Time for another Australian dollar five drivers update. MB’s five driver model for the Aussie is:

- global and Australian growth (or, more recently, Chinese growth and Australia’s terms of trade);

- interest rate differentials;

- investor sentiment and technicals; and

- the US dollar.

On the first, Australian growth is stellar versus the world at the headline level. There are problems, however, with income and the labour market quite weak under the bonnet. The outlook is also poor beyond six to nine months as the dwelling boom begins to fall along with the car industry exiting and the ongoing mining capex draw down. Markets still see one rate cut. We see no bottom.

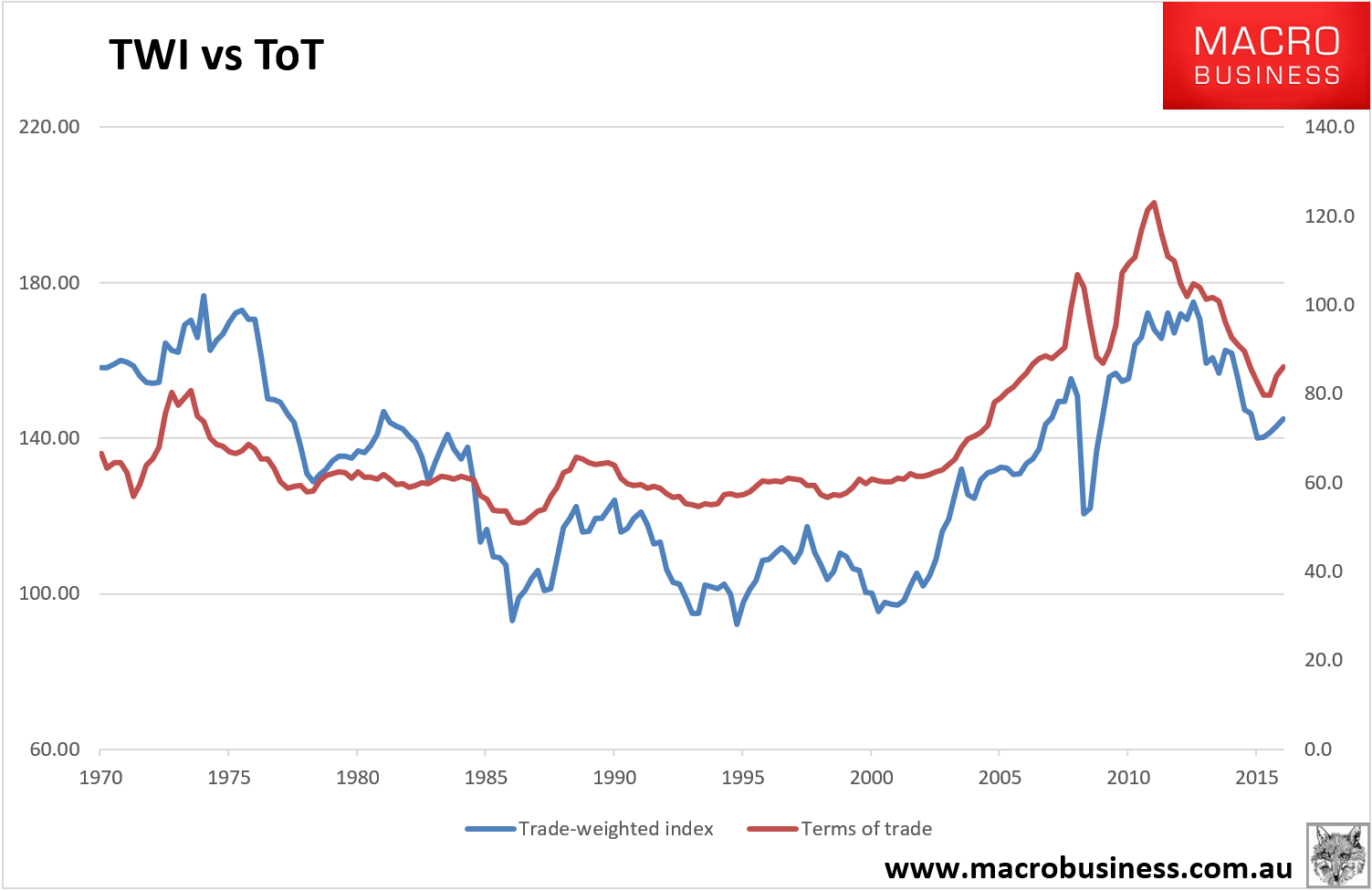

Still, in recent months the Chinese boomlet has offered some respite on income so the first driver is still a positive over the next six months:

