By Chris Becker

The Trading Week ended with a whimper on Friday night on Wall Street as tensions over the US/China relationship continued to simmer over as the rhetoric ramped up going into the CCP’s national congress. Meanwhile, the long weekend caused many traders to pare their positions with US stocks ending mixed, and Treasuries basically unchanged alongside a still strong USD that kept most of the major currencies depressed again. The latest initial jobless claims figures were muddled a bit, adding to the lack of direction, while the continued lack of reduction in coronavirus cases around world – particularly the “strong man” failures like Russia, Brazil and the USA – is keeping risk sentiment lower than expected.

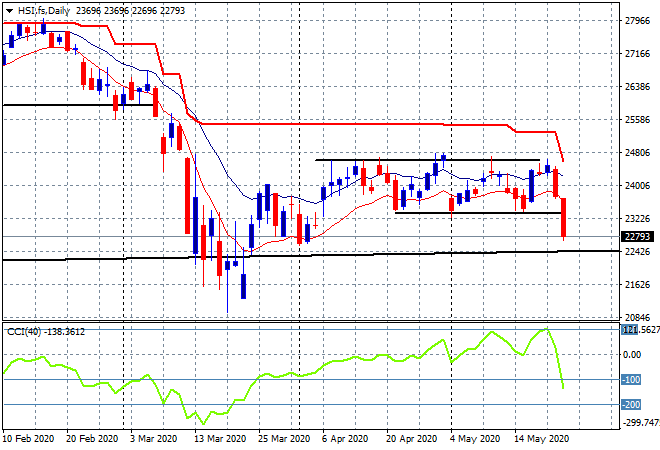

Looking at share markets from Friday’s session where in mainland China, the Shanghai Composite closed down nearly 2% lower to 2813 points having wiped out all of this month’s gains as concern over the trajectory of the Chinese economy gathers apace. Meanwhile the Hang Seng Index fell over 5% in a big rout to below 23000 points as a clear breakdown of what was firm support at that level, turning this sideways move into something more interesting. This takes price action almost down to the long held trendline and could be presaging a wider rout: