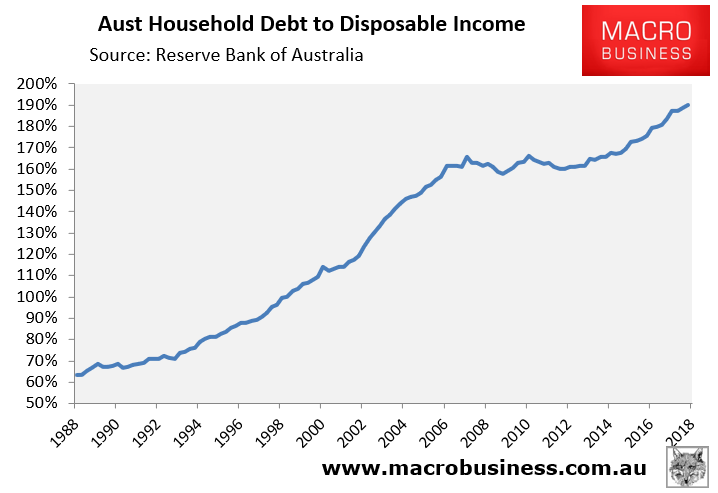

The Reserve Bank of Australia (RBA) has released its debt ratios for the March quarter, which revealed that Australian households’ debt loads have hit another all-time high.

The ratio of household debt to disposable income hit 190.1% in March:

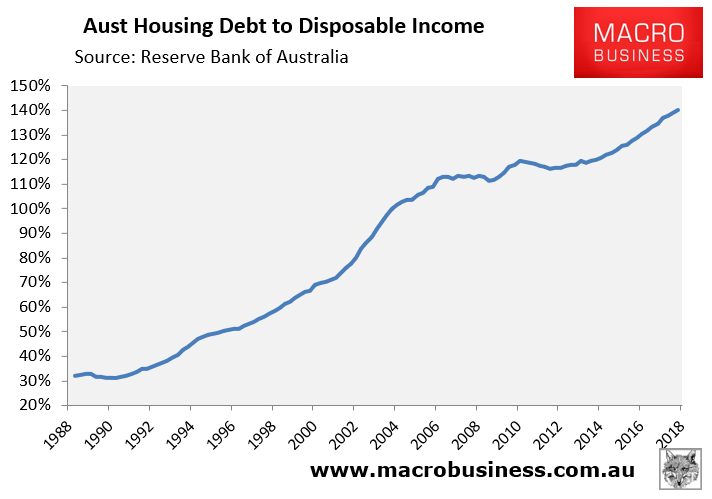

As expected, this increase has been driven by surging mortgage debt, where the ratio hit a record 140.1% of disposable income:

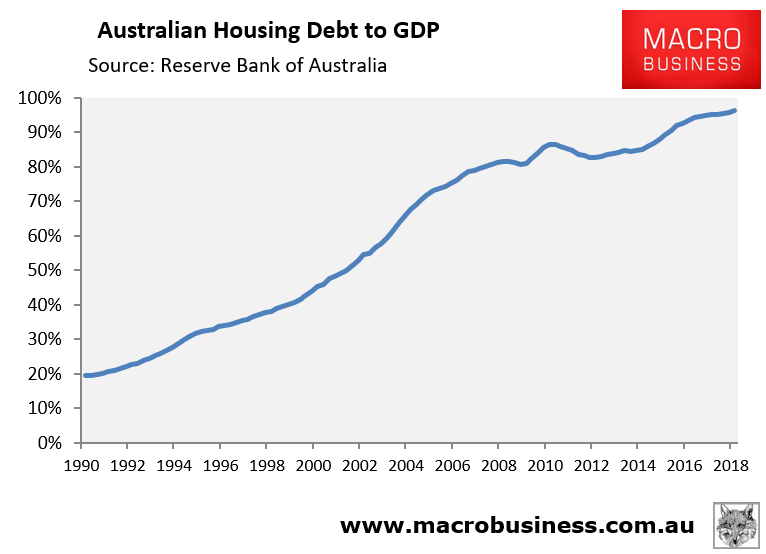

Mortgage debt also hit a record high 96.2% of GDP in the March quarter:

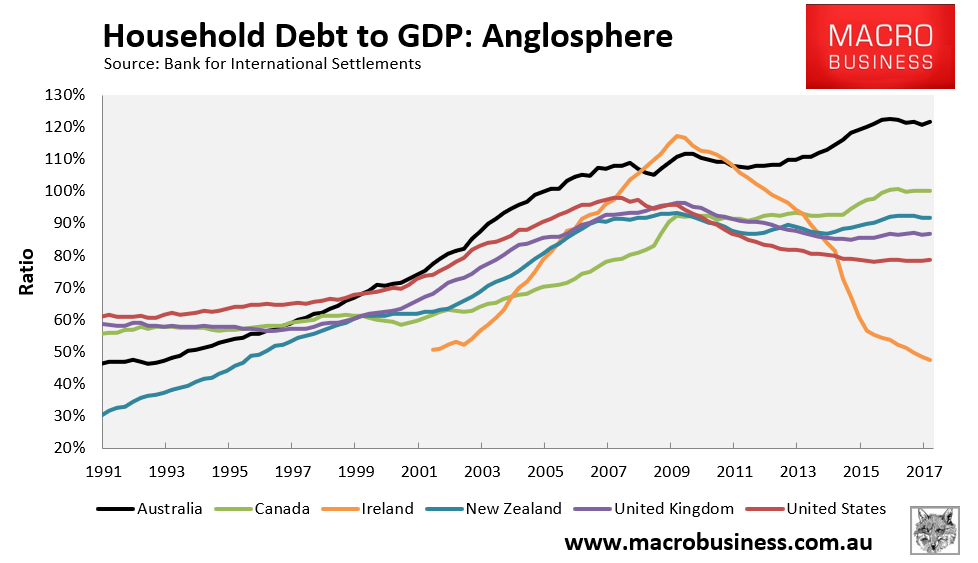

Whereas Australia’s household debt-to-GDP is the second highest in the world (behind Switzerland) and way above the other Anglosphere nations, according to the Bank for International Settlements:

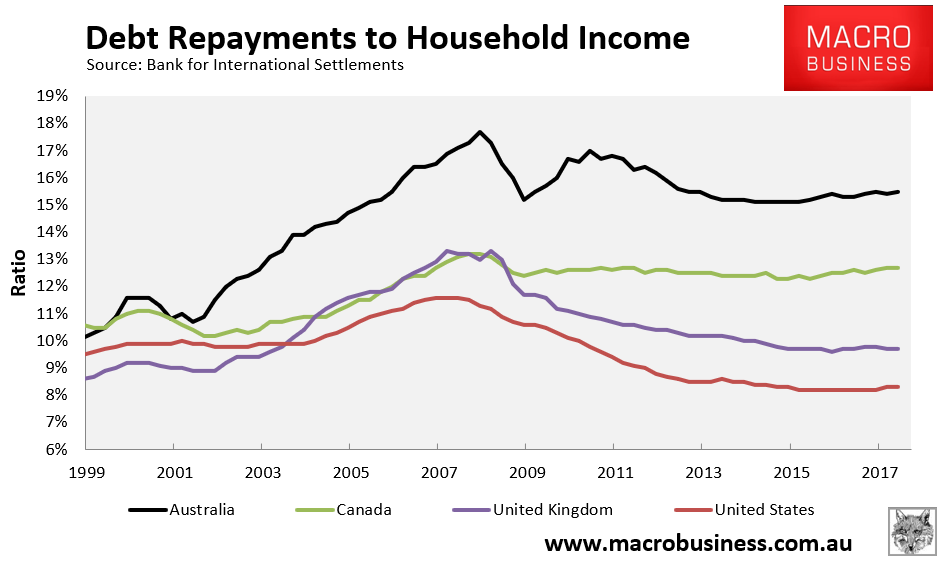

The only saving grace is that the recent cratering of mortgage rates means that the ratio of debt repayments to income is below the 2008 peak, albeit way above the other Anglosphere nations:

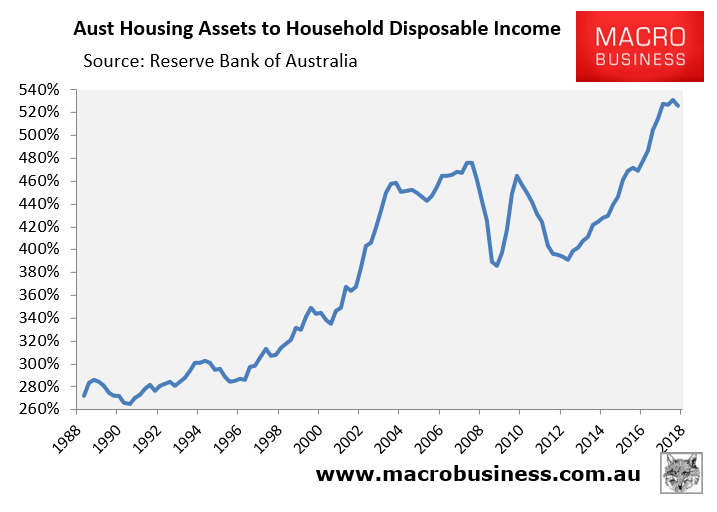

The primary reason why mortgage repayments remain so high, despite cratering mortgage rates, is because Australian housing values have ballooned to 526% of annual household disposable incomes – almost double early-1990s levels:

The data confirms that Australia is at the very top of most indebted households in the world with a housing bubble to match.