The Australian dollar was battered to 2018 closing lows Friday night:

It still has room to fall before violating the uptrend in the mid-75 cent range, though I think it will break it this year.

In fact, the Aussie was crushed on the crosses too. Against DMs:

And EMs:

Sentiment appears to be breaking down. CFTC net positioning turned negative last week, at -0.8k contracts:

But there’s a lot more room to get bearish there.

The proximate triggers for the Friday weakening were a firming USD on solid data and plunging yield spreads which are all verging on new lows versus the USD:

That said, the spreads remain historically wider than the currency price differential:

Held that way by the strong terms of trade. But as iron ore, coking coal and LNG all break down, expect the two lines to converge as the yield spread keeps falling but the currency falls even faster.

FYI, MB has launched a new Australian dollar forecast index which will be updated regularly to keep you abreast of market outlooks. See it here.

———————————————————–

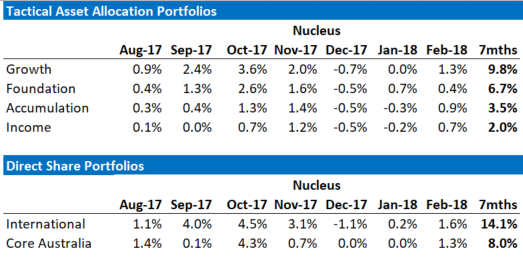

David Llewellyn-Smith is chief strategist at the MB Fund which is currently overweight international equities that will benefit from a weaker AUD so he definitely talking his book. Fund performance is below:

If these themes interest you then contact us below.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.