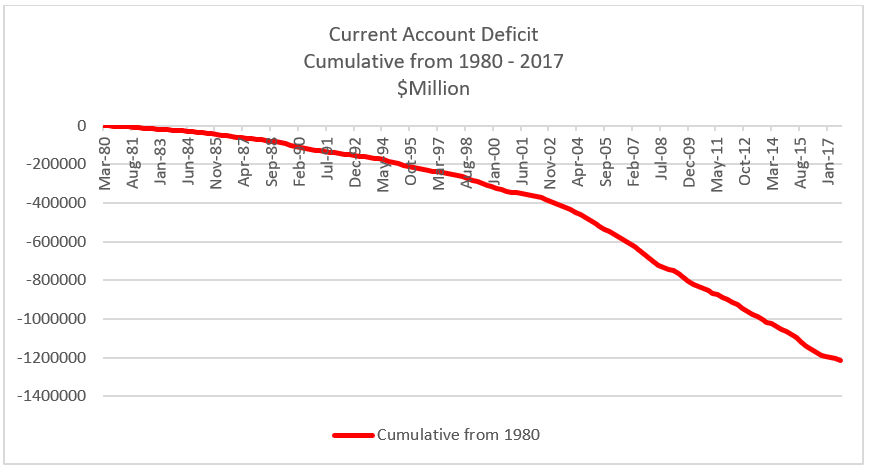

How many of you are aware that Australia has accumulated a total current account deficit of $1.217 Trillion since 1980? From the ABS data base:

With the above in mind, I want to challenge two memes that continue to be perpetuated by many on a daily basis and point to perhaps the largest threat to the Australian financial system. Often why things are the way they are, are misrepresented in order to disguise true reasons and push biased agendas.

Firstly, non-residents buying new Australian housing does not in isolation add to the housing stock that Australian residents need and arguably it misallocates resources and reduces both available and suitable housing for residents.

Secondly, whilst banks use the funds they borrow offshore to lend on residential mortgages, banks do not have to borrow offshore to fill the ever-increasing demand for residential mortgages from Australians. Offshore borrowing funds the current account deficit and the resulting loss of deposits.

It would seem to defy logic to suggest that foreigners buying new high-rise apartments or houses does not add to the housing stock. I define housing stock as housing that is required to house residents. It does not include empty boxes in the sky or vacant suburban homes that are meant to be a store of value for a non-resident that have their own motivations whether legal or not.

The point is that houses or apartments required to house residents can be built and funded entirely within Australia. A loan from an Australian bank to an owner occupier or investor creates its own funds for the mortgage whilst there are more than enough investment funds available in say, superannuation for the bank to fund the capital requirement and therefore the building of all housing if there is demand to live in that housing by owning or renting. Affordable social housing is a government responsibility that again can be funded solely by internal means.

Non-residents buying Australian existing and new housing as a store of wealth or as pure speculation distorts the allocation of Australian resources, drives up house prices and increases unaffordability. Clearly certain sections of Australia – notably the FIRE sector – benefit as do politicians and regulators in the short-term.

But why does Australia hurt the majority of existing residents to the benefit of peoples in other parts of the world? It’s simply one of the mechanisms to fund the current account deficit (CAD) in a way that appears not to lessen the credit risk of the country.

