The reaction to last week’s national accounts release featured various talking heads attempting to put lipstick on a pig.

The most notable of these was Treasurer Josh Frydenberg, who trumpeted the Australian economy’s 28th year of uninterrupted growth and “remarkable resilience”:

Today’s National Accounts show the Aust economy has completed its 28th consecutive year of growth in the face of domestic & intl headwinds. Real GDP grew to be 1.4% higher through the year, proving the Aust economy’s remarkable resilience.

More here: https://t.co/7axsB7e7F6 pic.twitter.com/r3jfZfrDBA

— Josh Frydenberg (@JoshFrydenberg) September 4, 2019

Along similar lines, The AFR declared that Australia’s standard of living has soared to record highs:

A mix of high resource prices and rising wages have helped Australia dig itself out of an income recession and reach a record standard of living as measured by disposable income per person…

KPMG chief economist Brendan Rynne said the reasons for the rising income went beyond strong mining profits.

“What you are also seeing is a recovery in wages and that recovery in wages has been taking some time to come through but you are seeing it,” Dr Rynne said.

Whereas AMP chief economist, Shane Oliver, claimed there were “a bunch of positives that should help the economy avoid a recession even though growth will remain weak for a while yet”, namely:

- Rate cuts and tax cuts should provide some growth boost;

- The threat of crashing property prices looks to be receding;

- Infrastructure spending is booming;

- The low $A is helping to support the economy;

- The business investment outlook is slowly improving;

- Australia has a current account surplus;

- There is scope for extra fiscal stimulus;

- Population growth remains strong; and

- Finally, cyclical spending (consumer durables, housing and business investment) as a share of GDP remains low.

What is completely ignored by each of these pundits is that for the very part of the economy that matters the most – Australian households – the economy has been in recession for seven long years.

Consider the below evidence.

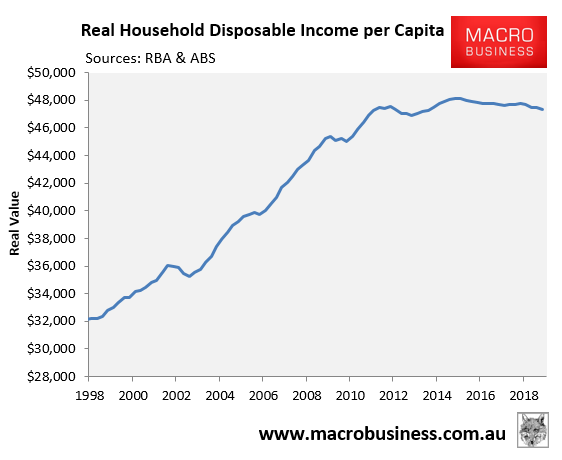

First, and most importantly, real household disposable income (HDI) per capita has fallen 0.5% over the past seven years:

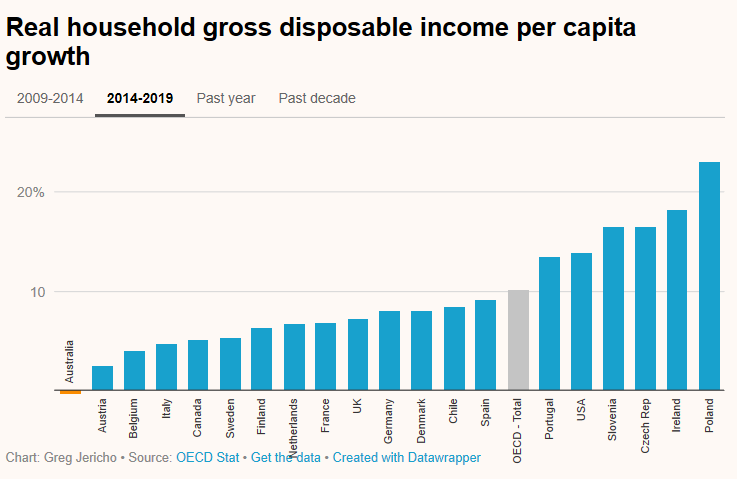

Moreover, Australia has experienced the lowest HDI growth of all OECD nations in the five years to 2019:

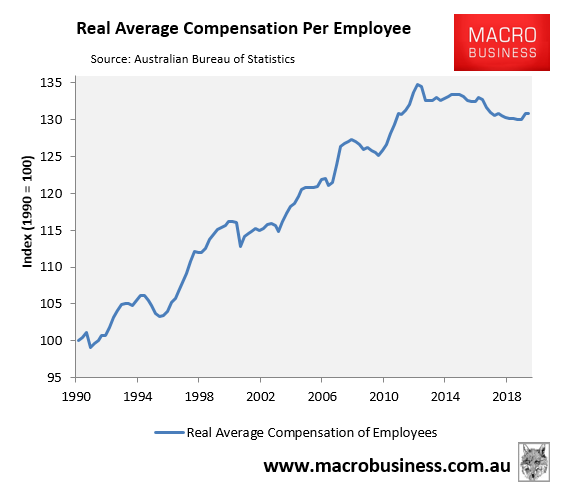

Real average employee compensation has also fallen by 2.9% since March 2012:

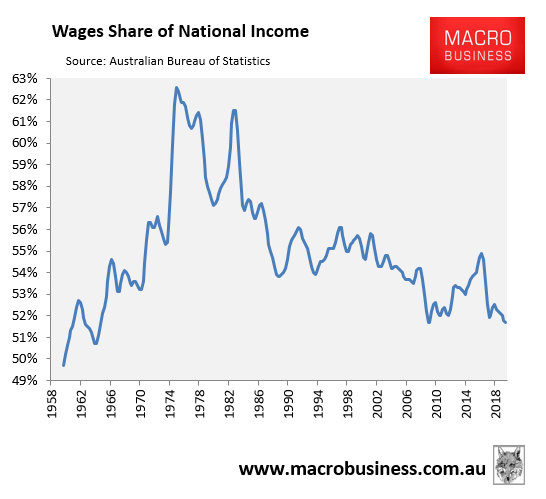

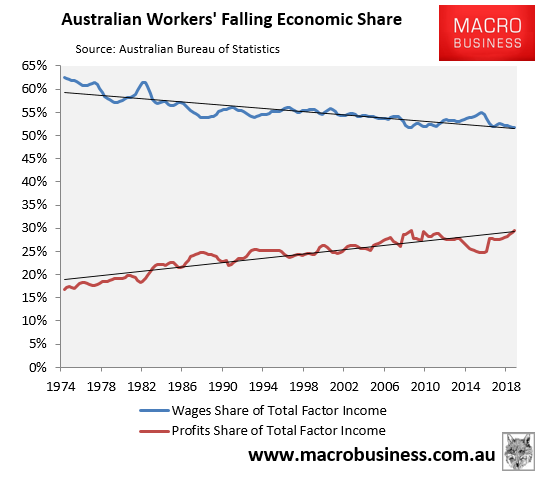

The reason why the aggregate Australian economy has grown while real per capita HDI and average employee compensation has fallen is because the share of national income flowing to wages has hit the lowest level since the mid-1960s:

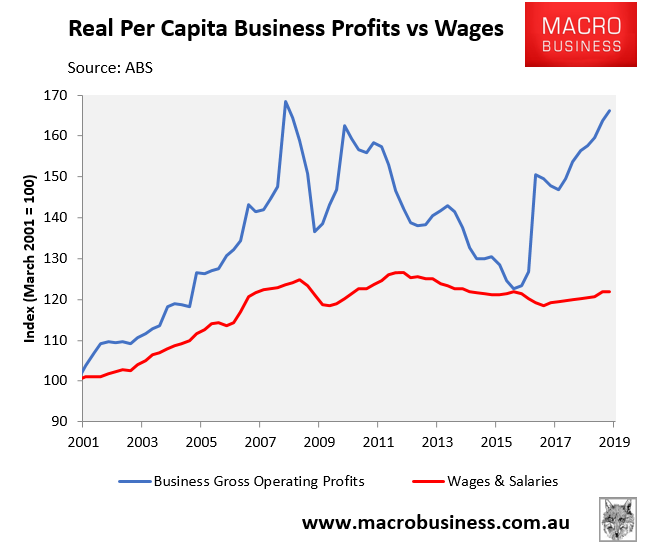

So, while corporate Australia has done handsomely, Australian households have gone backwards:

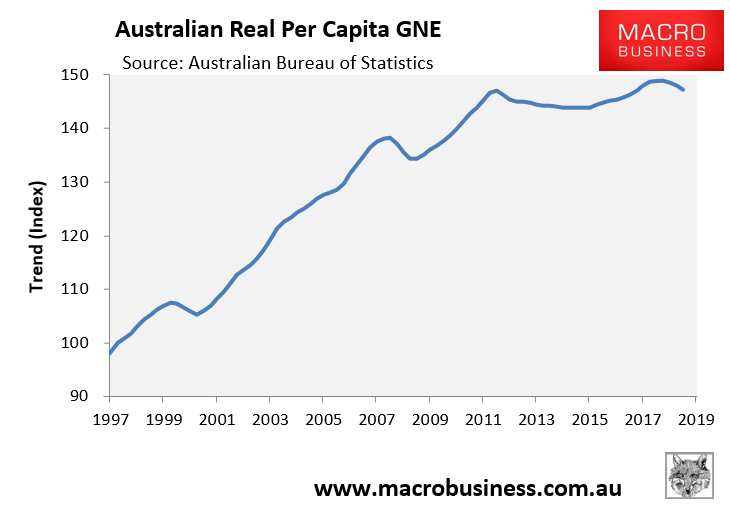

Second, gross national expenditure (GNE) – which measures “the total expenditure within a given period by Australian residents on final goods and services (i.e. excluding goods and services used up during the period in the process of production). It is equivalent to gross domestic product plus imports of goods and services less exports of goods and services” – has recorded zero growth since March 2012:

Put simply, Australia’s economy has been in recession for seven years from the perspective of households.

This is remarkable given we are at the tail end of the global business cycle when the economy is supposed to be booming. This also makes Australia a “sitting duck” as the global cycle slides towards its end.