The banking system is broken, propped up by every day taxpayers for the benefit of a few, mainly in the FIRE sector. Mortgage loans are the cancer that’s eaten away whatever financial stability Australia had previously. Our own politicians might smell that something is rotten with MegaBank, but how many realise that their careers and future taxes will pay for the bonuses and excesses of the Banksters once the system needs rescuing?

A broken banking system needs fixing but is it by wholesale replacement or strategic repairs? Whilst there is no doubt in my mind that MegaBank needs reform, there are perhaps changes that can be made under current oversight that would force the whole system to reform itself. The key is how banks calculate and fund core Tier 1 capital (ie ordinary shares).

Tier 1 capital is important because banks can’t create it, they must raise it from external sources. As we all should know by now banks create money when they lend or out of nothing. Whilst personally I did not think it necessary, there is a scientific paper on the issue that proves this point. Tier 1 capital cannot be manufactured by banks like their lending creates money.

Just think of a simple system that has one bank (MegaBank). MegaBank lends $100 on a mortgage to A who buys a house for $100 from B. B deposits the funds with Megabank. Under the above mentioned paper, money is created out of nothing. However, they’ve left out the next step. Megabank must raise Tier 1 capital as well as a “protection” against loss. For MegaBank today that’s an especially small amount of about $2 on the $100 loan. MegaBank issues shares to Z super fund for the $2. Z withdraws $2 from MegaBank to subscribe for shares. So the situation is that Megabank created net funds from debt of $98 ($100 – $2) and raised $2 from shares to fund the $100 loan.

Raising Tier 1 capital is problematic for banks as this can reduce return on Tier 1 equity (ROE). The more Tier 1 capital to be raised on a loan the bigger and more probable reduction in ROE. ROE also drives Bankster’s bonuses. This is the reason that MegaBank repeatedly misrepresents its capital as representing unquestionably strong when any reasonable analysis would tell you they are just average. Although It now appears that our global regulators have woken up that small amounts of Tier 1 capital per loan creates excessive lending and asset bubbles and are changing the rules.

The banking world awaits the finalisation of the now termed Basil IV. The most controversial point outstanding and yet to be agreed is a floor on the discount to the standard method of calculating bank capital requirements or risk weighted assets. The floor is to be imposed on those banks using internal risk based (“IRB”) models. Regulators in Europe and the USA are in some disagreement but it does seem that they’ll settle on a discount floor of 25%. or 30%.

Setting such a floor will have significant implications for MegaBank that now use the IRB method to determine risk weight on assets especially as it effects residential mortgages. Whilst the floor is likely to result in risk weights increasing at the margin and across the board, the failure of Basel IV for the Australian taxpayer is that it does not go far enough in determining appropriate risk weights for residential mortgages on the books of MegaBank.

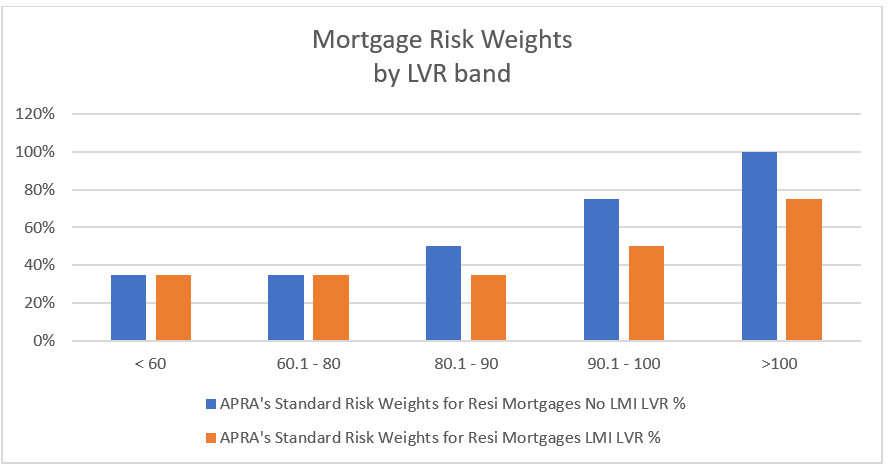

To start with, the standard risk weights for residential mortgages are grossly inadequate and simplistic. The following graphs represent the risk weights on a standard mortgage with and without Lender’s Mortgage Insurance (“LMI”). For the capital requirement the risk weight is multiplied by 8%.

Whilst Basel IV can be applauded for setting a floor on the discount to the standard weights and for increasing the strength of MegaBank and cushioning the financial system against any future requirement for government support it does not go anywhere near far enough in identifying loans that should require even higher risk weights than the standard.

There are aspects of residential mortgages that significantly affect the risk and are not considered by the standard method. The standard method only considers LVR as in the bands above, or defines a non-standard loan as one in which the income of the borrower is not fully verified. There are other factors that should be considered in the risk weight and capital calculations.

To nominate the most important mortgage factors, not formally accounted for in the standard method in determining risk weights; varying periods of interest only, investment loans, new high rise apartments and high risk regions. Even if APRA, behind the scenes, is requiring larger risk weights for these factors that is just not good enough. If Basel IV sets a floor for IRB banks, ie MegaBank, based on a discount to the standard weights then the standard weights must consider all significant factors to guard against gaming.

More controversial though are macro factors and bank specific factors that also should be considered to both protect against system risk and to increase competition for the benefit of consumers. High order systems are created from basic and understandable components but that does not mean you can understand the high order system by just analysing the underlying components.

Understanding the destructive power of a cyclone does not come from analysing water, air and heat. It’s also not possible to understand the mortgage loan market and inherent risk by analysing every dollar lent. External factors brewed with other mortgage factors can create a high order system risk that is destructive and unstoppable like the cyclone. What about the following?

“Size of the Mortgage book relative to household incomes” must be a very important consideration and a clear indicator of systemic risk. Australia appears regularly in the top 3 on this metric with The Netherlands and Denmark. As both these countries have tax deductibility of mortgage interest, on an after tax basis Australia would be a clear winner. The RBA recognises the risk, so where’s the risk weight.

“Concentration in the banking book” is a factor that APRA should consider under Basel II requirements in setting or agreeing risk weights. The concentration of residential mortgages on the books of MegaBank is extreme by international standards as is the size of the book relative to the size of the market. Yet there is no specific weight for this factor imposed by APRA.

“Asset (house) prices” where they are at inflated levels relative to measures such as GDP should be considered in determining risk weights and, therefore, the level of bank capital. Inflated house prices do not necessarily mean that those prices will collapse but it does mean that if prices do drop significantly loses on mortgages will be much greater and therefore represent a greater risk to a bank’s balance sheet.

“Funding from international sources” needs to be identified as a specific risk factor that must be incorporated into risk weights. International sourced loans represent an additional risk to the total Australian banking system from APRA’s liability management regime. If international lenders withdraw funds from the Australian system, this capital flight would only be managed by banks sourcing funds from the Reserve Bank and, therefore, represents a risk to the Australian taxpayer that must be considered when determining risk weights.

So how can the above factors be considered in capital calculations?

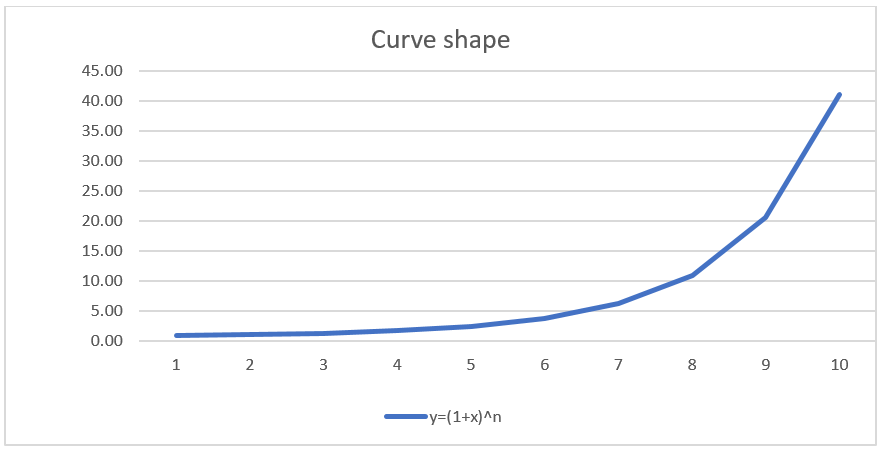

The thing about risk is that combining risks on top of each other doesn’t create a linear probability, rather its exponential. I do like the equation y = (1+x)^n. Applying the right variables and we create the following curve:

That looks to me like the shape of a curve that could represent the risk inherent in the Australian mortgage market as we pile mortgage risks on system risks to greater and greater heights. It, therefore, can be used to determine MegaBank and all bank’s risk weights and Tier 1 capital requirements.

As an example of what’s possible, if we set Y to equal the multiplier to the standard risk weight, X to be sum of the mortgage risks and n to be the sum of the system risks we can perhaps create an algorithm that will provide us with a system and bank protecting negative feedback loop.