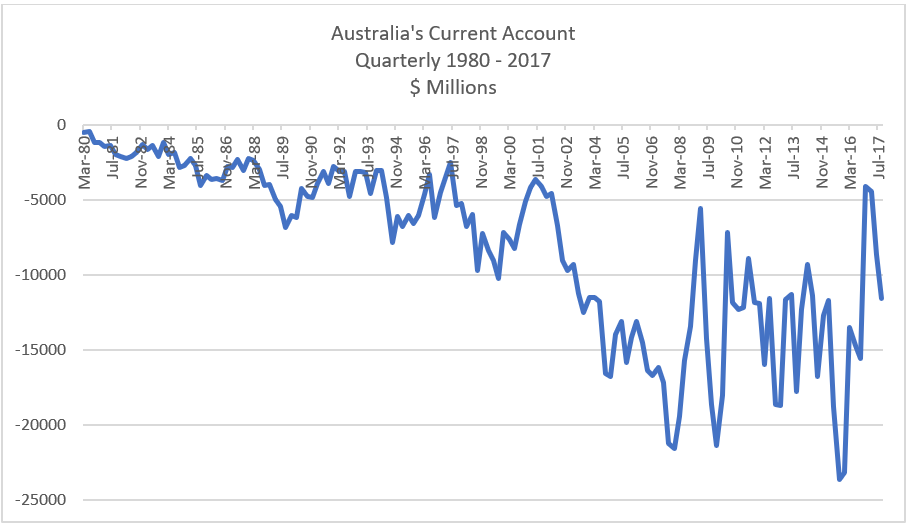

The current account is defined as the “Current Account is the sum of the balance of trade (exports minus imports of goods and services), net factor income (such as interest and dividends) and net transfer payments (such as foreign aid).” The current account is our monetary balance (excluding “capital and financial account”) with the rest of the world and Australia has been raking up a current account deficit (CAD) since 1980 as follows from the ABS:

To repeat, an accumulated CAD of $1.217 Trillion since 1980!

To ensure that the Australian money supply is not decreased the CAD must be funded by Australia selling assets or borrowing offshore. The RBA could have printed/lent money to the government to spend to cover the monetary shortfall but that’s a controversial alternative.

Allowing non-residents to invest in new Australian housing is a very poor way to plug the hole in funding the CAD. Unnecessary, distorting and highly risky. What happens when these same non-residents sell en masse? A run on housing rather than a run on the banks?

There are better and less risky means to fund the CAD than selling real estate to foreigners, we just need to put some thought into it.

This provides a nice Segway into the second meme on banks borrowing offshore to meet mortgage funding requirements. I repeat, Australia can fund all its mortgage and housing requirements within Australia. However, Australia has built an international deficit (cumulative CAD deficit funded by debt) of close to $1 Trillion that must be serviced and, one can only speculate, repaid at some point.

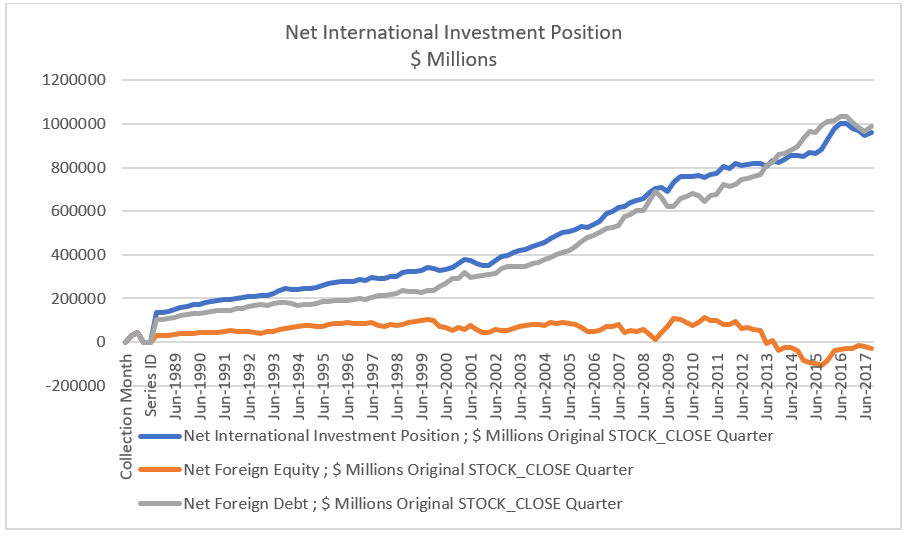

The ABS quaintly refers to this debt as part of the “International Investment Position (IIP)” that is described as follows: “Australia’s net IIP liability position was $958.8b at 30 September 2017, an increase of $13.2b (1%) on the revised 30 June 2017 position of $945.7b. Australia’s net foreign debt liability increased $26.0b (3%) to $989.7b. Australia’s net foreign equity asset increased $12.8b (71%) to $30.8b at 30 September 2017.”

Historically, the balance is as follows from the ABS (series only starts in 1988):

So, Australia has a cumulative CAD of around $1.2 Trillion funded mostly by net debt of close to $1 Trillion, the balance being net asset sales.

