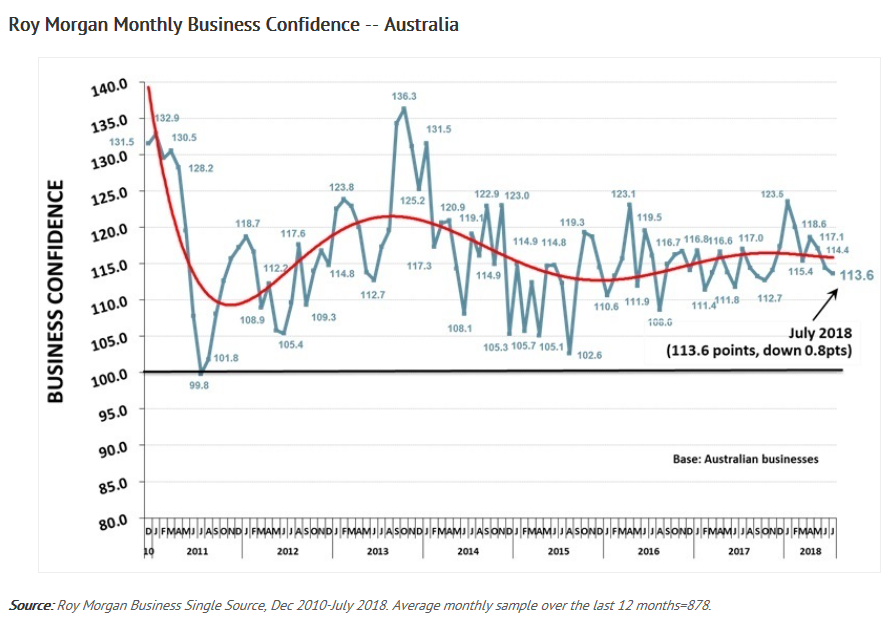

Roy Morgan Research has released its Business Confidence survey for July, which recorded its third consecutive fall, with the index now below “its level of a year ago for the first time in 2018 and is now 3.4pts lower than in July 2017 and 2.7pts below its long-term average of 116.3”:

According to Roy Morgan, NSW led the decline in business confidence, possibly due to the correction in the property market:

“Analysing Business Confidence by State shows falls in the larger States and New South Wales now has the lowest Business Confidence of any State. This is the first time Australia’s largest State has lagged the rest of the country on this indicator for more than four years since February 2014″.

July’s decrease in business confidence was also “driven by a drop in expectations about the performance of the economy”:

Driving this month’s overall decrease is a drop in expectations about the performance of the Australian economy over the next year with 49.3% (down 4.9ppts) expecting ‘good times’ for the Australian economy while 43.7% (up 5.1ppts) expect ‘bad times’;

However longer-term views on the Australian economy are little changed in July with 50.5% (up 0.2ppts) expecting ‘good times’ for the Australian economy over the next five years and 38.7% (down 1.1ppts) now expecting ‘bad times’;

Now 40.9% (down 2.6ppts), say the business is ‘better off’ financially than this time last year compared to 30.6% (up 2.8ppts) saying the business is ‘worse off’ financially;

Businesses’ confidence about their performance in the next 12 months has increased slightly with 48.1% (up 0.8ppts) expecting to be ‘better off’ financially and 20.9% (down 1.5ppts) now expecting to be ‘worse off’ financially this time next year;

A slim majority of businesses 50.9% (up 4.4ppts) now say the next 12 months will be a ‘good time to invest in growing the business’, while 37.9% (down 3.3ppts) say it will be a ‘bad time to invest’.

