DXY held on last night:

Commodity currencies roared:

Gold firmed:

Brent held on:

Base metals faded:

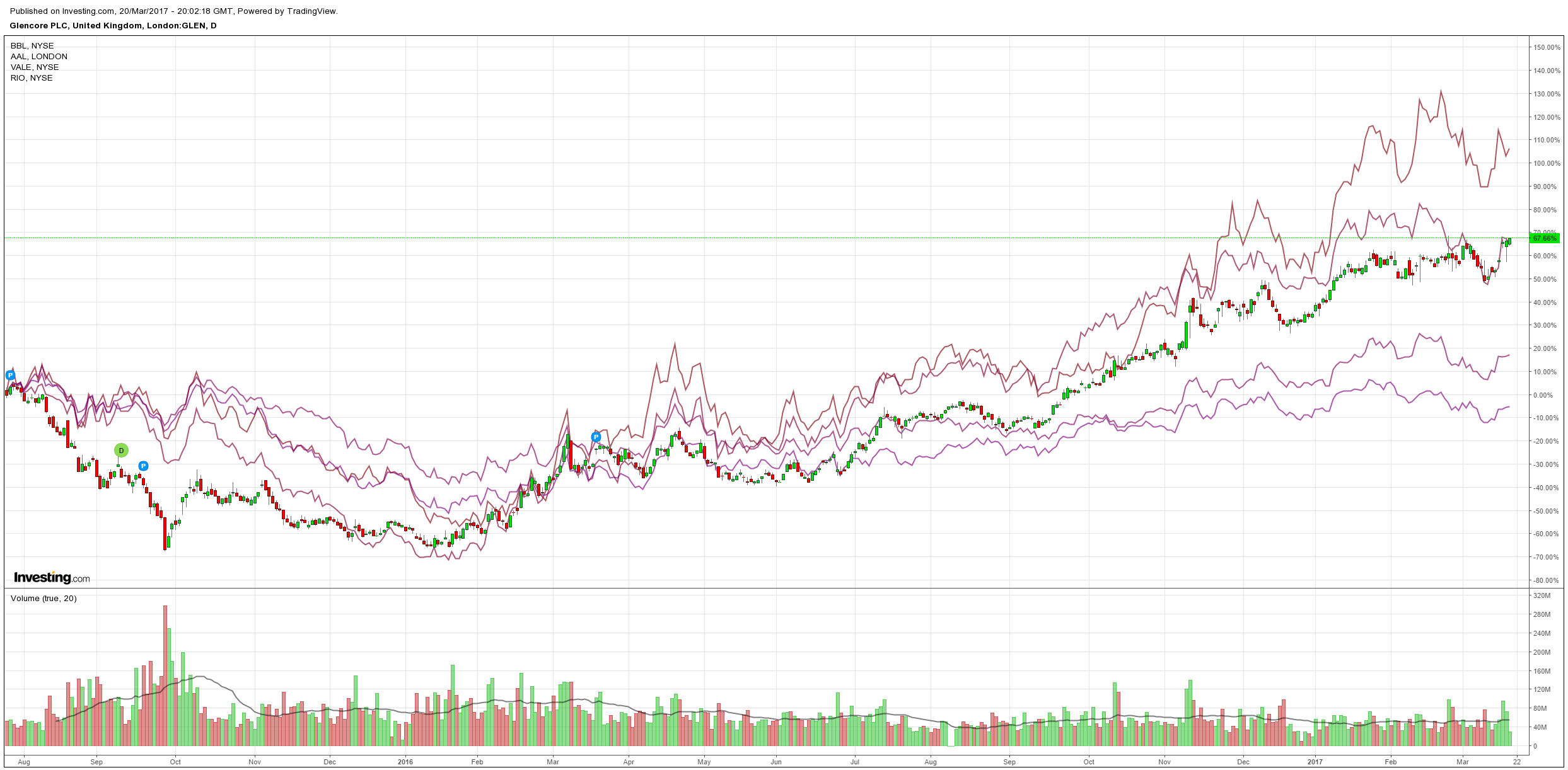

Big miners firmed:

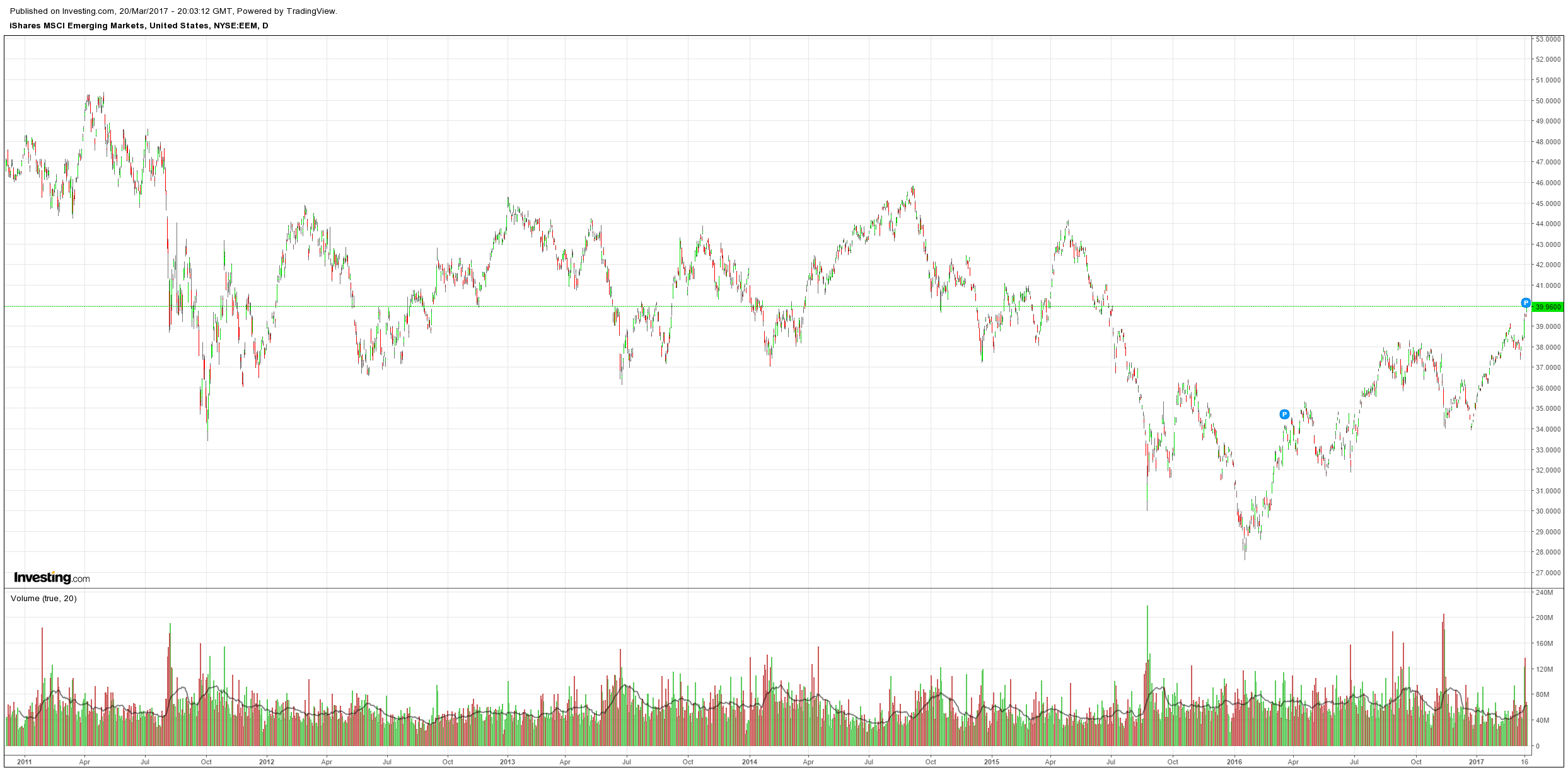

EM stocks are roaring:

But not high yield:

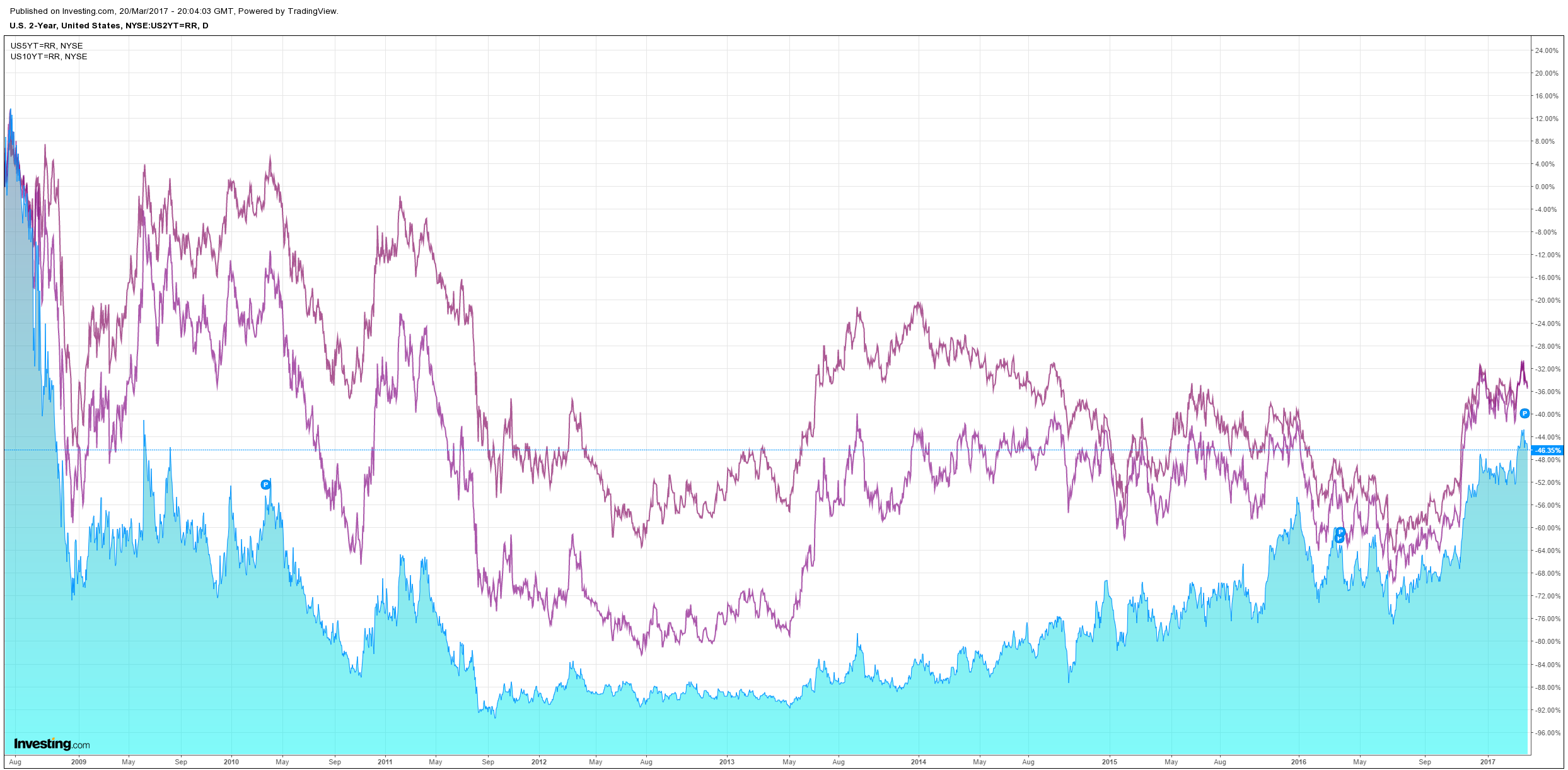

US bonds were bid:

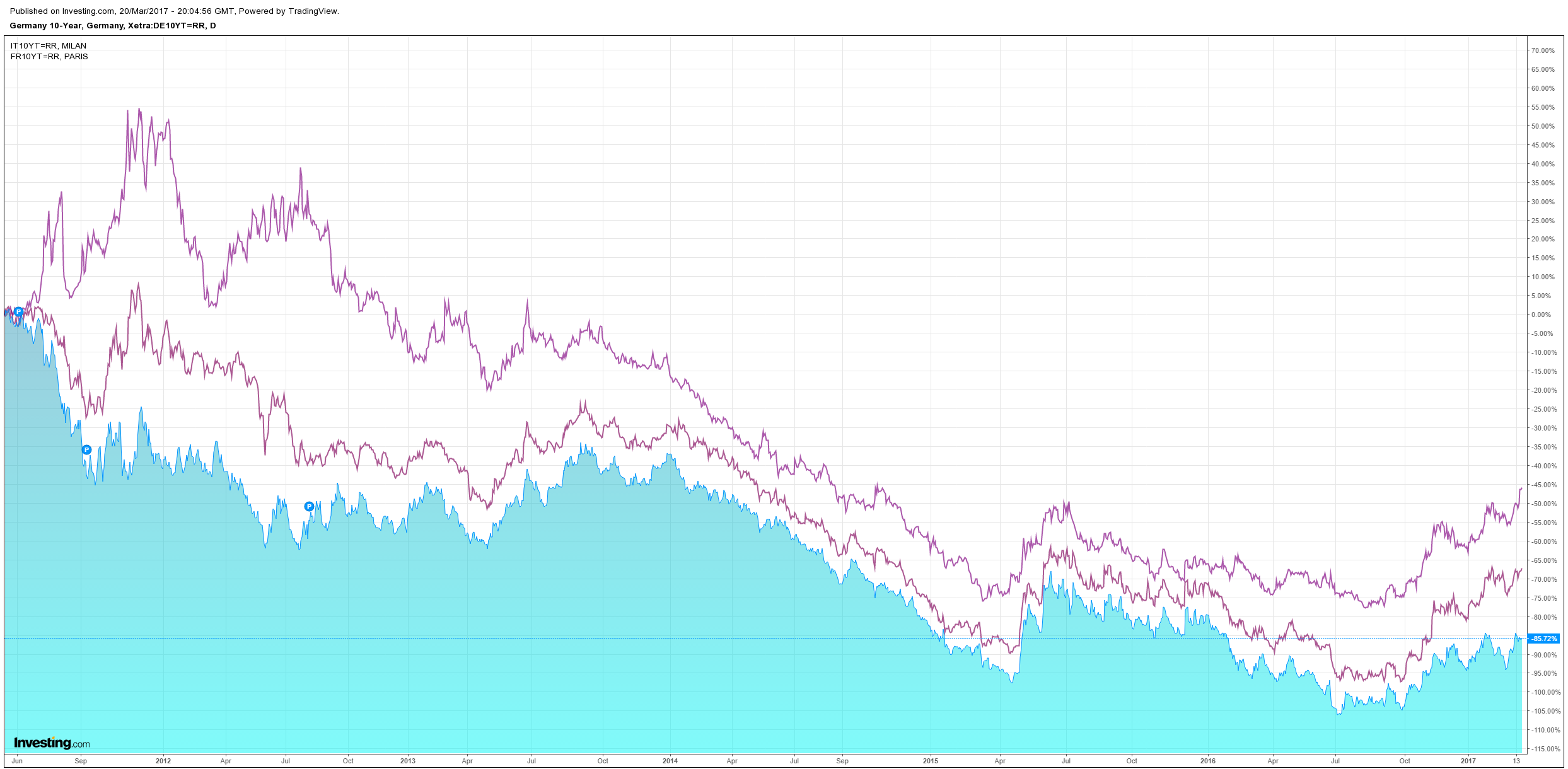

European yields took off:

US stocks hiccuped, Europe softened:

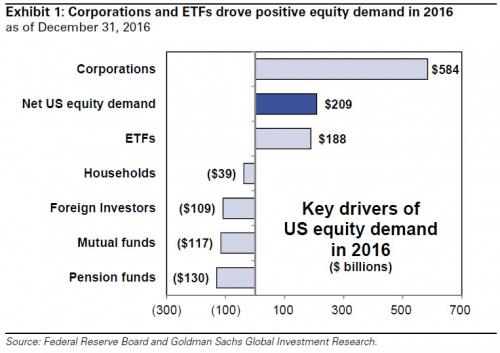

US reflation is off and global reflation is on. The Fed has stalled US exuberance, oddly by being less hawkish, and solid Chinese data plus the weakening USD has refired hopes for emerging markets. As well, fears of a slower hand-off to US fiscal are manifesting in sell-side analysis, via Goldman:

Corporations and ETFs were the key drivers of US equity demand last year. Net equity purchases by corporations and ETFs equaled $584 billion and $188 billion, respectively, which offset net selling by mutual funds, households, and pension funds. Foreign investors also fled US equities during 2016, including $60 billion of net selling post-election amidst concerns of potential protectionist policies proposed by the Trump Administration.

In 2017, we expect history will repeat itself. Corporations and ETFs will continue to drive equity demand while mutual funds, households, and pension funds will remain net sellers of equities.

We lower our 2017 forecast of corporate equity demand by $100 billion, to $700 billion, given our Washington, D.C. economist’s expectation for a delay in corporate tax reform. However, corporations will remain the primary source of US equity demand this year. Our prior forecast assumed a one-time tax on untaxed foreign profits would occur in 2H 2017, resulting in an additional $150 billion of buybacks as firms repatriate overseas cash. However, we now expect corporate tax reform will not occur until in late 2017 or early 2018. Given this delay, we now estimate firms will only repatriate $60 to $70 billion of overseas cash this year and spend $50 billion (around 75%) on share buybacks.

ETF equity purchases will equal $200 billion given continued investor preference for passive vs. active management. Total inflows into equity ETFs equal $66 billion YTD vs. $23 billion of outflows from equity mutual funds. ETF ownership of the corporate equity market is at an all-time high (5%) while mutual fund ownership (24%) is at its lowest level since 1Q 2004.

We expect mutual funds will remain net sellers of equities ($50 billion) given investor outflows and low liquidity. Mutual fund liquid assets as share of total assets are near historical lows (3% as of Jan 2017). However, higher dispersion and improved fund returns YTD suggest that mutual fund demand in 2017 (-$50 billion) will be higher than in 2016 (-$117 billion).

Pension funds will sell $175 billion of equities during 2017 alongside rising interest rates. We expect the 10-year US Treasury yield will equal 3% by year-end. Households will be net sellers of equities due to the surge in share repurchases. Given our forecast of $700 billion of net buybacks, we expect that Households will be the key sellers to companies ($300 billion).

The US will tighten further this year and we’ll see ebbs and flows around that. China will slow in H2 a little too and, coupled with simple lowest marginal cost dirt dynamics, commodities will come off too. So I see current action as largely tactical and there are no changes to our allocations:

- buy the dips in S&P500 and the USD;

- buy the dips in selected European stocks;

- sell rallies in AUD and commodities;

- buy the dips in short end Aussie bonds;

- buy the dips in gold;

- sell property!