The Australian’s Adam Creighton has done a great job today outlining the risks inherent in Australia’s $1 trillion of net foreign debt, which has left Australia deeply exposed to a sudden lift in global interest rates:

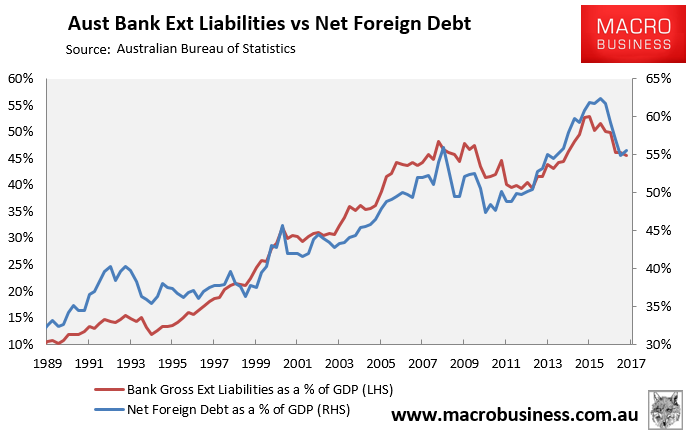

Indeed, few countries should be as worried about the prospect of sharply higher global interest rates as Australia… Not many nations have accumulated $990 billion in net foreign debt like we have, equivalent to about 56 per cent of GDP, up from 8 per cent in 1995.

While many other countries’ national debt levels are far higher, few have sourced so much of theirs from foreigners. The Japanese government, the world’s most indebted, is the classic case, having borrowed almost entirely from its own citizens. Unlike Japan, Australia’s governments can’t tax foreigners more if they refuse to roll over the loans.

…a sustained rise in interest rates could be the sledgehammer that derails Australia’s Goldilocks economy. Household spending — the biggest part of economic activity, already labouring under sluggish wage growth — would suffer if mortgage repayments began to climb…

Australia’s total foreign debt, totting up those of government, households and business, totalled just under $1 trillion last year. That’s a higher ratio than Argentina or Mexico, reflecting foreigners’ confidence in the Australian economy and our ability to repay our debts.

The current level of foreign debt is roughly twice the proportion of GDP it was in the late 1980s, when serious people, including then treasurer Paul Keating, worried it was too high.

Keating oversaw politically painful budget surpluses for three years to try to curb our debt dependence. We haven’t had any of those for a while.

Too much foreign debt, the argument went, risked a financial and economic crisis if foreigners, for whatever reason — spooked, say, by a collapse in the price of Australia’s commodity exports — decided Australia hadn’t the economic capacity to repay.

“If it weren’t for the level of foreign debt, interest rates in this country would be much lower,” John Howard said in the 1996 election campaign he would go on to win…

According to calculations by respected economist Saul Eslake, the implied net interest rate on Australia’s current foreign debt mountain was just under 2.3 per cent last year.

About a decade ago, when foreign debt was $535bn, it was closer to 5 per cent.

Back-of-the-envelope calculations suggest a return to 5 per cent would cost more than $20bn a year in extra interest payments, money that could have gone on new cars, smartphones or kitchen renovations. Australian households are the main culprit in the foreign debt bubble, having a total credit-to-GDP ratio of 122 per cent, putting us at the top of the world rankings with the Swiss…

Warwick McKibbin, one of the country’s top macro-economists, believes rising global rates would filter through to suburban mortgage payments.

“Everything else taken as given, a change in the US long-term bond rate will eventually feed into borrowing rates here,” he told The Australian yesterday.

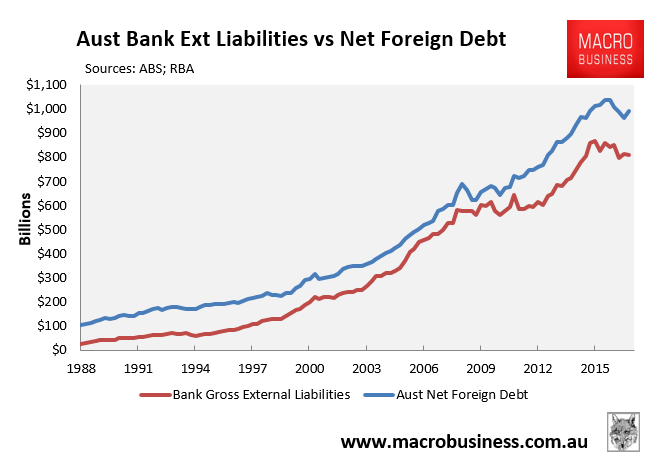

Australia’s extreme net foreign debt (NFD), which has been channeled through the banking system via mortgages (see below charts), is something that MB has warned about since its inception.

