From the house price Satanists at Domain:

Communities where people oppose immigrants moving in experience less house price growth than neighbouring suburbs with more accepting residents, new research has shown.

Immigration lifts house prices by increasing demand for an already limited supply of housing and anti-immigrant communities were excluding themselves from this benefit, Deakin University researcher Chris Doucouliagos said.

“In theory, if people are more predisposed towards immigrants there may be a higher price as well, but we found that those areas with negative attitudes get a lower increase in house prices,” Professor Doucouliagos said.

…Some studies in the past had claimed the inverse, that immigration drove down prices, Professor Doucouliagos said.

“We didn’t find that,” he said. “Some people look at one area or one city but we looked at all of the data.

“You can get a localised effect.”

So, according to the good professor, immigration raises house prices but it’s missing out on the gains, as opposed to missing out on getting a house at all, that drives racism. Except maybe those folks that missed out can only afford to buy where there are less migrants, no? And perhaps they’re unhappy about foreign peoples enjoying greater privileges than themselves in access to land in their own country.

There are so many weaknesses in this “research” that I do not know where to begin. The most important finding is that migrants inflows drive up house prices. The attitudes to such are irrelevant to public policy, even if the Domain worships the house price Satan.

This conclusion is similar to a recent study of Vancouver property, another migrant hot spot, via SCMP:

A study has found long-sought evidence linking foreign ownership to extreme housing unaffordability in Vancouver, a Canadian city that has attracted waves of Chinese capital and millionaire migrants.

The white paper by Josh Gordon, an assistant professor at Simon Fraser University’s school of public policy, found a near-perfect 96 per cent (or 0.96) correlation between various metro Vancouver municipalities’ price-to-income ratios (a common measure of unaffordability), and the proportion of their detached houses in which at least one owner was a non-resident.

A leading researcher who was not involved in Gordon’s study said its findings were “unimpeachable”: the more that a Vancouver municipality was favoured by non-resident owners, the more unaffordable its detached houses tended to be.

“When I plugged the numbers in it blew my mind … I mean, holy smokes,” said Gordon of the strikingly close correlation.

Advertisement“This is compelling evidence that when it comes to the extreme ‘decoupling’ [of prices from local incomes] seen in the Vancouver housing market, foreign ownership is the primary culprit,” the paper said.

Vancouver’s housing has long been considered among the world’s most unaffordable. The city ranked second – behind only Hong Kong – in the latest Demographia study of unaffordability in 309 cities around the world, with a price-to-income ratio for all housing of 12.6.

But among detached houses, the ratio is about 25 or 30 to one, in areas popular with Chinese buyers including the City of Vancouver, Richmond and West Vancouver.

Gordon’s paper was not peer reviewed before publication last week, but it was checked afterwards by University of British Columbia geography professor David Ley, who has studied Vancouver real estate unaffordability for decades.

The calculations, based on 2016 data, were also checked by Andy Yan, director of the City Programme at Simon Fraser University, who sat with Gordon as he reproduced the results.

Ley said of Gordon’s “unimpeachable” argument and conclusions: “Such a high correlation is rarely seen in social science research … It indicates a very strong relationship. So it is the presence of non-resident buyers that is forcing up prices.“But there’s a qualifier here because it forces up prices relative to incomes … we can more accurately say that non-resident demand shapes affordability.”

The so-called “r-squared” value, depicting how much of the variations in unaffordability could be predicted by non-resident ownership in 2016, was 93 per cent.

AdvertisementGordon conducted the same comparisons using 2013 data and found an r-squared value of 91 per cent.

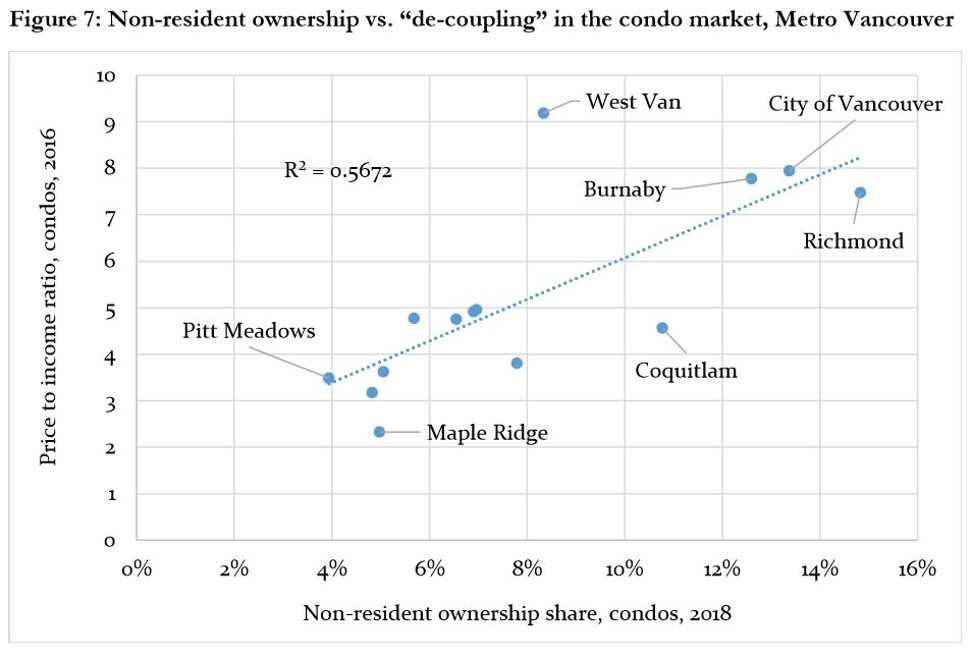

In the 2016 condominium market, the correlation between the unaffordability ratio and non-resident ownership was also “strong” at 75 per cent, Gordon found, with an r-squared value of 57 per cent. The correlation rose to 88 per cent if the single municipality of West Vancouver was discounted.