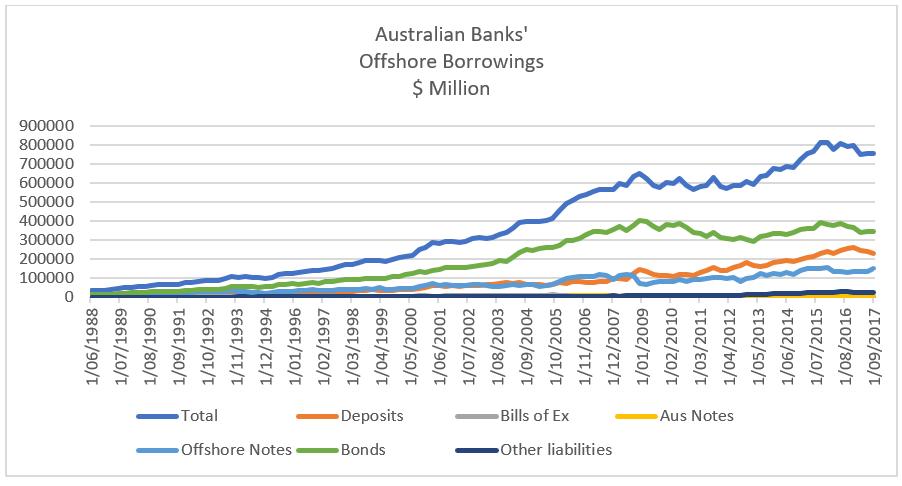

The net foreign debt is funded via international holders of government debt or through private debt, but mostly through Australian Banks’ offshore borrowings. The ABS notes the growth in those borrowings to a total of over $750 Billion:

The Banks may inject the offshore borrowings into the housing market, but it’s to fund the ongoing CAD and not because there is a need for offshore borrowings to fund excess mortgage demand.

If the accumulated CAD is not funded by offshore borrowings or asset sales, it sucks funds out of the banking system which is a form of deleveraging, through a reduction of deposits and therefore the amount of funds available to lend. Whilst that deleveraging would mostly occur in mortgage markets, that’s as a consequence and not actually banks borrowing to directly fund mortgages. Rather it represents borrowing to plug the whole in the mortgage funding markets caused by deposits being used to fund the CAD.

Offshore borrowing to fund the CAD, not offshore borrowing to directly fund mortgages may seem like a moot point but it isn’t. It’s very important. I’m arguing that as a nation we’ve used the easiest route to live large off the back of international benefactors, but this has led us down the path of an unstoppable debt feedback loop and subsequent bust.

Australian governments and policy makers have purposely chosen for Australia to run continual CADs to fund life styles. If we/they had chosen to structure a system where Australia had a minimal to zero cumulative CAD, Australia would have little offshore debt and be much more in control of the $A through the trading and capital account. The consequences for wealth and lifestyle may be problematic but if we wanted to improve both we would have had to work for it and not borrow it. We would have needed to be much more innovative in creating and selling our goods offshore to buy the TVs, Iphones, SUVs and whatever fills Bunnings and every department store that we all enjoy now, rather than rack up debt.

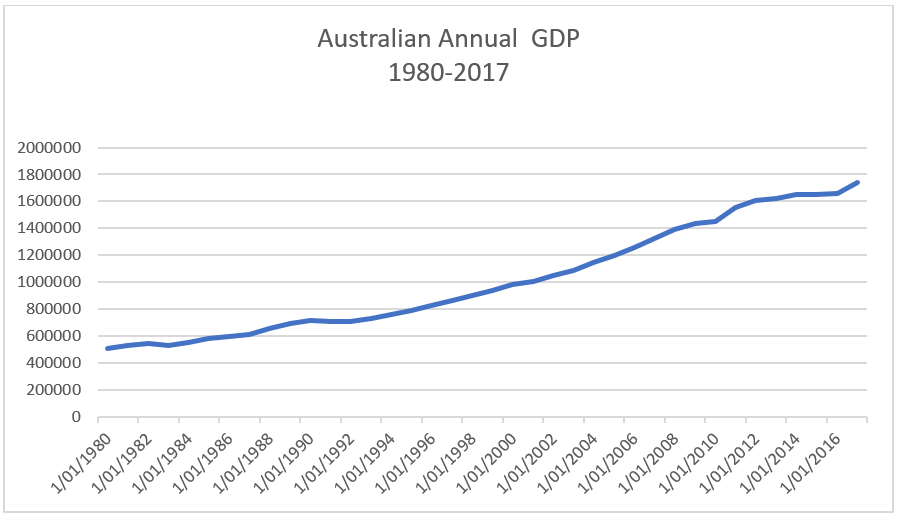

But our GDP numbers look great as borrowed and spent money pumps GDP. The following, from the ABS, are our GDP numbers since 1980:

Unsurprisingly, as the data shows, Australia’s increase in GDP since 1980 is $1.2 Trillion, equal to the cumulative CAD with the CAD being funded by $1 Trillion of offshore borrowings mostly through the banking sector ($750 Billion).

