From UBS:

Is the recent retracement in iron ore bearish for the AUD? No, though further falls would be worrisome.

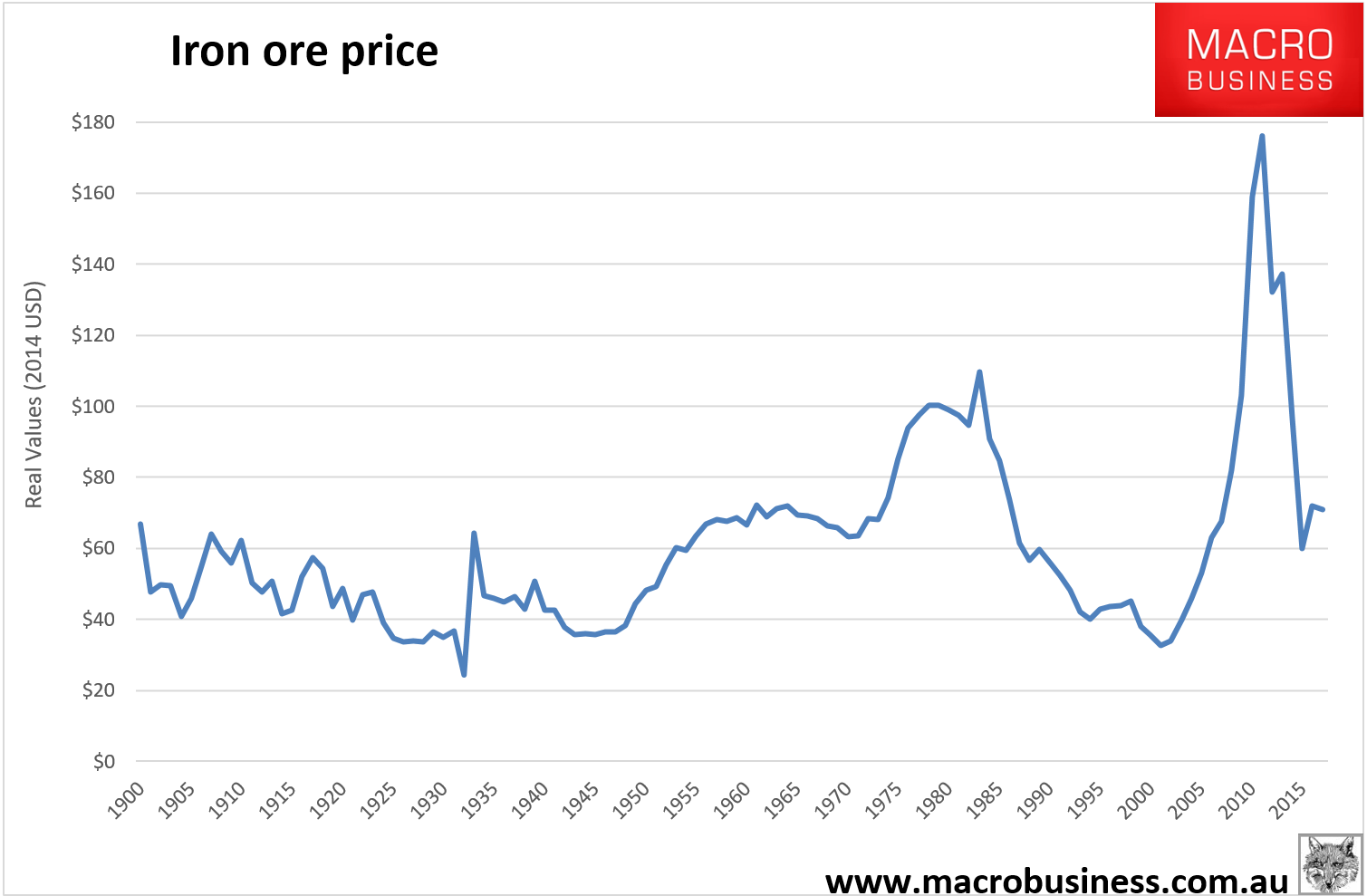

- While market woes over a slowdown in China growth appear to have receded somewhat over the past month, iron ore remains fairly depressed at ~$56/t vs. $86/t in Q1-17.

- However, few believed that iron ore prices >$80/t would be sustained for a prolonged period, and we would argue that such levels were far from being priced into the currency.

- In fact, we estimate that our year-end AUD/USD forecast from a flow perspective is consistent with an average 2017 iron ore price of $65/t, which would be realised at steady spot prices around current levels until year-end.

- Our commodity analysts expect iron ore prices to average $71/t in 2017 – which should facilitate a record-high trade surplus, over time supporting AUD – and end the year at $60/t.

- … some speculation that the RBA’s next move on rates will be lower … ultimately the gradually improving inflation story should dictate its path

- Inflation has likely bottomed

- Signs wages are due to pick up as well

- A sustained turnaround in wages is a likely precondition ahead of any hawkish shift from the RBA.

- We are modestly bullish the AUD based on its beta to global growth, and our view that the RBA is done easing.

- We expect commodity related FX inflows to provide support for AUD.

- Previous episodes of trade surpluses saw commodity prices trump rate differentials as a driver of the FX.

Back in the real world, iron ore has not bottomed let alone staying in the high airs of $6o-70. It’s only a question of when not if it goes to new lows: