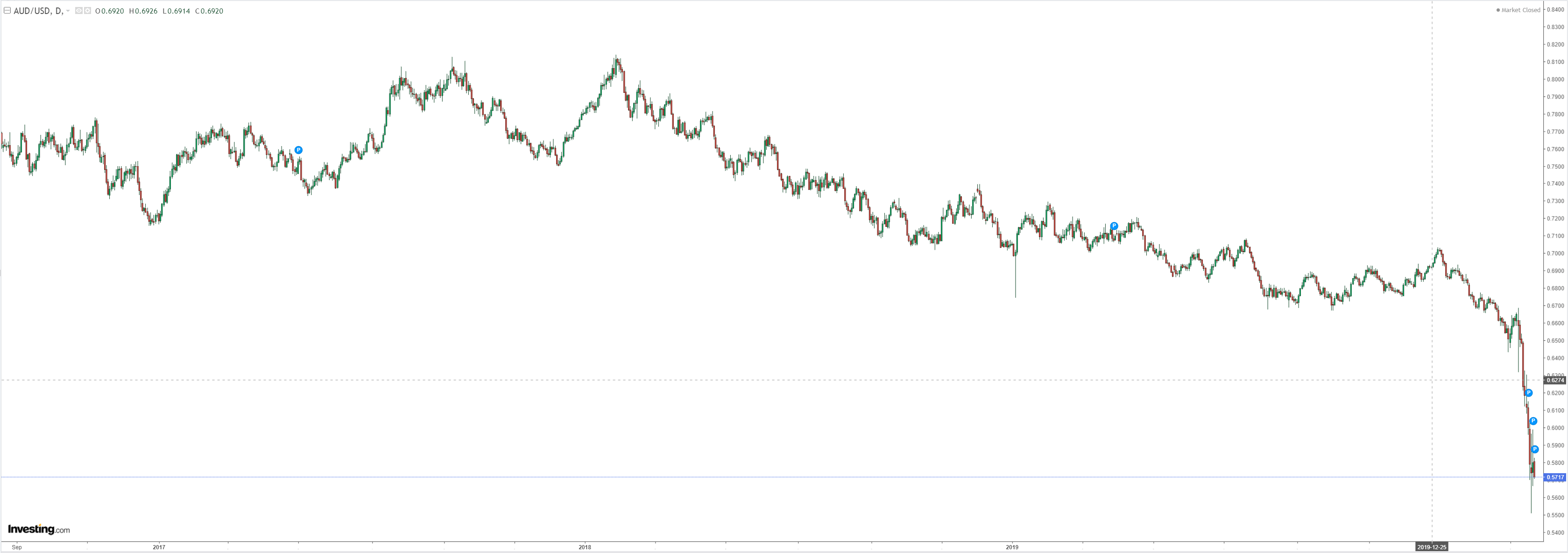

All those long only equities managers calling buy the dip are being minced again today. The Australian dollar is down hard again:

Bonds are bid bigly:

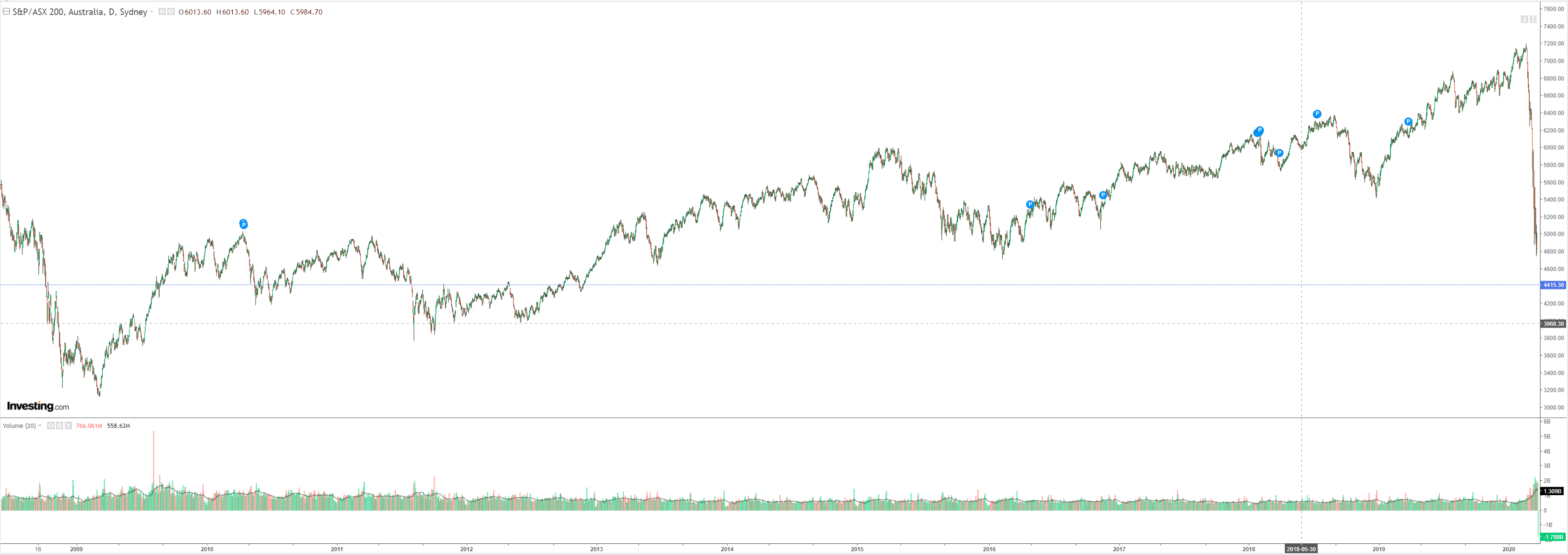

XJO’s bath of blood is hosing everything, gapping down 8%:

Advertisement

And the damage is still not priced.

Big Iron is down:

Big Oil too:

Advertisement

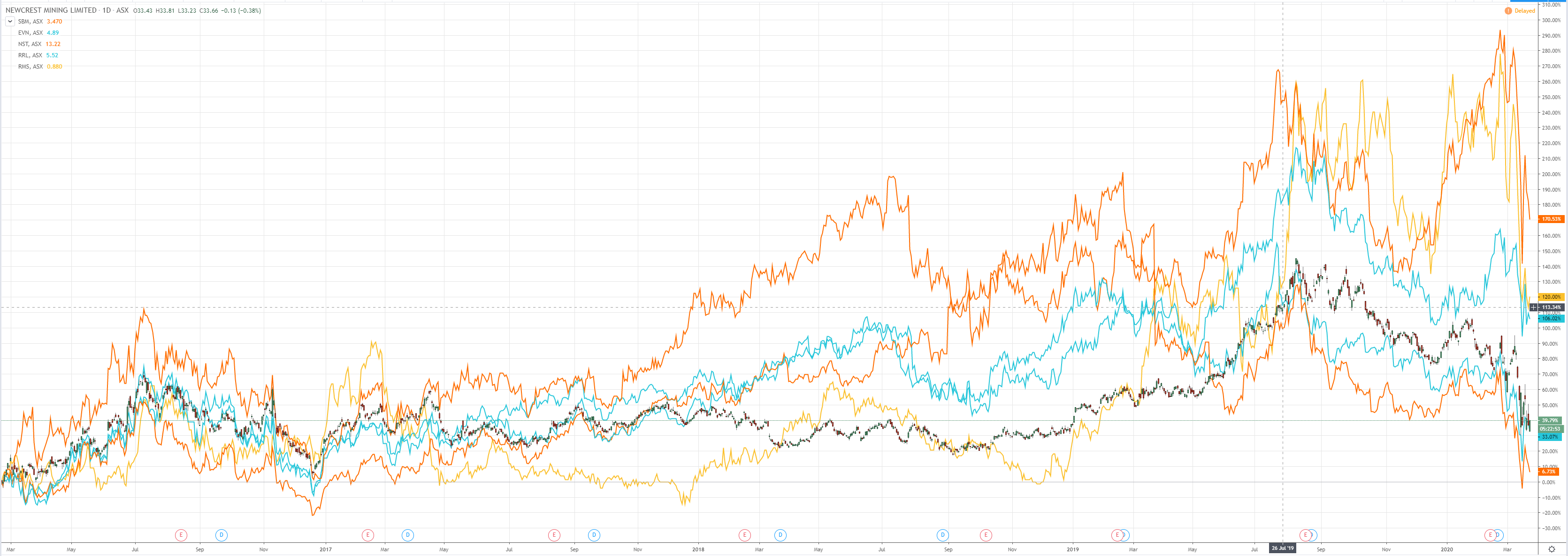

And Big Gold:

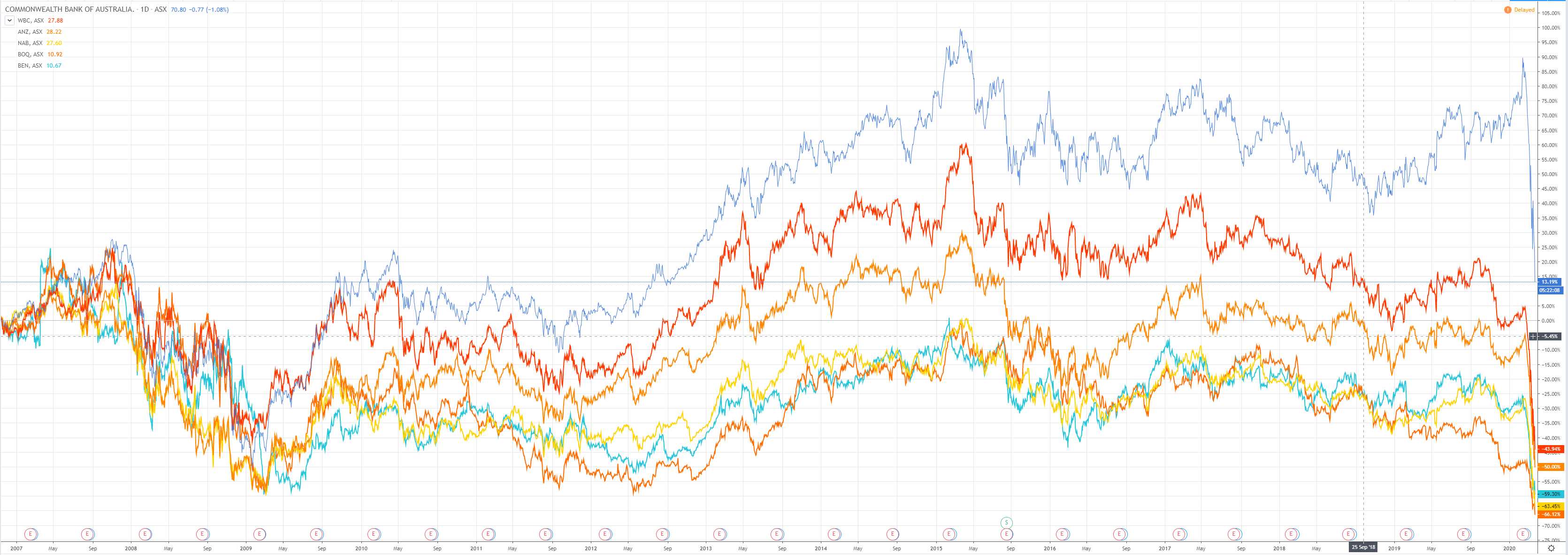

Big Banks are slaughtered:

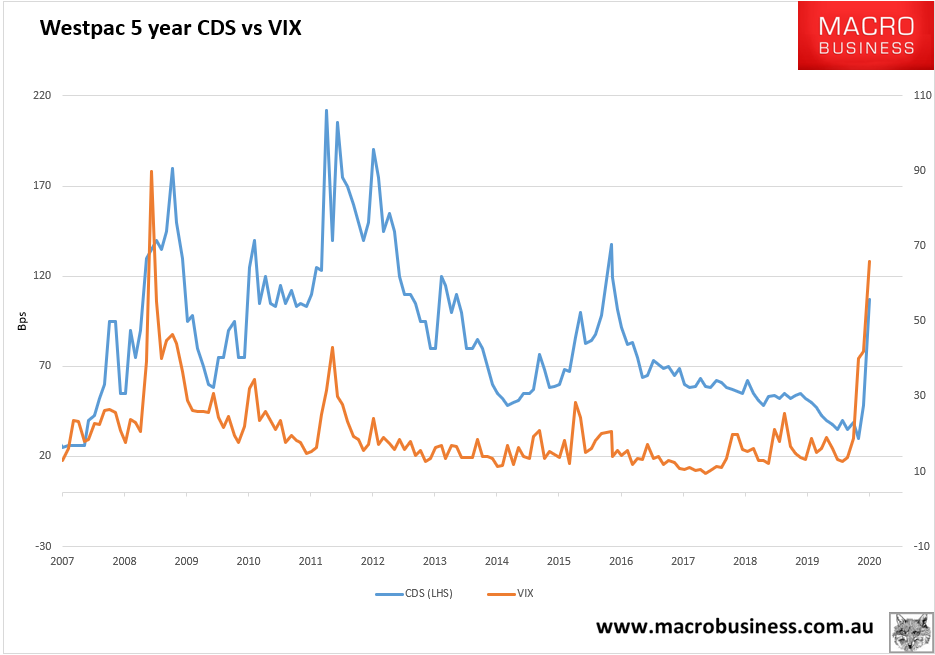

CDS was at 109bps Friday, worse today no doubt:

Advertisement

Big Realty has far, far yet to fall:

More pain ahead.

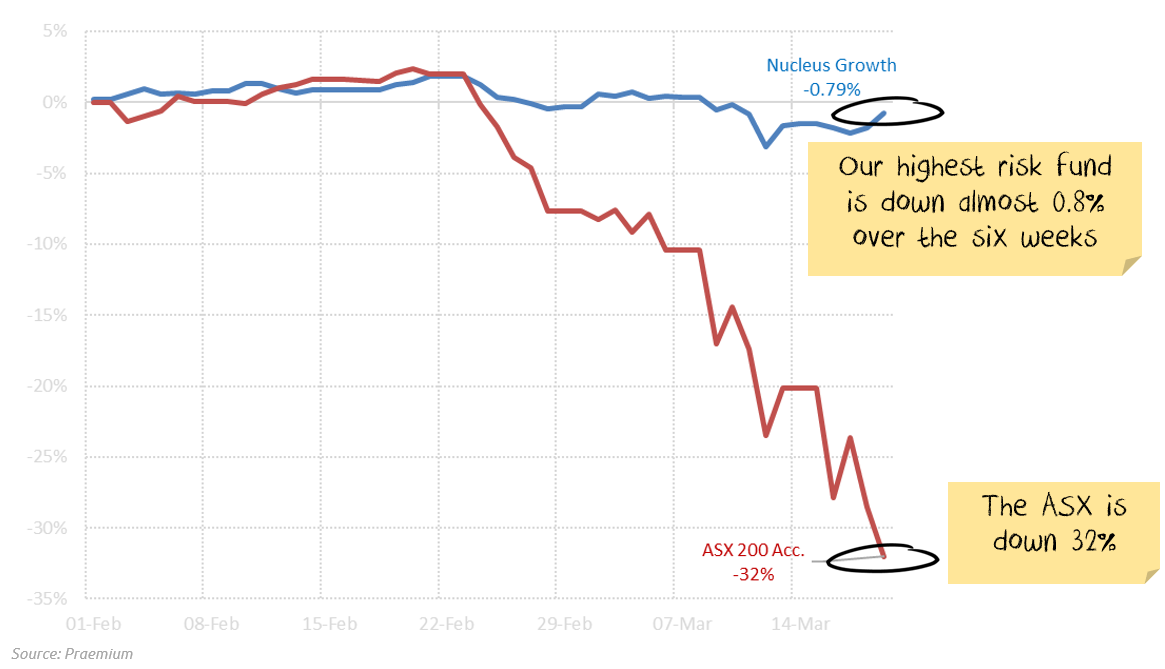

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super which is very conservatively positioned for coronavirus risks including a falling Australian dollar, so far falling just 0.7% through mid-March versus -32% for the ASX200:

Advertisement

If you’re interested in the fund, contact us below.