Recall that one of MB’s favoured allocations has been dollar-exposed industrials. This has included CSL which today pumped out a massive profit upgrade:

We’ve been on this runaway freight train since 2012, up around 600%:

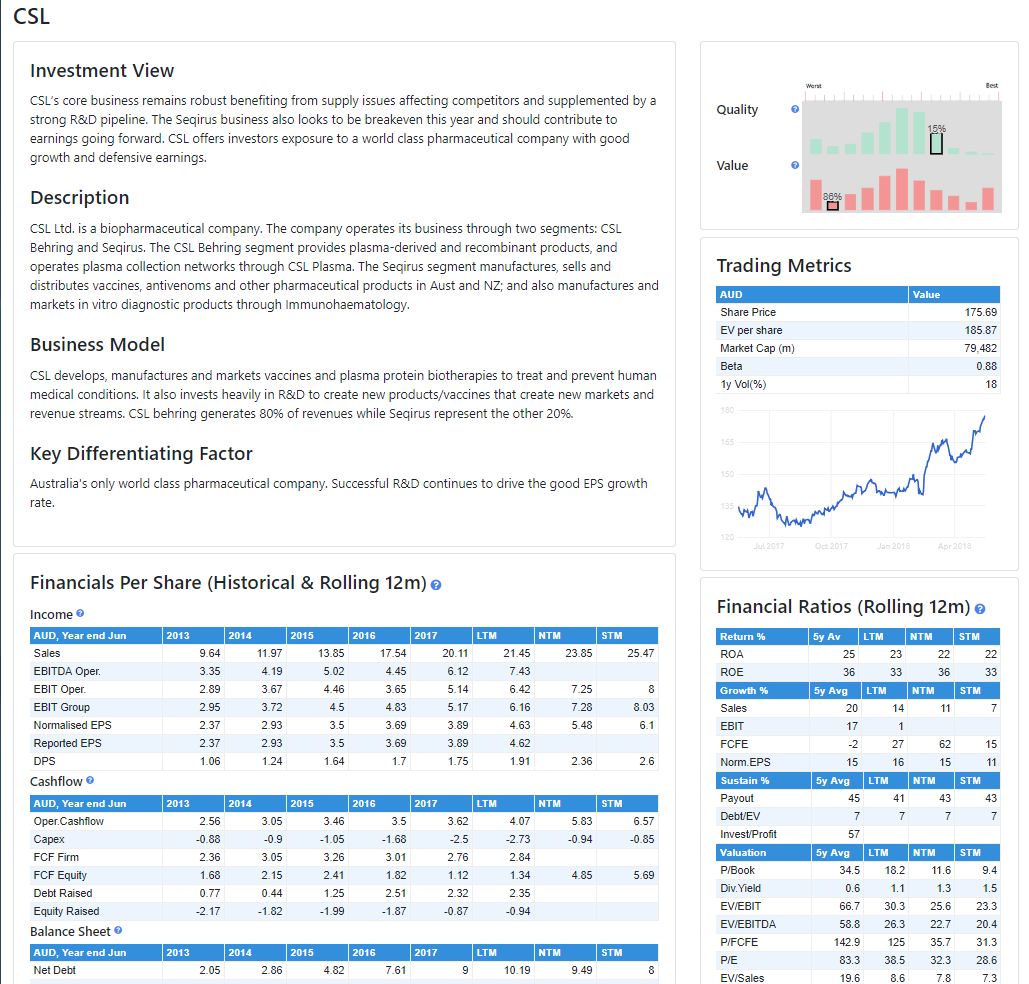

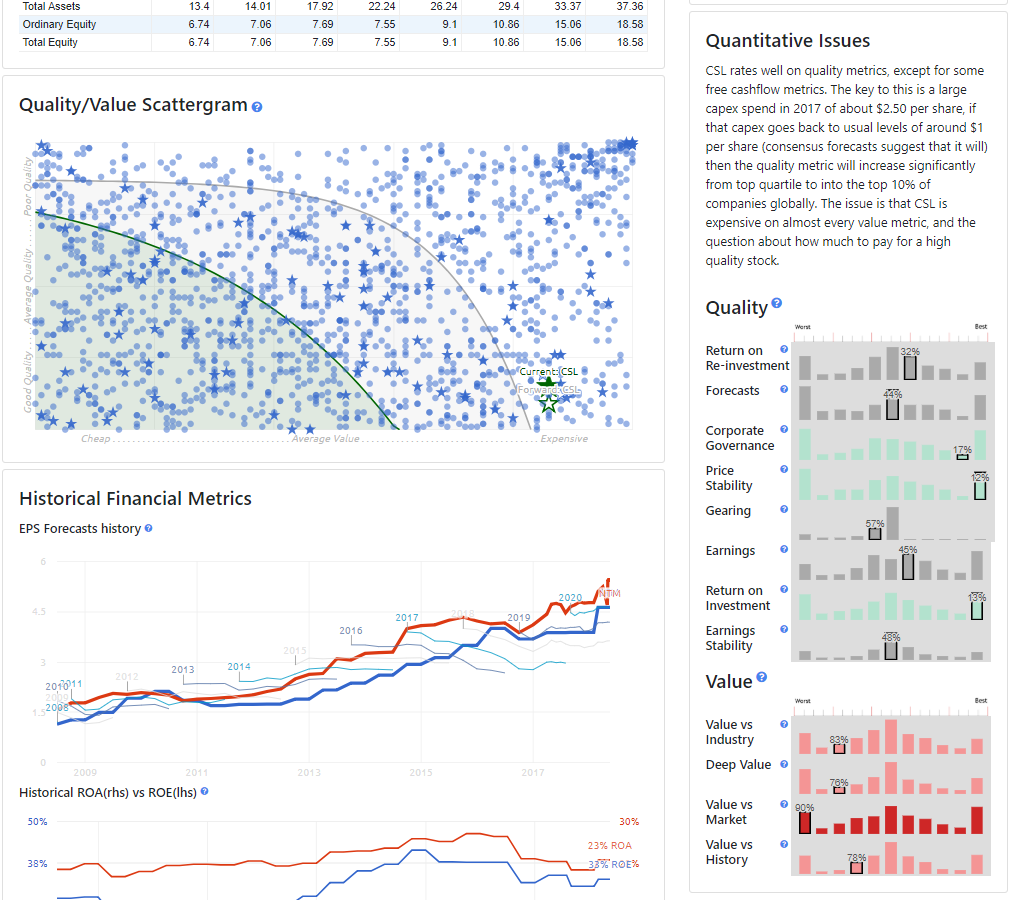

It is a big holding in the MB Fund because it fits our quality/macro allocations model. Following is a snapshot of the next phase of the MB Fund portal that will provide instant access to the background research on every stock that we hold in your fund:

So, why am I telling to you sell it? Well, I’m not, in truth. I don’t provide advice! What I am hinting at is that we have been lightening up on CSL in recent times for the following reason, also from the MB fund research note:

CSL is now wildly expensive and so has pushed outside the value metrics of our matrix.

Now, we’re not exiting the stock. It’s a keeper given our view of the Aussie dollar going much lower. As well, we’re forced to hold 15% Aussie equities for risk balance and we can’t find anything else worth bloody buying!

But all good things come to an end and taking profits on wildly stretched value is always a good idea.

———————————————–

David Llewellyn-Smith is the chief strategist at the MB Fund which offers two options to benefit from a falling AUD so he is definitely talking his book. The first option is to use the MB Fund International Stocks Portfolio which is always 100% long as a part of your own asset allocation mix. The second option is to use an MB Fund tactical allocation in which we choose the asset mix for you, including exclusively international stocks, but with bonds and other assets as well to ensure a more conservative mix.

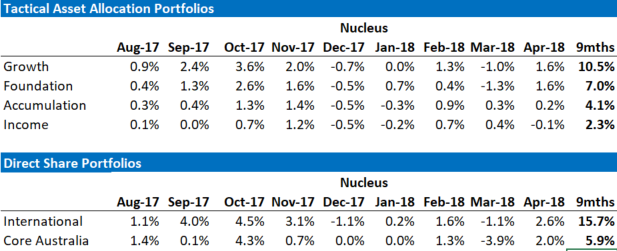

The recent performance of both is below:

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.