What many in hindsight may find difficult to understand is why in the history of the world would other countries lend to a small 3rd world economy like Australia, to fund its population a 1st world life style, and presumably, not expect to be repaid? For a population of around $25 million, to have $1 Trillion of offshore debt with very little productive industry (except selling rocks) is remarkable.

The question must become do we ever have to pay the debt back and if yes how? The problem we have is that the debt funded consumption and asset/house trading are not real productive assets.

So, firstly, we are not creating offshore income producing assets to repay debt.

Secondly, the distribution of wealth or the benefits of the borrowing are distributed inequitably among the population and the generations.

The debt is on the external account and growing. Australia cannot do anything to diminish the size of existing debt either in $A or a foreign currency. It’s owed and if our benefactors come calling then we must pony up under their rules. How?

The Banks could simply be forced to repay offshore debt and decrease deposits and therefore deleverage. If even 20% or $200Bn of the debt is repaid what do we think that will do to the economy and house prices?

We could print or use the modern version of printing – aka Quantitative Easing (QE) – but this in itself could cause capital flight and destruction of the value of the $A severely exacerbating capital flight. But it would work as a debt reduction for future generations even if scorching those that benefitted over the last 35 years. The RBA has set up Australian Banks to be able to pull the trigger on Aussie QE at any time.

You could argue that our offshore benefactors, expected Australia, at some future point, to sell so many rocks and apartments to overseas buyers and or severely decrease our offshore purchase of goods that it would produce an external account excess and pay down the “net foreign debt”. Seriously, don’t laugh, its possible that back in the day the benefactors believed this delusion and perhaps do even now.

Or perhaps, something else is a foot. Once the Banks took on the role of funding the majority of the accumulated CAD some 20 years ago, pressure was eased on the federal government’s balance sheet but it mounted onto the Banks. The Banks’ reaction was to greatly expand its asset base into what they thought were the lowest risk assets possible in order to placate those offshore benefactors/lenders that the risk it was incurring was low. That is, residential mortgages.

So rather than run federal government deficits by increasing government spending that ultimately turns into bank deposits funded through offshore government borrowing, Australia chose the magic of increasing deposits by increasing credit to residential mortgages through the Banks using offshore borrowings to plug the CAD hole. As traditional economics ignores the effect of private debt, its both a bizarre and cunning plan.

On a simplistic basis, this does appear to be the same thing – i.e. a large portion of the tax paying population of Australia is still responsible for repaying the offshore debt, either through tax payments to governments or their mortgage payments. Unfortunately, the different methods produce strikingly different results. Over time, one method is a controlling negative feedback loop whilst the other creates a positive feedback loop with negative consequences.

Running continual federal government deficits to spend is transparent but against the austerity doctrine and would surely have forced the credit rating agencies to strip Australia of its AAA, or never get there in the first place. As the twin debt and deficit grows to fund the cumulative CAD, the poor effect kicks in and this negative feedback loop effectively forces governments to adopt policies to curb debt and offshore spending growth and even go into reverse. Although, this method of funding the CAD does have the benefit that a wise government could more equitably distribute its deficit spending – i.e. offshore borrowings – to the benefit of most working Australians.

The antithesis of that process is borrowing through banks and “low risk” residential mortgages where the ever-increasing debt to plug the CAD creates a wealth effect through house price increases, strong bank balance sheets and low funding costs creating a positive feedback loop that has severe negative consequences as it compounds on itself turning “low risk” mortgages into high risk time bombs and transferring responsibility for too much debt onto younger generations or speculators. Or to put it another way, we need to continue to borrow to fund the CAD because that props up the housing market which is backing Australia’s external liabilities. There is no solution to this where there is not a lot of pain. there is not even a will to have a solution to this calamitous feedback loop. It’ll run until it breaks.

One problem, two seemingly similar methods for dealing with it, but two very different outcomes.

However, we shouldn’t forget that Australian Dollars exist to repay the debt and therefore there are means by which the situation could be mitigated by transferring from the haves to the have nots and then to repay debt. Though I can’t imagine how this could occur by government initiative prior to a crisis.

I doubt that any politician in the country understands this dynamic and I have never met a financial regulator or banker that does either. They all believe in the delusions of the wealth effect and “low risk” lending. But you only need to understand that borrowing to fund the CAD using mortgages as security is just one delusional way to fund the CAD. That’s a strategy that can’t last no matter what the powers that be throw at it.