DXY is at the bottom of its recent range. EUR is looking to bottom:

The Australian dollar to the moon versus DMs:

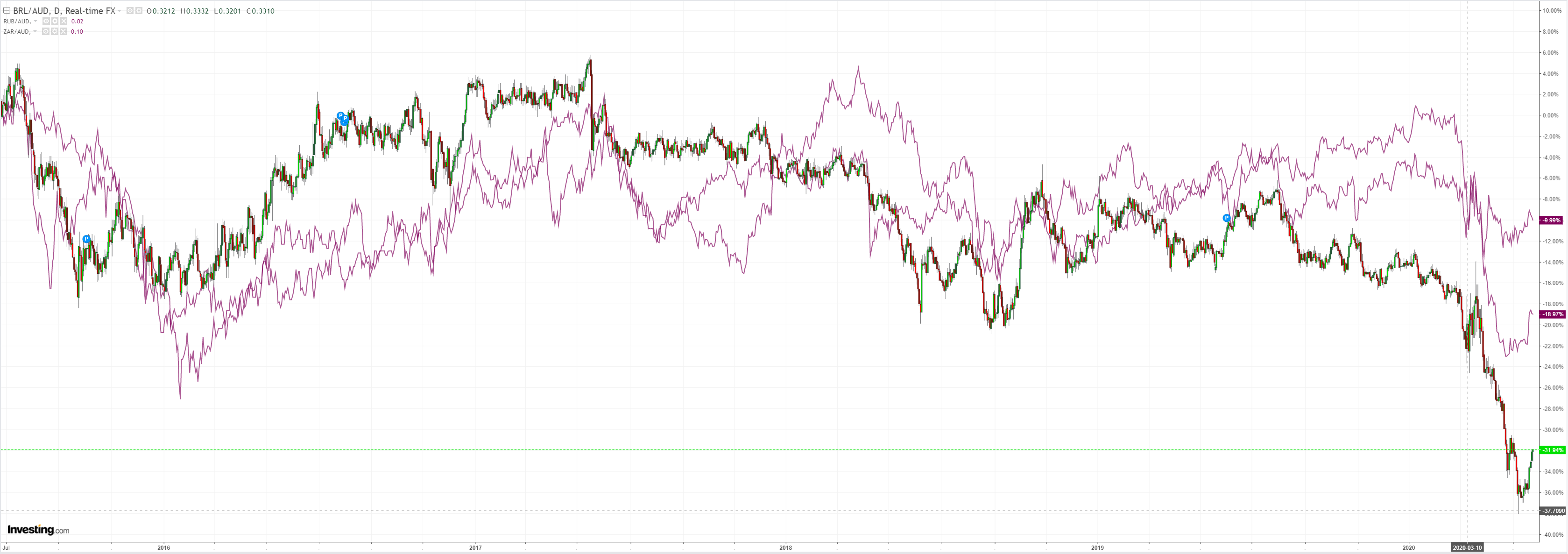

It outbid most EMs too:

Gold sagged despite DXY:

Oil is coiling for a new spring:

Dirt is more truthful:

Big miners were mixed:

EM stocks couldn’t catch a new high:

But junk could, as defaults mount. Say what?

