The Australian dollar’s top forecaster has a warning: the worst is yet to come.

Investors should short the Aussie versus the yen as increasing global-trade tensions weigh on the nation’s exports, according to CIMB Bank Bhd. The currency is also poised to decline versus the U.S. dollar, says CIMB, which had the most accurate estimates for the Aussie in Bloomberg’s second-quarter rankings.

“On all fronts, the U.S.-China trade war is Aussie-negative,” said Marcus Wong, a treasury strategist at CIMB in Singapore. “Retaliatory action that inadvertently impacts the upstream or downstream of China’s value chain, or leads to a keen deterioration in global risk sentiment, would see a further deterioration in the Aussie.”

Makes sense to me!

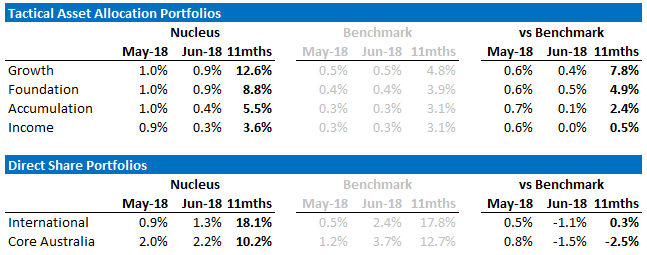

David Llewellyn-Smith is chief strategist at the MB Fund which is long US equities that will benefit from a falling Australian dollar so he is definitely talking his book. Below is the performance of the MB Fund since inception:

If the ideas above interest you then contact us below.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.