In Friday’s testimony to the House of Representatives Standing Committee on Economics, Reserve Bank of Australia (RBA) governor, Phil Lowe, explicitly blamed mass immigration for fuelling the strong house price inflation experienced over the past decade:

Chair: Since its peak in 2011, the cash rate has fallen from 4¾ per cent to 1½ per cent… Is the expectation of the RBA that, if we continue to drop interest rates, you’ll see a proportional increase in house prices?

Dr Lowe: It’s certainly possible, because one of the ways that monetary policy works is by pushing up asset prices. That’s how it works, and it’s no surprise to me that equity markets around the world are very high at the moment, at a time when central banks are expected to cut interest rates—and the same mechanism works on all asset prices. I think the housing market is more complicated. I think the piece of work that Peter Tulip did was very good. I don’t agree with all its particular conclusions, but, in the same spirit we talked about before, we encourage our staff to look at things from different perspectives, and we think it’s important they go in the public domain. The paper is right, though, in saying that lower interest rates have pushed up housing prices. I think that’s pretty clear. In my own view, there are other things that are probably more important over the past decade, and they go to population growth and the slow response to that on the supply side. I think we talked about this last time—that population growth picked up in Australia quite a lot and it took almost a decade for the rate of growth of the supply to respond to that.

I’m just raising this in the context of the next phase in the housing market, because what we’re seeing at the moment is quite strong population growth, which I think is good, but the additions to supply of the housing stock are slowing right down. New development is slowing down, and one of the issues we’re going to keep a very close eye on over the next little while is what the supply of housing is doing. If developers cannot get financed, the supply of housing will slow a lot and we will be sowing the seeds for the next upswing. It’s coming from this intersection, again, of strong population growth and the supply side that takes a long time to respond.

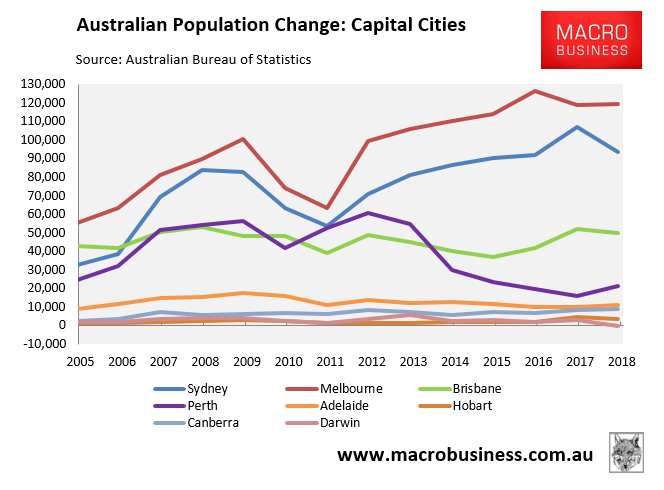

There’s no denying that the rapid population growth and densification of Australia’s two major cities – Sydney and Melbourne – helped drive the cost of housing to extreme levels.

In the 14-years to 2018, Sydney and Melbourne added 1,050,000 and 1,300,000 people respectively, of which 470,000 and 590,000 people were added in the five years to 2018 alone:

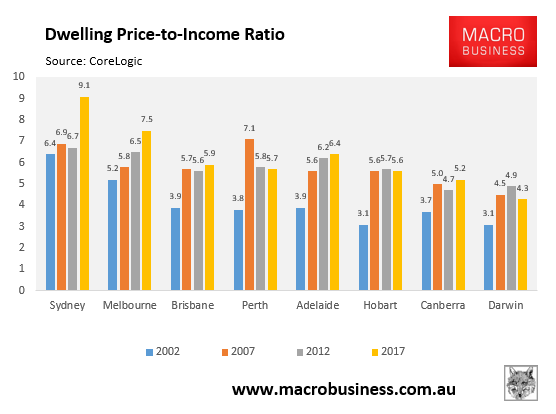

Reflecting this strong population growth, especially over the most recent five years, both Sydney’s and Melbourne’s dwelling price-to-income ratio surged to an extreme 9.1 and 7.5 respectively as at the end of 2017 – well beyond Australia’s other capital cities where population growth was lower:

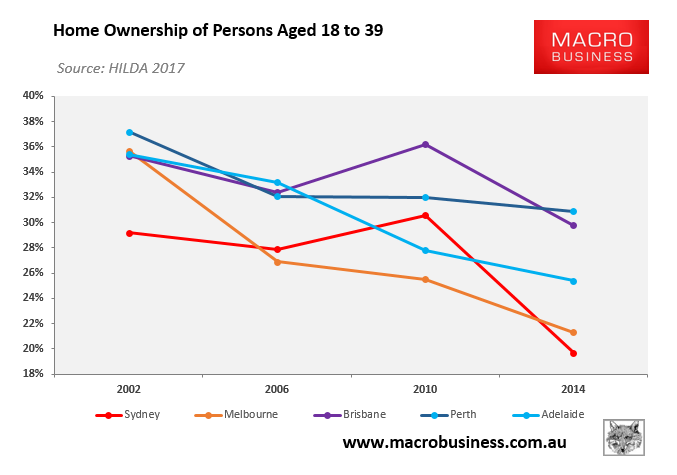

Reflecting this cost escalation, home ownership rates in both Sydney and Melbourne have collapsed among under-40 Australians:

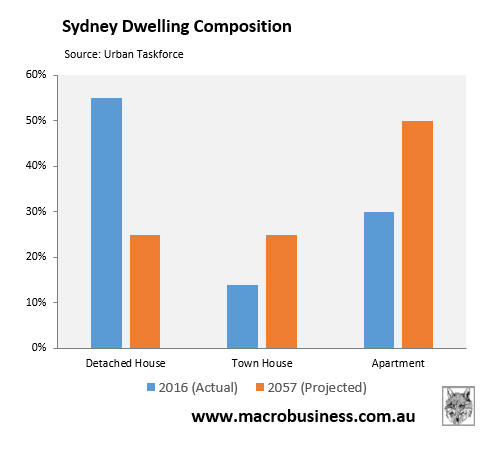

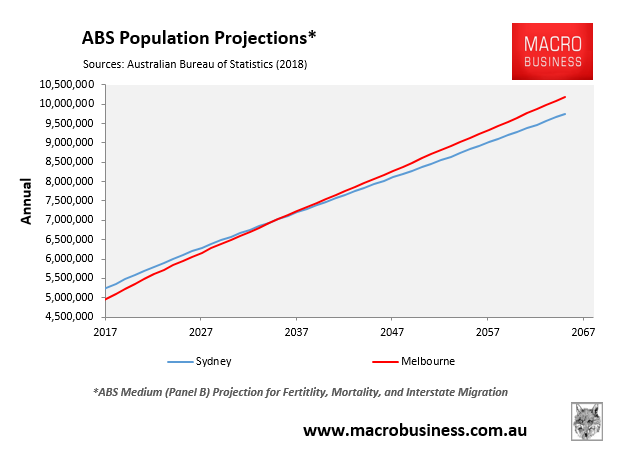

Given both Sydney’s and Melbourne’s populations are projected by the ABS to balloon to around 10 million people over the next half century, driven by ongoing mass immigration, the chronic housing affordability problems in both cities will continue.

In turn, both Sydney and Melbourne are facing a future whereby only the wealthiest residents will be able to afford a detached house with a backyard, while the majority of residents will be forced to live in cramped accommodation, an increasing share of whom will also be renting.