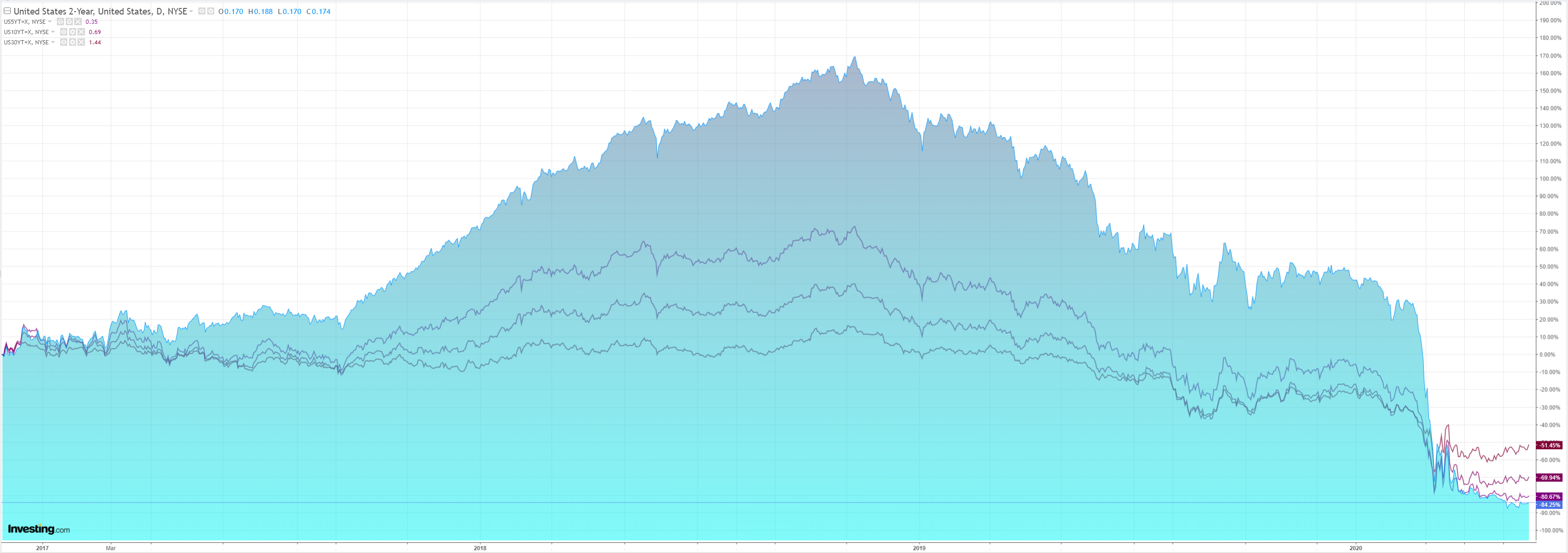

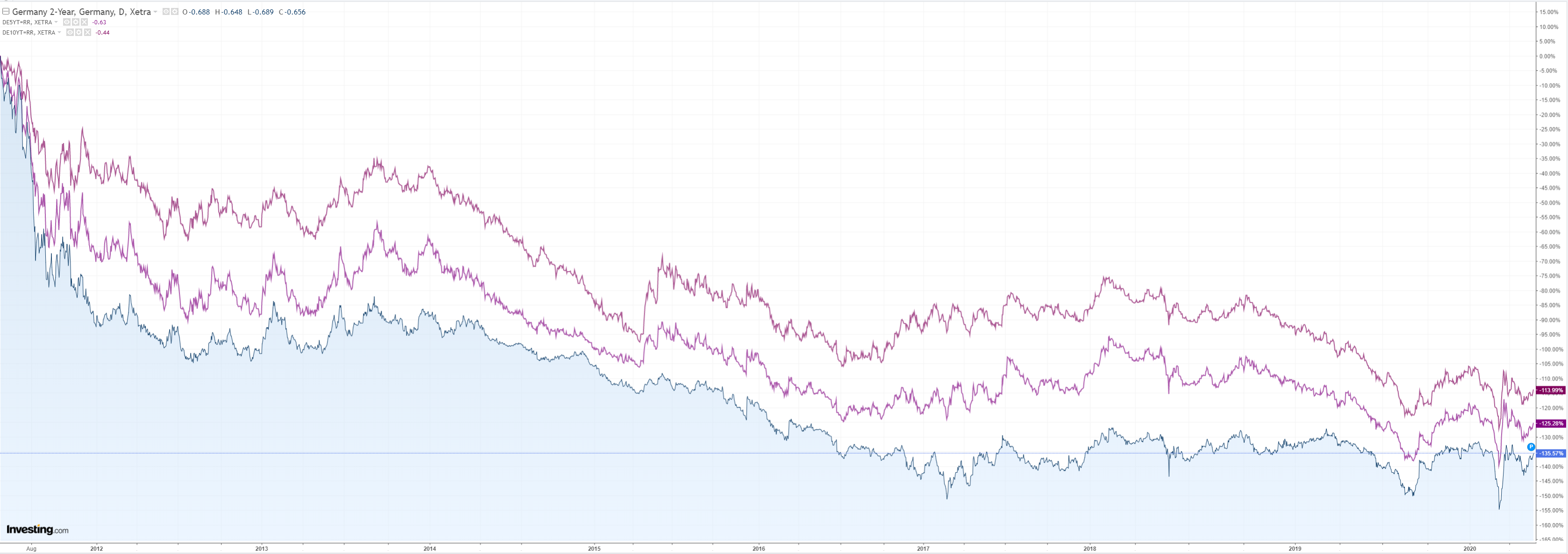

Bonds were sold:

Stocks took out new highs but did struggle to push on:

Westpac has the wrap:

Event Wrap

US economic data was second-tier but mostly beat expectations. Dallas Fed manufacturing activity in May rose from April’s record low of -73.7 to -49.2 (vs -61.0 expected). Conference Board consumer confidence rose from 85.7 to 86.6 (as expected). New home sales in April rose 0.6% (vs -23% expected).

