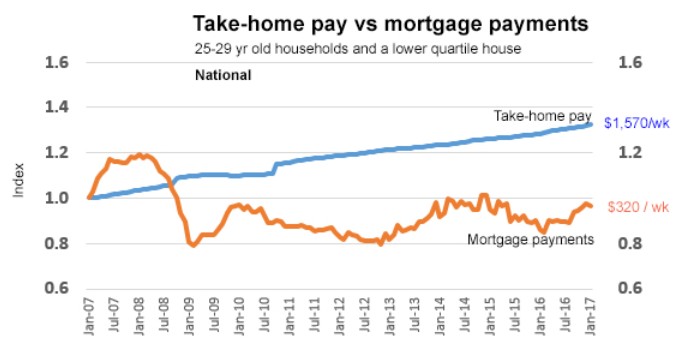

Interest.co.nz’s David Chaston has produced some interesting charts comparing mortgage repayments to take home pay across New Zealand’s major markets over the past decade.

At the national level, Chaston finds that mortgage affordability is actually better now than just prior to the GFC, courtesy of falling mortgage rates and the steady rise in incomes:

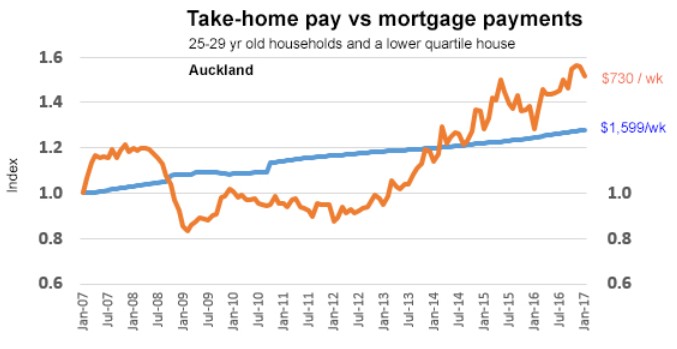

However, in New Zealand’s biggest and most expensive market – Auckland – mortgage affordability has clearly deteriorated sharply over the past decade:

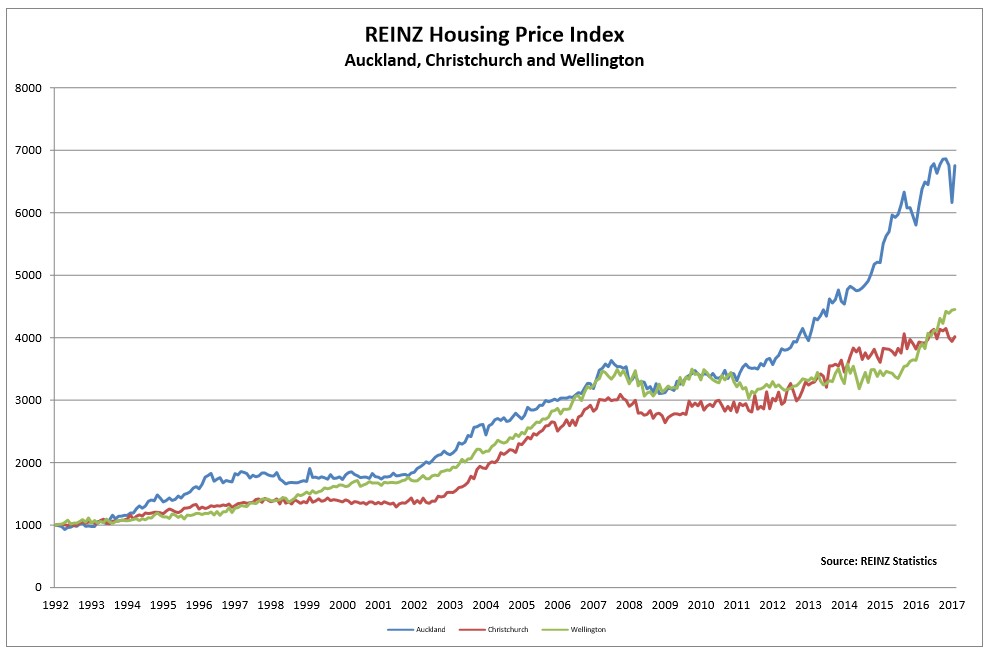

And this is due to the hyper-inflation of home values in Auckland, which has far exceeded growth in the other cities:

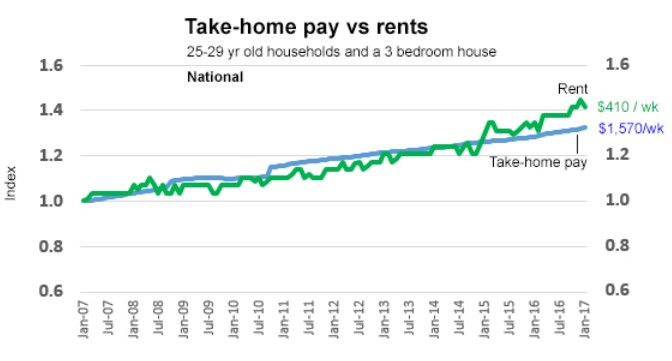

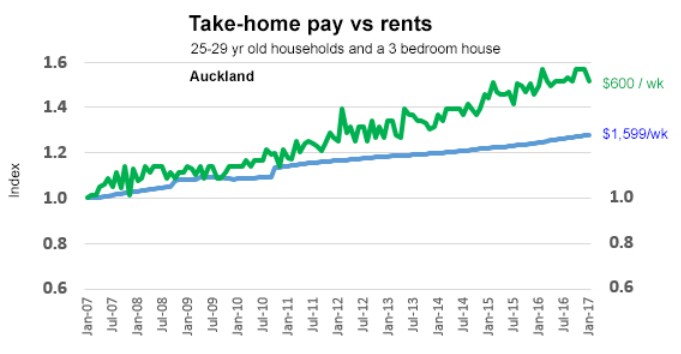

The picture is worse for rents, however, with rents growing faster than wages over the past decade across New Zealand:

But again, the situation is worst in Auckland:

Bottom line: New Zealand’s housing problems relate primarily to Auckland. This is much like Australia, where Sydney and Melbourne are the primary trouble zones.