In fact, we recently consulted extensively to Dick Smith Fair Go’s (DSFG) latest report, entitled “Australia’s Debt: an Honest Debate”:, which covers the same issues mentioned by Creighton:

Australia’s bigger problem is private debt…

When it comes to household debt – which includes people’s mortgages, credit cards, overdrafts, and personal loans – Australian households are the second most indebted in the world (after Switzerland) when measured against the size of the economy, or Gross Domestic Product (GDP)…

Most of Australia’s $1 trillion dollars in net foreign debt has been borrowed through the banking system and used to increase home lending.

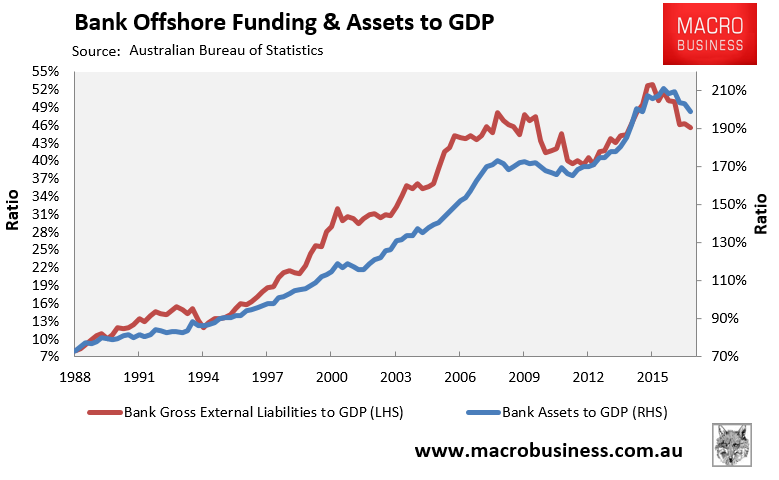

As at June 2017, the banking sector had borrowed some $850 billion from offshore, equating to 49% of Australia’s GDP.

Australia’s banks would never have experienced anywhere near the same degree of asset (loan) growth without this tapping of offshore funding markets. Accordingly, the total value of Australian home loan debt would never have grown so strongly, and Australian house prices would be materially lower as a result.

Australia’s banking system is also now so large that it is considered ‘too-big-to-fail’ by the ratings agencies, which means that the federal government (read taxpayers) would be required to bail the banks out in the event that there was a banking crisis. Accordingly, the major banks’ credit ratings are now inextricably linked to Australia’s sovereign AAA credit-rating.

The higher the rating, the safer bet you’re seen to be by lenders who will be willing to extend larger amounts at a cheaper rate of interest.

The key risk is that the banking system’s ability to continue borrowing from offshore rests with foreigners’ willingness to continue extending credit to them. This willingness will be tested in the event that Australia’s AAA sovereign credit rating is downgraded (automatically downgrading the banks’ credit ratings), if there is another global shock, or a sharp deterioration in the Australian economy (raising Australia’s riskiness as a borrower).

While Australia’s government debt is currently low, the Federal Budget is hostage to the banks’ offshore borrowing excess as it cannot borrow to spend on infrastructure or other initiatives for fear that Australia will lose its AAA credit rating, automatically downgrading the banks’ credit ratings and causing an unravelling of the private debt bubble created by the banks.

Indeed, credit ratings agency, Moody’s, last year noted that “A key issue for the Australian sovereign and the country’s banking sector is their reliance on overseas funding… This means a relatively greater vulnerability to ‘event risk’ than most other AAA – rated sovereigns”.

In a similar vein, the Murray Financial System Inquiry warned that “Australia’s banking system is highly concentrated, with the four major banks using broadly similar business models and having large offshore funding exposures… Australia is susceptible to the dislocation of international funding markets or a sudden change in international sentiment towards Australia, which would reduce access to, and increase the cost of, foreign funding [and] a severe disruption via one of these channels would have broad economic and financial consequences for Australia”.

Domestically, the build -up in private debt has been sustainable while interest rates have been at record lows.

However, loans run for 25 to 30 years. Anyone who thinks rates will stay at record lows for that length of time has their head in the sand.

There are plenty of people who’ve bought into the frenzy, borrowed to the hilt, and given themselves little room to move in the event of a rise in interest rates…

Higher loan costs would lead to less spending, which would affect employment rates, hit the government’s budget, and plunge us into a recession.

Australia’s huge external vulnerability via the build-up in non-productive private (mostly housing) debt is a ticking time bomb for the nation.

unconventionaleconomist@hotmail.com