Last week it was Virgin, today NAB-owned U-Bank has announced that it will lift its mortgage rates by up to 20-basis points. From The Adviser:

The second wave of out-of-cycle mortgage rate hikes has continued, with another lender announcing increases of up to 20 basis points.

NAB-owned lender UBank has announced that it has increased interest rates on its fixed rate investor home loan products by 20 basis points, effective for new loans issued as of 14 January.

The lender’s investor mortgage rate increases are as follows:

- A rise of 20bps on its 1-year UHomeLoan fixed rate with interest-only terms, from 3.99 per cent to 4.19 per cent

- A rise of 20bps on its 3-year UHomeLoan fixed rate with interest-only terms, from 3.99 per cent to 4.19 per cent

- A rise of 20bps on its 5-year UHomeLoan fixed rate with interest-only terms, from 4.49 per cent to 4.69 per cent

UBank is the latest lender to increase its home loan rates, after the Bank of Queensland (BOQ) and Virgin Money announced rate increase of up to 18bps and 20bps, respectively.

Both BOQ and Virgin Money attributed their decisions to lift home loan rates to the sustained rise in wholesale funding costs.

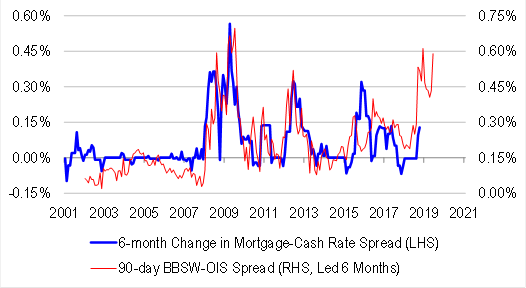

Regarding the “sustained rise in wholesale funding costs”, the below chart from Credit Suisse tells the story:

Surely, it can’t be long until the RBA bites the bullet and cuts the cash rate?