Event Outlook

Australia: Construction work is set to fall in Q1, reflecting underlying weakness and disruptions from the bushfires and coronavirus. Private new home building and private non-residential construction will remain weak, but public works should provide some offsetting support this year as governments add new projects to the pipeline. On balance, Westpac is looking for a print of -1.4%, with risks to the downside.

New Zealand: The RBNZ will publish its 6-monthly Financial Stability Report. The main interest in this release will be around any up-to-date information on how banks and the wider financial system are faring through the crisis.

China: Industrial profits are poised for another soft print in April. The 34.9%yr contraction in March was led by weakness in oil, metals and motor vehicle profits.

US: In line with other regional surveys, the Richmond Fed index is expected to remain subdued at -40.0 (albeit up from the record low of -53 in April). The Federal Reserve’s Beige Book will then provide a comprehensive overview of COVID’s effect across the 12 Fed districts. To round out the day, the FOMC’s Bullard (02:30 AEST) and Bostic (05:00 AEST) will discuss the economy during the pandemic.

Data was universally disastrous and there is little point showing it. The recovery is going to terrible as the virus keeps the US half-shut all-year, everywhere else is badly hamstrung and EMs sink into pandemic hell.

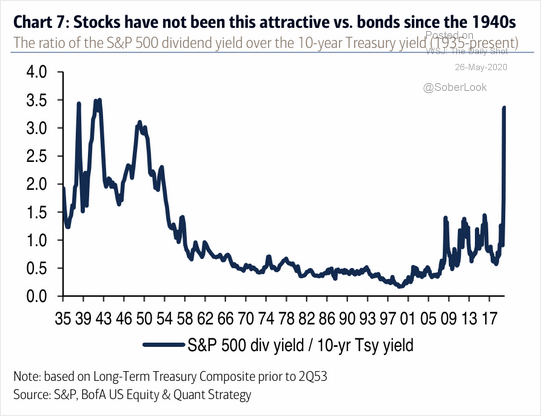

But qhat matters is that that keeps yields down and so this:

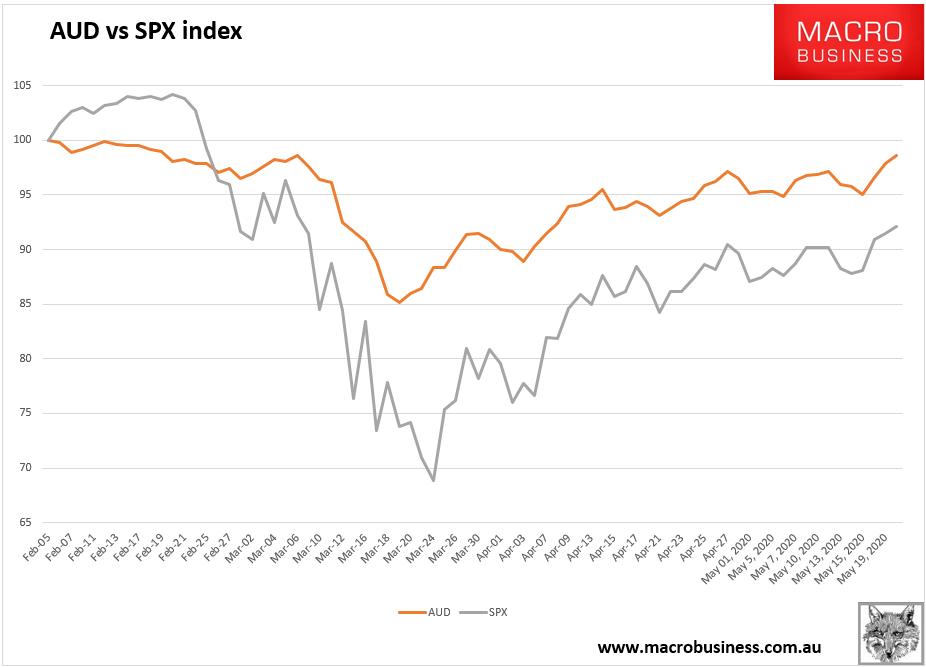

Earnings schmearnings! As such, the former currency and now US-listed stock, the Australian dollar, parrots on:

To infinity and beyond!