Watching stocks you could be forgiven for thinking that the world is about to boom. It is very diifferent in forex which is signalling the approach of a major bust with safe havens in demand. DXY is approaching a major breakout line as EUR drowns:

Try as it might, the Australian dollar remains squashed by King Dollar:

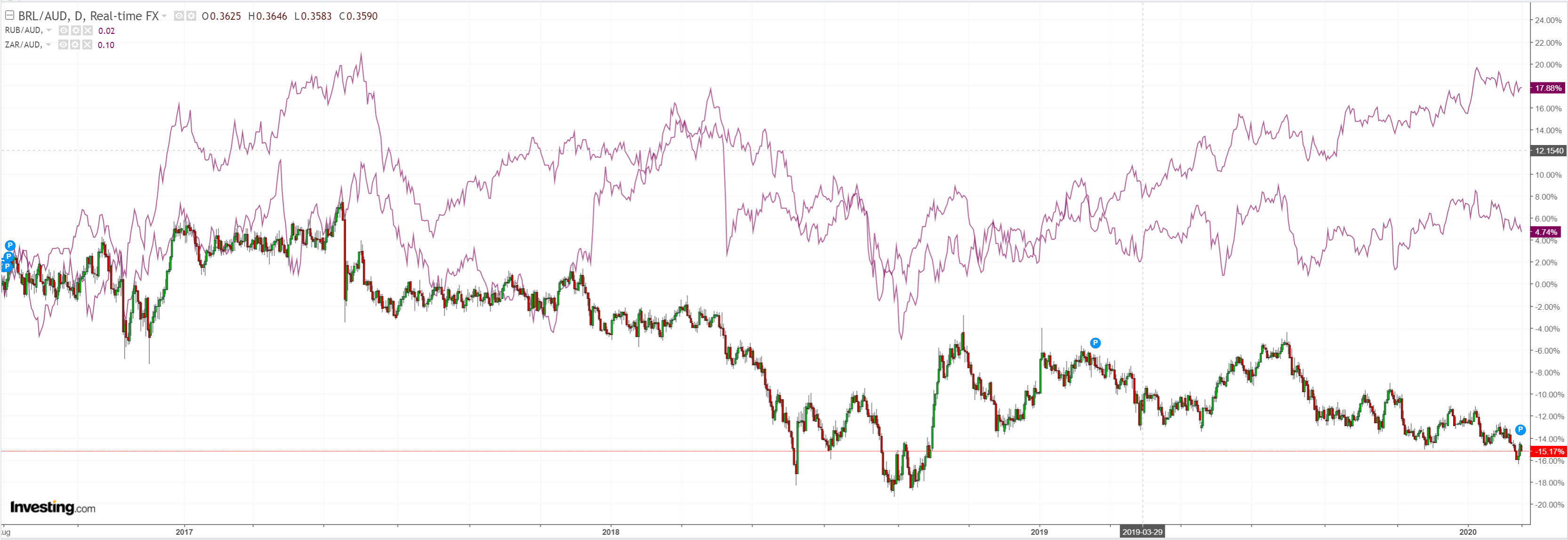

EMs are also struggling:

Gold is poised for breakout despite the powerful DXY. This is very unusual and signals the potential for a major, atypical global shock:

Oil is trying to be positive:

As are metals:

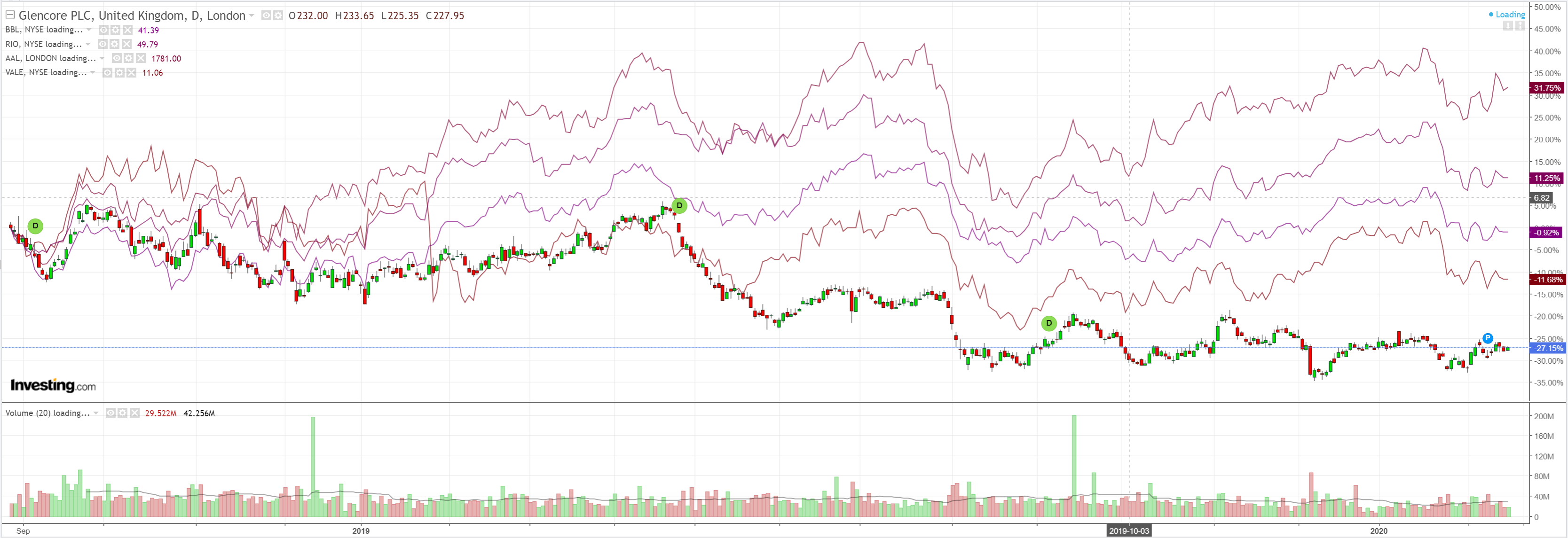

Miners did OK:

EM stocks not so good:

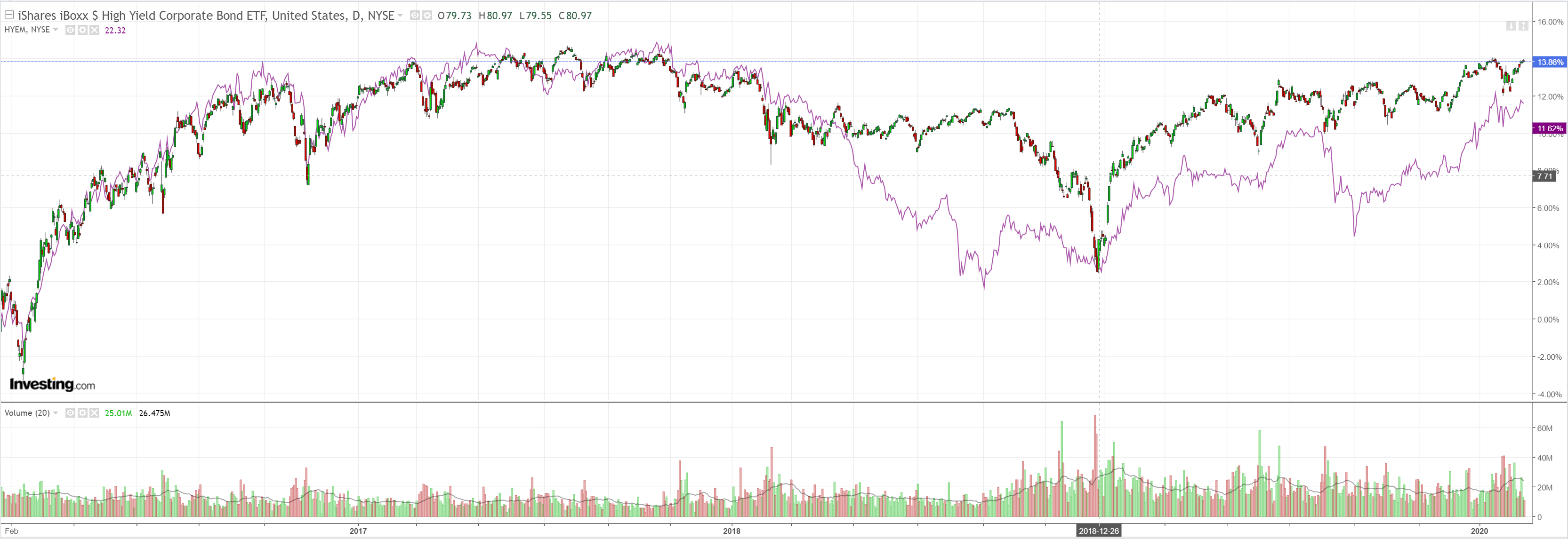

Junk doesn’t care:

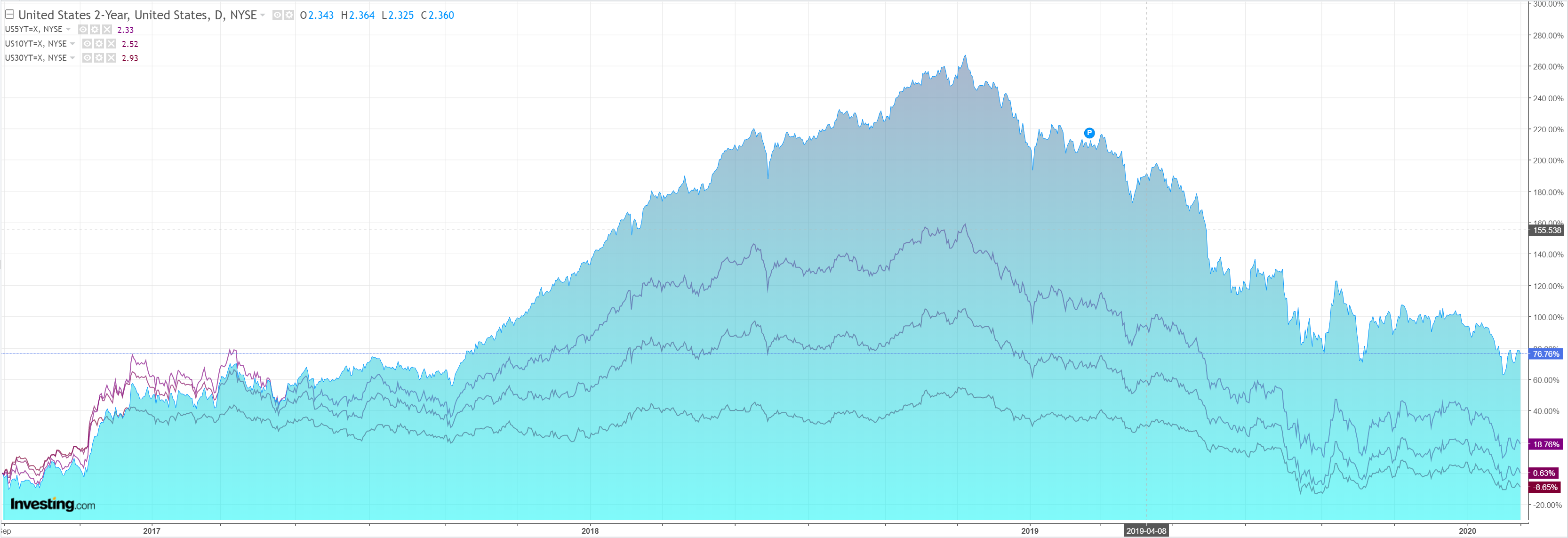

Bonds were bid again:

US markets were closed but European stocks lifted:

Westpac has the wrap:

Event Wrap

No major data to report.

Latest coronavirus statistics show 71,450 cases to date (896 outside China), with 11,429 recoveries (159 outside China) and 1776 deaths (5 outside China).

Event Outlook

The RBA has begun 2020 with a sanguine view of the domestic and global uncertainties clouding the outlook. The Board’s discussion of these factors will be critical to assess when the minutes are released.

In NZ, REINZ housing data is due this week for January. The supply of homes is tight, while low interest rates are supporting demand, resulting in robust price growth.

In Europe, the ZEW survey will offer an assessment of market participants’ confidence.

For the US, the NY Fed’s Empire State manufacturing survey is due as is the NAHB housing market index. On the latter, the labour market and interest rates are clearly supportive of robust housing demand.

Bloomberg sums it up:

Many forecasters came into 2020 expecting that U.S. growth might trail other parts of the world and act as a drag on the American currency. They are now being forced to reassess. Resource-related currencies such as the Norwegian krone and the Australian dollar have tumbled as concern about China has smacked commodity markets and undercut expectations for global growth.

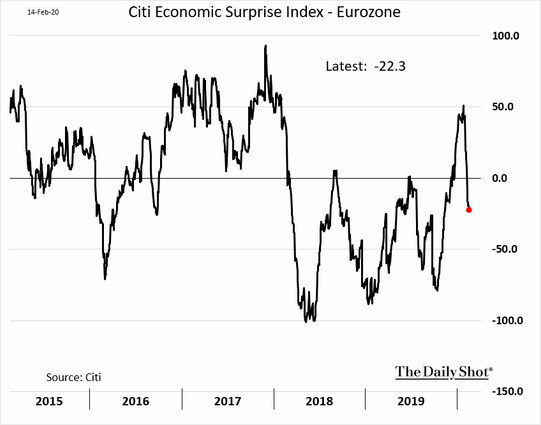

The euro, meanwhile, has slumped to its lowest level against the dollar in almost three years after data showed industrial production in the common-currency region shrinking and the German economy flatlining.

For Ben Emons at Medley Global Advisors, the weak outlook will hinder the European Central Bank’s ability to bring rates back up, and that should provide another support for the dollar against its trans-Atlantic peer.

…“When the Fed shifted gears to easing and cutting rates, all it really did was open the door for everybody else to either cut rates or increase the size of balance sheets, or both,” Das said. “So the interest-rate differential, monetary-policy differential, balance-sheet differential arguments in favor of a weaker dollar haven’t worked either. Those issues are still going to be there for some time to come.”

Add the virus and we’re at a major technical inflection point for major forex markets with the USD poised to break higher not lower.

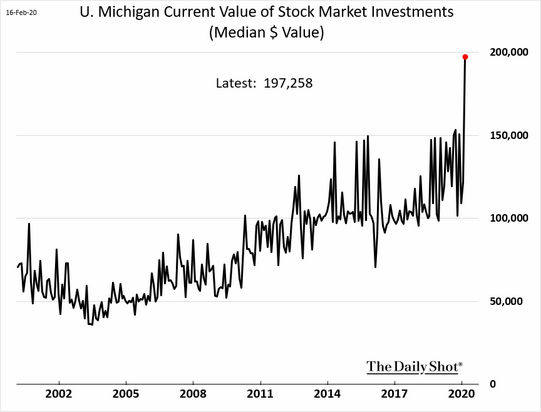

The US economy remains the best of the bad bunch:

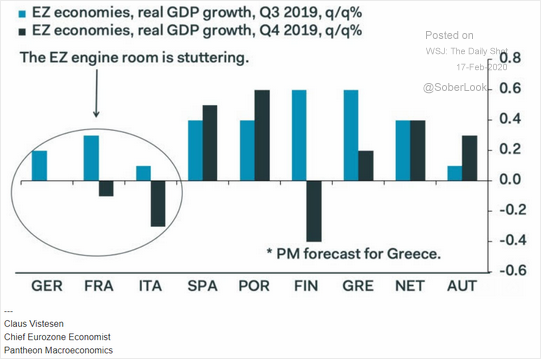

I would not be at all surprised to see the EUR sink to parity in the months ahead. The underlying European economy is stalled:

And the mother of all export shocks is upon it as China remains shuttered. Recession is coming, with exhausted monetary policy and fiscal failure to boot.

Once the RBA is forced to cut, the European-based global growth crisis will see an Australian dollar trap door open.