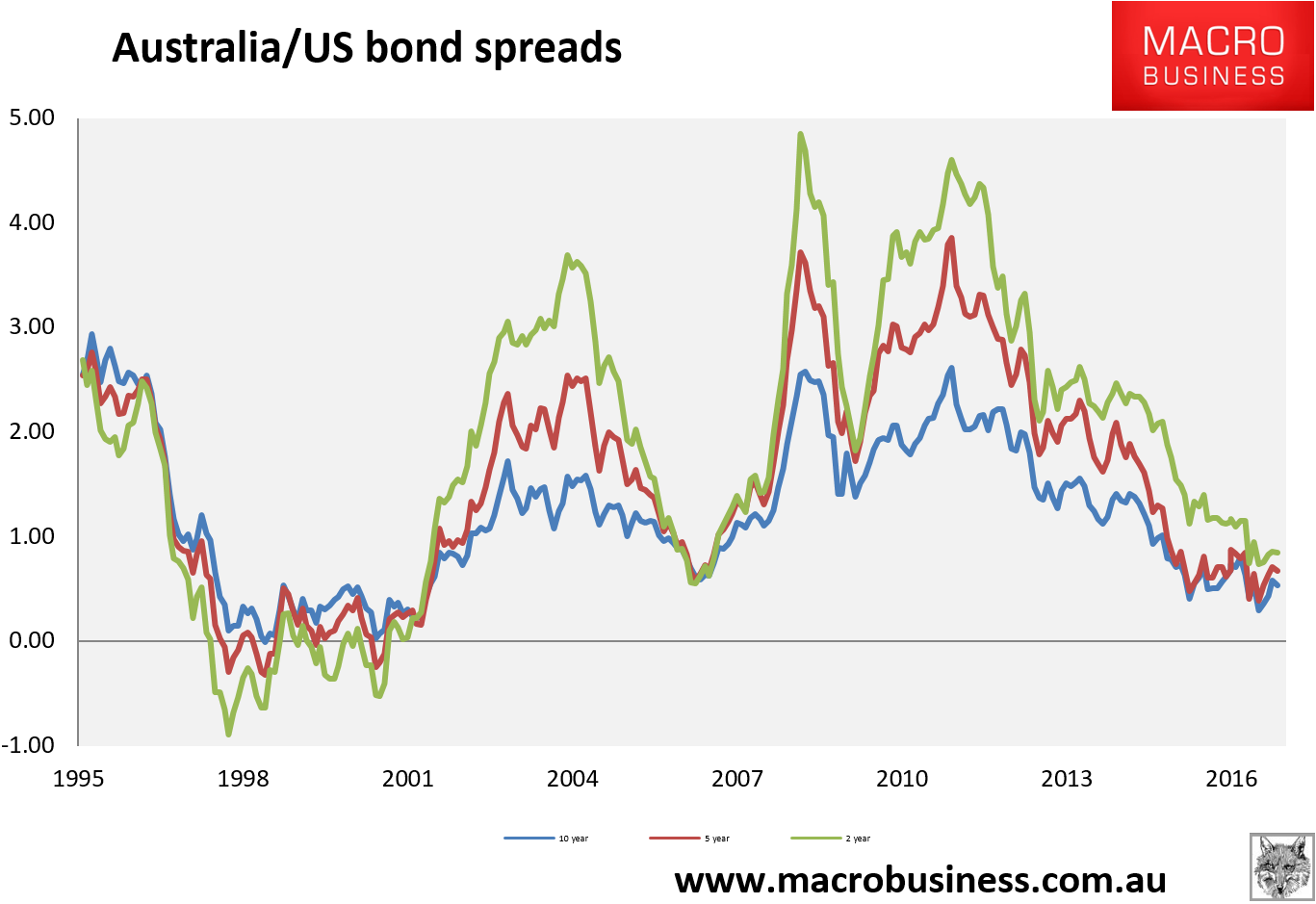

On interest rate differentials, the situation is unchanged. Although local rates are on hold for a bit, US rates are firming, with the net result that downtrend in the spread has slowed but is well intact:

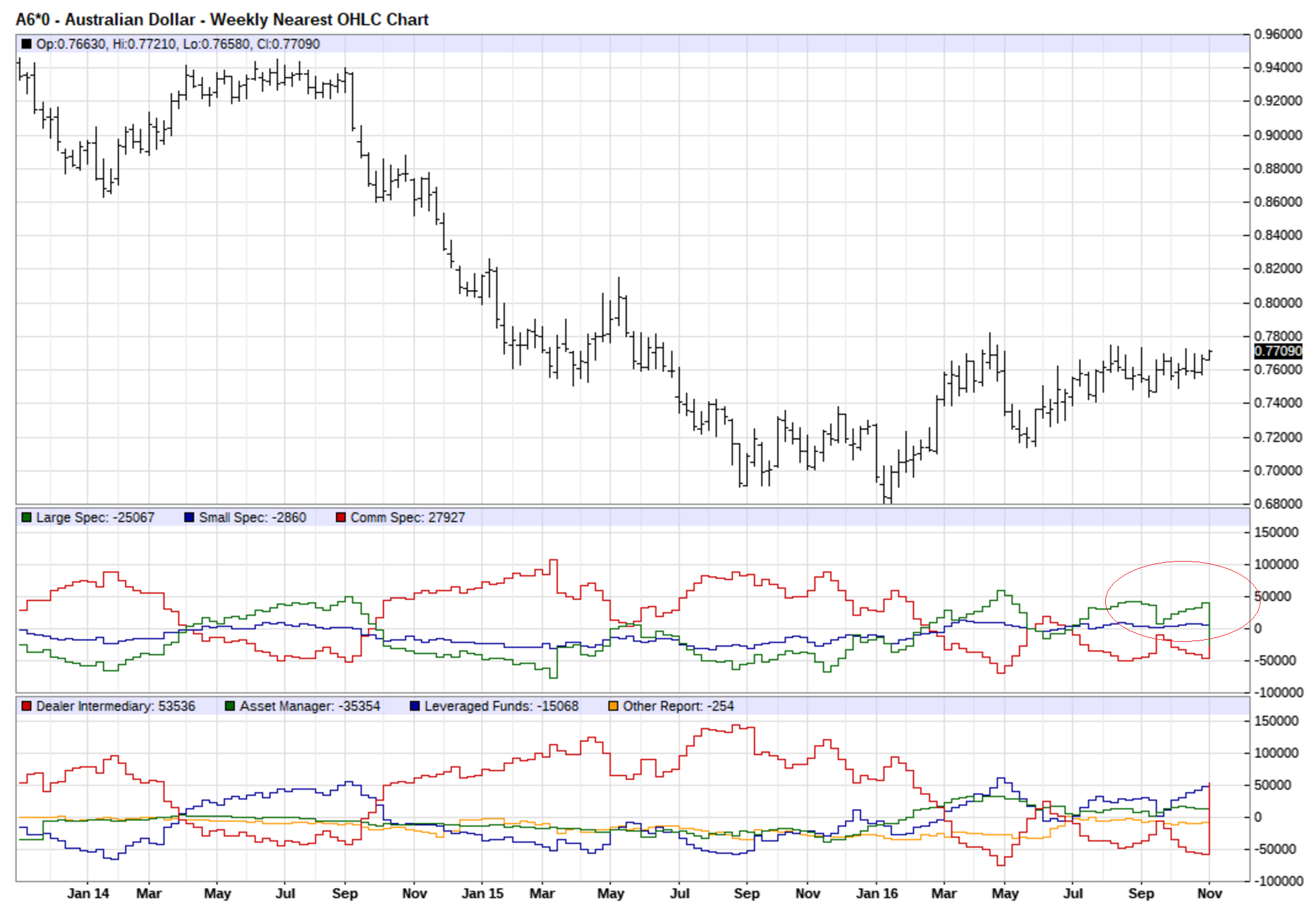

On driver three, sentiment is strongly bullish. The large specs that drive the price are long 46k contracts in the COT:

There is room here to get more long though this data is now a week old and it is probably well above 50k by now. Recent highs have reached 70k.

On technicals, whether it is the daily:

Weekly:

Or the monthly chart:

It’s a bullish set up with wall-to-wall ascending triangle patterns. Although it should always be noted that such patterns are meaningless until resistance levels break.

Our last driver is the US dollar which also looks strong within its broad trading band:

Assuming Hillary Clinton wins, the USD should firm further as the Fed moves to tighten. Meanwhile the CNY is still weak and likely to keep falling as China chases its growth targets. EUR is structurally inhibited by ongoing exit risks. And JPY is weak on ongoing easing. All will bias the USD up. Driver five remains a headwind for the Aussie.

So, I would sum up by saying that the fundamentals of the currency have stabilised for as long as Chinese bulk commodity boomlet runs and local growth holds up. Until the raging ferrous bubble pops – which may happen suddenly on a policy shift or more slowly on a supply response – markets are going to buy the Aussie. Indeed, so far, they’ve probably held back for fear of a sudden coal policy reversal in China.

That seems to me pretty sensible. China is in the process of delivering itself a moderately large producer inflation shock thanks to its supply-side coal policy errors. It seems not to have anticipated the surge into commodity futures markets by local Chinese punters and, if I were them, that would be my next target for a policy reversal. Still, it may not come in which case the Aussie can only fall as the supply response squashes prices instead. That’ll take a year for a full reversal.

So, at this stage there is still a clear risk of an upside spike in the Aussie. My last call was that the Aussie end the year at 73 cents. That looks in jeopardy.

If the spike comes, I would see it as opportunity to either get short, get offshore, of get hedged. I still see the Aussie in the sixties next year as the bulks settle, the US keeps tightening slowly and rate cuts return to Australia.