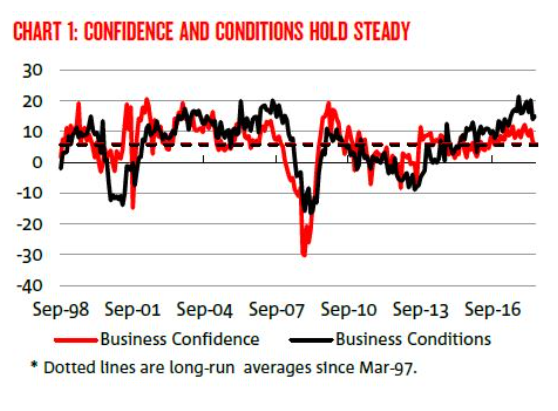

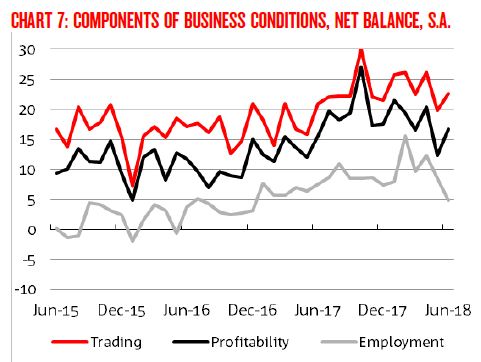

Roy Morgan’s results are broadly matched by the latest NAB business survey, which recorded falls in both business confidence and conditions:

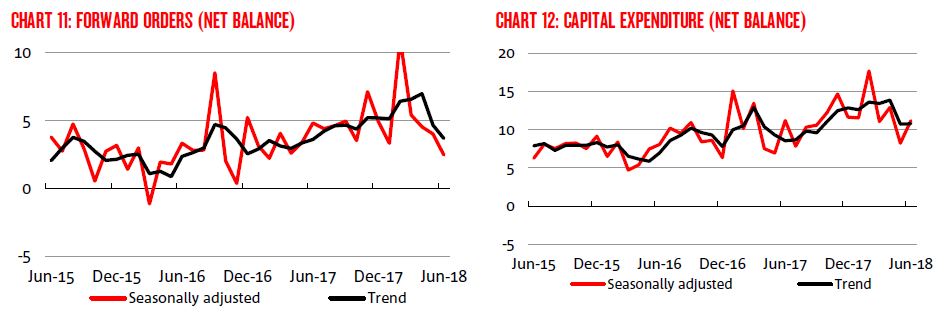

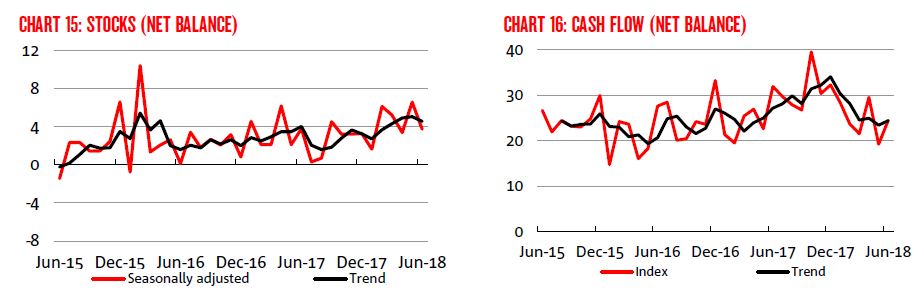

Led by notable weakness in forward orders, stocks, employment, cash flow and capex:

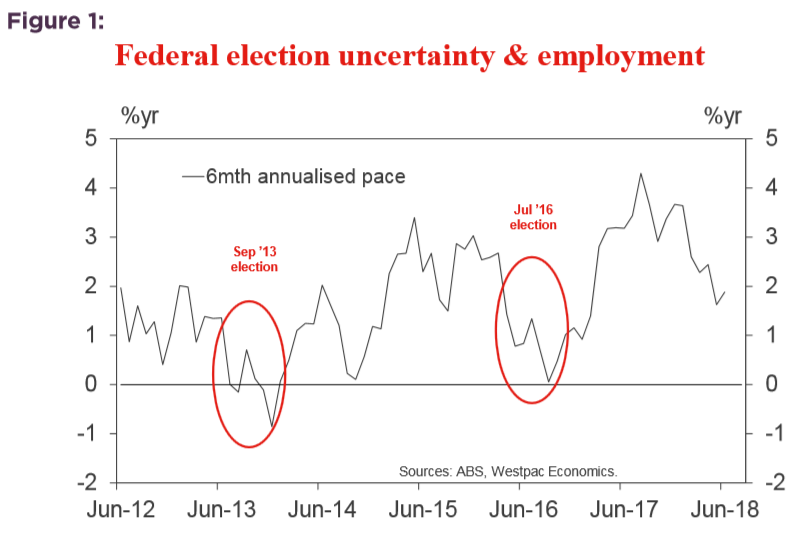

As noted today by Westpac, the lead-up to federal elections generally weighs on the economy:

Therefore, we should expect the slowdown in business confidence and conditions to persist.

unconventionaleconomist@hotmail.com