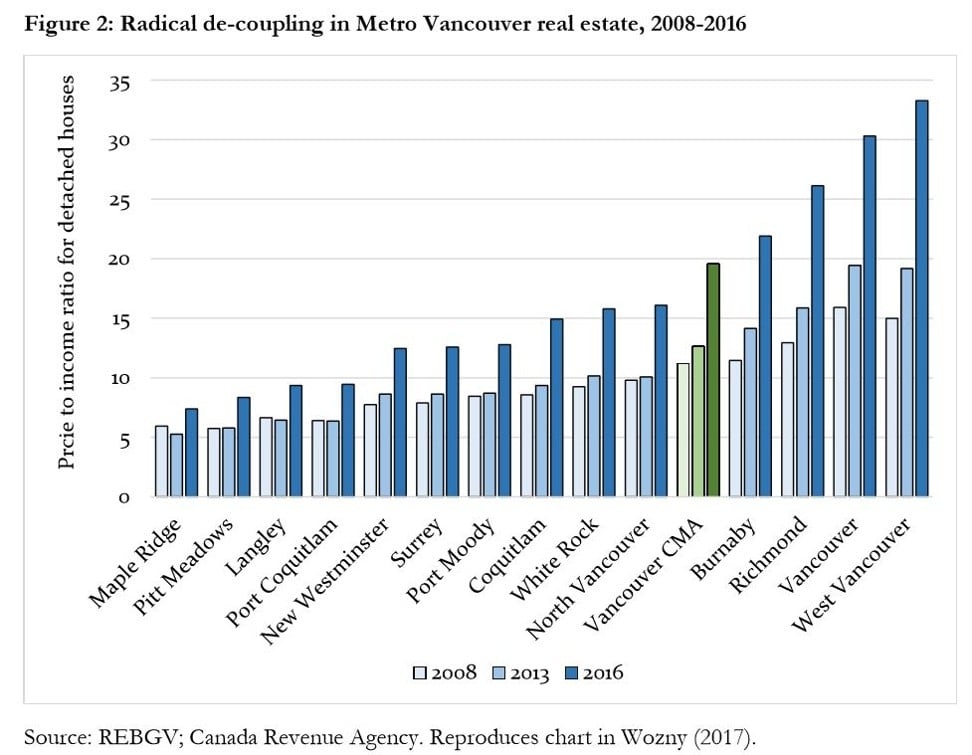

A chart originally produced by Vancouver real estate analyst Richard Wozny depicts the decoupling of house prices and incomes in various Vancouver municipalities, and how the gap widened from 2008 to 2016. Graphic: Richard WoznyYan said he endorsed Gordon’s study and its “very straightforward” methodology: “This puts together the story about the forces that are behind Vancouver real estate … [it] gives us a foundation and a direction, for how we [produce] effective housing policy.”

Key to that was “understanding just how much Vancouver real estate is connected to the global economy, of which a large component is being driven by China.”

By investigating non-resident ownership, Gordon’s study sought in part to address the issue of “satellite families”, who live in Vancouver but whose primary breadwinner earns abroad.

Advertisement“[A] family with a low declared Canadian income might live in a multimillion-dollar mansion. This particular situation would represent ‘decoupling’ on steroids,” the study said.

The phenomenon has been closely associated with millionaire migration, primarily from mainland China, Hong Kong and Taiwan. Vancouver was long the world’s most popular destination city for such migrants under wealth-determined schemes, attracting them by the tens of thousands.

Vancouver has recently become a global test bed for affordability policies, with the introduction of a foreign buyers’ tax, a speculation and vacancy tax, and increased provincial property taxes.

A chart by researcher Josh Gordon depicts the “strong” relationship between condominium price-to-income unaffordability, and non-resident ownership, across 14 Vancouver municipalities. Graphic: Josh GordonThese demand-side measures appear to have sent the market into retreat, with sales and prices falling. The average price of a detached house across metro Vancouver is C$1.6 million (US$1.2 million).

Gordon’s study was a response to a landmark 2017 report by the long-time real estate industry analyst Richard Wozny, which came to the “inescapable conclusion” that locally declared incomes could not support prices.

AdvertisementWozny, who said he was concerned for the fate of Vancouver amid a runaway real estate market, died of cancer not long after he turned whistle-blower on his industry.

Wozny’s report depicted the decoupling of prices from incomes as he examined 14 Vancouver municipalities. Gordon, who said his work was “testament to Richard Wozny’s instincts and character”, looked at the same municipalities as he tried to find an explanation for the decoupling and its variation among them.

Similarly, development charges, a frequent industry bugbear, did not typically apply to the building or rebuilding of detached houses, the style of home Gordon and Wozny focused on.

Gordon found the correlation with non-resident ownership via a cache of data recently generated by Statistics Canada.

AdvertisementHis findings are consistent with Ley’s previous peer-reviewed research, which found an “unusually decisive” correlation between immigration and Vancouver home prices.

It is also consistent with the findings of Markus Moos and Andrejs Skaburskis, who concluded that Vancouver prices and incomes decoupled because recent immigrants’ housing consumption was less tied to their local labour-market participation than it was for other buyers.

“These are proxies for foreign money at times when we don’t have direct measures of foreign money,” Yan said. “So we have these various scholars, with various data sets, all pointing in the same direction. That is a call for action.”

Both studies simply confirm the obvious. Immigration drives up house prices. Good public policy would be to ensure that that does not happen so that Australians are not marginalised within their own nation.