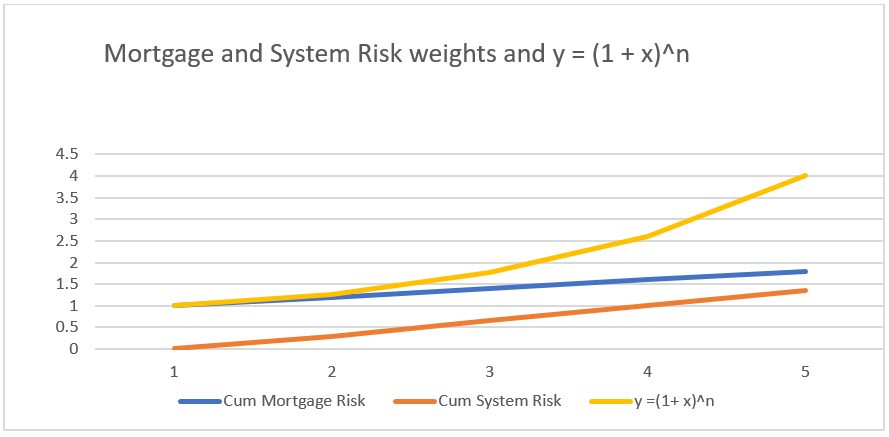

Let’s set the standard at 1 and incremental risk increase of 20% for each of the interest only, investment, high rise and regional risk increases. In addition, we can set the incremental risk increase of 30% for each system risk of the very large size of the mortgage book, concentration of residential mortgages, inflated asset prices and international borrowings. Our algorithm produces the following risk curve.

Logically these risk curves can be dialled up and down and adjusted for additional risks and circumstances.

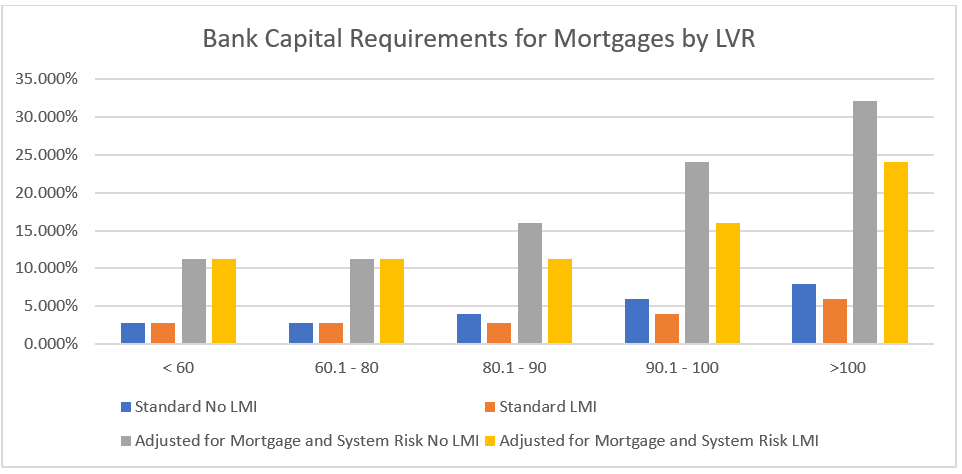

Whilst our algorithm will produce a myriad of combinations, in my example and at the extreme of all mortgage and system risks outlined herein being at play, the following graph represents the adjustments to the standard bank capital requirements.

My example produces very large capital requirements as it should be for such an extreme example of added risk factors. My purpose, however, is to demonstrate that a capital requirement system for residential mortgages that is consistent, detailed and covers all reasonable loan and system risks is easily created. With modern technology a central system could assess every mortgage application and every mortgage loan in Australia with risk assessments specific for every bank and provide an instant risk weight for a mortgage on parameters set by APRA. It could be built for less than 1% of MegaBank’s annual IT budget. That’s a cheap strategic repair to the current system.

The key to controlling the Bankster’s risk taking and gaming of the system is to capture what they are doing before loans are written and capital requirements set relative to the total risk factors both mortgage loan and system factors.

The banking system can’t blow asset bubbles with rising requirements to access Tier 1 capital rather than the theoretical perpetual debt and money bubble machine that currently exists and requires little to no capital for unlimited growth. Until of course the borrowers default.

That’s how you do macroprudential.

At the beginning I alluded that perhaps there was system fix. Unfortunately it’s too late for Australia, we are too far in and are cooked. Next time around hopefully.