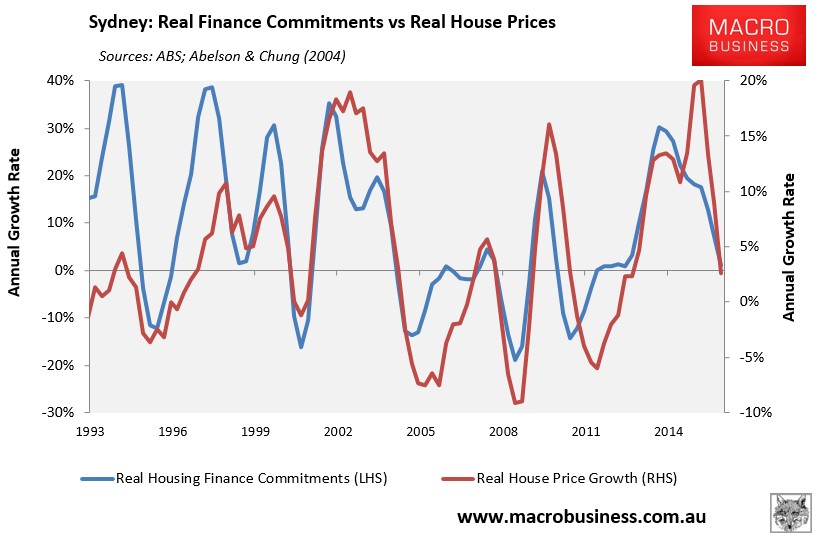

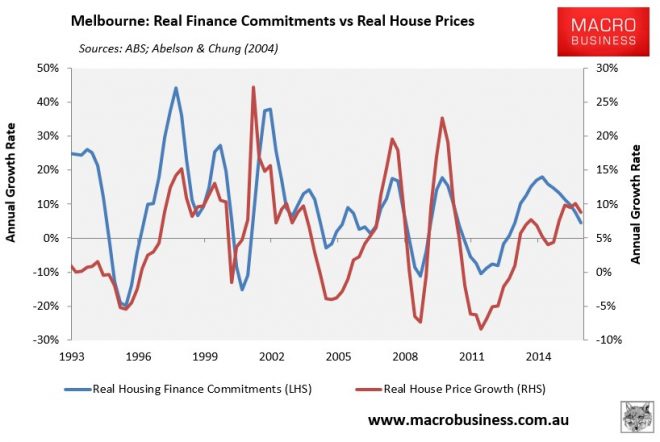

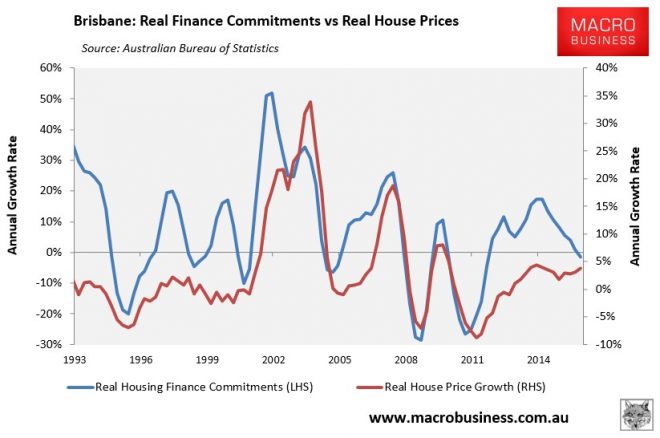

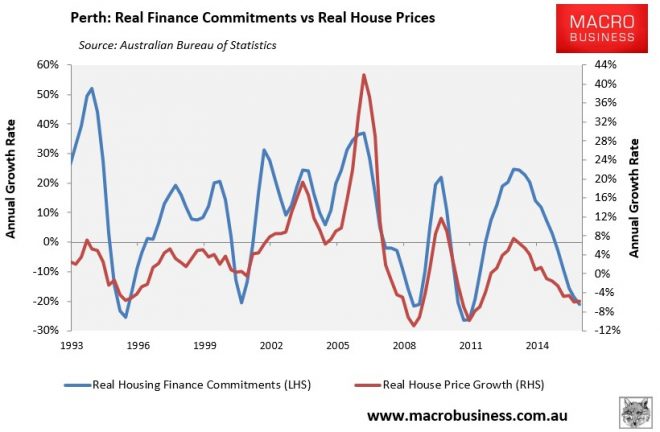

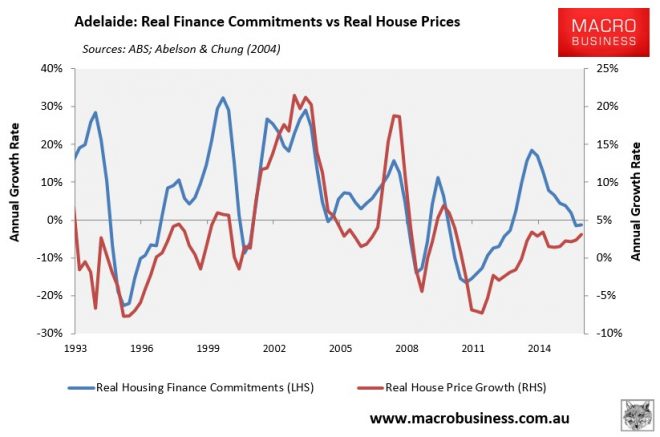

Across the five major capitals, there has also been a strong correlation between finance commitments and dwelling price growth; albeit with different lead/lag times:

Note from the above that after diverging wildly from finance, Sydney’s house price growth has fallen back into line.

Melbourne’s prices, by contrast, appear to still be levitating, as do Brisbane’s and Adelaide’s. Whereas Perth’s prices are falling in line with finance commitments.

The broad relationship between house prices and finance commitments is also re-converging across three of the four major house price indices, with CoreLogic the odd index out:

Still, the relationship between house price growth and housing finance does not seem to be as strong as it used to be, possibly because of:

- falling transaction volumes; and

- the potential for cash buyers, such as buyers from overseas, whom are not captured in the housing finance statistics.

Tomorrow, I will provide a detailed report examining the first issue – transaction volumes – which have fallen heavily across the country as prices have risen.