Magazine cover alert? Via The Australian:

The arrival this week of an inverted yield curve on the bond market has been taken with all the gloom of a portent from Dr Doom: It may indicate a recession ahead but it also signals that bonds are back.

In fact, high net worth investors have been betting big on the fixed interest rate markets over the past six months seeking both the reliability of bond-style investments with the additional possibility that bond prices might just bounce if interest ratess start dropping again around the world.

Citi Australia says it has seen a near tripling of volumes in its bond products. Unfortunately, the global bank won’t attach dollar numbers to those soaring statistics but it is safe to say investor demand is elevated in what is a prosaic — but regularly lucrative — wing of the investment markets.

This is the kind of MSM story that can warn that we’re approaching an asset class high. In this case, Aussie bonds have now been on a tear for four months:

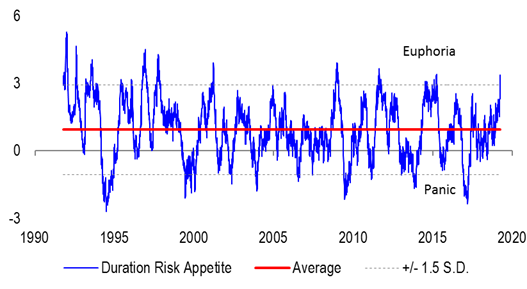

And they are overbought, as Credit Suisse’s proprietary indicator shows:

So we may be due a pullback.

But I remain comfortable that a pause would be to refresh not reverse the trade. The RBA is yet to break but it will have to unless it wants to be painted with blood. Nor is there is any prospect of substantial fiscal easing in Australia kicking in before 2020 as a new government takes power mid-year. The tax cuts booked in are not big enough and will get saved in this environment anyway. House prices will keep falling with the new government and the deflationist RBA’s stupidity in using lagging indicators will mean rising unemployment long after any turn in policy. I am not concerned about China and the terms of trade. They will fall anyway as Vale eases supply strains.

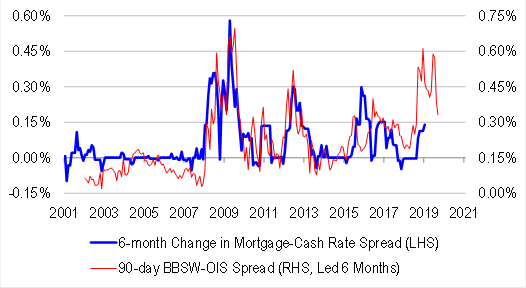

The one area where the bond thesis for ten year yields heading to 1% might come under pressure is if BBSW keeps correcting:

That would take pressure off bank net interest margins and mean the RBA cuts would see full pass through to mortgage rates meaning it may need to cut less. But with bank profits under pressure across the board that is still some distance hence.