As we start the year in currency land, two themes are getting interesting – one local, one peripheral/ephemeral.

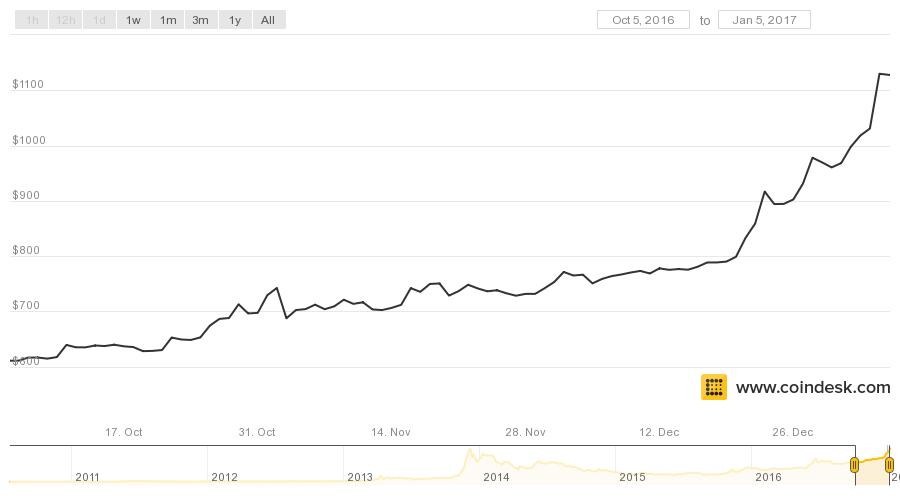

First to Bitcoin, which was the best performing currency in 2016, more than doubling, but has surged spectacularly towards the end of the year, cracking the $1000USD level over the break and now at $1114USD:

We’ve gone through these fluctuations before, which is a double edged sword for the cryptocurrency as any currency alternative needs stability and transparency, so it begs the question why is it happening again?

Its probably certain that Chinese buyers, who want to escape a weakening domestic currency – the Yuan – are looking for suitable substitutes, particularly those that are easier to launder than a Melbourne dogbox apartment.

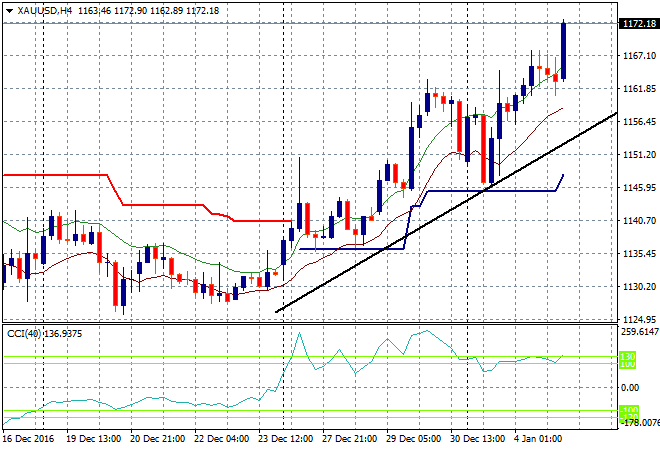

Gold has seen a slight resurgence too up over $50 since Xmas:

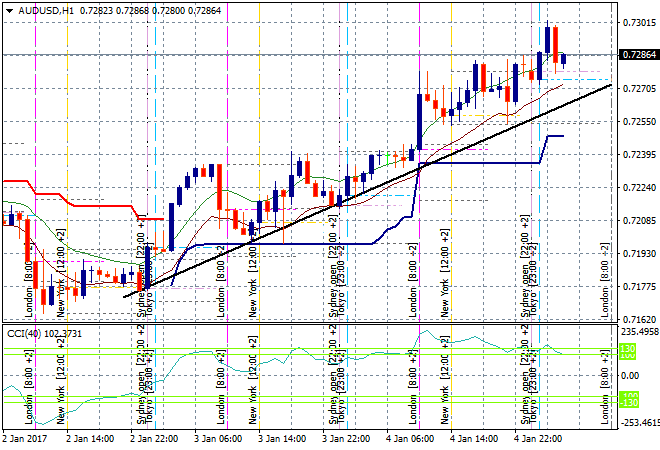

And another local beneficiary, the other undollar – Australian dollar, now up nearly two cents against USD since the break:

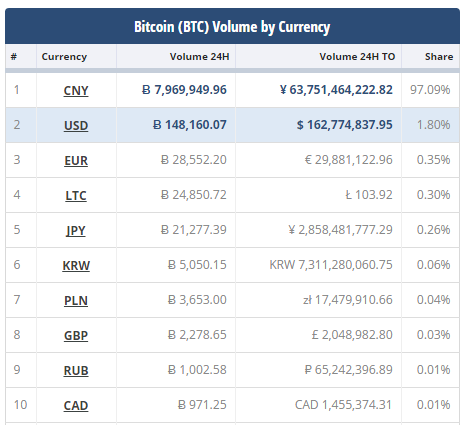

Back to Bitcoin, where the buyers in the last 24 hours have been almost Chinese, according to volume tracker Cryptocompare:

This is part of the outflow problem China has been having all of last year and have been trying to shore up the weakening Yuan since the new year, with a raft of measures including selling more US Treasuries, strengthening the reference rate to 6.93 (down from 6.95 – a big move today!) and conducting lots of OMOs.

Given the Fed is signalling further rate rises sooner rather than later, an even weaker Yuan is going to see alternative currencies like Bitcoin look more attractive for mainland Chinese buyers.