Asian share markets are starting the week with a fresh bounce in the wake of Wall Street’s rally post-NFP print, with the Federal Reserve likely to support risk assets one more time. The Yuan is weakening again as Chinese authorities manipulate the currency as the trade war goes on, with the USDCNH offshore pair moving closer to a 7 handle as the latest exports figures show a big hit higher.

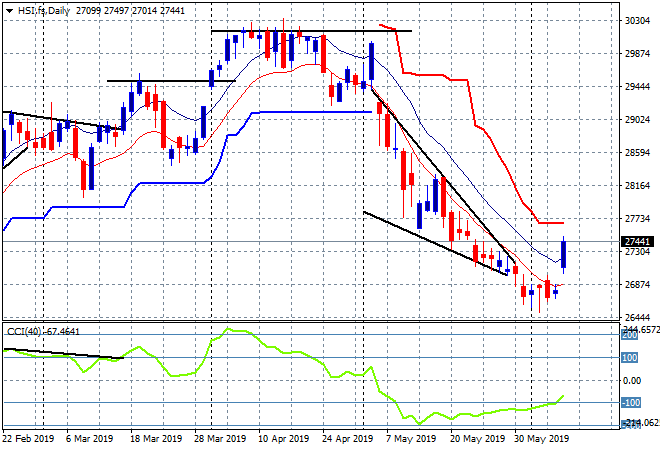

Chinese share markets repopend from their long weekend with the Shanghai Compsite advancing 0.6% to be just below the key 2900 point resistance level while the Hang Seng Index is brushing off domestic turmoil to soar over 2% higher, finishing at 27556 points.

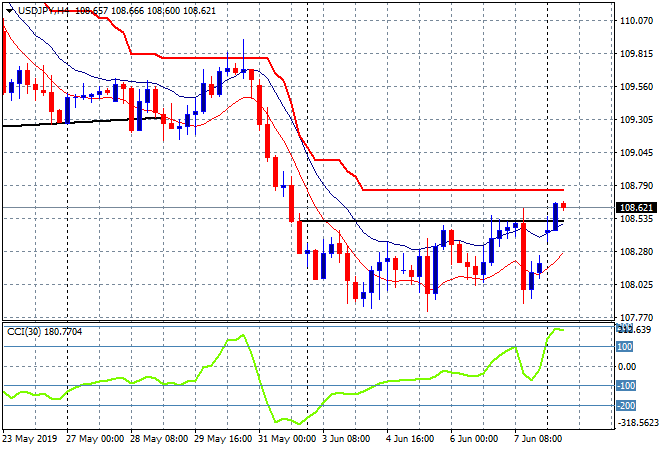

Japanese share markets advanced firmly again with the Nikkei 225 closing just over 1% higher to 21134 points, really getting steam behind it as it builds way above the key terminal and psychological support level at 20000. The USJDPY pair has gapped higher, forcing itself above key resistance at the mid 108’s, now looking to engage even more despite a weaker USD meme as risk sentiment improves:

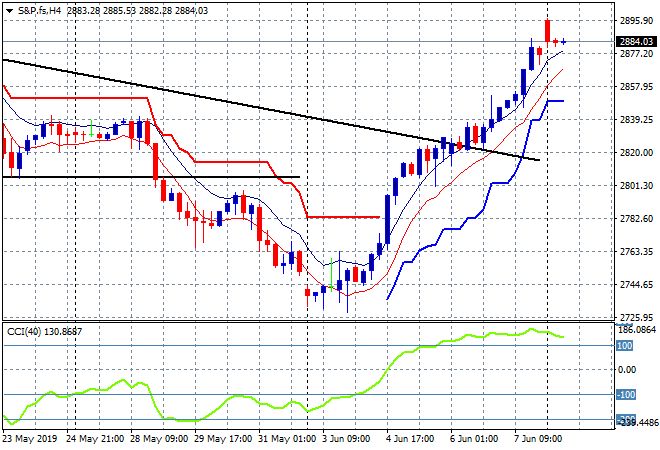

S&P and Eurostoxx futures are up over 0.4% with the four hourly chart of the S&P500 chart showing a desire to keep moving higher above terminal support at 2800 points and the recent downtrend line as confidence returns from the Fed put:

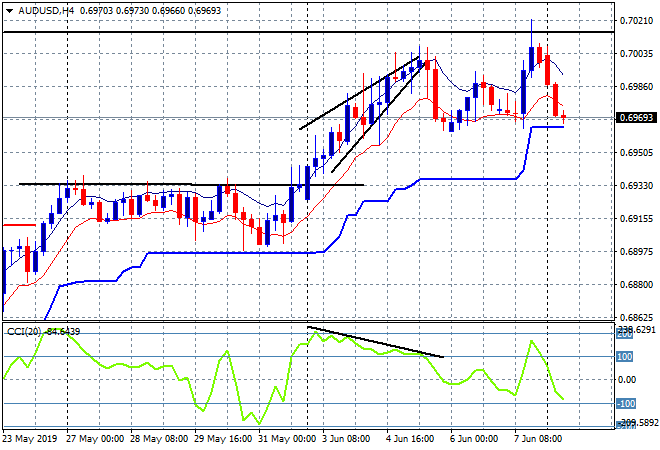

The ASX200 was closed for the Queen’s birthday holiday (although this little black duck was still working!) while the lack of other traders saw the Australian dollar retreat from its Friday highs to be well below the 70 handle here going into the London session:

The economic calendar does the usual quiet reprieve following the NFP print with US Treasury auctions the only event of note tonight.