Via Domainfax:

Australia’s version of the sub-prime crisis that ushered in the global financial crisis could be looming, with a significant number of the 1.5 million households with interest-only loans likely to struggle with higher repayments, experts warn.

Martin North, the principal at consultancy Digital Finance Analytics, said interest-only loans account for about $700 billion of the $1.7 trillion in Australian mortgage lending and it was “our version of the GFC”.

“My view is we’re in somewhat similar territory to where the US was in 2006 before the GFC,” Mr North said.

Craig Morgan, managing director of Independent Mortgage Planners, said one in five people who took a loan two or three years ago would not qualify for the same loan now, because of the crackdown on lending by the regulator and ongoing fallout from the Royal Commission into financial services.

“In the last six months lenders have had this lightbulb moment of what ‘responsible lending’ means,” Mr Morgan said.

One of the triggers for the GFC was rising defaults from over-leveraged borrowers who were unable to refinance when their honeymoon rates ended. However, the sub-prime lending in the United States before the GFC included large mortgages being given to people without jobs or on minimum wage.

“This is absolutely not ‘sub-prime’ in the US definition but there were people [in Australia] who were being encouraged to get very big loans on the fact that principal & interest was impossible to service but they could service interest-only,” Mr North said.

More panic at The Project:

The interest-only reset is as opaque as it is large. There is still confusion about how much the back book and front book of the banks can absorb the reset. Banks can only issue 30% of new loans as interest-only now. That’s roughly $40 billion per quarter, which would mean that the reset would reflect the banks’ entire front book IO capacity as folks refinance.

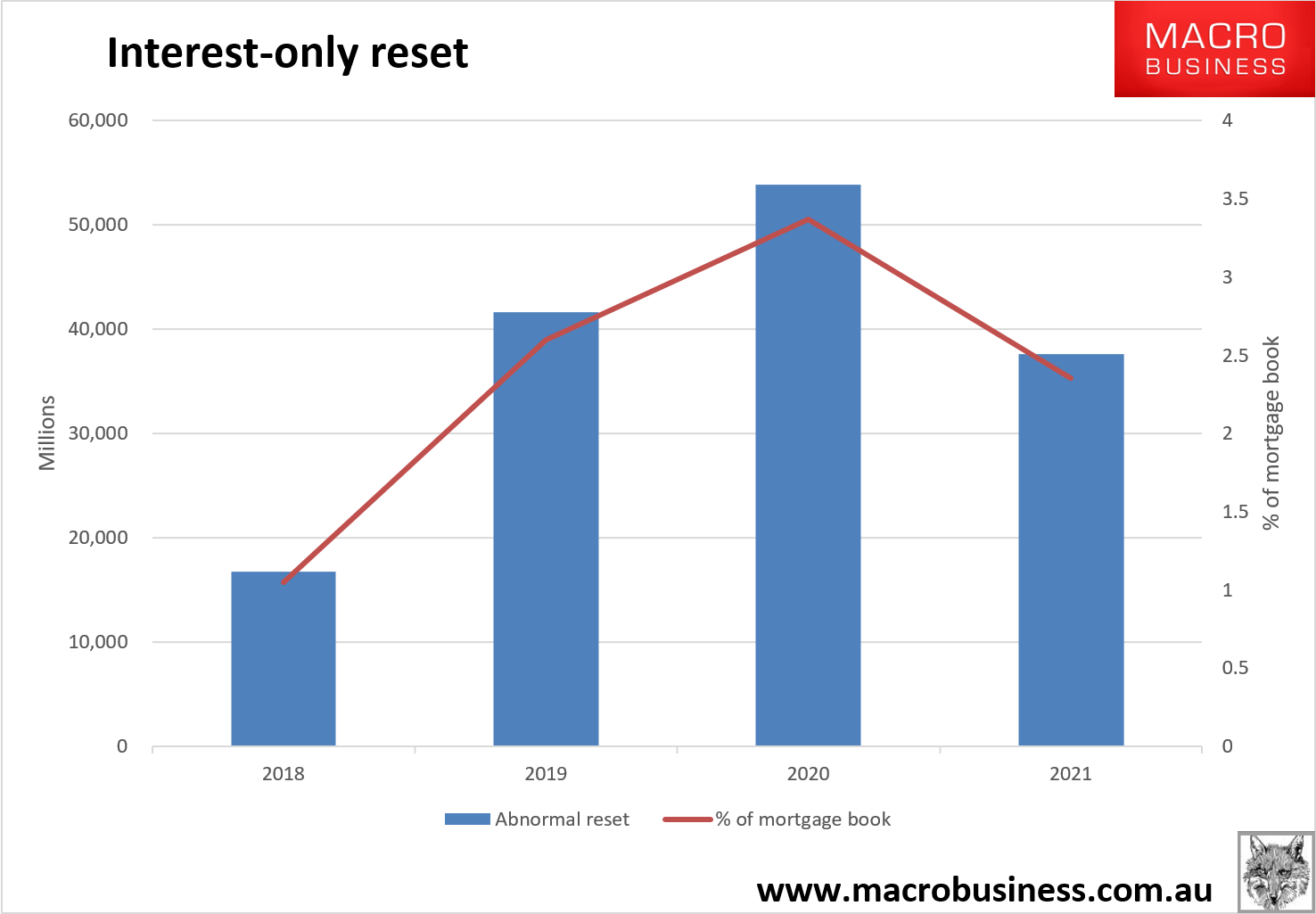

Therefore, some large portion will have to transpire in the back book. Our best guess how much that will be is based upon the history of what the banks have managed previously, We’ve guessed they will be able to manage some $25 billion per quarter in the back book as the great reset builds. That means we’ll see the following total resets to principle and interest:

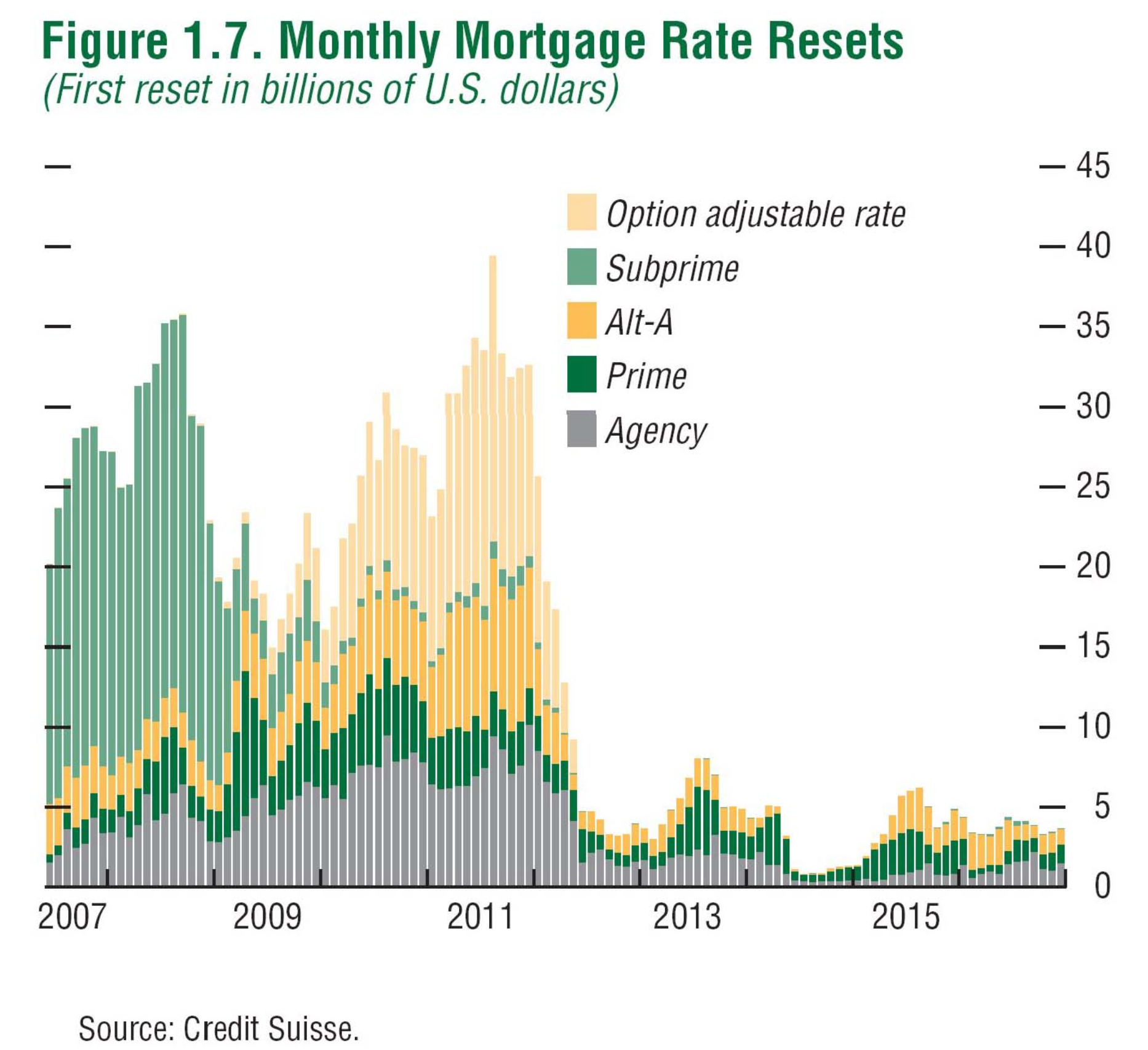

In terms of scale, this is around 3% of the loan book at peak which is similar in scale to the US experience:

At roughly $30bn per month, the US interest rate reset bounced around 2.5% of the total mortgage market for four years. It is not a coincidence that its house prices resumed price rises, and the economy to exit chronically slow growth, in 2012 when the reset ended.

Nobody knows quite how it will play out but any way you cut it the Australian interest-only reset is big and dangerous. Even Jess Irvine has grown up:

The Bureau’s latest quarterly report clocked national home values falling 0.7 per cent in the first three months of this year, wiping $22.5 billion from Australians’ combined housing wealth.

…The headlines have been worrying indeed.

An exodus of investors following a crackdown on investor borrowing and interest only lending.Tighter lending standards for new borrowers expected after revelations of lax lending in the banking royal commission.

A drop in foreign investors thanks to new charges.

A fresh funding squeeze forcing smaller lenders to inflict out-of-cycle interest rate hikes.

And this week, minutes released from the latest Reserve Bank board meeting – at which it left interest rates at record lows for a now unprecedented period – reveal Australia’s top economic policy makers discussed (at length) a special report on the risks of Australia’s world-leading level of household debt.

Yep. Jess rightly trailing the scent of RBA panic.